David Ryder/Getty Images News

Hitting headlines back in July, 1Life Healthcare (NASDAQ:ONEM) has been a recent acquisition target by Amazon (AMZN) as the retail giant seeks to “reinvent healthcare” according to AMZN’s own SVP of Amazon Health Services Neil Lindsay.

ONEM is a “…membership-based primary care practice on a mission to make getting quality care more affordable, accessible, and enjoyable for all through a blend of human-centered design, technology, and an exceptional team.” ONEM’s model of subscription virtual care is delivered via an app, utilizing video calls for physician appointments.

AMZN believes it can use technology to improve patient experience in the healthcare sector, and purchasing 1Life Healthcare will expand its footprint to include ONEM’s existing 188 offices in 29 markets, along with their 767,000 subscribing members.

But ONEM is yet to turn profitable, despite a dizzying growth rate over the past 5 years since IPO. So the big question is, was ONEM worth the 13.43 price to sales premium AMZN was ready to offer it?

We will be comparing ONEM to the “All US Stocks” screener on Seeking Alpha, which includes 2,462 of the largest US stocks on the market.

(Data & prices correct as of pre-market 5th November, 2022)

(The “All US Stocks” list referred to in this article can be found on this Seeking Alpha screener)

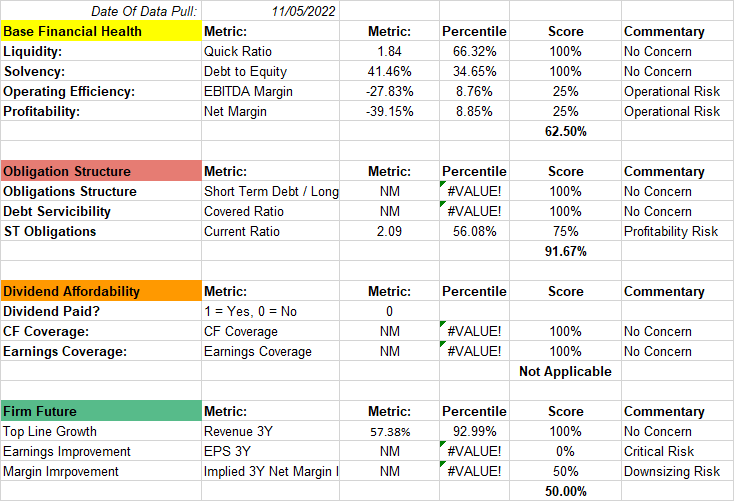

1Life Healthcare’s Base Financial Health

Let’s start by assessing ONEM’s basic balance sheet financial health, to get a good basis for what AMZN was acquiring.

Starting with liquidity & solvency, there are no concerns with the firm’s ability to meet a worst-case scenario operating environment, and the firm’s debt levels are very moderate. However, when our attention turns to profitability metrics, we start to see some rough-looking numbers.

With this said, recall that ONEM is in its growth phase and will soon be supported by AMZN’s own financial balance sheet to sustain losses in the longer term, however we are looking at ONEM independent of AMZN.

Next, we look at the setup of ONEM’s obligations and debts, and we see that this has been well structured, with no concerning short-term debts. With that said, we get a non-meaningful covered ratio, given the firm has no earnings to cover its debt obligations. However, there is a very reasonable current ratio of 2.09 to give ONEM sufficient coverage of its short term obligations.

1Life does not pay a dividend, so we can ignore the next section.

Lastly, the firm’s future outlooks show a consistent and strong picture of growth, with an expected 3Y forecast revenue growth of 57.38%. But given revenues today are unprofitable, the firm’s earnings improvement and implied margin improvement metrics are non-meaningful. Looking at estimates, ONEM is expected to turn profitable in 2025, still a long time away.

So with rising profitability (or rather, a deceleration of losses) over the next 3 years, we’ll assign a passing 50% score to margin improvement.

Author

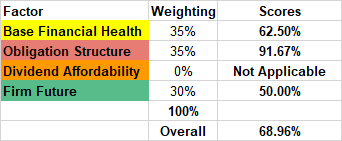

Overall, ONEM earns a 68.96% financial health score, which indicates to me that ONEM has some concerns in its metrics, though it is not hard to see where savings can be made to improve profitability and therefore the firm’s financial health.

