Liz Leyden/iStock Unreleased via Getty Images

Introduction

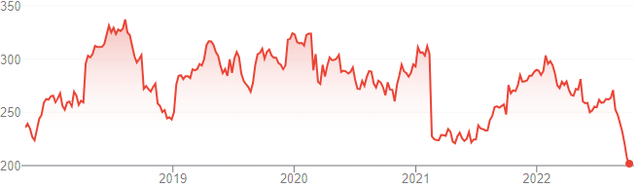

We review Tesco PLC (OTCQX:TSCDY), the #1 U.K. grocery chain by sales, after shares in London fell to a new 5-year low following the release of H1 FY23 (ending August 31, 2022) on Wednesday (October 5):

|

Tesco Share Price (Last 5 Years)  Source: Google Finance (07-Oct-22). |

Tesco shares are now trading at a 9.6x P/E, a 10%+ Free Cash Flow (“FCF”) Yield and a 5.8% Dividend Yield, having fallen 31% year-to-date, despite starting 2022 as a “value” stock trading at a 13.3x P/E.

Tesco has executed a successful turnaround before COVID-19 and benefited from the pandemic. EBIT has been in decline and fell 9.8% in H1, but largely due to post-COVID normalization and current U.K. macro headwinds. We believe its U.K. business is strong, holding its market share in groceries and benefiting from growth in its Booker wholesale business. Even with pessimistic assumptions, provided growth resumes in FY25, a recovery in Tesco’s P/E should offset near-term EPS declines. With shares at 199.6p, we expect a total return of 31% (12.7% annualized) by February 2025; investors less bearish on the U.K. may see a much higher return in their forecasts. Buy.

With its low growth and comparatively low returns, Tesco is a stock more suited to investors bullish on the U.K, prioritize income and/or prefer “value”

Tesco Company Overview

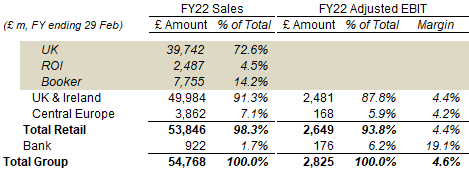

Tesco is a U.K. grocery chain that generated close to 90% of its Adjusted EBIT from U.K. & Ireland in FY22:

|

Tesco Sales & Adjusted EBIT by Segment (FY22)  Source: Tesco results release (FY22). NB. Sales exclude fuel and VAT; EBIT margins are based on revenues, not sales. |

The U.K. grocery business generated 73% of group sales in FY22, and consists of 3,500 stores in a variety of sizes and formats. It is the UK’s biggest grocery chain, with a 27% market share. Online sales were 12.9% of sales in H1 FY23.

Tesco also owns Booker, the #1 wholesaler in the U.K., and this generated 14% of FY22 group sales. Booker sales are roughly 55/45 split between retail and catering customers.

Tesco Bank in the U.K. provides personal finance products, including credit cards, loans, travel money and insurance. The segment generated 6.2% of group EBIT in FY22.

Tesco has grocery businesses in the Republic of Ireland (“ROI”), which generated 4.5% of FY22 group sales, and in the Czech Republic, Hungary and Slovakia (together as “Central Europe”), which generated 7.1% of sales.

Tesco Share Price & Valuation History

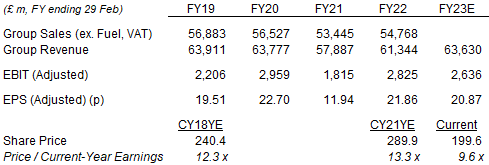

Tesco is a classic “value” stock. At 199.6p, shares are at just 9.6x FY23 Adjusted EPS, per consensus estimates:

|

Tesco Financial & Valuation Snapshots (Since FY19)  Source: Tesco company filings. NB. Pre-FY21 EPS figures and CY18YE share price adjusted for reverse 19:15 stock split in Feb-21. Group sales and EBIT figures are as originally reported. |

Tesco’s share price has fallen by 31% year-to-date, despite starting 2022 already in “value” territory with a 13.3x P/E relative to FY22 actual Adjusted EPS.

For most of the past 5 years, Tesco shares have been at a low-teens P/E. Adjusted for a reverse stock split in 2021, the share price has mostly been above 250p, and the Adjusted EPS has been at around 20p each year, except the COVID-impacted FY21. (For example, Tesco stock was at 12.3x FY19 EPS at the end of 2018.)

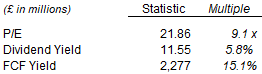

Relative to its FY22 financials, Tesco shares are trading at a 9.1x P/E:

|

Tesco Valuation Metrics  Source: Tesco company filings. |

In addition, Tesco has a 10%+ FCF Yield on its Retail FCF alone. Retail FCF was £2.277bn in FY22 and is guided to “at least £1.8bn” in FY23 (lower due to a smaller EBIT and larger working capital from inflation), compared to its market capitalization just £15.1bn. Retail FCF excludes Tesco Bank, which expects a FY23 EBIT of £120-160m.

