Yoshiyoshi Hirokawa/DigitalVision via Getty Images

Co-produced with “Hidden Opportunities”

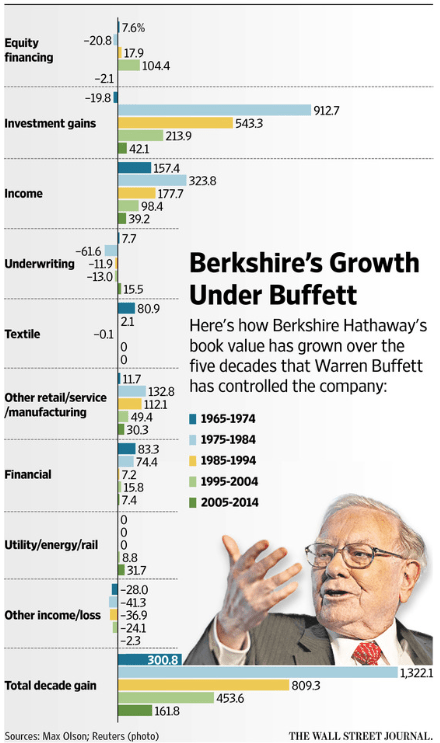

We keep hearing that inflation is at 40-year high levels. Everyone is anticipating a terrible recession like the U.S. economy of the 70s. Let us look at what Mr. Buffett’s portfolio did 40 years ago.

WSJ

Between 1975 and 1984 (a decade marred by high inflation, slow growth, and a hawkish Fed under Volcker, who responded with record interest rates), Berkshire Hathaway (BRK.A) (BRK.B) boasted its highest investment gains and the highest income.

How Did This Happen?

By not panicking and selling amidst economic hurricanes, Mr. Buffett did very well for himself when the market bounced back. He spent the 1970s making successful investments in stocks such as the Washington Post Company, GEICO, ABC Broadcasting, and RJ Reynolds. These powered BRK to hit the $1,000 milestone for the first time in the early 80s.

“Someone’s sitting in the shade today because someone planted a tree a long time ago” – Warren Buffett

Mr. Buffett was able to look past short-term concerns and focus on the big picture. He invested in profitable companies that could exit the dark tunnel. These rewarded him handsomely for his patience.

We aren’t traders looking to make money by reading sentiment, and volumes, and predicting market action. Instead, we utilize the irrationality of the market to build and sustain a portfolio of dividend-paying stocks. When these stocks drop in value, we add a higher yield and amplify our income. When the market recovers, we are well-positioned for capital upside without dealing with the stress of timing the market. Remember, Mr. Buffett likes to collect dividends with a bucket. His company collected over $5.3 billion in passive income last year.

With that said, I would like to discuss two picks with yields of 8% that will pay you and let you sleep well at night while Mr. Market does his thing.

Pick #1: FEN, Yield 8%

First Trust Energy Income & Growth Fund (FEN) has done quite well since our coverage in December, with ~16% in total returns while the rest of the market bleeds in chaos. Our income method emphasizes buying discounted securities with high yields, so you get paid to wait for the upside. Yet, the CEF continues to provide a lot more value to shareholders.

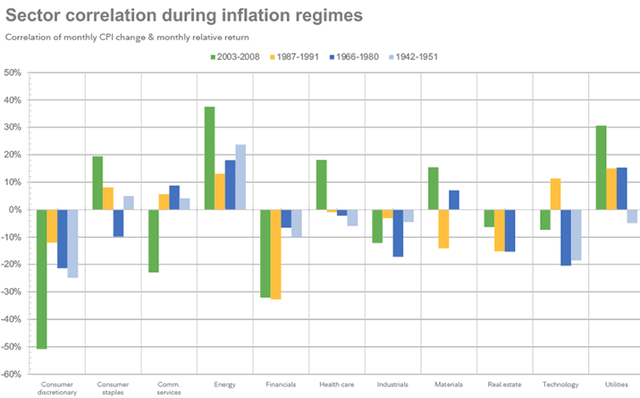

Energy is a vital industry that has historically done well during periods of higher inflation, and FEN gives you diversified exposure and big dividends from this promising sector.

With over 60 holdings, FEN has a large number of midstream names. This is a good thing because leading midstream companies have mostly fee-based revenues, reducing the correlation and variation of their income with commodity prices.

