Rmcarvalho/iStock via Getty Images

While the leading Brazilian fintech has been under pressure this year, StoneCo (NASDAQ:STNE) continues to have a long runway of growth left. The macro challenges related to the Brazilian economy has caused investors to remain on the sideline, though with interest rates starting to flatten and GDP estimates being revised higher, it appears the underlying macro environment may be starting to bottom.

STNE recently reported a good Q2 report with the company demonstrating revenue growth recovery and margin expansion. However, ongoing macro uncertainties continue to push the stock lower, though fundamentally, the company continues to perform well.

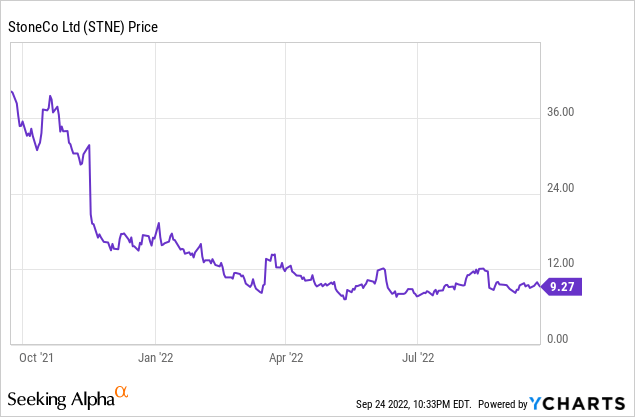

The stock remains down over 50% so far this year including a 20%+ pullback since the company reported earnings last month. Relative to their all-time high above $90, the stock remains down around 90%. And while I do not think the stock will reach that $90 level any time soon, I do believe that current levels present an attractive long-term buying opportunity.

Valuation currently stands at 17.5x 2023 EPS, though I believe the consensus estimate remains a little conservative. Assuming STNE continues to execute well and maintain their growth recovery and margin improvement, I believe 2024 EPS could end up being closer to $1.00, which would imply a currently valuation of just 9.2x, which screens very cheap for Brazil’s leading fintech company.

Despite the ongoing macro challenges, I believe long-term investors should sharpen their pencil around STNE and look to buy the dip.

Macro Factors Pressuring the Stock

The Brazilian economy continues to swing in volatile ways and investors in STNE has experienced quite a bit of this volatility with the stock now down over 50% so far this year.

One of the positive developments post-pandemic has been the acceleration in the use of digital payments. Prior to the global pandemic, Brazil was largely dependent on cash forms of payment with consumers being slow to adopt digital payment methods. The hype around digital payments and a growing Brazilian economy led to STNE’s stock trading above $90 in early-2021.

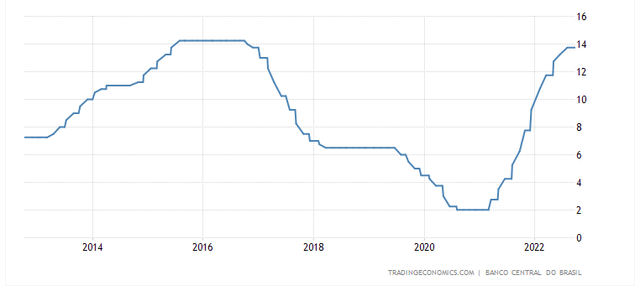

However, macro economic pressures combined with rising interest rates and a strong USD continue to be headwinds against the business, thus placing a negative sentiment overhang.

STNE currently estimates there are >28 million mid-sized and SMBs in Brazil and with STNE having <2 million business relationships, there remains significant growth opportunities over the coming years.

After 12 straight interest rate increases, Brazil’s central bank decided to hold interest rates firm at 13.75%. As seen in the chart above, the significant and rapid rise in interest rates started around the height of the global pandemic as governments around the world tried to slow down inflation.

And even more recently, Brazil’s economic ministry raised their forecast for economic growth to 2.7% for 2022, which is higher than their prior 2% expectation in July.