Tesco has paid a dividend of 11.55p in the past twelve months, implying a Dividend Yield of 5.8%.

Tesco’s Operational Track Record

Tesco has gone through significant corporate changes in recent years, so the headline numbers above do not tell the whole story about its operational track record. Instead, we look at Adjusted EBIT by segment.

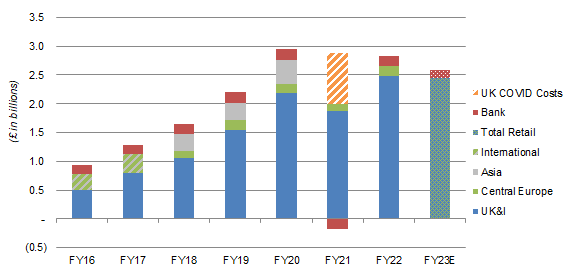

Adjusted EBIT grew dramatically in FY16-20, in a successful turnaround led by then CEO Dave Lewis, who took up his role in September 2014 (in FY15). Adjusted EBIT fell in FY21 with the sale of the Asian business, £892m of direct COVID-19 costs and credit reserve build at Tesco Bank, but (excluding Asia) more than recovered in FY22 thanks to the pandemic’s boost to in-home demand and lockdowns affecting other retailers are not “essential” like Tesco stores:

|

Tesco Adjusted EBIT by Segment – Annual (FY16-23E)  Source: Tesco company filings. NB. FY ends 29 Feb. Booker acquired in FY19 and contributed 51 weeks that year. FY21 figures exclude discontinued operations in Asia and Poland. |

Adjusted EBIT is expected to fall in FY23, with management guiding to an 6-10% decline in Retail EBIT (from £2.65bn to £2.4-2.5bn) and a 9-32% decline in Bank EBIT (from £176m to £120-160m).

U.K. Macro Headwinds Affecting Tesco

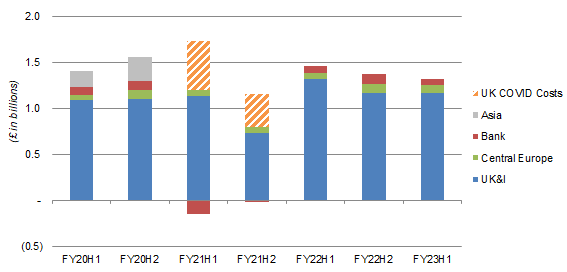

On a half-yearly basis, Adjusted EBIT has already been falling since FY22, and was 9.8% lower year-on-year and 3.8% sequentially in H1 FY23, driven by a decline in the core U.K. & Ireland business:

|

Tesco Adjusted EBIT by Segment – Half-Yearly (FY20 to H1 FY23)  Source: Tesco company filings. NB. FY ends 29 Feb. FY21 figures exclude discontinued operations in Asia and Poland. |

Tesco’s U.K. & Ireland Adjusted EBIT fell 11.3% year-on-year, largely due to its Adjusted EBIT margin falling 78 bps year-on-year to 3.9%. U.K. & Ireland sales actually grew 0.6%, or 0.7% on a like-for-like basis.

Part of the decline is simply post-COVID normalization, with Tesco losing “roughly half” of the volume gained during the pandemic and its U.K. business retaining just 70% of the online customers gained in the past two years.

However, U.K. macro headwinds have been a key negative, with rising inflation hitting Tesco both directly through higher costs and indirectly through customer shifting to lower-margin products. As CEO Ken Murphy said on the H1 FY23 earnings call:

We can now see tangible changes in behaviour, purely relating to increases in the cost of living. Whether it’s switching to Tesco own brand … or making more subtle changes such as switching from fresh to frozen, we can see customers prioritising value wherever they can. This can create challenges for us in terms of our mix, even before we overlay the impact of significant commodity and cost inflation.”

The U.K. has been buffeted by a number of negative events, including higher energy costs after the Russian invasion of Ukraine in February, higher trade barriers with the European Union after the transition period ended at 2020 year-end and, particularly in 2022, a sharply weaker U.K. pound.

We believe the macro headwinds that Tesco faces will persist and potentially worsen. In the event of a prolonged U.K. recession, Tesco’s EBIT may continue falling for an extended period.

Tesco May Be Stronger in U.K. Than It Seems

We believe Tesco’s U.K. business is stronger than it seems, holding its market share in groceries and benefiting from growth in its Booker wholesale business.

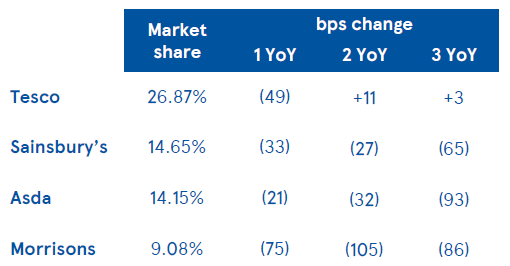

The biggest threat to U.K. grocer profits has been German discounters Aldi and Lidl, which have rapidly expanded in recent years. Together they now have 16.4% of the U.K. grocery market, with Aldi’s share having reached 9.3% in September (according to Kantar), putting it at #4 (just ahead of Morrison’s).

Aldi and Lidl operate fundamentally differently to traditional U.K. grocers, with a more limited range in smaller stores, which help them maximize their sales density, achieve lower unit costs and ultimately deliver more competitive prices. They are also taking advantage of the disruption in the retail property market to open new stores. As Tesco CEO Ken Murphy acknowledged on the H1 FY23 call, “the limited range discounters [are] gaining share as a result of them adding millions of square feet of new space”.

However, Tesco has mostly been able to maintain its market share, actually gaining slightly across 2-year and 3-year time periods and losing just 49 bps year-on-year, while other traditional U.K. grocers continue to lose share:

|

Tesco U.K. Market Share vs. Other Traditional Grocers (H1 FY23)  Source: Tesco results presentation (H1 FY23). |

Tesco has been able to defend its market share better due to a number of reasons. It has superior economies of scale, with a market share that is almost twice as large as the next grocer competitor and additional scale from its Booker wholesale business. It has pursued an aggressive pricing strategy, where it “inflate a little bit less and a little bit later than the rest of the market” (CEO, H1 FY23 call). It has invested in its Clubcard loyalty scheme and Aldi Price Match guarantee. We expect Tesco’s lead to continue, especially with ASDA and Morrison both now more burdened by leverage after being acquired by private equity (in February and October 2021 respectively).

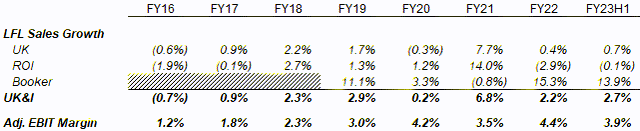

Growth in Tesco’s U.K. business is also helped by its Booker wholesale business, which has achieved an average like-for-like sales growth of 8.6% (including the COVID-impacted FY21) since being acquired:

|

Tesco U.K. & Ireland Like-for-Like Sales Growth (Since FY16)  Source: Tesco company filings. |

Booker benefits from the same advantages as Tesco’s grocery business but does not face competition from discounters. It is gaining market share and also being helped by the post-COVID rebound in catering demand. We expect it to continue to deliver solid growth in future years.

We believe EBIT declines in Tesco’s U.K. business will be relatively modest, and growth should resume once macro headwinds abate.

Tesco Capital Allocation

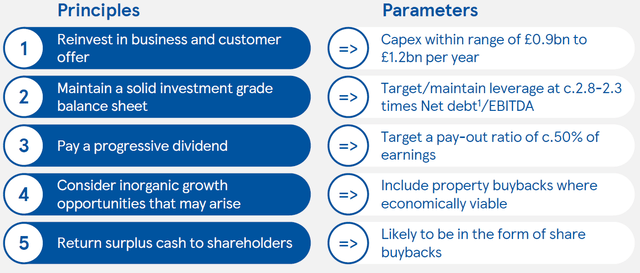

Tesco has a shareholder-friendly capital allocation policy that rewards shareholders and assist EPS growth:

|

Tesco Capital Allocation  Source: Tesco results presentation (FY22). |

For dividends, Tesco targets a Payout Ratio of “around 50%” (with the interim dividend targeted as 35% of the prior-year dividend). After paying dividends, management will repurchase its store properties where there are “economically viable” opportunities. Any surplus cash after that will be returned to shareholders, likely as buybacks.

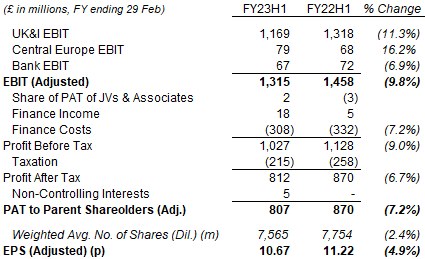

H1 FY23 results showed how this capital allocation helps EPS growth. While Adjusted EBIT fell 9.8% year-on-year, Profit Before Tax fell only 9.0% because Finance Costs fell 7.2%, the latter the result of property buybacks (which more than offset a £75m mark-to-market charge on inflation-linked swaps). Adjusted EPS fell only 4.9%, compared to Profit After Tax to Parent Shareholders falling 7.2%, because share buybacks have cut the share count by 2.4%:

|

Tesco Group P&L (H1 FY23 vs. Prior Year)  Source: Tesco results release (H1 FY23). |

Tesco is currently executing the last £300m (equivalent to 2.0% of the current market capitalization) a £750m buyback program that was announced in April 2022 and supposed to be completed by April 2023. Its Net Debt / EBITDA is 2.5x, within its 2.3-2.8x target range. We expect more share buybacks to follow in future years.

