shaunl/iStock Unreleased via Getty Images

Reitmans Canada (TSXV:RET:CA) is dual-listed (Canada & US). All figures in the article are in CAD unless noted otherwise.

Situation Update

I introduced this idea in the beginning of the 2022. The thesis back then was that Reitmans equity was going to survive the bankruptcy restructuring, and the stock was incredibly cheap. Reitmans recently released its 2023 second fiscal quarter (ending July 2022) and the results look pretty darn good. The sales level is normalizing for the right reasons: increased customer traffic, higher ticket value, and less markdowns. Gross margin expansion despite higher supply chain costs. This was partially offset by higher SG&A (due to higher sales level), but still resulted in both higher EBITDA and EBITDA margin expansion. Additionally, e-commerce was 25% of the total sales in Q2.

Valuation

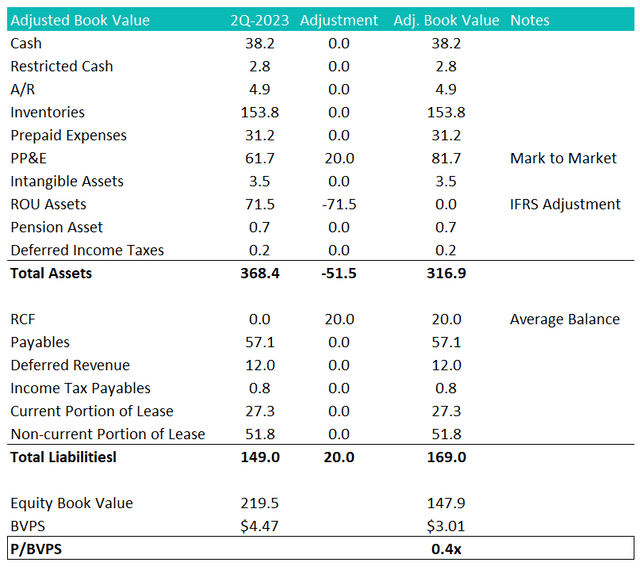

Even though the stock went up +20% post earnings release, Reitmans is still incredibly cheap no matter how you look at it. The GAAP book value is roughly $4.50/share. Even after conservatively adjusting for some items like minimum cash balance, writing up the buildings and distribution centers, the adjusted book value per share is a double from where the stock is trading.

Company Financials & Author’s Adjustments

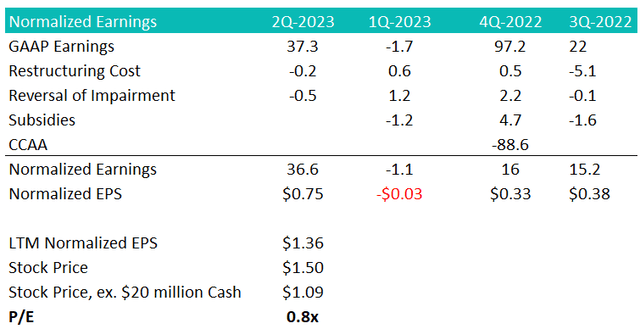

The stock is even cheaper from an earnings standpoint. If we normalize for some one-time items (CCAA, restructuring costs, and government subsidies), Reitmans earned about $67 million on a LTM basis or $1.36/share normalized EPS. This translates to a P/E ratio of 0.8x (assuming $20 million minimum cash balance, i.e., excluding $28.2 million in cash). This theoretically means that Reitmans can pay an $18.2 million special dividend (~25% of current market cap) and the payback period is still less than one year.

Company Financials & Author’s Adjustments

Risks

As a reminder, Reitmans has a dual-share class structure, so nobody other than the founding family has a say in the strategic direction of the company. However, it’s difficult for me to think how the founding family will take advantage of the minority shareholders. Maybe a creeping takeover via a series of rights offering, but the company doesn’t require any additional financing. A take private transaction where the non-voting shares stays public? Repeated, generous option grants? In any case, the focus right now is on getting the pie bigger, and the pie is indeed growing bigger.

Another major risk is that we are more likely than not entering into a recession, which is typically not a great environment to own a special apparel retailer. Another headwind is the strength of US dollar (Reitmans purchase inventories in USD). I’d make an exception for Reitmans purely based on valuation – how much lower could it rerate? Besides, the quality of the business (both from a profitability and a leverage standpoint) improved dramatically through the CCAA cleansing.

Catalysts

On the potential positives, given the excess cash flow and the valuation, I cannot think of anything more accretive than shrinking the share over time either via a NCIB or a SIB (the Canadian version of share repurchase program or a Dutch auction).

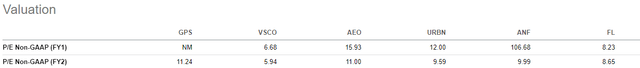

A take private transaction is also not outside of the realm of possibility, although the founding family has control without taking the company private, so this is probably a little bit of wishful thinking, but the back-of-the-envelope math looks compelling: at $3.00/share, the implied equity value is ~$155 million and the founding family only needs to buy out 75% of total shares (i.e., the non-voting shares). Assuming 10% fees and expenses, the founding need to raise ~$125 million to buy out the public shareholders – $25 million can come from cash on hand and $100 million from debt financing (Reitmans already has a $115 million RCF that they were able to pay off completely within one year out of CCAA). Importantly, $3.00/share is a take-out PE multiple of ~4.2x – a substantial discount to public comps.

Seeking Alpha

Lastly, I believe another good option for Reitmans is to apply to graduate from the TSXV to the main TSX exchange. Hopefully, a little bit more institutional equity coverage and some IR effort can bring more eyeballs to the story to get a rerating going.

Conclusion

Reitmans is a much higher quality business compared to its recent past, but the market is not giving it full credit yet. Although an apparel retailer is not a typical holding into a recession, Reitmans stock valuation is so inexpensive that it should not rerate lower much lower even if the macroeconomic condition further deteriorates. I can’t promise there won’t be any marking-to-market volatility along the way, but Reitmans is one of the few ways to get a double (my base case) with very low risk of permanent impairment of capital.

Be the first to comment