Duncan_Andison/iStock via Getty Images

Investment Thesis

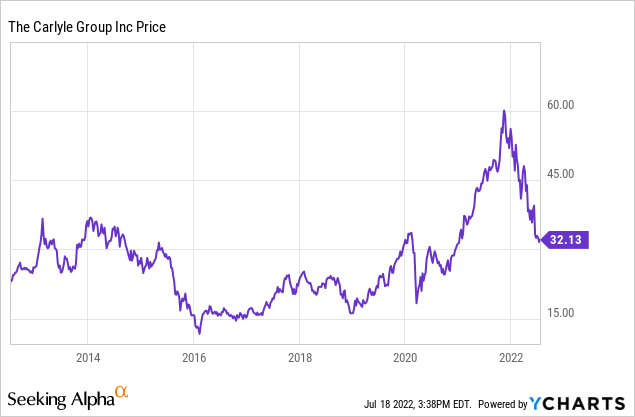

After falling ~47% from its highs in November 2021, The Carlyle Group (NASDAQ:CG) represents an opportunity for investors to invest in a highly scalable and growing global alternative asset manager at a discount to its sum-of-the-parts valuation. Alternative asset managers with successful track records will continue to benefit for decades to come as institutions slowly rotate trillions of dollars out of traditional stocks / bonds and into alternative assets such as private equity, infrastructure, and real estate. With a history of consistently growing AUM, revenues, and earnings, I believe CG represents a rare opportunity to purchase a great company with a long runway at an attractive price.

Company Description

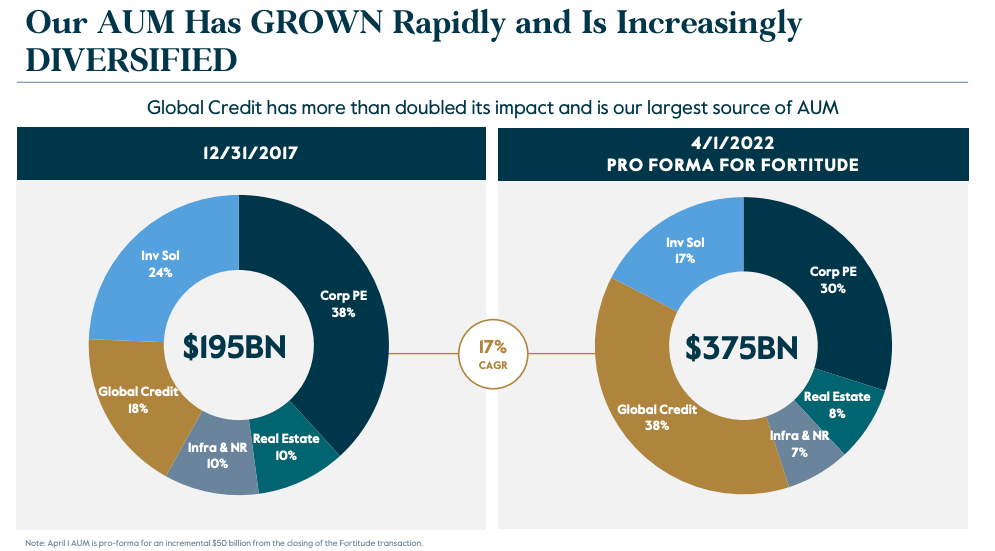

Founded in 1987, The Carlyle Group has become one of the most successful alternative asset managers in the world with $375B in total assets under management (or AUM). The firm operates across three business segments:

-

Global Private Equity ($169B AUM): focus on corporate private equity, real estate, and natural resources (infrastructure and energy).

-

Global Credit ($141B): focus on liquid credit (loans and structured credit), illiquid credit (direct lending, opportunistic and distressed credit), and real assets credit (aircraft financing and servicing, infrastructure debt).

-

Global Investment Solutions ($65B): focus on providing investment opportunities and resources for investors and clients to build private equity portfolios through fund of funds, secondary purchases of existing portfolios and managed co-investment programs.