Author

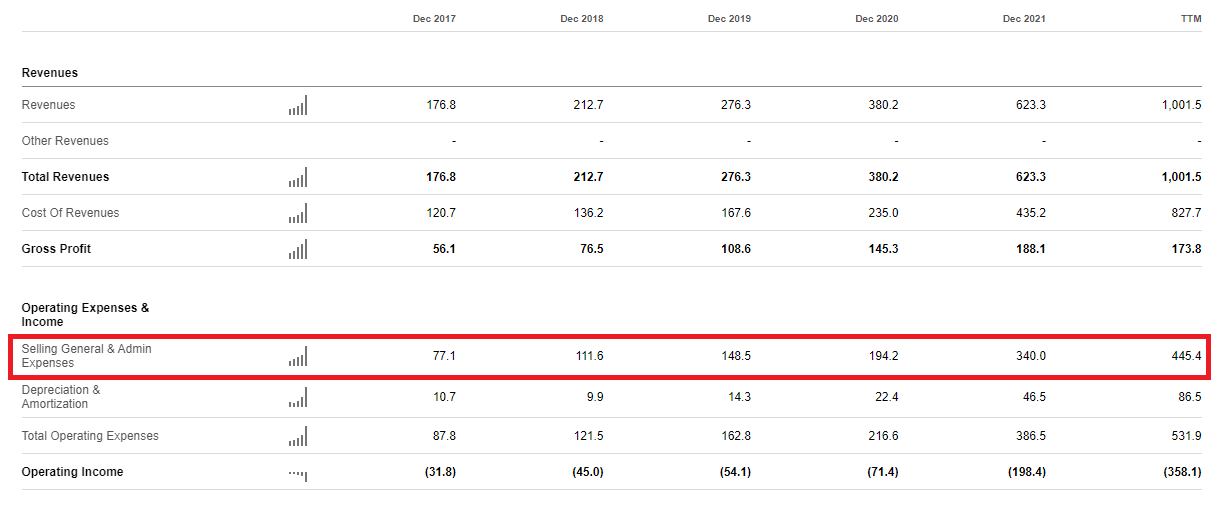

ONEM has spent 180% of gross profit in 2021, and 250% of gross profit in the TTM in SG&E costs in order to fuel its growth, which we can expect would be the first area for the business to cut costs in order to fuel a turnaround in profitability. Prior to 2021, ONEM was spending usually between 130% to 140% of GP to fund its growth.

Seeking Alpha

Next, we’ll compare ONEM to the US market to assess how attractive its current price is.

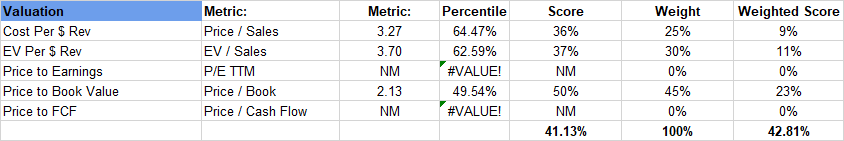

Assessing 1Life Healthcare’s Pricing Attractiveness

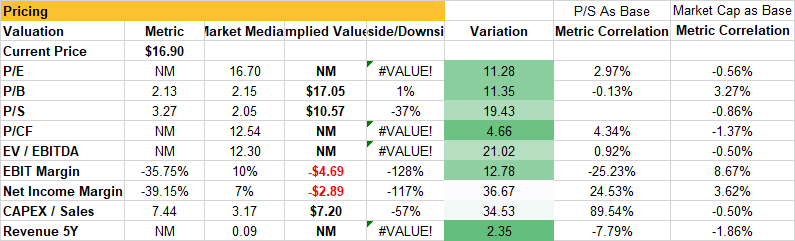

Turning our attention to valuation metrics, we see ONEM is unsurprisingly expensive compared to the market, given its price and enterprise valuation to sales. Ranking in the top third of most expensive stocks in the US market under these metrics, tells us that AMZN is certainly paying a premium for acquisition.

(Note that these metrics are based on a current price of $16.90 per share, and not Amazon’s $18 per share)

Given the firm has no earnings, and free cash flows are negative, we can’t rank ONEM on these metrics easily without nonsensical results.

Interestingly, the price book value of ONEM is considered average for the US market at 2.13.

Author

Now we will attempt to value ONEM and determine how much of a premium AMZN has elected to pay for its acquisition.

Finding An Appropriate Valuation Method For 1Life Healthcare

First we will consider a list of plausible, and several non-standard, valuation metrics to see how the US market values firms to guide us in our valuation of ONEM.

