Robert Way

Ping An (OTCPK:PNGAY), a leading Chinese financial conglomerate with stakes in life insurance, property & casualty insurance, banking, and securities, posted a mixed set of Q3 2022 results. On the one hand, operating profit growth was strong at Ping An Life and Ping An Bank, yet, this was more than offset by negative investment headwinds in the P&C unit, as well as asset management. New business value (NBV) trends also fell short of expectations following another round of COVID-driven lockdowns in the quarter and broad-based consumption weakness.

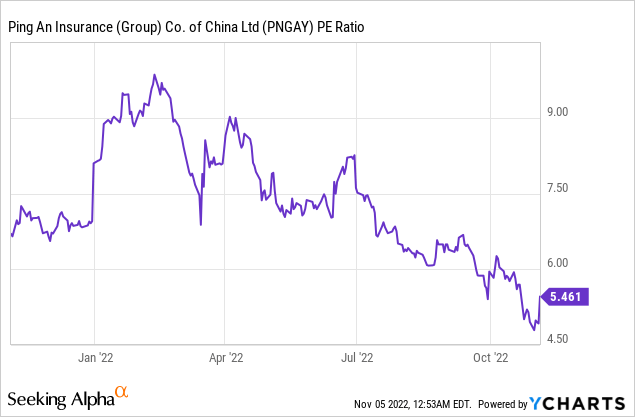

That said, Ping An’s progress on its life insurance reform has been positive, and even though the near-term benefits of its reform efforts could be outweighed by the macro headwinds ahead, the insurer remains positioned to drive a sustained NBV recovery through FY23. Valuation-wise, the H shares currently trade at an undemanding ~5 fwd P/E, while the A shares trade at ~7 fwd P/E, indicating most of the negatives have likely been priced in.

Investment Losses Cloud Quarterly Results

Ping An’s reported Q3 operating profit was solid at Rmb37.9bn (+3% YoY), primarily on the back of strong growth at Ping An Life (+16% YoY) and Ping An Bank (+26% YoY), both of which more than offset YoY declines elsewhere. These declines were mostly down to equity market weakness for the quarter (vs. operating underperformance), though, as investment fluctuations for non-life businesses are reflected in their reported operating profit numbers. Similarly, net profit was weighed down by equity investment losses, as the company had to mark many of its real estate equity investments to market values.

While Ping An’s exposure to the real estate sector had long been a key investor concern, the recognition of most of the investment losses and the company’s balance sheet de-risking efforts should help massively. Per management, total real estate exposure now stands at Rmb206.6bn or 4.8% of total investment assets – this represents a significant step-down from the prior Rmb222.8bn or 5.2% exposure as of Q2. On another positive note, the company cited no impairments on its bond investments this time around. So, while book value declined ~1% sequentially this quarter on elevated investment losses and the interim dividend payout, the kitchen sinking in Q3 should pave the way for a YoY improvement in the coming quarters.

Life Business Remains Pressured But Recovery Signs Emerging

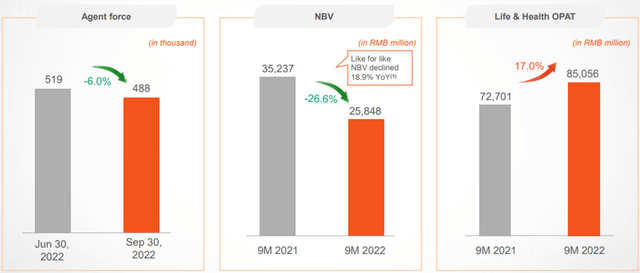

YTD new business activity continues to slow down in the life segment – the value of new business (VNB) fell ~27% YoY, with Q3 contributing an outsized portion of the decline at -20% YoY. Adjusting for the impact of assumption changes, however, the VNB decline for the nine months to date would still have been underwhelming at -19% YoY. As a result, life agent streamlining continued, with Ping An’s agent headcount down by ~6% sequentially this quarter (in line with the industry). Expect more near-term turnover as well amid the ongoing COVID-driven quarantine measures across China and consumption weakness. The recruitment challenges are a concern, but I view this as a temporary rather than a structural trend. Ping An will eventually see a relaxation in quarantine measures as the pandemic winds down, and as economic activities recover (helped by the PBoC’s easing in China), turnover should ease over time.

Ping An

In the meantime, Ping An is pushing forward with its three-year life business reform and has reached the pilot run stage for its third and fourth batches. Thus far, reform efforts have yielded positive outcomes – VNB per agent is up ~22% YoY for the nine months to date, even as overall VNB is down in the double digits %. Expect further reform progress to drive a gradual VNB recovery in FY23 and beyond. Additional upside could come from Ping An’s 2023 ‘jumpstart’ pre-sales campaign later this month – assuming VNB margins of the ‘jumpstart’ products remain stable YoY, the continued focus on savings should yield another quarter of strong sales contribution, in my view.

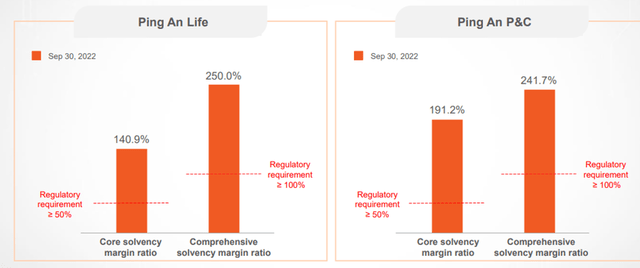

Capital Ratios Surprise to the Upside

Of note, management did a great job addressing the two key areas of concern heading into the results – the balance sheet strength and dividend sustainability. While bears will point to the wide gap between operating profit and net profit this time around, most of the delta was due to one-offs like investment income. Instead, I would focus on the progress of Ping An’s Life and P&C operations, both of which saw improved core solvency ratios on a sequential basis alongside Ping An Bank’s core capital ratio.

Ping An

A key reason for the improvement in Q3 was management’s efforts to reduce minimum capital requirements, which led to a more robust C-ROSS II solvency ratio. Given the latest numbers also incorporated the impact of counter-cyclical factors, the company looks well-capitalized and should have little trouble maintaining the dividend. Thus, the current mid to high-single-digit % dividend yield for the H and A shares makes Ping An a compelling play for income investors. Those betting on an earnings rebound will also draw comfort from the solid capital base and limited capital return downside, as they now get paid to wait for a pending earnings recovery.

Nearing A Bottom

Ping An has underperformed in recent years amid concerns about the quality of its investment book and challenges in its key life insurance business. The ongoing COVID lockdowns in China and macro/consumer weakness have not helped matters either, but a recovery could be on the cards sooner rather than later. Management has not only made good progress on its life reform initiatives, but the balance sheet has also been largely de-risked following this quarter’s strong solvency levels under C-ROSS 2.

With dividend concerns largely addressed, I suspect the key negatives have been priced in at the current ~5x fwd earnings multiple for the H-shares (~7x fwd earnings for the A-shares). Expect the reaffirmation of the dividend and a sustained life insurance recovery to support a valuation re-rating.

Be the first to comment