Vitalii Petrushenko/iStock via Getty Images

Investment thesis

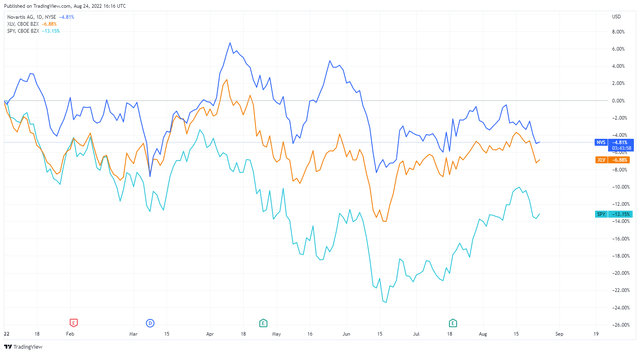

Novartis (NYSE:NVS) is one of the largest pharmaceutical companies in the world and has been performing better than the entire S&P 500 since the beginning of the year due to the consistency of its cash inflows. As of today, the recession scenario does not seem to be ruled out at all, so I consider it likely that from a short-to-medium-term perspective this stock can continue to outperform the market. According to the latest quarterly report, the two most important drugs for the company (Cosentyx®, Entresto®) are continuing to generate more and more revenues by achieving double-digit growth rates. Kisqali® and Kesimpta® have also seen excellent results although their weight is not so significant in terms of revenues. Among the negatives of this Q2, however, we find losses from an unfavorable exchange rate: a strong dollar does not help Novartis. Calculating the fair value of Novartis through a discounted cash flow the stock seems very undervalued as a potential upside of 64% emerges. Wanting to be more conservative by applying a 20% margin of safety the stock still remains at a discount as the potential upside is 31%.

Reliability of the pharmaceutical industry

The year 2022 has so far not proved to be a good year for the S&P 500 due to multiple macroeconomic problems derived from the pandemic outbreak and the Russian-Ukrainian crisis. Although the S&P 500 is recovering some of the losses of 2022 we are still far from the highs and there are still many doubts.

- Inflation may have peaked, but it is still high

- The yield curve has been inverted for weeks and has always been a harbinger of a subsequent recession

- U.S. GDP has been contracting for 2 quarters in a row, typical of a recessionary phase

- Commodity costs are still high though reduced, and problems in the supply chain are still present

- The Fed is implementing a restrictive monetary policy: less liquidity for stock markets therefore

These are just some of the reasons that make me believe that the difficulties related to this historical phase are not yet over; therefore, more than ever I consider stock picking important at this stage. Among my favorite sectors to invest in at the moment is pharmaceuticals, because throughout history they have proven resilient to economic downturns. Even during financial crises people buy their drugs, after all, nothing is more important than health.

Among the companies I currently consider most interesting in the pharmaceutical sector is Novartis, a Swiss company that capitalizes $184 billion. Over the course of this year, Novartis has performed better than the pharmaceutical sector (albeit by a small margin) and the S&P 500, proving to be quite resilient even in such a complex phase.

As can be seen, Novartis’ return this year was -4.81%, slightly higher than the pharmaceutical sector’s -6.88% and far better than the S&P 500’s -13.15%. While Novartis also experienced a loss, it is not comparable to that of the S&P 500, and also does not take into account the issuance of a 3.98% dividend yield and a buyback program.

Main drugs and impact of exchange rate

The most important aspect related to the analysis of a pharmaceutical company is obviously the growth of its pipeline. Since Novartis has a rather large pipeline, I am going to comment only on those drugs that have an important weight on overall revenues and those that although not too relevant have proven to be very interesting in this Q2 2022.

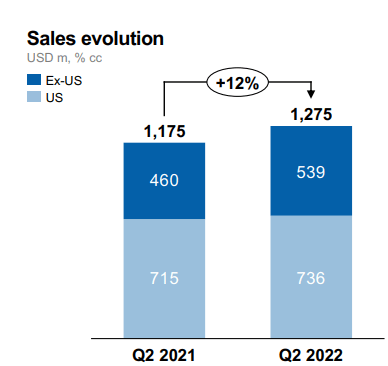

Cosentyx®

Novartis, Q2 2022

Cosentyx® once again proved to be the most important drug by sales made: it alone covers about 10% of total revenues. Most importantly, despite having such a large weight, sales continue to increase rapidly, registering double-digit growth. This drug fights psoriatic arthritis, a disease of the immune system. This market was valued at $7.15 billion in 2019 and is expected to reach $13.64 billion by 2027 (9.2% CAGR). Finally, it is important to note that the patent on this drug will last for a while longer; in fact, it is expected that it could expire in 2028 in the U.S., 2030 in Europe, and 2029 in Japan.

