yalax

If you’re looking for a long term contrarian income investment, you may want to consider BlackRock Science and Technology Trust II (NYSE:BSTZ) and/or its sister fund, BlackRock Science and Technology Trust (BST).

These were two formerly popular sister tech funds, which cover different aspects of the tech sector. Both have beaten down in the tech exit in 2022, but BSTZ is selling at a much larger discount to NAV/Share.

Profiles:

BSTZ is a limited-term closed-end equity fund. BSTZ commenced operations in June 2019 with the investment objectives of providing total return and income through a combination of current income, current gains and long-term capital appreciation.

Under normal market conditions, the Trust will invest at least 80% of its total assets in equity securities issued by U.S. and non-U.S. science and technology companies in any market capitalization range, selected for their rapid and sustainable growth potential from the development, advancement and use of science and/or technology. (BSTZ site)

BST is a perpetual closed-end equity fund. BST commenced operations in October 2014 with the investment objectives of providing income and total return through a combination of current income, current gains and long-term capital appreciation.

Under normal market conditions, the Trust will invest at least 80% of its total assets in equity securities issued by U.S. and non-U.S. science and technology companies in any market capitalization range, selected for their rapid and sustainable growth potential from the development, advancement and use of science and/or technology (high growth science and technology stocks), and/or potential to generate current income from advantageous dividend yields (cyclical science and technology stocks).

As part of its investment strategy, management sells covered call options on a portion of the common stocks in its portfolio. (BST site)

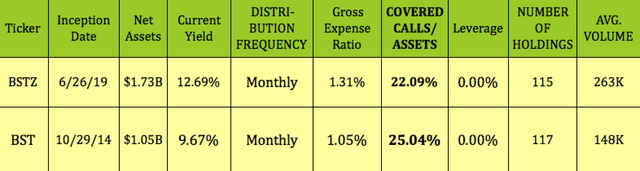

BSTZ is the newer of the two funds – it IPOd in 2019. It has a larger asset base than BST, with more trading volume. Both funds pay monthly distributions, and have a similar quantity of holdings. BSTZ’s expense ratio is higher, at 1.31%, vs. 1.05% for BTZ:

Hidden Dividend Stocks Plus

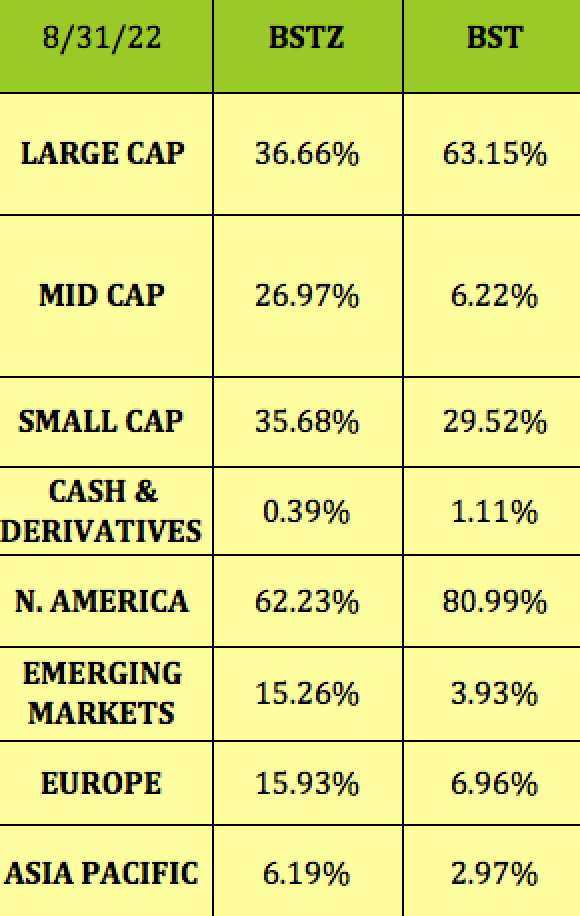

Both funds share the same management team. BSTZ favors small caps, and more cutting edge companies. BSTZ also has more exposure to non-US regions.

