z1b/iStock via Getty Images

Most investors have heard of arbitrage, in which one is able to take advantage of price dislocations, by buying an asset in one place and selling it in another for a profit. While such opportunities existed many years ago, before the advent of technology, they are now rather hard to come by.

However, I’m a believer in time arbitrage, in which negative market sentiment can translate into great long-term buys. This brings me to Highwoods Properties (NYSE:HIW), which has gotten more attractive since earlier this year, when it was trading at $47. This article highlights what makes HIW an attractive income and growth play at present, so let’s get started.

Why HIW?

Highwoods Properties is an internally-managed REIT and a member of the S&P MidCap 400 Index. It acquires and develops high quality office properties in what it calls BBDs or better business districts in the growing Southeastern and Mid-Atlantic regions of the U.S.

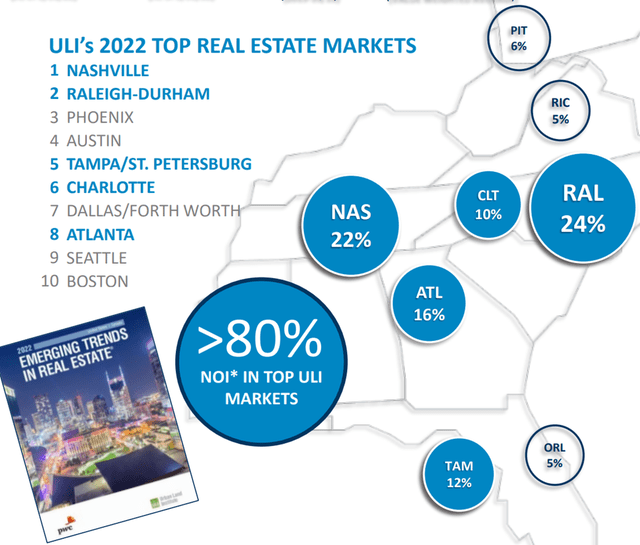

This strategy works well for HIW, as it largely avoids competition from “big boy” REITs such as Boston Properties (BXP), resulting in higher cap rates from regions that may see faster growth than Tier 1 markets. This is reflected by more than 80% of HIW’s properties falling within the top 10 growing real estate markets, as defined by the Urban Land Institute, as seen below.

HIW Locations (Investor Presentation)

Moreover, HIW enjoys the benefits of a rather young property portfolio, with an average age of just 20 years, which helps it to resonate with the needs of today’s tenants. It also sees a healthy occupancy rate of 91% and grew its average in-place cash rents by 4.2% per square foot YoY during the first quarter.

Looking forward, HIW is well-positioned to grow with a strong BBB rated balance sheet and a net debt to EBITDAre ratio of 5.3x, sitting below the 6.0x level that’s generally regarded as being safe for REITs. It also maintains $640 million in available liquidity on its revolving credit facility plus $18.7 million in cash on hand to fund its $283 million development pipeline, of which is 55% pre-leased.

Furthermore, HIW has plenty of incremental investment opportunities stemming from its large land bank, which can be used to create mixed-use assets, as noted by management during the recent conference call:

Our land bank has a value of approximately $340 million and has never been more attractive. It can support $2.2 billion of future office and another almost $2 billion of adjacent mixed-use development via new apartments, shops, restaurants and hotels. These mixed-use sites create excellent optionality for us as we may choose to sell the parcels outright or participate in the ownership and development. Either way, the build-out of this mixed-use land will bring even more desirable amenities to our adjacent office properties as will be the case at Bay Center.

Risks to HIW include higher interest rates, which may increase its cost of debt funding. In addition, remote work introduces uncertainty to office space. However, I don’t believe most companies want to go fully remote. This is supported by hybrid work environments, as stated during the recent conference call:

Utilization across our portfolios increased to around 50%, up about 10 percentage points during the past couple of months. And we expect to continue to pick up based on the return to work plans we are hearing from our customers.

As we’ve stated before, even though utilization is below pre-pandemic levels and customers are figuring out their office workspace schedules, many of which are hybrid, we are encouraged by the consistently strong leasing activity we’ve seen across our markets since the start of last year.

Notably, HIW has paid an uninterrupted dividend since 2003, and its current dividend is well-covered by a 51% payout ratio, based on earned FFO per share of $0.99 during Q1, excluding gains on sale of land.

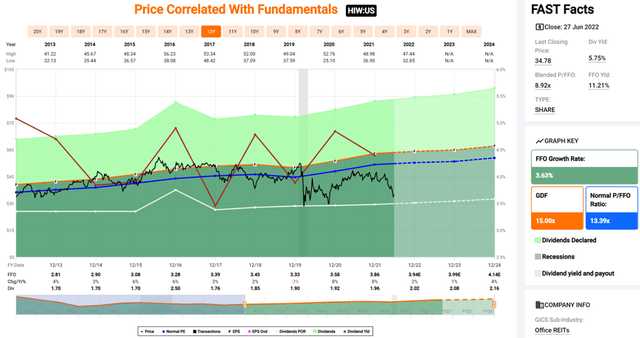

I see value in the stock at the current price of $34.78 with a forward P/FFO of just 8.8, sitting well below its normal P/FFO of 13.4 over the past decade. Sell side analysts have a consensus Buy rating on the stock with an average price target of $45.90, implying a potential 38% one-year total return including dividends.

HIW Valuation (FAST Graphs)

Investor Takeaway

Highwoods Properties is a well-run office REIT that’s positioned for growth in the coming years. It operates in growing markets with less competition from larger office REITs, and is positioned for a rebound in utilization rates for office space. Lastly, it offers a healthy and well-covered dividend yield of 5.8% and the current valuation makes HIW an appealing long-term buy for income and growth.

Be the first to comment