sturti

Consumers are turning a little less downtrodden about the economy. On Tuesday morning, the Conference Board released its monthly Consumer Confidence Index data. The survey verified at 108.0, better than analyst expectations of 104.6, and it was even a tick up from August’s reading of 103.2.

Digging into the report, folks reported better present situations, and expectations were ratcheted up. Moreover, new home sales figures this morning for August were significantly better than economists had been expecting.

All good news, right? A slightly more sanguine consumer and better news on the real estate front? Not so fast.

Hot Consumer Confidence Data This Morning, Rates Rise

First, Chair Jay Powell at the Federal Reserve does not want to see upbeat data and sentiment right now. The FOMC remains steadfast in its mission to crush inflation, and consumers going out and spending more aggressively now that gas prices are lower is a threat to the Fed’s war to tame prices.

Bigger picture, though, I think this morning’s data was a blip on the radar – sort of like when a hurricane wobbles in one stray direction, but its path is still clear. Just gander at other signposts of the health of the real estate market, and hence, the consumer.

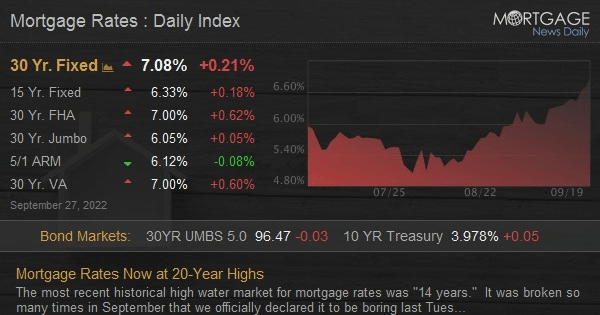

Mortgage rates finally climbed above 7% today. It seemed inevitable given the incredible bond market selloff since early July. The iShares Intermediate Treasury ETF (IEF), which measures the price of 7-10 year Treasuries, is down a whopping 11% from its intraday high less than two months ago. Moreover, interest rate volatility looks to print the highest monthly settle since the Great Financial Crisis.

Mortgage Rates Surge Above 7%

Mortgage News Daily

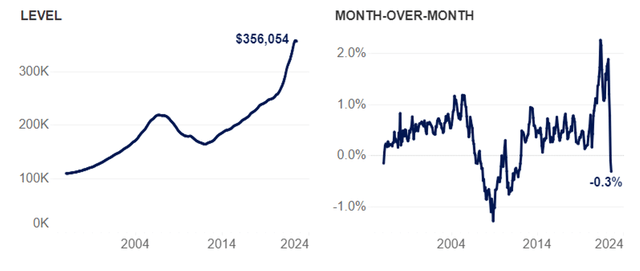

Consumers will not be so happy when they swipe into their Zillow apps over the coming weeks and months. They will find that, in net, U.S. home values are on the decline, according to Zillow Economic Research. This morning’s Case-Shiller Home Price Index also indicated that real estate is cooling off rapidly from the heat we saw in late 2021 and through the first half of this year.

Home Values Now Falling

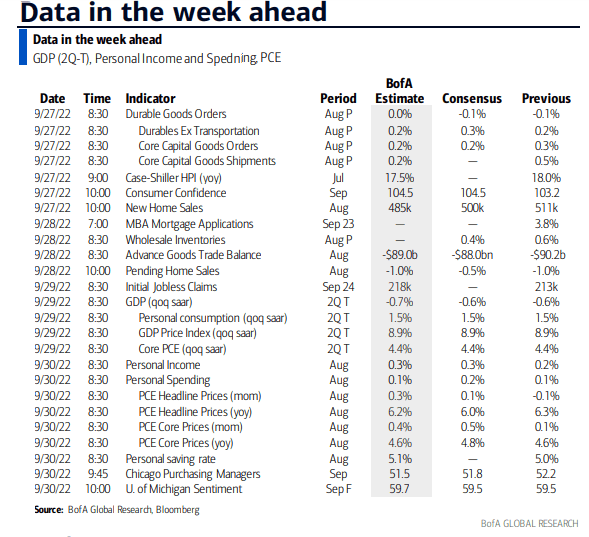

Looking ahead, more pivotal consumer-related data crosses the wires Wednesday with pending home sales. Perhaps more market-moving will be personal spending and saving figures for August on Friday. We’ll get a fresh look at critical PCE rates, one of the Fed’s favorite inflation indicators, to cap off the week, as well. Finally, a final print on the University of Michigan’s Consumer Sentiment survey comes Friday at 10 a.m. Bad news might be good news, and would help tame wild rate swings this week.

Consumer Data On Tap

BofA Global Research

But nothing cuts through the noise and news like price action. Take a look at the Vanguard Consumer Discretionary ETF (NYSEARCA:VCR). The full-replication sector fund tracks one of the most important sectors to the market and economy right now. It’s also highly liquid and costs just 10 basis points per year to own. Amazon (AMZN) and Tesla (TSLA) comprise about 38% of the sector and ETF.

The Technical Take

VCR has rewound to the same levels at which it traded two years ago. Of course, the CPI is about 12% higher now versus then, so it’s a “real” return loss. Notice how VCR found resistance at its 200-day moving average, just like the S&P 500, back in August. There’s support, though, at its June low, unlike the SPX which is cracking through that trough. So there is some relative strength here with VCR.

Unfortunately, the trend remains lower, and we need to see the bulls bring the fund back above the $276 to $280 range as of now. A break of $220 could lead to a quick test of its pre-COVID crash peak of $205.

VCR: Bearish Falling 200-Day Moving Average, Support At June Lows

The Bottom Line

We get a slew of important consumer economic data this week. It might be ‘bad news is good news’ given bond market volatility lately. Slower growth might finally bring about a Fed mini-pivot. Keep your eye on the falling 200-day moving average on VCR and its June low.

Be the first to comment