The Ministry’s Secretariat for Economic Policy said the upbeat revision comes after GDP growth between April and June surprised expectations with a 1.2% rise. Activity will continue to grow in the second half, though more slowly, it added.

Importantly, the ministry left their GDP growth forecast intact at 2.5% for 2023, which seems to be a reasonable starting point. Given that Brazil’s interest rates are starting to flatten out and the economic ministry raised their growth expectation, it appears to be time to become more bullish around the Brazilian economy. While there continues to be fears over a looming recession, I believe these two factors above should start to build confidence in the long-term growth trajectory of Brazil.

Q2 Results and Guidance

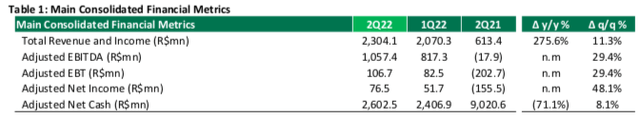

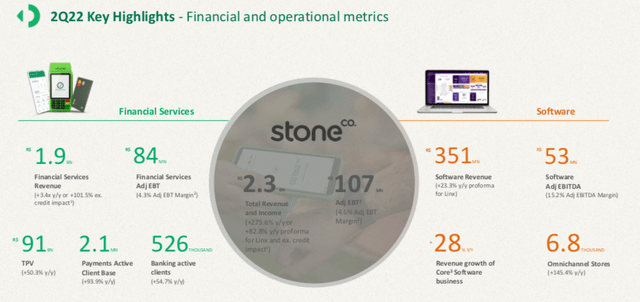

During the company’s Q2, revenue grew 276% yoy to R$2,304 million, which also represented organic growth of 128.5% yoy. Despite the ongoing challenges within the Brazilian economy, revenue during the quarter came in 5% above the high-end of the company’s guidance range of R$2,150-2,200 million.

Adjusted EBITDA during the quarter came in at R$1,057 million, which was well above the adjusted EBITDA loss of R$18 million in the year-ago period. This reflected adjusted EBITDA margin of 45.9%, which also represented sequential improvement from the 39.5% margin last quarter.

With interest rates having significant gone higher over the past 18 months in Brazil, STNE has initiated a few pricing increases to help offset their higher expenses. I believe that if interest rates were to come down over time, that STNE would maintain their pricing, thus be able to generate higher incremental margins over the long-term.

While the macro environment factors may impact the company’s profitability, the longer-term trend of increasing digital payment mix will likely remain a tailwind for many years to come.

Impressively, the company’s Financial Services segment grew revenue 243% yoy to R$1,933 million, and represented 84% of total revenue. Most of this growth was driven by strong performance in the mid- and small-sized business segment, including strong TPV and client growth as well as increased take-rates. On the earnings call, management called out five main factors which drove improvement in the Financial Services segment during the quarter.

First, the strong evolution of our payments client base, which crossed the 2 million mark, with an acceleration of net adds in the quarter. Second, the strong MSMB TPV growth of 78% year over year, driven by both our active client base growth and a continued improvement in go to market strategy for Ton and Stone products. Third, we were able to continue increasing our take rates while we increased our average TPV for both Stone and TON products sequentially. Fourth, the expansion of our banking platform, generating more engagement, and increasing opportunity to monetize clients in the future. And finally, efficiency gains in costs and expenses.

While we are not likely to see this level of strength going forward, I do believe that as the Brazil economy continues to recover and STNE benefits from pricing raises, investors should expect solid growth and improving profitability.

Within the Software segment, revenue grew 23% yoy (pro forma for Linx acquisition) to R$351 million with adjusted EBITDA reaching R$53 million, representing a margin of 15.2%. With adjusted EBITDA margin improving around 300bps sequentially, STNE continues to execute on their expense strategy and expand margins.

This improvement was the result of continued efficiency gains and back-office synergies, even though we continue to invest in our distribution, customer service and marketing capabilities. We expect to continue ramping-up our software margins in the second half of the year.

