FG Trade/E+ via Getty Images

Telefônica Brasil (NYSE:VIV), and its Vivo brand, is the market leader in Brazil’s telecommunications. For a mobile network operator (MNO), the company has an extremely strong balance sheet. Its core business is profitable and has growth potential left in the tank. In addition, the company has promising digital business endeavors that are growing fast and making its core business stickier among its customers.

In dollar terms the stock is back to the levels seen last time in 2016. Last year the company generated 50% higher net income by 5% higher revenues – in Brazilian reals. The stock has a low historical and relative valuation, offering a 13% free cash flow yield and potentially a forward dividend yield of 6.4%. Political risks of Brazil and potential weakness of the real could offer an interesting entry point to build a position in Telefônica Brasil.

Company overview

Telefônica Brasil is a leading MNO in Brazil under a brand called Vivo. The company is a subsidiary of Spanish mobile network operator Telefônica (NYSE:TEF). which owns 74.2% of Telefônica Brasil shares. Vivo operates both in mobile and fiber, it has 1700 stores across Brazil and over 112 million customer accesses.

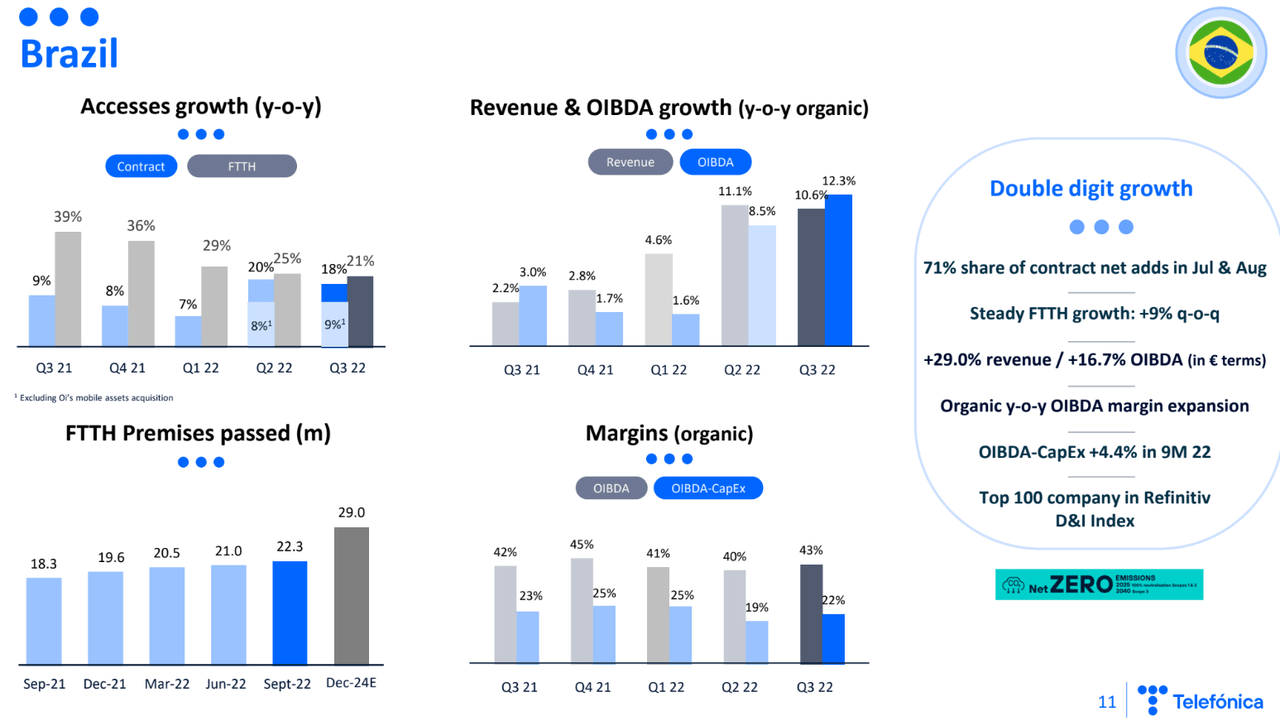

The underlying fundamentals for the core business growth are solid. First, the penetration rates of smartphone and fiber connections and average revenue per user have room to grow when compared to international levels. The fiber business has grown at a CAGR of 29% over the past five years and the company has a plan to increase the amount of connected homes from 21 million to 29 million by 2024. Second, the demographics of Brazil, market leadership and low-churn rate are prone to add more customers on the Vivo platform in the long run.