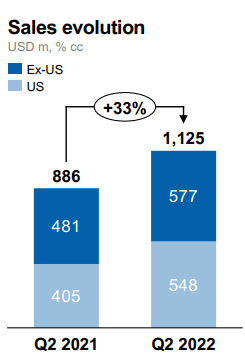

Entresto®

Novartis, Q2 2022

Entresto® is the second most important drug for Novartis; in fact, it is responsible for nearly 9% of total revenues, but its share is set to increase. The growth of this drug has been astonishing, mainly due to strong demand growth in Europe. The importance of this drug is crucial as it treats chronic heart failure, a progressive syndrome that drastically reduces a patient’s quality of life. Despite advances related to the prevention of cardiovascular disease, patients with chronic heart failure continue to increase mainly due to an aging population, which is why demand for Entresto is increasing so much. Finally, it is estimated that Entresto®’s patent may last until 2036, so there is no doubt that this is the most interesting drug in the entire pipeline from a future perspective.

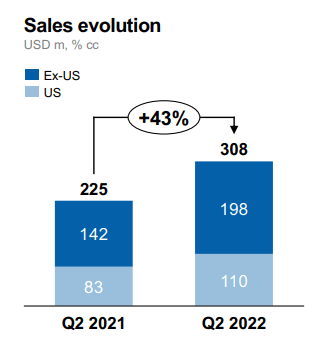

Kisqali®

Novartis, Q2 2022

Kisqali® is a drug that fights metastatic breast cancer. This is a very serious disease that affects mostly women and it is critical to intervene early as it is highly fatal. The economic growth of this drug has been remarkable over the past year, and the trend is unlikely to stop. In 1975 in the U.S. 1 in 11 women suffered from breast cancer to date unfortunately the statistic has increased to 1 in 8 women. The metastatic breast cancer treatment market has been valued at $15.52 billion in 2020 and is expected to grow by 2030 to $41.74 billion (10.40% CAGR). Kisqali®’s patent has been estimated to be valid until 2036.

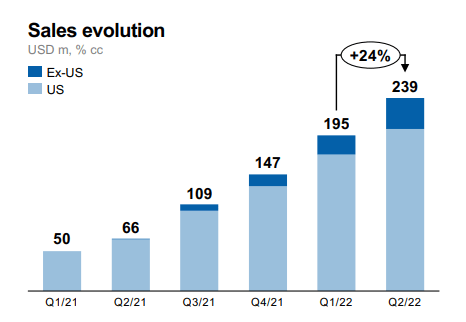

Kesimpta®

Novartis, Q2 2022

Kesimpta® is the best performing drug in terms of growth. In Q2 2021 there were sales of $66 million, while in Q2 2022 they reached $239 million: this is 270% growth year-on-year. The purpose of this drug is to fight multiple sclerosis, a disease that seems to be more present. The causes of increased cases of multiple sclerosis seem to have a connection to the growing phenomenon of obesity: large amounts of excess weight promote the creations of inflammation that can lead to this disease. The multiple sclerosis drug market is worth $25.43 billion in 2022 and is expected to grow to $33.17 billion in 2029 (3.9% CAGR). This is not such a large growth rate for this market; however, Kesimpta® is achieving great success by far outpacing the growth rate of the reference market. The patent for this drug is expected to expire in 2033-34.

