Wachiwit

What’s The Goal Of This Article?

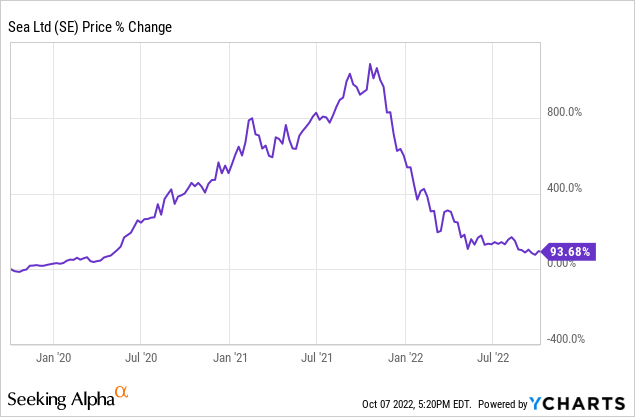

If you invested in Sea Limited (NYSE:SE) throughout 2020 and 2021 like I did, you are surely not happy with your loss of returns. This company was dubbed by many as “the Amazon (AMZN) of South Asia and soon to be all of Latin America” and take over MercadoLibre’s (MELI) territory, and maybe even Europe. It was a three-headed monster of revenue growth in e-commerce, gaming, and digital banking.

Now if you invested in Sea Limited earlier like three years ago, you probably are not too upset considering you are still up 93% on your return. Just one supporting example of getting in a stock at a reasonable price and holding in the long-term pays off. Sea Limited was the FinTwit darling of the investment community, everyone was talking about the massive revenue growth it was delivering. The stock reached a 52-week all-time high of $372 a share this year and since then has lost over 83% of its value! So, was Sea Limited just one of the biggest one hit wonders in the stock market, or is there more to the story?

My goals of this article are to share both the risks that are in place in buying more shares of Sea Limited or starting a position in the stock, but also why I believe there is a much higher chance of reward if you do so. I believe the next 12-18 months are going to be a defining moment for Sea Limited as a company, stock, as well as for their Founder & CEO Forrest Li.

Let’s Layout The Risks And Challenges Of Investing Now

Sea Limited is a holding company with three businesses under it, Garena their digital gaming arm, Shopee their e-commerce business, and SeaMoney the finance arm. Sea Limited has always relied on the profitable part of their business, Garena, to fuel financing the growth in their other two businesses. In a business model like this, it puts concentration risk on the necessity of Garena’s success to ensure the other parts of the business can continue to grow.

Sea Limited’s Garena started out distributing well known game titles on their social online gaming platform Garena+, in various countries across Southeast Asia and Taiwan, including the online football (soccer) game FIFA Online, the first-person shooter game Point Blank, and multiplayer online battle arena (MOBA) games like League of Legends and Arena of Valor. However, Garena also started publishing games and released its own game Free Fire, which was an instant success. Free Fire has been the number one mobile game on the App Store and Google Play Store for several years now. It was the Free Fire franchise that has caused Garena to be a profitable business for Sea Limited. Free Fire’s growth peaked with over 243 million players monthly in 2021, but has now declined by 23% to a little over 189 million players.

Free Fire Mobile Game (Garena Website)

Now if you are like me, and are concerned that there is concentration risk to Sea Limited producing cash, because of its heavy reliance on Free Fire, you would be right. However, at the time of my first investments in Sea Limited I was able to look over this because I was still bullish on all the fast expansion Sea Limited was delivering with its other business units.

Sea Limited was using its mobile game to intrigue gamers in multiple regions to use its other online products like Shopee and SeaMoney. Sea Limited expanded from their Southeast Asia Market into Latin America and even European countries like France and Poland. Sea limited then started building new businesses like their food delivery services and an artificial intelligence business segment called SeaAI.

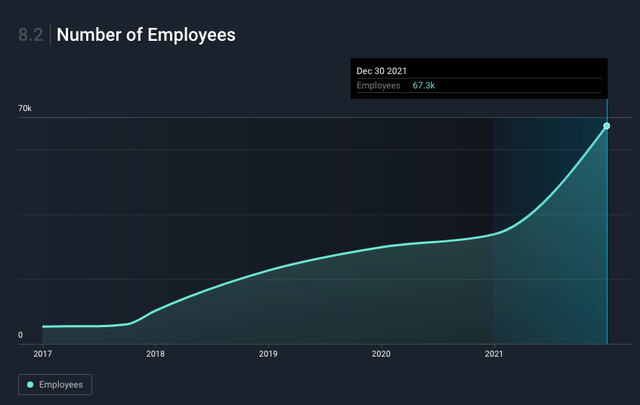

My point to all of this was Forrest Li and his company were scaling their business rapidly fast to capture as much market share as they could and turn profits later, when they felt it was the right time. Money was cheap in 2020, we had mobile gaming and e-commerce at all-time highs, due to the pandemic constraints. Sea Limited was so committed to achieving fast paced growth that it grew its employee count from under 34,000 to nearly 68,000 in the year of 2021.

