peshkov

Global refined oil product markets are on track to remain tight until mid-decade, with the global downstream industry facing significant near-, medium- and long-term challenges, according to a new report by S&P Global and the International Energy Forum (IEF).

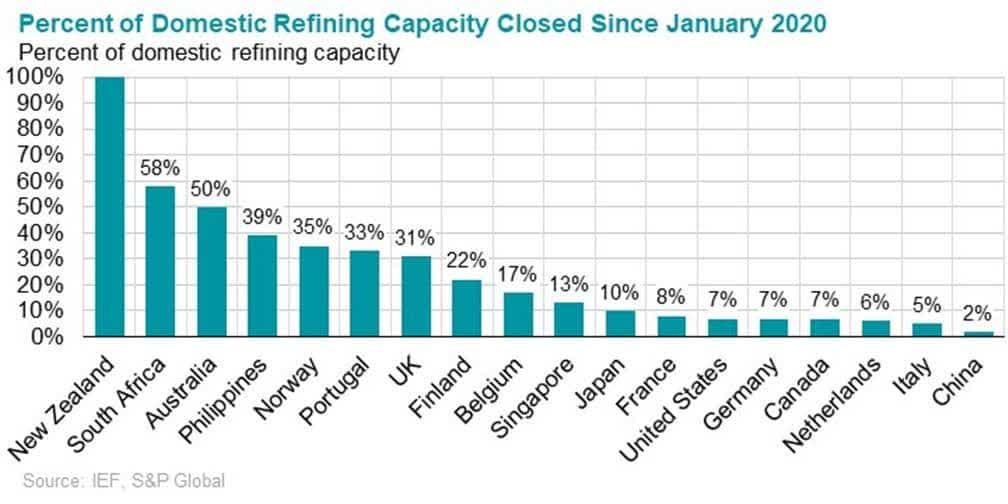

Global oil refining capacity dropped for the first time in 20 years in 2020 and again last year, on pandemic-weakened margins, accelerated refinery closures, and motivated conversions to biofuels or distribution terminals, according to an Oil Refining Industry Insights report issued last week.

S&P Global Commodity Insights forecasts that there are no quick fixes for the forces at play in creating a tight market for refined oil products now and into the future. The causes for the current market conditions include headwinds from the unprecedented restructuring following record refinery closures in 2020-2021, to sanctions on one of the world’s largest fossil fuel exporters, to China’s strategic shift to reduce petroleum product exports. All of which comes even as owners are facing an uncertain future for refining demand as the world transitions to lower-carbon energy sources.

By the numbers

- Refining margins for key products ballooned in the summer of 2022 to a record $35-50/bbl compared to the normal $10/bbl – underscoring the severe bottlenecks in the sector.

- More than 2 mb/d in net capacity is scheduled to come online by end-2023, but history shows delays and startup challenges could slow progress. In addition, these are likely the last major greenfield fuel-oriented refineries to be built as the energy transition will limit the need for conventional refinery capacity additions in the future.

- Russia and China are the primary two countries that have available refining capacity, but sanctions limit Russia’s exports and domestic policies limit China’s.

- High refining margins in the past led to more investment, but that is not occurring now. The expectation that the energy transition could reduce the need for refineries has deterred investment.

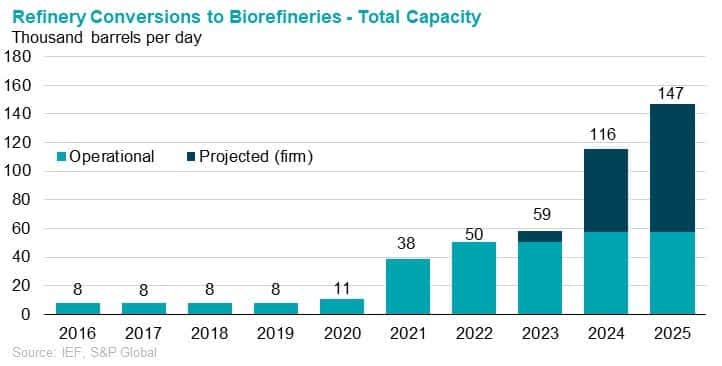

Further, prompted by renewable fuel policies, some refineries, particularly in the US and Europe, are opting to become biofuel producers (using hydrotreater units to produce renewable diesel and other means) rather than completely shutting down. Importantly, the volumetric output of a converted refinery is typically much lower compared with when the facility processed crude oil into transportation fuels. Based on announced projects that are considered as “firm”, conversions will accelerate from 2023-24. Conversion capacity will nearly triple by 2025, expanding to 147 kb/d in 2025 from 50 kb/d in 2022.

Capital Expenditures

Downstream capital expenditures will need to reach $190 billion through 2030 for upgrades to refining capacity, petrochemical feedstock buildouts and sustaining existing assets to become reality, according to the report. It forecasts only 2.3 mb/d of net global refinery crude distillation unit (CDU) capacity will come online between 2022-2027.

The Russia/Ukraine Impact

Russia’s invasion of Ukraine is spurring an unprecedented reshuffling of global refined product trade and more obstacles are on the horizon. Meanwhile, rerouting traditional flows of Russia’s petroleum product exports is more complicated than for crude oil, according to the report.

- Russia is one of the largest global exporters of fuels, exporting a total of ~2.9 mb/d of refined products pre-invasion, of which the EU imported 2.2 mb/d while the US imported 0.4 mb/d.

- The most likely alternative markets for Russian products, particularly diesel, are Africa and Latin America.

- However, the transit time for product deliveries from Russia to West Africa and Latin America is 25-30 days, compared to 8 days to Europe. Already high freight rates, and a looming insurance ban means these trades may be uneconomic for both buyer and seller.

Further, an EU embargo on importing Russian crude via pipeline comes into effect on December 5, 2022, and a ban on importing refined products of Russian origin beginning February 5, 2023. There are several exemptions to the embargo, but it will broadly cut 90% of Russian crude imports and nearly all product imports.

EV penetration accelerating and offsetting 4 mb/d of demand by 2030

Passenger EV sales are expected to rise sharply in the upcoming years as policy support continues, the cost of lithium-ion batteries decline, and more EV models come to showroom floors.

- Plug-in vehicle sales are expected to grow from 6.6 million in 2021 to 35.7 in 2030. This is expected to replace 4 mb/d of gasoline and diesel demand by the end of the decade, and cause hydrocarbon fuels share of transportation fuels consumption to plateau by 2028.

Refining’s Rocky Road

While the refining industry is headed toward a less carbon-intensive future, it will be a rocky, uneven road, due in large part to an evolving and fractured decarbonization policy landscape. That said, the downstream industry is innovative and resilient and there is little doubt that successful companies will emerge leaner, more efficient, and better adapted to the evolving market and fuels of the future.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment