DNY59

Thesis

Templeton Global Income Fund (NYSE:GIM) is a fixed income closed end fund. As per its literature, the fund:

[…] seeks high, current income, with a secondary goal of capital appreciation. Under normal market conditions, the Fund invests at least 80% of its net assets in income producing securities, including debt securities of U.S. and foreign issuers, including emerging markets

The fund is focused on emerging market debt, which accounted for over 80% of the portfolio as of the latest portfolio review. The vehicle has a broad mandate and has the option to hedge foreign currencies exposures and interest rate risk, but does so sparingly. This translates into taking a view on dollar strength and U.S. interest rate risks when hedges are not in place.

These types of global bond funds run multi-faceted risks: i) credit risk via the bonds they purchase and related probability of default, ii) FX risk via the translation into USD of the fund NAV, iii) interest rate risk via the local currency monetary policy. The fund is a straggler, with a negative annual total return when looking back over a decade. It is not surprising to see such poor results given the significant move up in rates this year across the world as well as the dollar outperformance.

Generally speaking we are not big fans of these global bond funds because historically they have produced poor results, with too many risk factors being comingled into one pot:

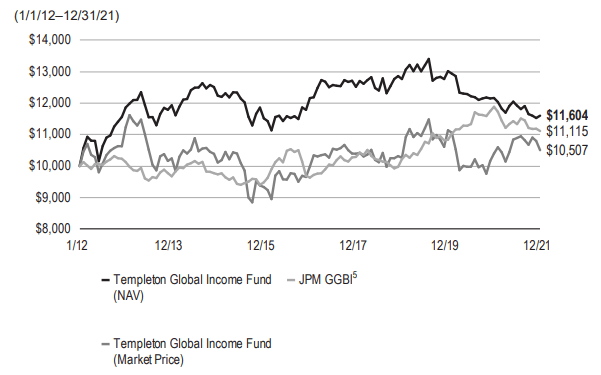

Return (Semi-Annual Report)

We can see from the above graph, courtesy of the fund’s Semi-Annual report, its lack of a return as benchmarked up to December 2021. In the graph the CEF is benchmarked against the JPM Global Government Bond Index.

With peak dollar and peak rates in sight, this CEF’s viability is to express a view on these two risk factors with a 2-year holding period in mind. Long term GIM is not an ideal option because it will underperform, but after the vicious moves seen in the U.S currency and rates this year we feel 2023 and 2024 will be kind to GIM.

Holdings

The fund is overweight emerging markets bonds:

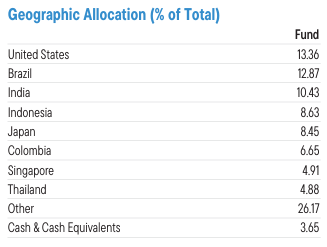

Allocation (Fund Fact Sheet)

We can see from the above table that Brazil and India represent the largest geographic exposures, closely followed by Indonesia. The fund currently runs significant FX exposure:

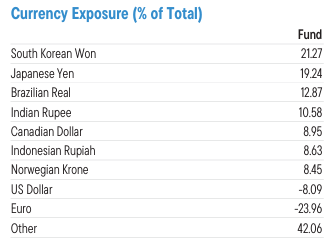

FX Exposure (Fund Fact Sheet)

As the dollar rallied this year the fund lost money, since the above currencies depreciated against the USD. Non-dollar bond exposure represents a conundrum, because many asset managers prefer to hedge the currency exposure, but by doing so they reduce the overall returns. When un-hedged, the foreign currencies can produce significant loses if the USD appreciates.

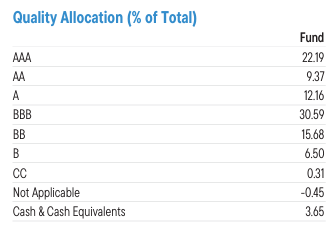

From its ratings distribution table we can see that GIM does not run a significant credit risk profile, with a moderate amount of credits in the sub-investment grade bucket:

Ratings (Fund Fact Sheet)

To give you a flavor of the holdings, let us have a closer look at some of the largest exposures:

Collateral (Semi-Annual Report)

The above table is from the fund’s Semi-Annual report; hence, the concentration figures are slightly different than the most recent portfolio posted on their website in aggregate. We can observe that the CEF holds four sovereign Indian bonds, all in the local currency INR. The story is similar for the Indonesian sovereign debentures.

Performance

The fund is down over -10% this year:

We are comparing the CEF here with an ETF which does something similar, namely provides an investor with exposure to unhedged local EM bonds. The ETF in question is EMLC. Longer term the fund’s performance is deeply negative:

It is interesting to note that the best performance for the fund was from the 2016 trough to a top right before the Covid crisis.

Distribution

The plan has a managed distribution policy, as stated in its Semi-Annual Report:

Managed Distribution Policy: The Fund’s Board of Trustees (the “Board”) has authorized a managed distribution plan pursuant to which the Fund makes monthly distributions to shareholders at an annual minimum fixed rate of 8%, based on the average monthly net asset value of the Fund’s common shares (the “Plan”). Effective March 7, 2022, the annual minimum fixed rate increased from 7.5% to 8%. The Fund calculates the average NAV from the previous month based on the number of business days in the month on which the NAV is calculated. The Plan is intended to provide shareholders with a constant, but not guaranteed, fixed minimum rate of distribution each month and is intended to narrow the discount between the market price and the NAV of the Fund’s common shares, but there can be no assurance that the Plan will be successful in doing so.

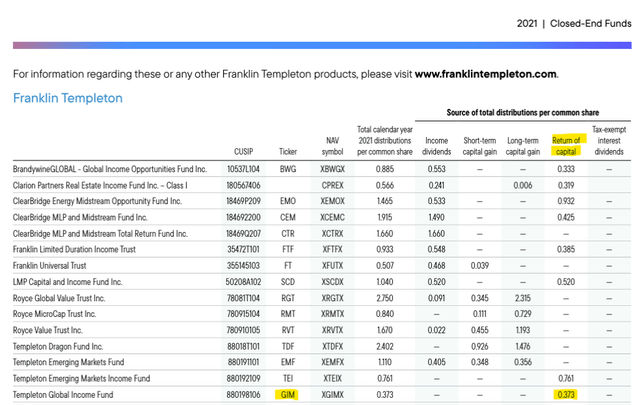

Currently the fund’s distribution is close to being supported, but historically GIM has utilized a significant amount of ROC (37% ROC for 2021):

Conclusion

GIM is a global bond fund from Franklin Templeton. The vehicle has a large allocation to EM debt and a broad mandate. GIM only chooses to hedge certain interest rate and currency exposures, and largely runs significant FX and interest rate risk. Credit risk is secondary in this CEF, with an overweight allocation to investment grade credits. The fund has used significant ROC in the past to cover its dividends, but is now generating a cash-flow closer to its managed distribution. A long-term underperformer given its multitude of risk factors, GIM is best suited for retail investors looking to underwrite a peak dollar and peak rates view.

Be the first to comment