History of Employee Growth (Simply Wall St. App)

That was a very aggressive and large gamble that essentially backfired on the company, one could argue. After 2021 the world changed again, with the pandemic ending and the macroeconomics and geo-political landscape becoming what it is today. Since then gaming has decreased significantly, hence the huge decline in Garena Entertainment revenues, which also contributed to the over $1 billion in net losses this recent Q2.

Let’s sum up these challenges which have created possible risk in the business, these past few quarters.

- Free Fire has had its daily average player decrease by over 50% in one year to 18.3 million and monthly average players 23%.

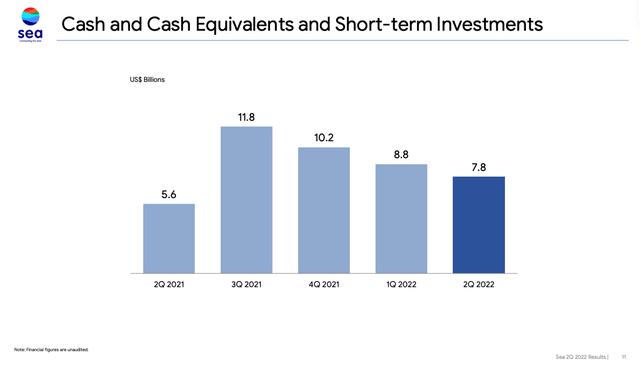

- Sea Limited is on average losing over $1 billion in cash per quarter since Q3 of 2021

- Sea Limited over-hired by doubling its employee count in one year and over extended itself in trying to capture multiple global regions of marketshare.

- The company was committed to growth at all cost and was not prepared for if conditions were not ideal or relatively difficult from a macroeconomics & geopolitical perspective.

- Sea Limited is not projected to be profitable next year in 2023, and right now the stock market is not in favor of money losing growth businesses.

Sea Limited Cash on Hand (Sea Limited Q2 Earnings Presentation)

The Defining Moment

Okay, so if you are like me and are down significantly from your cost basis on your investment of Sea Limited, you may ask yourself “Is it time to sell? And most importantly do I believe Forrest Li and leadership can turn this ship around?” because if you don’t believe in the capabilities of the leadership team, then you may want to sell your shares now, because in the short-term things still might be painful for a bit.

However, let me share why I believe this is the defining moment that we see Sea Limited transform into a stronger business with a more mature focus on steady and reliable growth. Since the Q2 earnings presentation, Sea Limited has cut giving guidance on its e-commerce business Shopee as the macroeconomic headwinds are too hard to predict and this allows them to focus all efforts not on rapid revenue growth but optimizing costs and efficiencies.

I was extremely impressed with CEO Forrest Li’s letter to employees this past September, around creating a self-sufficient and sustainable business that doesn’t require any more third party funding to operate. I believe Forrest is evolving as a CEO and leader and recognizes the growth at all cost approach was not necessarily a mistake, but an approach that can backfire if the world of macroeconomics has a 180-degree shift. This shift is exactly what happened for global economics considering all of the following events happening, the war of Ukraine and Russia, supply chain issues, tensions between China and Taiwan, inflation and the cost for energy, and the economic aftermath of the pandemic.

My point is Forrest appears to be humble and strategic enough to know when the company must change course and do it fast to adapt in the new world, we are living in. In my opinion, this is a sign of a great leader and indications of someone that you can trust with your investment. The decisions the leadership team at Sea Limited had to make were not easy ones but necessary to position themselves to where they would not need to get more external financial funding and had a path to free cash flow positive and eventually profitability.

Here are all the things Forrest and his leadership team have done to cut costs in the recent months:

- CEO Forrest Li and his leadership team decided they will not take any cash compensation until the company achieves self-sufficiency (assuming this means until Sea Limited is free-cash-flow positive.)

- Sea Limited cut staff by 3% in Shopee Indonesia and its marketing and operation units

- The e-commerce arm Shopee will also shut down local operations in Chile, Colombia, Mexico, but will maintain cross-border operations.

- Shopee will be completely exiting Argentina which is where MercadoLibre is Headquartered

- The Garena gaming unit will be laying off hundreds of staff, totaling 15% of their workforce in their Shanghai office and canceled several new games

- Shopee has withdrawn job offers and shutdown operations in India and France

- As of October 1st, Sea will cap business travel to economy class flight fares, with travel meal expenses of $30 daily

- Hotel Stays for business trips capped at $150 a night, and travel for local taxi and ride sharing also applied

So some would read this as a lot of negative news for Sea Limited, but I would argue that this is what is needed and this focused approach on profitability over growth and gaining self-sufficiency will be the inflection point for this company. So many companies try to run the Amazon business model with trying to grow at all cost, capture marketshare, and then choose when to pull the profitability levers in their business.