Hidden Dividend Stocks Plus

Distributions:

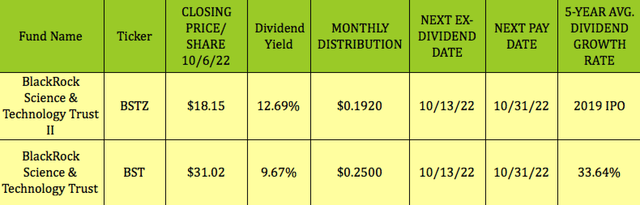

At its $18.15 10/6/22 closing price, BSTZ yields 12.69%. BST, at its $31.02 10/6/22 closing price, yields ~300 basis points less, at 9.67%. Both funds should go ex-dividend next on ~10/13/22, with a ~10/31/22 pay date.

Hidden Dividend Stocks Plus

Holdings:

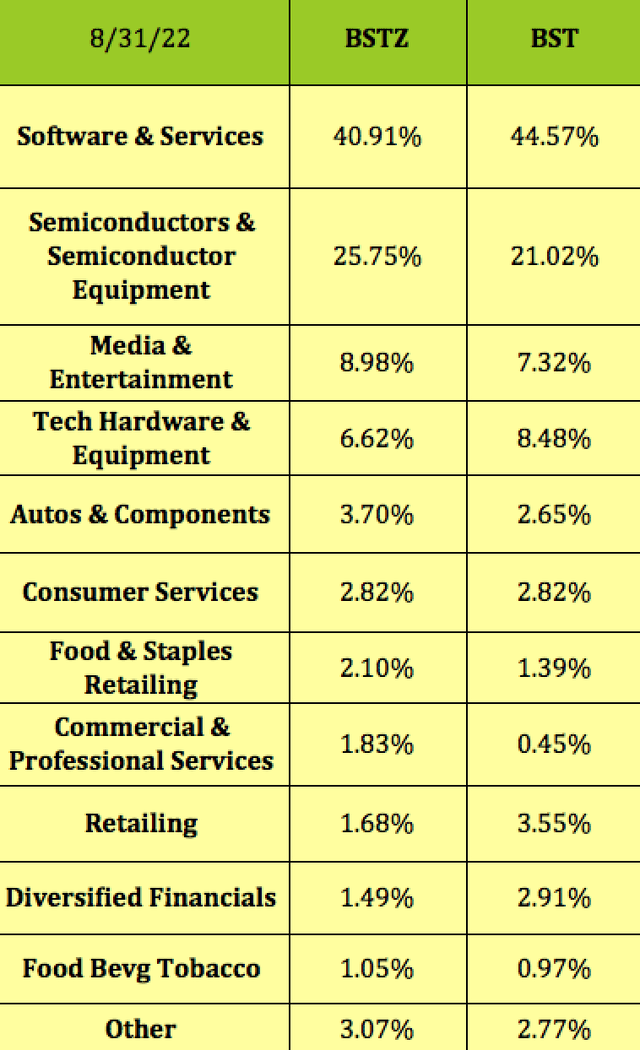

The funds’ sector holdings are roughly similar, with BSTZ having a bit more exposure to semi’s and semi equipment, and less exposure to software and services.

BSTZ also has a bit more exposure to Media/Entertainment, Autos & Components, Food & Staples Retailing, and Commercial & Professional Services:

Hidden Dividend Stocks Plus

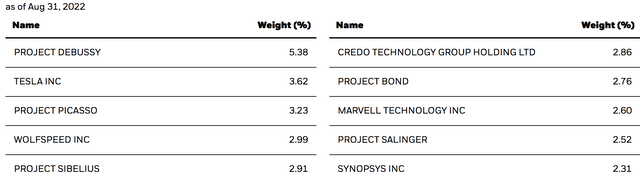

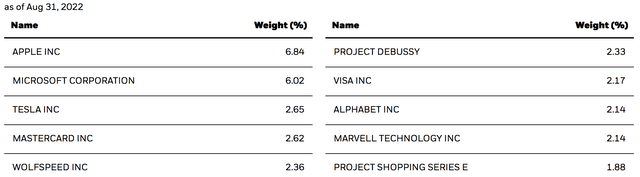

BSTZ: Its top 10 holds a few big cap names, such as Tesla (TSLA) and Marvell (MRVL) but is much more eclectic than BST’s, with several lesser-known holdings, forming ~31% of its portfolio.

