VioletaStoimenova/E+ via Getty Images

We have talked to countless investors over the years who despite thinking they are doing everything right, are still losing. Some of this is the market. Some of this is impatience. Some of this is the lack of planning. Maybe a touch of bad luck, lack of diversification, or just plain old junk stock picking. The one thing that we have noted is that many people should be trading on top of their investing. They should use trading gains to fund long-term investing. Instead, we see people invest faithfully, and get frustrated when for months and even years, their accounts just are not improving, if not, even losing value. So instead of watching winners turn into losers in the name of ‘investing’, why not do some trading? We have traded Cleveland-Cliffs Inc. (NYSE:CLF) stock successfully several times in the last year for short-term, rapid-return gains. In October, we told you to let the stock fall below $13, then do some buying, with $12 per share possibly in the cards. Sure enough, shares fell, and we were able to scoop them in our desired range, only to enjoy rapid returns in less than a month selling at over $16 per share. The thing is, the data suggest we can see another decline in coming weeks. Barring a Santa Claus rally, one of the biggest source of bullishness here is auto demand, but we just saw big declines in November auto sales, though there are globally pockets of strength like in India, and in the UK. Not good, but not the end of the world. Steel pricing is a major driver, and the company has taken action to boost its sale pricing, despite a tough pricing market. Further, if the Chinese economy reopening is real, we will get boosts. At this juncture, our recommendation is to let the stock fall once again, then start buying in the $14 range. Look to add if we get a Q1 pullback in the market that brings us back to $12. Look to exit at $16-$17 near-term, but if you get that second buy in the $12 range, take trading gains over $15. Note, you can also do this to a smaller degree even if you are a buy and hold type investor. It simply boosts returns. Let us discuss why we are still willing to buy here, even if we had some negative flash auto news.

Cleveland-Cliffs takes action on pricing

Pricing has come way down for steel and every time the company reports earnings it seems to reduce the 2022 outlook for pricing. So, if pricing is down, volumes need to be up. But pricing often reflects higher demand, so the linkage is pretty clear, and as demand softens, prices do too. So, the company has been relying on strong auto demand, and might get a boost from China reopening, if we can believe it. For now, it does seem restrictions are loosening, and this is good.

As the Fed has been working to lower inflation, we expected commodities to retract some, and metals often go first. Steel pricing fell pretty much all year, and was magnified as the Fed hiking began. Look at Q3 pricing. When Cleveland-Cliffs reported earnings, there were lower volumes in steelmaking than expected and pricing was down. Not to mention, expenses are up. It led to disappointing EBITDA and earnings.

Declining pricing has been problematic. In Q2, management still had a strong “full-year 2022 average selling price expectation of $1,410 per net ton.” In Q3, full year pricing came down, again. After it reported. management saw $730 for the average hot-rolled coil pricing, and full year selling prices of $1,370 per ton. That means lower revenues and earnings can be expected. Even with the declines, Cleveland-Cliffs still expects to generate massive levels of free cash flow in 2022, and should still have strong cash in 2023. But the company did make a move to offset some of this pain.

With all new orders as of November 28, 2022, Cleveland-Cliffs said it was increasing current spot market base prices for “all carbon hot rolled, cold rolled and coated steel products by a minimum of $60 per ton.” So that was effective immediately with all new orders, and while it may not be massive, it is a boost. If pricing was say $600 at the time of the announcement per ton for hot-rolled coil pricing, this would be a 10% boost. So it helps revenues, and hopefully margins, and stops the bleeding. Hopefully, this sets a floor on its own pricing, and the market gives it a boost. Let us say, if the China reopening is real, it is a huge boost for steel prices, among other commodities like oil.

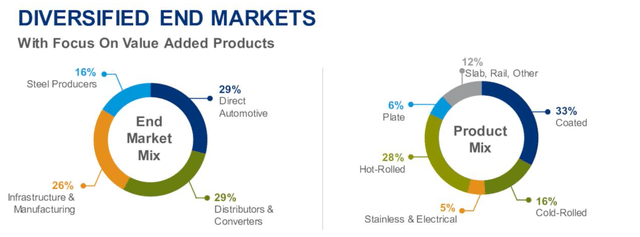

Please also keep in mind that the company’s end markets and products are diversified.

This means that while automotive is a key component, multiple industries are customers and there are various steel products with varying margin profiles.