The reality is Amazon had a business model that was one in a million! To be able to continue and fund their aggressive pursuit for market share dominance and growth at all costs, they bet on creating cloud computing with AWS, which became the ultimate cash cow. This is why in some facets their business model should not be adopted or at least tried to be completely replicated.

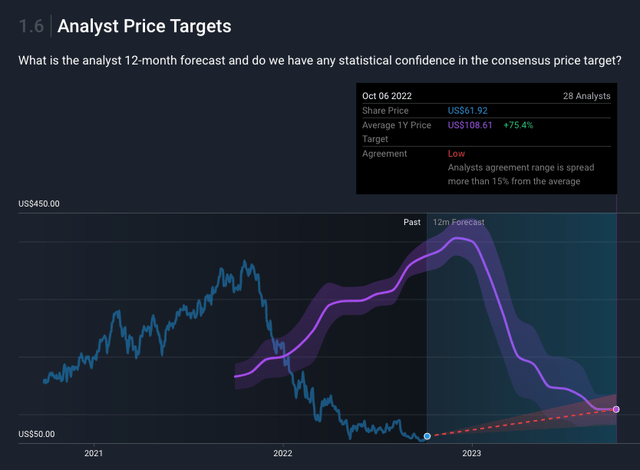

1yr Analyst Price Targets (Simply Wall St. App)

Where To Find The Positive Future?

In my opinion, this could be the defining moment for Forrest Li’s turnaround of Sea Limited and making it a long-term profitable company a lot faster than what was originally projected. Here are some of the positive catalysts we could see.

- Sea Limited will now focus on its primary markets of business such as Southeast Asia and Brazil now, and could see increased revenues.

- Traditionally the 2H of e-commerce businesses are much higher, so we could possibly see that here.

- SeaMoney is expected to be Cash flow positive by FY23.

- Parts of Shopee in Taiwan and Southeast Asia are projected to be EBITA positive by FY23.

- I expect to see less stock-based compensation and more control on all expenses.

- Garena has new games that are in the pipeline of their game studio Phoenix Labs, who created the hit RPG franchise Dauntless.

- Garena could see growth from their investment in VIC Game Studios, who have a hit franchise called Black Clover that is releasing its RPG mobile version later this year.

Summary

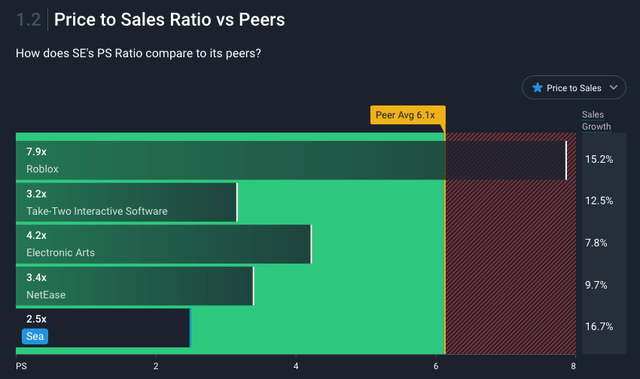

There have been numerous changes within the business that in the long run, I believe will make them more resilient and control their own fate, opposed to needing to rely on external financing for growth. I also believe with less regions to focus on expansion and more focus on concentrated execution, Shopee will be a more efficient and optimized e-commerce business. This company is trading significantly much cheaper than it was a year ago and is cheaper than its peers.

Forward Price to Sales Ratio (Simply Wall St.)

I believe Garena has shown us they know how to create a winning franchise mobile video game and monetize it effectively and will do so with other titles in the future. Remember, as long as Sea Limited gets a handle on their spending and business operations, they still have $7.8 billion in cash to put towards their operations. I expect to see goodness from the new games coming from VIC Game Studios and Phoenix Labs, especially if Phoenix Labs could release a mobile version of Dauntless, as it is only on consoles yet it still has 30 million players worldwide!

Dauntless by Phoenix Labs (Phoenix Labs Website)

I will agree this past year has been a crushing blow in the markets, especially for Sea Limited, but I feel these next one to two years are going to show the adaptability and resilience of Forest Li and the company. I know an 83% drop from all time highs hurt like a punch in the gut, but Amazon also had a drop or two like this over its history. I am not saying Sea Limited is the next Amazon, but saying that Sea Limited is not a dead company by any means. I believe they can bounce back and get to those all-time highs for patient investors.

This company still has nearly 30% revenue growth year over year, $7.8 billion in cash, new revenue catalysts ahead of it, a new company focus on free-cash-flow positive operations, and secular tailwinds to ride with e-commerce, mobile gaming, and esports, and providing fintech solutions for the unbanked.

Please let me know what you think of this article and comment with your thoughts below.

Be the first to comment