IGphotography/iStock via Getty Images

Aurora Innovation (AUR) has long been touted as a leading player in the autonomous vehicle technology space with roots tied to founders leading the related technology divisions at Waymo (GOOG, GOOGL), Tesla (TSLA) and Uber (UBER). While the company offers a ton of promises, the stock isn’t so promising in the near term. My investment thesis remains Neutral on the stock following their first quarterly earnings report after the de-SPAC transaction in November.

Out Of Touch

The company chose an odd time in their development process to go public. Investors originally rushing into the SPAC on the surge back in November just didn’t understand the investment.

By all accounts, Aurora Innovation wasn’t ready for a public market not keen on money losing operations. The company is spending aggressively on building AV technology and the public market doesn’t handle these scenarios very well where future funding rounds aren’t automatic or controlled by a parent company in the case of Waymo and Cruise Automation (GM).

My original research fretted over the large spending levels and the elongated period for when material revenues would start reaching the financial statements. The Q4’21 earnings report really hit home on the issues with this business where the going public process skims over these details.

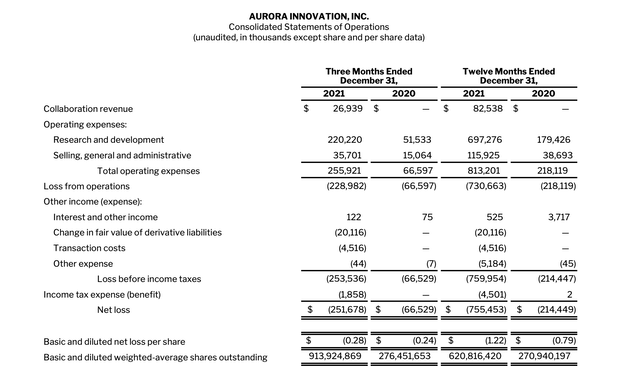

For the December quarter, Aurora Innovation spent $256 million in operating expenses. The company received $27 million in collaboration revenue from a deal with Toyota (TM) leading to an operating loss of $229 million for Q4’21.

Source: Aurora Innovation Q4’21 shareholder letter

For the year, the company lost $731 million on $813 million in operating expenses. The spending levels ramped up over the year to reach a $1 billion annual runrate during Q4’21.

Excluding stock-based compensation and acquisition costs, the operating expenses totaled $593 million on the year. The adjusted EBITDA loss for the quarter was $123 million and $487 million on the year. Sure, the cash losses for the year were only ~$500 million, but the stock-based compensation in the magnitude of $220 million last year has an impact on share dilution in a period where Aurora Innovation isn’t delivering any revenues.

As the company spends $600 million in cash a year when adding the $48 million in capex and an expected ramp-up in spending, the $1.6 billion cash balance will slowly disappear. Aurora Innovation could easily end 2023 with less than $500 million left on the balance sheet while the launch of AV products could easily slip into future dates.

The company forecasts the launch of Aurora Truck in late 2023 and the Aurora Connect product for ride-hailing in late 2024 with the main Aurora Driver product at a later date. The business still has to fund at least 2 years of escalating spending until the launch of official products, but the company doesn’t predict commercial revenues topping much above $100 million until 2026.

Aurora Innovation has impressive partnerships with Uber Freight, FedEx (NYSE:FDX), Volvo (OTCPK:VOLAF) and PACCAR (NASDAQ:PCAR), yet the combined forecasted EBITDA and FCF losses top $500 million annually through 2026. In fact, the actual forecasted FCF burn is as follows to reach a total of $3.7 billion before turning profitable in 2027:

- 2022 = ($651)M

- 2023 = ($784)M

- 2024 = ($863)M

- 2025 = ($834)M

- 2026 = ($584)M

The company has ~21 million warrants outstanding with an exercise price of $11.50. If exercised, these warrants will raise slightly over $200 million in additional cash. When completing the business combination, Aurora Innovation freely admitted the cash on hand is only expected to fund operations through commercialization in 2024 leaving the company with a multi-year funding gap.

Valuation Disconnect Problems

The deal valuation is appealing with where Waymo and Cruise Automation have completed funding deals. Both of these autonomous technology platforms have reached recent deals or market valuations placing those firms in the $30 billion valuation range including this $2.75 billion fund raising by Cruise Automation nearly 10 months ago.

The issue here is that public markets don’t handle funding gaps very well. Now Aurora Innovation is left needing to raise funds within a few years with the market valuation around $6 billion, not the proposed equity value of $11 billion at the time of the SPAC announcement and likely hopes the stock would be far higher by 2024. Even worse, a one to two year delay in the rollouts of AV technology to trucking or ridehailing could be devastating for a business in a precarious money losing position.

Takeaway

The key investor takeaway is that Aurora Innovation has very appealing AV technology and an intruding growth story. Unfortunately, the public markets don’t handle these scenarios where companies aren’t fully funded for reaching cash flow positive scenarios in over five years.

Investors should avoid this stock until the business model progresses and funding is fully secured.

Be the first to comment