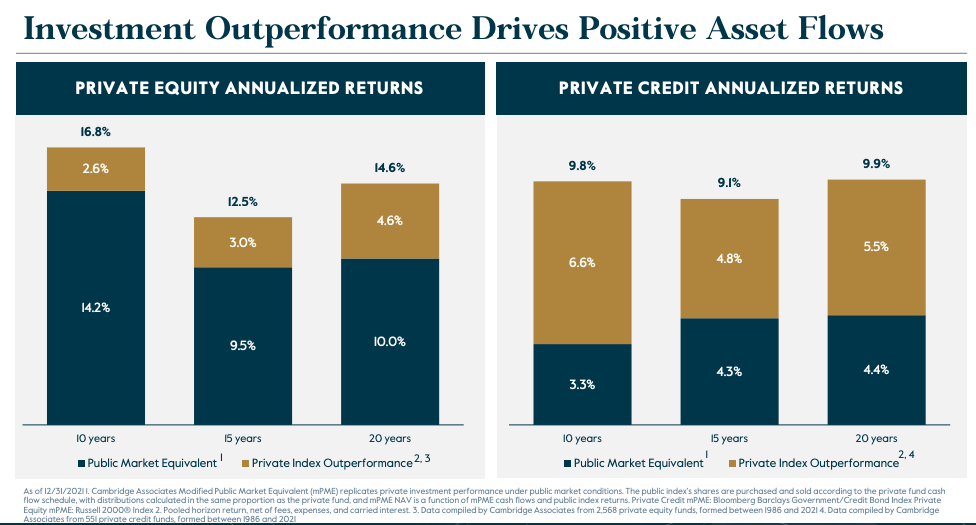

The firm has a strong track record of generating returns across its segments: ~15% private equity annualized returns and ~10% private credit annualized returns.

June 2022 Presentation

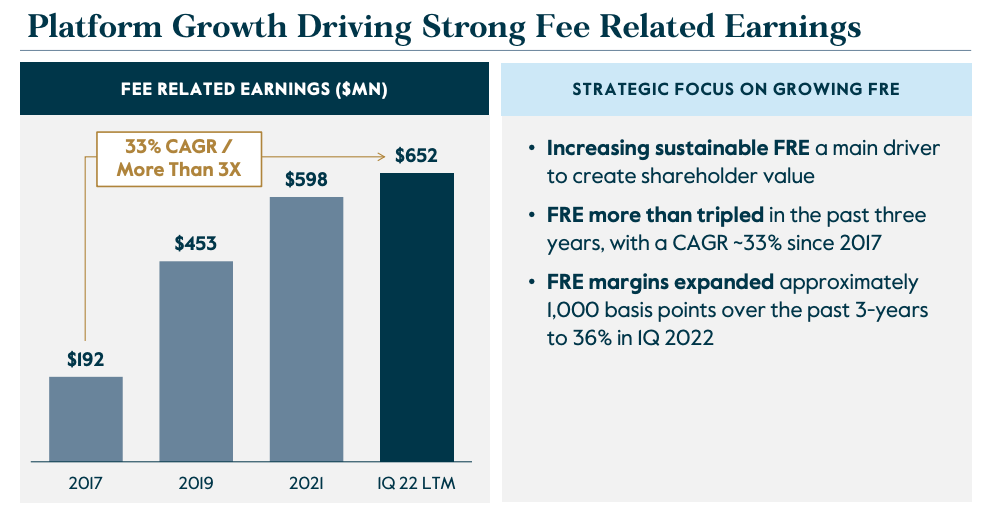

On top of strong returns, Carlyle has also proven its ability to raise assets and sustainable fee-related earnings (or FRE).

- 2013: $170B AUM ($194M)

- 2017: $195B AUM ($192M FRE)

- Q2 2022: $375B AUM ($652M FRE)

This is also an interesting time to point out the inherent scalability in the asset manager business model, where firms are able to increase revenues without a commensurate increase in capital expenditures or fixed costs.

- In 2017 when AUM was $195B, FRE was $192M.

- In 2022, AUM roughly doubled but FRE more than tripled (up 3.3x).

Carlyle also benefits from increasing FRE margins (as a result of scalability), which have expanded ~1,000 basis points over the past 3 years to ~36%.

June 2022 Presentation June 2022 Presentation

Similar to most alternative asset managers, Carlyle’s business is firing on all cylinders. In addition, it has demonstrated its ability to opportunistically raise capital globally and achieve above-average returns.

Before moving on to valuation, I just want to touch upon how great the asset management business model is (when done properly):

- Scalable: the company is able to increase revenues without a commensurate increase in capital expenditures or fixed costs.

- High-Margins: FRE margins of ~36% (with a goal of hitting 40%).

- Asset-Light: similar to Blackstone/Apollo, Carlyle runs the business with an “asset-light” approach, which allows it to pay out the majority of its earnings to shareholders.

- Sticky Earnings: capital is often locked up for a few years, which makes the earnings stream fairly predictable or “sticky”.

