Just_Super/iStock via Getty Images

ARBE Robotics (NASDAQ:ARBE), a 2021 SPAC working on automotive RADAR systems, faces what might be the crucial 12 months in its life span. If the next year goes according to plan, it could be a billion-dollar company. Anything less, and it could be just another busted SPAC. Several major automotive players will make buying decisions in the next 12 months that will tie them into products for 3-5 years and ARBE is on the shortlist of companies totaling $7.5 Billion of sales contracts.

I first wrote about Arbe in January and described them as A high return low risk bet. This article builds on the first one, and it may be worth reading the first article to get a good understanding of what Arbe does.

Many startup companies have recently entered the Auto Radar market, often described as millimeter radar; start-ups from China, Korea, Israel, and the US have entered what looks like a lucrative market. However, Arbe was the first and is leading the technical challenge as its products will go into serial production early in 2023.

ARBE has developed a high-resolution imaging radar system on a chip that it is trying to sell to automotive companies as a competitor to Lidar and an improvement on the existing automotive radar. (My first article on ARBE covers the product in detail) ARBE hopes its chips will be a crucial element in the drive toward Autonomous driving. Arbe’s advantage is its IP. Its flagship product has 48 Transmitters x 48 Receiver Channels with a 1mm 1 degree resolution. It can detect objects of all size (and their speed) up to 300 m away, giving a full 360-degree point cloud that ARBE’s software can interpret. Its maximum range is 800m for objects. Being RADAR rather than LIDAR (it uses Radio waves, not Light waves), it works in all weather conditions; unlike LIDAR, it is unaffected by fog, snow, rain, and bright sunlight. RADAR can also see through many objects giving information like:-

“a dog is running behind that fence towards the road,”

“Visibility is only 10m because of the snow but there is a crashed car 25m ahead,”

“a cat is sitting behind that garbage can.”

RADAR is not as accurate as LIDAR; however, the Arbe Radar is accurate to 1mm, which is enough for any automotive applications. The increased information from the Arbe solution includes velocity at the pixel level.

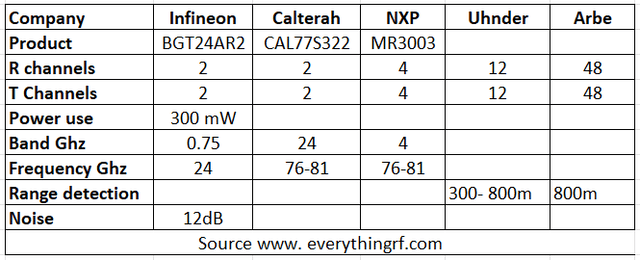

The ARBE product looks like a significant improvement on the existing automotive RADAR systems from companies like Infineon (OTCQX:IFNNY), NXP (NXPI), and Calterah. It also appears to be better than the other proposed offerings from startups pursuing the same market, of which Uhnder seems to be the closest to market.

Comparison of key features (author)

Uhnder, a startup based in Texas is pursuing a 4D digital radar product. They are collaborating with Magna (MGA) and have already signed Fisker (FSR) to their product. Full specs are not yet available on the website, and it is hard to be sure of the product. Uhnder uses terms like “virtual channels,” of which there are more than 100 as the product seems to be in the development stage, it is hard to be sure of precisely what it will offer.

ARBE is unique in its approach, as it develops its high-resolution 4D RADAR chip in collaboration with GLOBALFOUNDRIES (GFS) based on GFs 22nm architecture. ARBE’s chipset can decode the 4D point cloud (position + velocity for every point in the cloud) and feed that information to the car’s main information system. Arbe is also developing the algorithms necessary to interpret the information received.

The Market

The market for automotive radar was around $20 billion in 2020 and is growing with a CAGR of 10%. Current automotive radar helps with collision avoidance, cruise control, parking assist, and some blind spot detection.

The market for LIDAR is forecast to be $3.4 billion in 2026, with a CAGR of over 20%.

Arbe’s 4D radar system will be targeting both of these markets with its products capable of fulfilling both roles simultaneously.

