Maksim Labkouski

Investment thesis

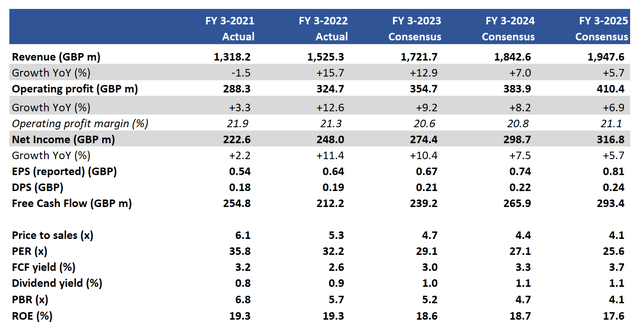

We maintain our buy rating, as we believe new investors have an opportunity to buy Halma (OTCPK:HALMY) (OTCPK:HLMAF) without a high premium, and holders should keep their shares as Halma begin to outperform its peers via stronger earnings growth underpinned by M&A activity. The shares are trading on consensus PER FY3/2024 27.1x, on a free cash flow yield of 3.3%.

Quick primer

Halma was founded in 1972 by David Barber and Mike Arthur, who used a listed business (called Halma) as a vehicle to acquire and manage a portfolio of small companies with successful management, high-quality earnings, and intellectual assets to generate value. Halma has now bought over 120 companies, most of them being leaders in niche technical fields. The company is an FTSE100 index name with a relatively low profile.

Key financials with consensus forecasts

Key financials with consensus forecasts (Company, Refinitiv)

Our objectives

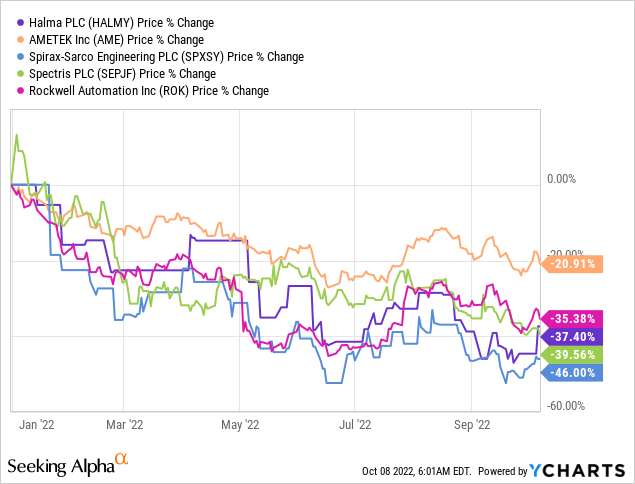

With significant exposure to the industrials sector with its Safety and Environmental & Analysis activities, operating activities are currently challenging for cyclical businesses and there is no indication of an upturn. Halma’s shares have performed in line with its peers such as Spirax-Sarco (OTCPK:SPXSY), Spectris (OTCPK:SEPJF), and Rockwell Automation (ROK), although it has underperformed versus another industrial conglomerate AMETEK (AME).

Reviewing our view from February 2021, we want to assess the medium-term outlook for earnings, examining the trading statement from September 2022, and prospects for future M&A activity.

Dissecting the trading statement

Halma will release interim FY2022 results on 17th November 2022. The trading statement was disclosed on 22nd September 2022, and the key takeaways for us are as follows.

Commentary about ‘good progress’ and performing in line with management expectations was not a major positive surprise and trading sounds in line. Original guidance for FY3/2023 sales growth is ‘good’ single-digit percentage organic growth YoY under constant currency, which does not appear hugely challenging for the company.

Order growth was said to be up YoY and ahead of revenue growth YoY which is positive, providing some short-term earnings visibility as Halma operates primarily as a short-cycle business (as opposed to long-term contracts).

The depreciation of the pound sterling has been highlighted as a tailwind for reported financials. This trend has become more pronounced into H2 FY3/2023, and we expect to see more of a material influence on earnings growth YoY. However, the flipside here is that the UK economy has become notably unstable into the second half, given new government policies over fiscal loosening and negative market reaction in terms of rising financing costs. However, as the UK made up 18% of FY3/2022 sales (page 31), the weakness here will have an impact but not a material one with large overseas exposure. Management has mentioned relative strength in the US and mainland Europe, versus a ‘modest’ showing in the UK and Asia.

What we found most positive in the trading statement was that order intake remained on an upward trend YoY and that there was no mention of customer ordering behavior changing. Although we are expecting to see some deceleration in order growth YoY into the second half of the year, there appeared to be no major signs as yet last month. Profitability also appeared stable, with no major issues over cost management despite price inflation.

M&A remains key to strategy

A core tenet of Halma’s sustainable growth strategy is M&A. The preference is to acquire smaller firms as opposed to large which would invite concentration risk. With this strategy Halma’s topline aspiration is to double every 5 years (so around 15% CAGR YoY). This 15% YoY would be split between 5% organic and 10% M&A impact, but this balance can bounce around a bit. Clearly in present climes aiming for 15% growth is unlikely, which could explain Halma’s share price correction.

In FY3/2022 the company acquired 13 companies, but in H1 FY3/2023 Halma managed to close only one acquisition – Deep Trekker, an Ontario-based manufacturer of remotely operated underwater robots used for inspection, surveying, analysis, and maintenance. Whilst this may pose some concern as activity has slowed, things seem to be picking up as Halma acquired Izi Medical Products (a medical devices company), and Weetech Holdings (manufacturer of safety-critical electrical testing technology for the aviation, rail, automotive, and engineering sectors) both in October 2022. The pipeline is said to be promising, and we believe that the temporary halt in activity was to be expected considering the rapid changes in the economic environment. Halma remains well-capitalized and is arguably in a better position to value deals more favorably now, as opposed to the last few years when potential targets were too richly priced. The only negative here is with the depreciating pound, foreign asset acquisitions could become more expensive, although Halma does have sizable access to foreign currency.

We expect to see a flurry of deals being executed in H2 FY3/2023, as Halma’s pipeline begins to convert. We believe this will be driven by the following factors; 1) potential targets wanting to accelerate deal closure as fundamentals begin to weaken 2) deal structures become more favorable to what is rapidly becoming a buyer’s market.

M&A is financed via a mix of self-generated surplus cash and debt – the company avoids financing via equity as it dilutes existing stakeholders, and is not seen as a self-sustaining solution to growth. Leverage remains at low levels, with debt to equity at 0.31x in FY3/2022.

Valuation

The shares are trading on consensus PER FY3/2024 27.1x, on a free cash flow yield of 3.3%. These valuation metrics are not exactly value territory, but for a business with a solid track record of sustained growth and value generation, it presents an opportunity to invest.

Risks

Upside risk comes from a major burst of M&A activity in H2 FY3/2023, driving accretive earnings growth YoY which re-accelerates sales growth into FY3/2024. With stable order intakes in H2 FY3/2023, management may raise guidance to demonstrate stronger-than-expected trading.

Downside risk comes from a major collapse in trading activity in the UK, given the September 2022 mini-budget that has placed significant pressure on borrowing costs. Limited M&A activity may also put into question Halma’s strategy over executing sustainable long-term growth.

Conclusion

Halma’s history of solid execution and sustained growth profile automatically results in the market valuing the shares highly. Consequently, it is only during times of economic uncertainty (such as today) that investors can realistically find the shares valued without a premium. We maintain our buy rating, as we believe new investors have an opportunity to buy and holders should keep their shares as Halma begins to outperform its peers.

Be the first to comment