Valuation Analysis

With ~363M diluted shares outstanding and a current price of $32.31, the current market cap is ~$11.7B.

Similar to my last few articles on KKR (KKR), Apollo (APO) and TPG (TPG), one can think of Carlyle (or any asset manager like Brookfield (BAM), Blackstone (BX), Apollo, etc.) as two segments:

- The income stream (management + incentive fees).

- The balance sheet (cash and investments net of debt); in other words, the book value.

The recurring management fees come from managing the pools of money and the variable incentive fees come from being profitable (over some hurdle). Think of it as the typical “2 and 20”.

The balance sheet is simply the cash and investments that Carlyle has on its balance sheet minus the debt.

Using a sum-of-the-parts (SOTP) approach, we can apply certain multiples to the income streams and balance sheet to estimate Carlyle’s intrinsic value.

- Management Fee Stream: FRE for 2021 was $598M (see slide above). Applying a 20x multiple (which I would argue is a fair multiple for a sticky earnings stream, maybe even up to 25x), we get ~$12B in value for the management fee. Already we see that the market is only valuing the management fee stream and entirely ignoring the incentive fees, book value, and any growth in AUM/FRE.

- Incentive Fee Stream/Carried Interest: like most asset managers, the performance related earnings (or PRE) is pretty lumpy, but Carlyle states that it projects $1B of annual average net realized performance revenues. To be honest, I’m not entirely sure how to value this stream (and I believe the accrued performance allocation is already considered under book value), so I’ll just mark it at a zero to avoid double counting.

- Book Value: taking book value at face value, we get ~$5B of tangible book value (note that the assets contain ~$8B in accrued performance allocations).

Therefore, the sum-of-the-parts valuation, according to the above calculations, is:

|

Value (billions) |

|

|

Management Fees |

$12.0 |

|

Incentive Fees |

$0.0 |

|

Balance Sheet |

$5.0 |

|

Total |

$17.0 |

|

Current Market Cap |

$11.7 |

With a current market cap of $11.7B, the valuation suggests that Carlyle is trading at ~69% of its intrinsic value. Of course, as AUM and interest rates fluctuate, the earnings and valuation multiples should be revised accordingly.

This is also a good time to note that the annualized dividend (based on the more recent quarter) is $1.30 per share, or ~4%.

Insider Ownership & Transactions

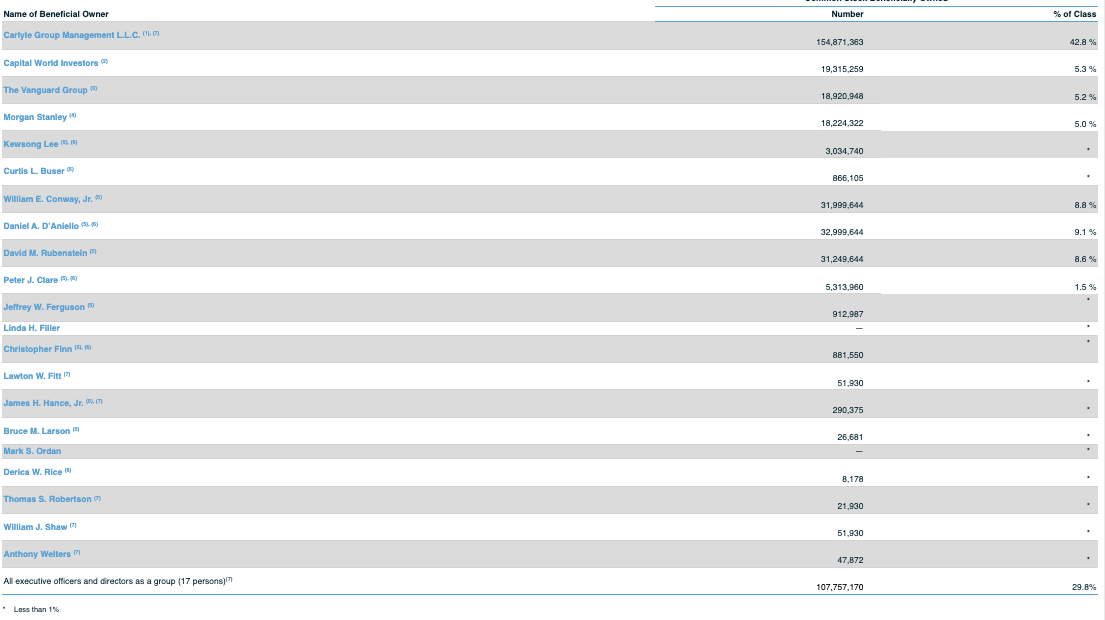

DEF 14A (2022)