A Crunch 12 months

It is now crunch time for ARBE and its competitors; Innoviz (INVZ) stole a march on the rest with its recent significant design wins (as predicted in this article, Lidar Review leading to buy Innoviz recommendation. Kobi Marenko (CEO of ARBE) said in the Earnings call following the Q2 results that between September and March, they expect ten decisions from different auto companies that Arbe has completed testing with; each decision accounts for revenue somewhere between $30 million and $100 million per year. As soon as he said that, the CFO jumped in, saying that these figures were from Identified customers and they thought revenue would go higher. Arbe has consistently guided to $300 million in revenue per annum, requiring three big wins out of the ten they are bidding on.

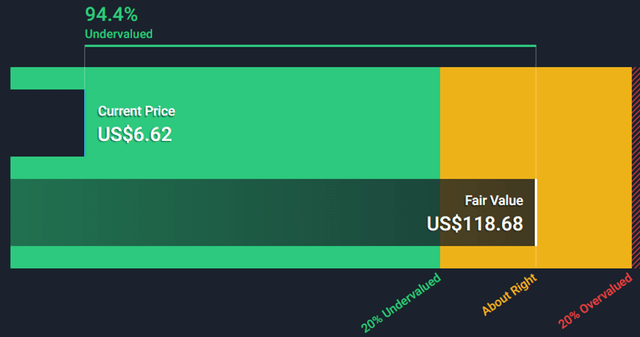

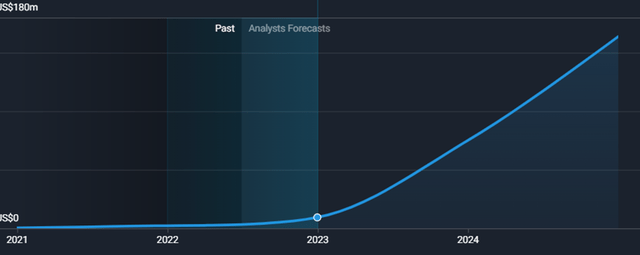

Five analysts follow Arbe, and using their forecasts (all of which assume Arbe will hit its $300 million revenue target), SimplyWall.st produced the following fair value calculation from a Discounted Cash Flow model.

DCF Fair value (simplywall.st)

This fair Value is a little higher than my model predicts with the given turnover. Arbe has guided to +60%.

Late in the conference call, analysts quizzed management about the ten expected contract decisions and the interjection by the CFO, saying things could be much more significant. The CEO, Kobi, said that if you add all the Request for Proposals to the Requests for Quotations, they are bidding on 7.5 billion dollars in revenue between 2023 and 2029. His seriousness was hard to judge when he said he expected to win 95% of those bids. I suspect he was being honest.

Adjusting the financial model for 95% of $7.5 billion revenue gives a share price well over $300, it is hard to estimate the costs of such an enormous ramp-up without more information.

Where are they right now?

GlobalFoundries is a vital part of the ARBE sales pitch. One customer received the first significant shipment direct from GF in the last quarter. A second customer will receive a shipment in the current quarter. GF is testing the chips in the fab, but that checking is not yet automated and needs to be before mass production begins. There is also an issue with auto grade approval; however, that is about to be resolved by GF. ARBE expects to go into total mass production in early 2023. All of ARBEs potential customers have spoken directly to GF to ensure that the product is of the correct standard and that GF is backing the ARBEs sales plan. In the earnings call, Kobi said that Tier 1 potential customers have had the production guaranteed by GF and that GF has established a designated area dedicated to producing and sampling ARBEs chipset within their fab. The commitment from GF is significant; global auto manufacturers are used to dealing with GF trusting their word, without GF ARBE is just a small-time Israeli startup.

HIRain, the leading tier 1 ADAS supplier in China, announced that it is undertaking projects with major Chinese OEMs with imaging radar based on ARBEs chipset. HIRain expects to reach total mass production in 2023. HIRain has been shortlisted for several high-profile RFQs with major Chinese manufacturers.