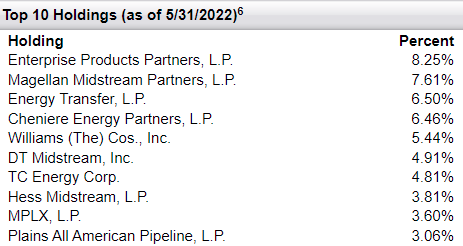

ftportfolios.com

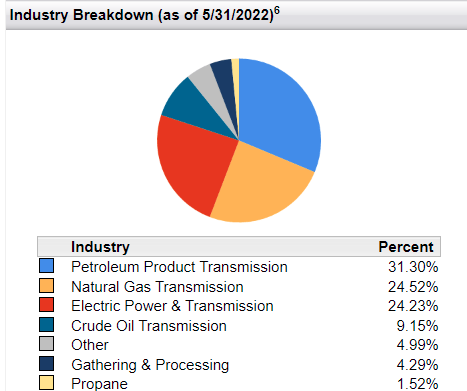

~90% of FEN is built with companies involved in the transmission of energy commodities, with the most significant chunks coming from the transmission of petroleum products, natural gas, and electric power – areas where infrastructure needs will grow to cater to the growing need for energy independence.

ftportfolios.com

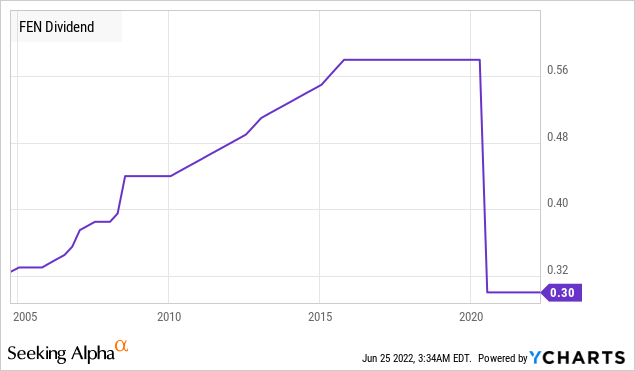

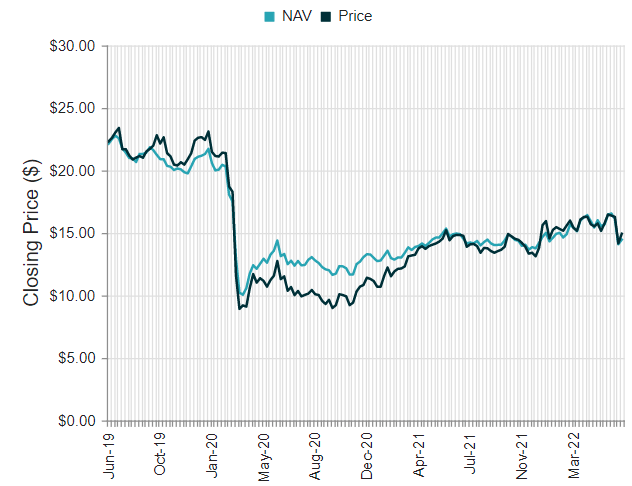

FEN pays $0.30/share quarterly, an 8.2% annualized yield. The CEF invests in several K-1 issuing MLPs but issues 1099 for tax purposes, so you don’t have to deal with undesired complexity. FEN has maintained growing distributions since its inception in 2004. However, the CEF was forced to cut the payment in 2020 due to the unprecedented demand shock for oil.

Experts agree that we are unlikely to see such a situation again. With geopolitical problems with Russian crude and gas to the EU, dependence on U.S. exports is higher. Hence, midstream is an excellent place to invest for capital upside and reliable dividends.

We expect FEN to incrementally raise distributions to shareholders as the energy sector continues its shareholder-friendly behavior. Mr. Buffett himself is highly bullish on the energy industry due to its cheap valuation and shareholder-friendly structure and has been boosting his stake in key players like Dominion Energy (D), Chevron (CVX), and Occidental (OXY).

FEN’s NAV has been recovering strongly since the early 2020 slump but remains ~35% below its pre-pandemic levels.

CEF Connect

FEN’s managers are First Trust Advisors, a leading advisory firm with over $172 billion in assets under management and 30+ years of portfolio management experience. This firm manages 16 CEFs in targeted market sectors, intending to derive income from their investments. High inflation and recession fears are causing an irrational sell-off in this CEF, despite its constituents being positioned from tailwinds from higher energy prices. This is your chance to buy the fear and lock in high yields.

Pick #2: MO, Yield 8.3%

Bull or bear market, Big Tobacco is well-positioned to make money, pay dividends, and buy back stock. They have done this for over 50 years with remarkable success. This recession-resistant business can produce massive free cash flows and has excellent pricing power to combat inflationary pressures. In the early 80s, Mr. Buffett, a known non-smoker, owned significant equity positions in major tobacco companies, notably Philip Morris, RJ Reynolds, and UST Inc. At the time, he said he was attracted to the business due to its fantastic margins and brand loyalty.

“Costs a penny to make, sell it for a dollar, it’s addictive, and there’s fantastic brand loyalty.” – Warren Buffett

Not everyone purchased Pelotons (PTON) and Teslas (TSLA) during the pandemic. For the first time in over two decades, U.S. cigarette sales saw a YoY increase in 2020. The stress and anxiety due to the pandemic-related uncertainties, higher unemployment, and several connected factors have contributed to this situation. With inflation at 40-year high levels and affordability being challenged, we can expect a similar cigarette sales pattern should the economy plunge into a recession.