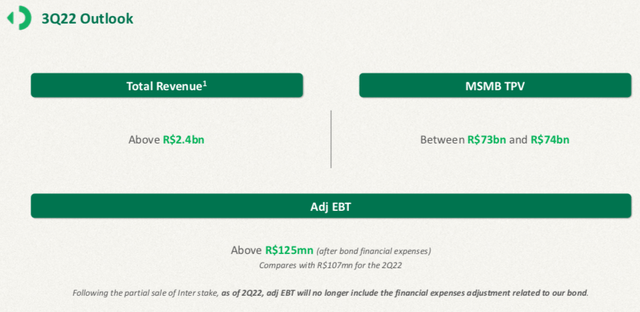

Guidance for Q3 includes revenue above R$2.4 billion, representing around 63% yoy growth. While this does reflect deceleration from the 83% yoy growth during Q2, the company was also facing much easier growth comparisons during Q2 given the economic challenges in the year ago period. As the economy continued to recover last year and throughout this year, the growth comparisons get tougher, meaning reported revenue growth will decelerate.

In addition, MSMB TPV is expected to be R$73-74 billion, which reflects 41.4-43.3% yoy growth. Adjusted EBIT is expected to be above R$125 million, which compares to R$107 million in the year-ago quarter.

We still have a long path ahead of us, but we believe the consistent results achieved in the first half of the year demonstrate we are on the right track, with an encouraging outlook for the second half of 2022 in which we continue to expand margins while keeping strong growth levels.

With management expecting profitability to improve throughout the remainder of the year, I believe STNE could be set up nicely for ongoing solid growth over the coming quarters. Yes, the macro factors could turn negative, but this is out of control of the company. Fundamentally, the business continues to improve.

Valuation

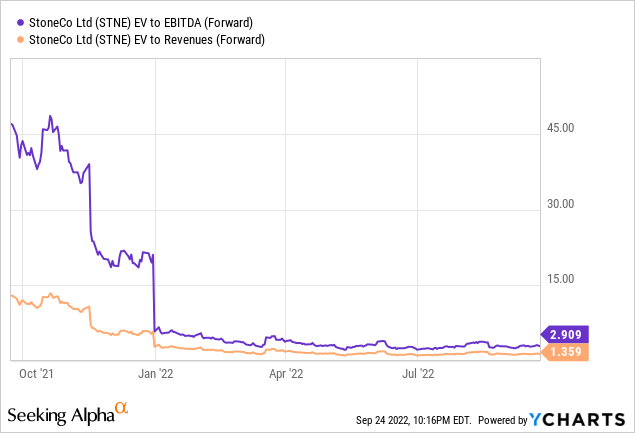

The challenging part about STNE’s valuation is the Brazilian economy, which can be a large swing factor. Ongoing uncertainties around Brazil’s economic recovery will likely remain a long-term sentiment headwind, though I believe the secular growth trends of digital payments will continue to drive strong fundamental growth.

Currently, STNE remains down over 50% year to day, including down over 20% since the company reported earnings in mid August. Nevertheless, I continue to believe that STNE is the best fintech company in Brazil and as the economy continues to recover, I believe long-term investors who hold through the volatility will be rewarded.

Currently, consensus expects 2023 EPS of just $0.53 (per Yahoo Finance), which implies the stock currently trades at just 17.5x 2023 P/E. Additionally, these estimates could prove to be conservative if the company were to beat and raise expectations over the coming quarters, much like they did during Q2. With management expecting profitability to improve during the remainder of the year, we could see EPS estimates rise over time.

For example, if 2024 EPS were to end up being around $1.00, then the stock currently trades at under 10x 2024 EPS, which screens very cheap. Assuming a modest 15x EPS, this could imply a $15 stock in the next 12-18 months, which does not seem overly optimistic.

With interest rates starting to stabilizing, GDP estimates being revised higher, and the ongoing trend of digital payments, I believe STNE’s shares remain attractive at under $10.

The biggest risk to STNE’s thesis remains around the uncertain macro environment and the Brazilian economy. If the macro environment were to turn worse, then we can see slower revenue growth and/or margin pressure. If these headwinds were to persist, then investors could push valuation even lower.

Be the first to comment