Arbe has one confirmed customer, AutoX, an Asian delivery vehicle manufacturer with some big-name backers, AutoX is making a delivery robot using Arbe Radar that is heading toward serial production in 2023. When Arbe launched, they made a big deal of this 400,000 unit agreement however, in the latest earnings call it was described as a small customer. That is a recognition of how Arbe has moved forward.

Arbe Product line up

In the last quarter, Arbe added a second product to their lead offering, the Lynx, introduced in July; it is a 24 transmission x 12 Receiver 360-degree long-range radar system. The product complements the flagship Phoenix 48 Transmission x 48 Receiver Radar, and the two devices can work in sync to provide full coverage around the vehicle. It comes with the same perception abilities using the same AI and has the 4th degree of velocity as standard. Arbe expects Lynx to be used at the rear and the corners of a vehicle, with any individual vehicle likely to have one phoenix and 5 Lynx plus one or two backup radars on board.

Lynx can be used for a front radar on driver assist rather than fully autonomous vehicles.

Arbe products are very low cost compared to the LIDAR competition, we do not have an exact price, but a Phoenix RADAR is expected to be one-tenth the cost of an equivalent LIDAR and the Lynx far less than a Phoenix. LIDAR is coming down in price but is unlikely to compete with RADAR in the foreseeable future.

Finances

The competitive situation looks good for Arbe, great products, low costs, and high customer engagement.

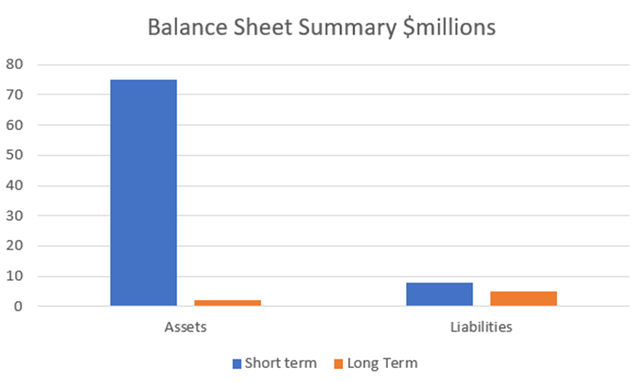

Have they got the cash to get to revenue generation?

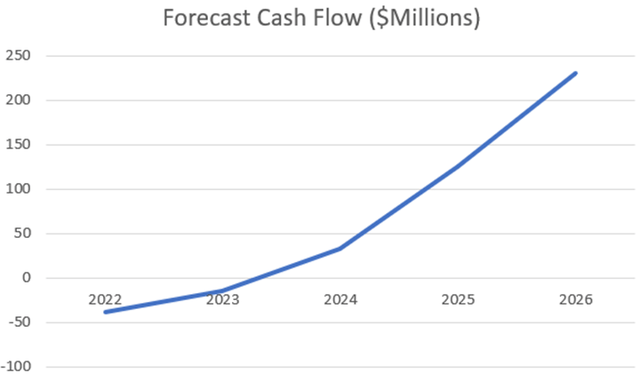

As with many of these recent SPACs, finances are strong. The balance sheet summary shows $75 million of cash on hand and zero debt. Cash burn in the latest quarter was close to $10 million (up from $6 million in Q1); they have a cash runway of approximately seven quarters.

Company guidance is for EBITDA of -$34 to -$38 million this year. The guidance is in line with my model of Arbe and suggests they will have sufficient cash as long as they deliver on the orders this year.

Arbe Model: Cash Flow (Author mathematical model)

Conclusion

This is Arbe’s moment, they have a product that appears price competitive and superior to the competition. However, I am not an auto Manufacturer and can only go off published information; we need to see confirmed orders to be sure.

Numerous potential customers will be making final decisions in the next 12 months. Wallstreet analysts expect Arbe to win several of these orders and give the following revenue forecast.

Revenue forecast (simplywall.st)

Arbe has suggested it could win orders for 95% of $7.5 billion

I first bought ARBE at $8.51. I added in April at $6.64 and again this last month at $5.80. My average cost is $6.71.

I will hold for the next 12 months and hope to see the orders and revenue roll in.

I recommend buying Arbe now.

Be the first to comment