Altria Group (MO) is one of the world’s largest tobacco companies and is the Marlboro brand’s parent company. The company’s sudden and irrational stock price drop is an opportunity for income investors, as we now have an attractive 8.3% dividend yield.

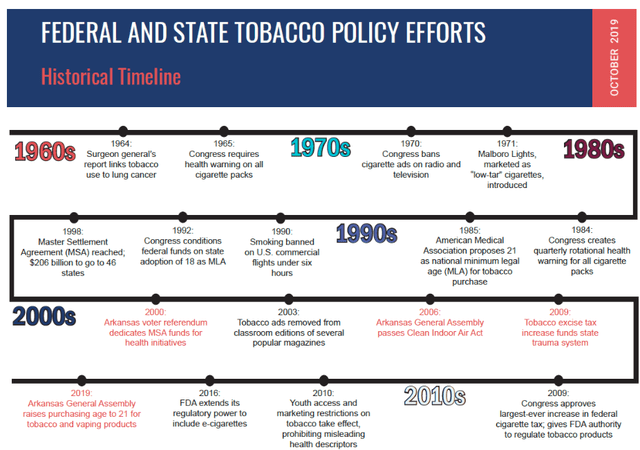

During bearish cycles, Mr. Market finds fault with good news and behaves pessimistically. And with bad news, he acts as if the company faces an existential threat. Believe me when I say this – Big Tobacco has seen multiple “existential threats” from regulatory pressures since the Surgeon General’s report in 1964.

In 2018, Altria invested $12.8 billion to acquire a 35% stake in e-cigarette maker JUUL. After several write-downs, the investment’s carrying value was down to $1.7 billion in January 2022. Since last week’s FDA announcement banning Juul’s vaping products, the ever-irrational Mr. Market has pushed MO’s market cap down by over $8 billion. Let us take a step back and look at things objectively. Firstly, MO has appealed the FDA’s decision, and a federal court has granted Juul Labs’ request to block the FDA’s order temporarily.

Secondly, combustible products account for about 85% of MO’s projected $21 billion in 2022 revenues. Tobacco is a very profitable business with tremendous brand loyalty, and the company projects full-year 2022 EPS between $4.79 to $4.93. This puts MO’s current dividend at a comfortable 75% payout. This is below MO’s target of 80%, leaving room for a dividend increase this year.

MO is a Dividend Aristocrat with an impressive 52-year dividend growth history. It has consistently faced regulatory pressures, and the Biden administration’s stance on its combustible products isn’t a new problem for the company. While this remains a longer-term risk and upside valuation multiple limiting factor, it is noteworthy that MO is diversified outside combustible products. The company maintains a significant 10% equity stake in Anheuser-Busch InBev (BUD), and a 45% stake in the cannabis company Cronos Group (CRON). Cannabis products have massive popularity among the younger generation and offer longer-term growth prospects for Big Tobacco. The best part is that companies like MO don’t need to rely on their high share prices to invest in growth segments; they can simply pursue these with their predictable free cash flows.

Today, MO trades at an extremely cheap forward PE of 9x. Low share prices are perfect opportunities for management to accelerate buybacks. And this is also an opportunity for you to pick up shares and collect high yields. Mr. Market can be pretty irrational sometimes, but you can relax knowing that tobacco is relatively recession-proof with very few competitors and high brand loyalty.

Dreamstime

Conclusion

Have you heard of the Henny Penny (a.k.a. Chicken Little) story? It is a European folk tale that teaches us about the quick and irrational propagation of fear of the worst thing imaginable (in this story, the end of the world). Henny Penny convinced everyone in her circle that the “sky is falling” and led them into the cave of an opportunistic fox. Here, the mainstream media is Henny Penny, we are all her “friends” or acquaintances, and our emotions lead us into the fox’s cave.

We often make rash and irreversible decisions at the worst possible time. These cause harm to our portfolio in the long term, and it is essential to be patient and rational, as the world isn’t ending.

“The stock market is a device which transfers money from the impatient to the patient.” — Warren Buffett

During the late 70s and 80s, the U.S. economy faced some of the most challenging times. Yet, this period represented Mr. Buffett’s best decade yet due to remarkable patience and disciplined investing.

At HDO, we are net buyers of income-producing assets and see no reason to stop buying at these discounted prices. The sky is not falling, but we may get hit on the head by acorns (sometimes large ones) from time to time. When life throws lemons, we make lemonade. We embrace market turbulence and take advantage of the opportunities to grow our income. When the market rebounds, we’ll own more shares, in more dividend-paying holdings. Our income will be higher.

Before you react to the market conditions, take a minute and remind yourself about your investment objectives. Will selling under pressure move you towards or away from those objectives? If reliable income when you sleep is your goal, this is a great time to be a buyer. Two picks with yields of 8% for a retirement dream.

Be the first to comment