Impact of exchange rate

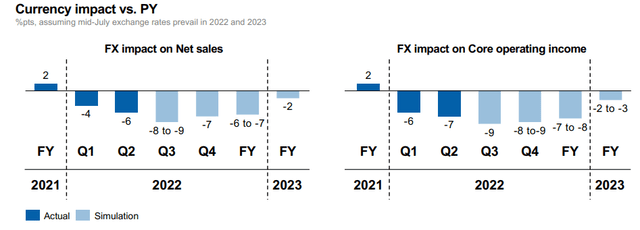

Total revenues for Q2 2022 were $12.78 billion, about 1% less than last Q2 2021. However, the reason for this deterioration was not due to an underwhelming pipeline, but to the unfavorable exchange rate. Novartis is a Swiss company that operates worldwide and is subject to foreign exchange risk, especially to the dollar. In its report, in fact, the company pointed out that if there had been a constant exchange rate, revenues would have increased by 5% instead. Regarding future exchange rate trends, Novartis management has made a series of forecasts designed to warn its shareholders that this situation will continue until at least 2023.

We can expect that in Q3 this issue will be even more pronounced, however in the full year 2023 it should not have that much of an impact. In any case, the company has not changed its guidance for FY2022: sales are expected to grow at mid-single digit compared to FY2021 considering a constant exchange rate.

Buyback and dividends

One of the most important aspects about an investment in Novartis is the continuous remuneration of its shareholders through dividends and buybacks.

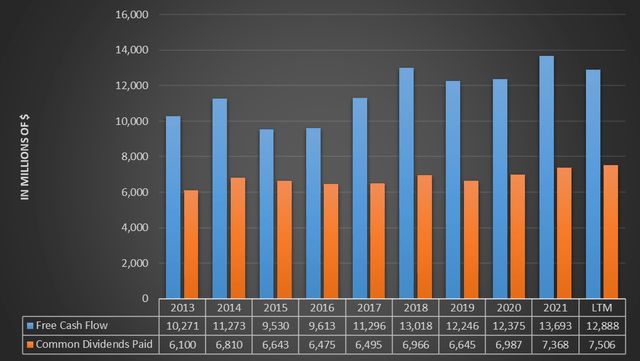

Novartis’ dividend currently has a dividend yield (FWD) of 3.98%, much higher than the industry average of 2.28%. What’s more, this dividend is absolutely sustainable.

As can be seen from this graph, albeit very slowly, both free cash flow and dividend have increased over the long term. For this company, the payout ratio typically hovers around 60%.

On the buyback side, on the other hand, Novartis shareholders are seeing their ownership share increase slightly over time. In December 2013 there were 2,426 million shares outstanding while as of today there are 2,182 million. Finally, in the quarterly report the company announced that it will continue its $15 billion buyback plan: as of today, $9.4 billion remains to complete the plan.

How much is Novartis worth?

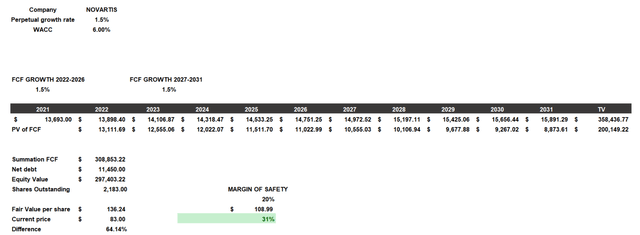

Novartis’ fair value will be calculated by using a free cash flow. This model will be constructed as follows:

- The cost of equity includes a beta of 0.49, a country market risk premium of 4.20%, a risk-free rate of 3.50%, and additional risks of 0.50%. The after-tax cost of debt will be 3.83%.

- The capital structure considered will be 85% equity and 15% debt, with a resulting WACC of 6%.

- The inserted growth rate will be 1.50%. This is a rather low figure, but then again, Novartis has never demonstrated fast growth. Its free cash flow has always been stable and growth has only been evident over long time horizons.

According to these assumptions the fair value is $136 per share while it is currently trading at about $83 per share: this is a rather marked undervaluation. If we wanted to consider a 20% margin of safety even then Novartis would undoubtedly be a buy. I personally believe that in the current uncertain environment having such a company that can guarantee a high dividend and constant free cash flow is a wise choice if you want to give some stability to your portfolio. In the event of a recession this is a stock that can potentially do better than the market, and so far it has already proven that. However, if your expectations are for a bullish market that has already bottomed, it would not make sense to buy this company expecting it to outperform the S&P 500: Novartis has a very low beta so we can consider it a defensive investment.

Be the first to comment