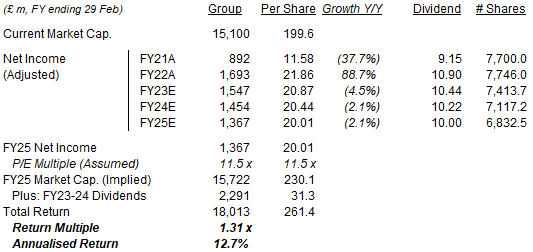

Illustrative Tesco Stock Forecasts

We have pessimistically assumed a U.K. recession and several years of earnings declines for Tesco. Even so, provided growth resumes in FY25, a recovery in Tesco’s P/E should offset near-term EPS declines, leading to a low-teens annualized return including dividends.

Our key assumptions are as follows:

- FY22 EPS to be 20.87p, in line with current consensus

- FY22 share count to fall another 2% from H1 FY23

- Net Income to fall by 6% each year in FY23-24

- Share count to fall by 4% each year in FY23-24

- Dividend Payout ratio of 50%

- FY25 year-end P/E of 11.5x

Our new FY25 EPS forecast is 20.01p, 17% lower than current consensus:

|

Illustrative Tesco Return Forecasts  Source: Librarian Capital estimates. |

With shares at 199.6p, our forecasts indicate an exit price of 230p and a total return of 31% (12.7% annualized) by FY25 year-end (February 2025).

Our forecasts of two more years of EPS declines differ significantly from current sell-side consensus, which indicates two years of growth instead. Investors who are not bearish on the U.K. will likely see much stronger EPS figures and a much higher return in their forecasts.

Tesco is a Low-Growth “Value” Stock

Tesco’s Buy rating does come with certain structural risks, especially in the event of a prolonged U.K. recession.

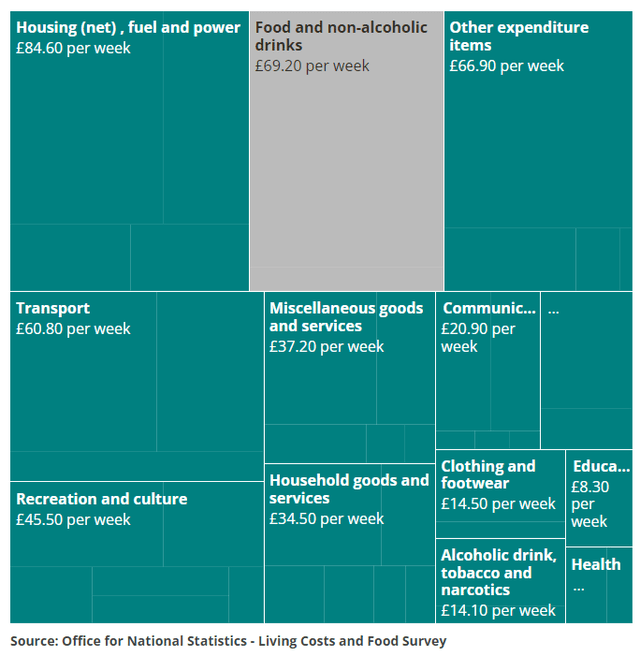

Groceries is mostly a commodity business, with much of the product range being non-exclusive branded goods and grocers’ own brands being relatively undifferentiated. While groceries are largely non-discretionary purchases, their status as one of the largest components of household spending means it is an obvious area for cutbacks in times of financial stress. Price is a key area of competition and, as described above, discounters are highly competitive. These unfavourable characteristics are reflected in Tesco’s low EBIT margin (around 4%).

|

UK Family Spending by Area (2021)  Source: U.K. Office for National Statistics (18-Jul-22). |

With the U.K. grocery market having matured and margins constrained by competition, Tesco is a low-growth business. Its relatively low pricing power and margin can make it uniquely vulnerable in a prolonged U.K. recession, as weak household budgets will encourage consumers to shift to low-margin products and discounters.

Compared to other stocks, the low-teens annualized returns we forecast for Tesco is also comparatively low. While stronger U.K. macro should increase investor returns significantly, this is not our base case.

Tesco shares are therefore a Buy more suitable for investors who are either (1) not bearish on the U.K.; (2) income investors who prioritize dividends; (3) “value” investors who prefer low-multiple stocks and/or have low expectations for other stocks.

Conclusion: Are Tesco Shares Worth Buying?

We assign a Buy rating to Tesco PLC stock, but note that it is more suitable for investors not bearish on the U.K. and/or are “value” investors.

Be the first to comment