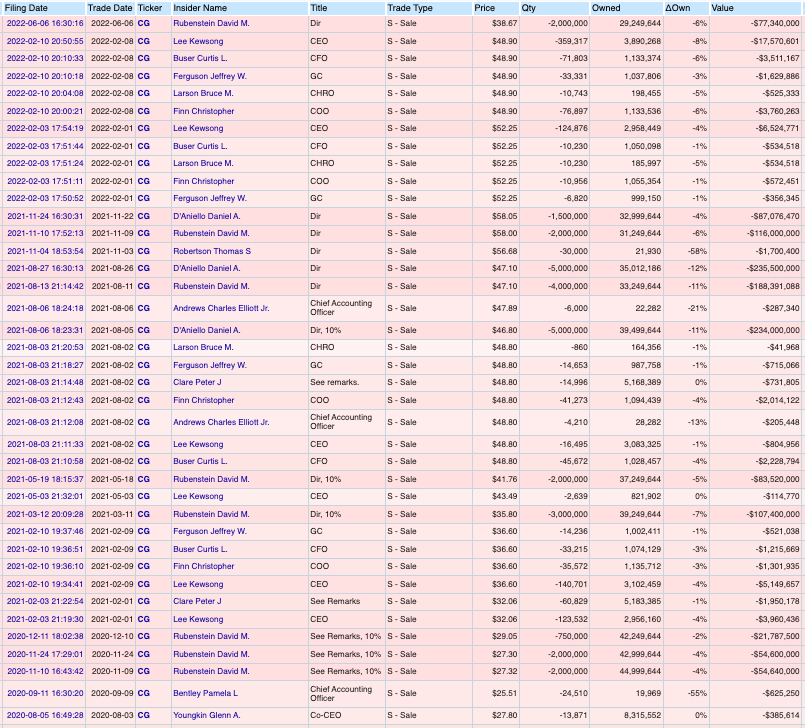

Insiders own ~30% of the shares, which demonstrates shareholder alignment. However, insiders have been consistent sellers of the stock (no recent buys), with sales ranging from $24 to $58 (~$1.3B sold in the last 2 years). The biggest seller has been David Rubenstein (~$700M of stock sold), who stepped down as co-CEO in 2017 (but still serves as a non-executive co-chairman) to presumably focus more on philanthropy (he is also hosting an interview program on Bloomberg: The David Rubenstein Show).

OpenInsider (CG)

Catalysts

- Continued Execution And Scaling: Carlyle continues to execute and scale on its strategies, which will lead to higher AUM, FRE and distributions.

- Strong Tailwind For Alternative Assets: there continues to be a shift of institutions (sovereign wealth funds, large public pension plans, etc.) moving trillions of dollars out of stocks and bonds and into alternative asset classes (private equity, real estate, infrastructure, credit); managers of those alternative assets who have a strong track record should stand to benefit in the next few years and potentially decades.

Risks

- Increased Demand for Alternative Assets: also cited as a catalyst, the increased demand for alternative assets will eventually serve as a double-edged sword: the increasing pool of capital chasing a finite selection of assets will eventually depress returns going forward; however, I don’t believe we are at that point yet, but I would be on the lookout for evidence of slowly eroding returns.

- Generational Succession: the relinquishing of the baton by the founders of these megafunds / private equity firms is something that will be interesting to witness: will the successors be able to maintain the culture or even perform better than their predecessors? So far, they seem to be doing just fine, but the ability for the successors to execute is something to keep in mind.

Investment Summary

If done right, asset management is a fantastic business, as the underlying business is scalable and earns a sticky, high-margin earnings fee. Carlyle has demonstrated its resiliency by having a consistent track record of raising and making money for over 35 years. Like other well-known alternative asset managers, Carlyle stands to benefit from institutions who are rotating trillions of dollars out of traditional stocks and bonds and into alternative assets (a trend that I believe has a long runway). Insiders also own ~30% of the company, although continued selling might dampen the stock price in the short term.

To summarize, Carlyle checks the boxes of a great business:

- The business model is simple to understand and within most people’s circle of competence. Carlyle manages money and allocates capital across different strategies.

- It is a fairly predictable business. Carlyle will probably be managing money for the foreseeable future and has a recurring and increasing earnings stream.

- It is on sale. Estimated intrinsic value is $17B and is currently trading at $11.7B.

Based on the analysis above, I recommend taking a long position in CG.

Be the first to comment