We will also turn our attention to the “noisiness” of each metric through the variation score, and the correlation between that metric and the P/S metric and overall market cap. This will help guide us in identifying and creating a pricing mechanism for ONEM.

Author

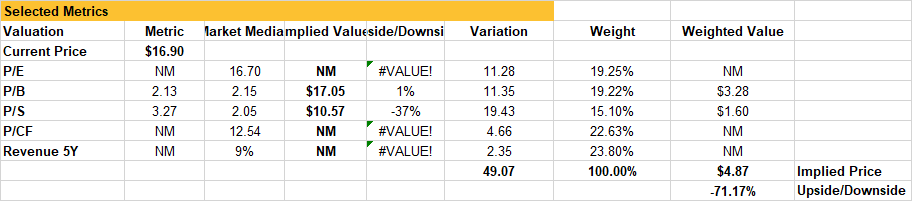

Determining which of the metrics are the most reliable, we’re left with a shortlist of metrics, which we can then apply weights to by tallying their variation scores and applying more weight to “quieter” metrics.

However, some of these metrics are reliant on forward-looking statements and given so few analysts cover ONEM, these figures aren’t particularly trustworthy (Seeking Alpha reports them as Non-Meaningful there is too little coverage). But this is the metric where ONEM could really show its worth and create the case for AMZN scoring a bargain buy.

Further, free cash flows and earnings are negative, so these metrics are not useful to us.

So now, we’re left with a decision of how to interpret the leftover results. I see two ways to look at this:

-

We take the non-meaningful metrics and apply a $0 value to them, and take the full weighted valuation as shown below as $4.87 (a 73% discount on AMZN’s $18 per share)

-

We ignore the non-meaningful metrics, and take a weighted average of just the P/B and P/S metrics, which would give us a valuation of $14.20 (a 21% discount on AMZN’s price)

Author

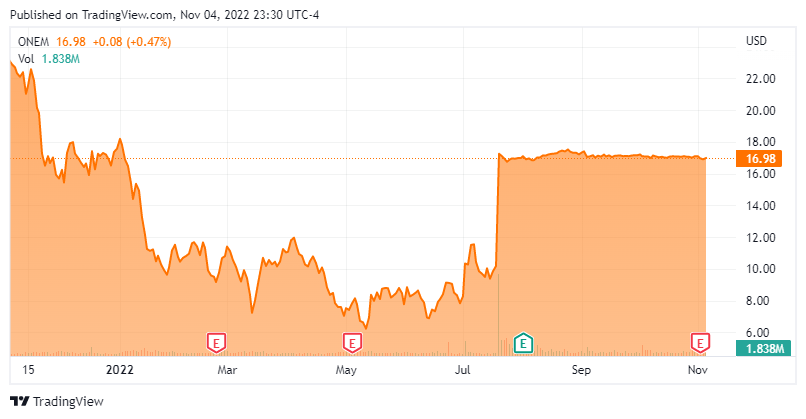

We do have the advantage of history to guide us, prior to the rumors of AMZN’s intent to acquire 1Life Healthcare, the stock was ranging throughout 2022 between $11.19 per share and $6.22, giving support to the thesis that the market did not see quite the premium on the firm that AMZN did, and placing a price on ONEM well within the bounds of our estimate valuation above.

TradingView

Closing Remarks

In reviewing the above, I would suggest that AMZN has overpaid for this firm based on how the US Market prices stocks, however, Jeff Bezos and his team probably see value here beyond the current financial performance of the firm.

When given the backing of AMZN’s vast financial, technical and human resources, there is every chance that ONEM could be worth $18 per share or more under the Amazon umbrella.

With that said, it would be irresponsible of me not to point out that this analysis is limited in its scope to just a quantitative peer analysis. While we do look at the firm’s financials, it does not go searching for detail and context that one might find reading earnings transcripts. Further, the analysis is of the market as a whole but does not consider the specific industry the firm operates in, and does not break down a near-peer comparison. Investors should use this analysis as a base-line for their analysis, but spend time looking at the firm’s qualitative aspects to further inform their thinking.

Author’s Note: The commentary in this article is general in nature and does not consider your personal circumstance. The opinions expressed in this article are opinions only, and data referenced is sourced from third party sources, including Seeking Alpha and other publicly available sources.

I make no warranties or guarantees around any of the views expressed in this article and suggest all investors consider my writing to be for interest purposes only and not considered exhaustive investment research or advice.

Be the first to comment