Make no mistake, it has been painful to watch the company suffer, but we think that a bottom is coming in Q1 2023. We think Q1 2023 will be weak for the markets because that is when we see a recession taking hold, or starting to, while earnings estimates come down, and the market, as a whole, is revalued lower.

What we know is that earnings estimates are coming down for Cleveland-Cliffs as well as the market. Even with the reduction in earnings and the weaker outlook and expectations, shares are still valued at just over 4X FWD EPS for 2022, and even if we take an extremely conservative view on earnings for 2023, and say $1.75 in EPS, the stock is 8.8X earnings. Bottom line, if shares pull back to our target entry of $14 you will be paying 8X FWD EPS. But of course this is a cyclical and EPS is only one part of the valuation story. We have to consider cash flow and EBITDA. While both are weakening compared to where they were, we see both stabilizing and likely bottoming out by Q2 2023, barring a massive recession. While we expect to be making rapid-return trades, we still think that trading around the core position necessitates you have an understanding of the medium-term.

Have to control costs

While revenues are falling, we think the market is honing in on better valuing the stock. $15 has been a key pivot level so we are trading around that for now. That said, Q3 2022 consolidated revenues were $5.7 billion, falling 5% from last year, and falling 10% from the sequential quarter. What the company must do is control expenses. Despite cratering revenues, Q3 expenses were up from a year ago. Not good. Steelmaking unit costs have increased and there are higher costs in natural gas, electricity, scrap work, and alloys. That all combined to lead to larger costs. We think that you should continue to watch nat gas prices, and tangentially, oil. A China reopening is bullish, but also should lead to higher energy costs.

However, the company does expect some falling costs in Q4. This is a positive when combined with higher selling prices being announced. It expects costs to fall about $80 per ton for steelmaking in Q4, so that is a positive.

We need to see continued balance sheet improvement

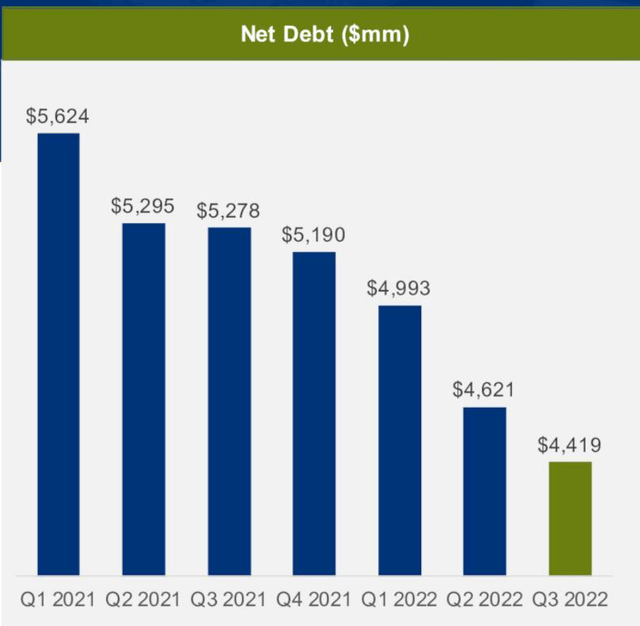

The valuation is still pretty attractive even after the declines, so long as cash flow holds up, and while earnings are not the end all and be all, they are pretty important. We gave a conservative view of $1.75 in 2023, relative to consensus. The reason we need strong cash flow is to help improve that balance sheet.

The balance sheet has been improving. The company has been paying down hundreds of millions of dollars in debt the last few quarters. There is still a lot of debt, but now down to about $4.4 billion worth, and debt associated with its recent major acquisition is $1.1 billion. The company also repurchased 2 million shares in the quarter, reducing the float, and has $2.4 billion of liquidity. We still think Cleveland-Cliffs will continue to manage to pay down this debt with cash flow unless things really take a turn for the worse.

Take home

We like trading this stock. There is nothing wrong with trading to make money. Buy and hold has not worked here, but trading has. Why not consider some trading? You can do it around a core position. All year performance has worsened. It has been horrible to watch the stock get obliterated. Pricing is tough to control, but demand is there. We like that the company raised its prices. Auto demand is a source of volumes, but keep an eye on the mixed data. We like the repurchases. We think this time around, you let the stock fall to $14, with an add at $12, and exit as prescribed above. We love investing, and long-term holding the right stocks for many years is wise, but Cleveland-Cliffs is still a better stock for trading.

Be the first to comment