Project Kafka, Project Gaugemela, and Kakao Corp. were replaced with Project Salinger, Wolfspeed, and Synopsis over the past quarter.

BSTZ site

BST: Its top 10 positions include mostly well-known big cap tech stocks, such as Apple (AAPL), Microsoft (MSFT), and Tesla (TSLA), in addition to Project Shopping, forming ~31% of its portfolio.

Project Kafka and Amazon were replaced in its top 10 with Wolfspeed and Project Debussy over the past quarter.

BST site

Performance:

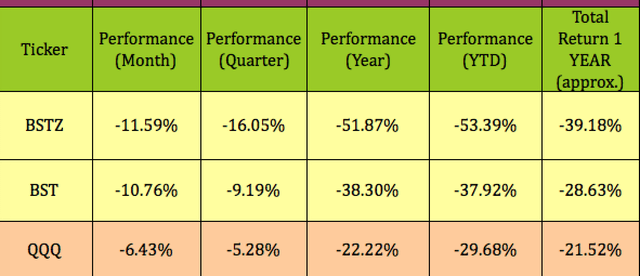

BSTZ’s much worse performance can be partially traced to its heavier concentration in smaller cap holdings. Small caps are down ~-29% in 2022, vs. -23% and -26% for large and mid caps, respectively.

Both funds have trailed the Nasdaq 100 over all of these periods. Looking at their one-year total returns, also shows both funds trailing, with BST trailing the Nasdaq by a much lower margin:

Hidden Dividend Stocks Plus

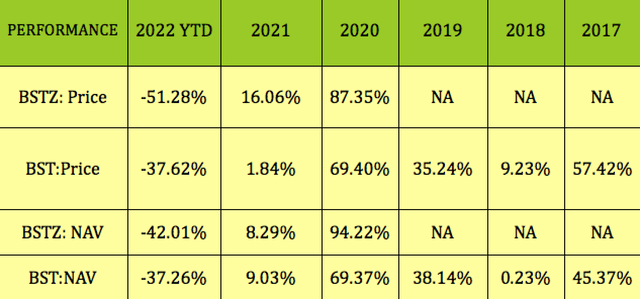

Looking back further shows both funds having positive price gains in 2021, with BSTZ vastly outstripping BST’s price performance, but slightly trailing BST’s NAV gains.

2020 was their biggest year, with BSTZ gaining 87% in price, and 94% in NAV; while BST gained 69% in price and NAV.

Hidden Dividend Stocks Plus

Valuations:

When buying closed-end funds, buying at a deeper than historical discounts to NAV can be a successful strategy over the long run, due to mean reversion.

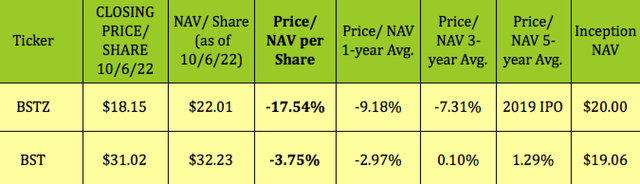

At its 10/6/22 closing price of $18.15, BSTZ was -17.54% below its $22.01 NAV/Share, a much deeper discount than its one-year and three-year average discounts of -9.18% and -7.31%.

BST was selling at a -3.75% discount to NAV, cheaper than its one-year discount of -2.97%, and its three-year and five-year premiums of 0.10% and 1.29%:

Hidden Dividend Stocks Plus

Parting Thoughts:

With the Fed still set on a rate-rising course in the near-to-mid-term future, tech/science stocks will probably continue to trail the market. Of course, at some point, the Fed will stop raising rates, and may even have to reverse course and lower them.

At that point, tech stocks and funds should start getting more market support. The billion-dollar question is when? Does anyone out there have some predictions?

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Be the first to comment