Telefônica Brasil is not just a mobile network operator. It has an impressive set of rapidly growing digital businesses. It distributes over-the-top media services such as Netflix, Disney and Spotify. Vivo has 1.8 million subscribers and the customer base grew 49% year over year.

Vivo Money and Vivo Pay are services for digital banking, including loans, money transfers and payment of bills. The digital banking loan book has grown at a very fast pace. In addition, Vivo has emerging services for telehealth, education and shopping. In the B2B-segment Vivo offers cloud services, cybersecurity and sales and leasing of equipment. This business grew 33% in the last quarter.

Recently, in the spring of 2022, Telefônica Brasil acquired mobile assets of its struggling competitor Oi. The acquisition added 12 million accesses to Vivo’s books. As a result Vivo’s mobile market share now stands at 38%, up from 31% ten years ago. Telefônica Brasil paid R$ 5.4 billion for the business in cash and expects to gain a similar amount in synergies. The deal increases revenues by 4% and EBITDA by 7%. Furthermore, the Brazilian market is now divided between three players.

For the past couple of quarters the business momentum has been strong revenues and OIBDA growing at a double-digit pace while the margins have remained stable.

Financial snapshot of Telefonica Brasil (Telefonica investor presentation)

Valuation has gone lower and margins remain steady

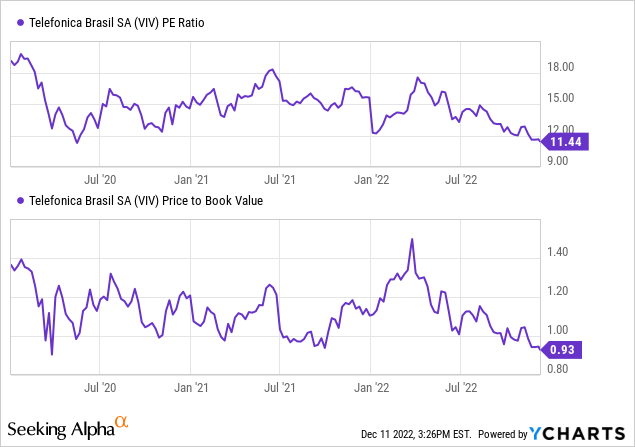

Telefônica Brasil is currently trading below its historical averages on traditional metrics. The price to earnings multiple stands at 11.6, price to book multiple at 0.93 and price to sales at 1.4.

At the end of the third quarter the book value of the company was R$ 41.2 per share and currently the stock is trading around R$ 37. Only 40% of the assets in the balance sheet are intangible. For a comparison, half of the assets on the balance sheet of Verizon (VZ) are either goodwill or intangibles.

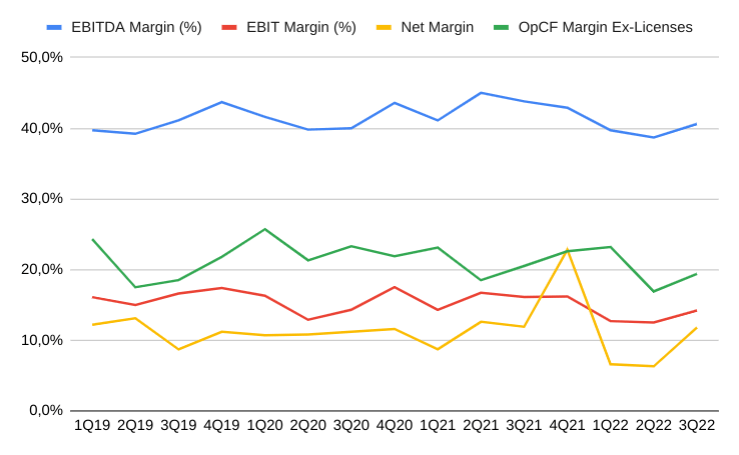

The direct Brazilian competitor TIM (NYSE:TIMB) is valued at price to earnings multiple of 14.5, price to book multiple at 1.4 and price to sales at 1.5. TIM has been able to maintain slightly higher margins than Telefônica Brasil. Nevertheless, the margins of Telefônica Brasil can be described steady and resilient. It is difficult to spot a pandemic drop from the chart below.

Overview of margin development of Telefonica Brasil. (Telefonica Brasil, Author.)

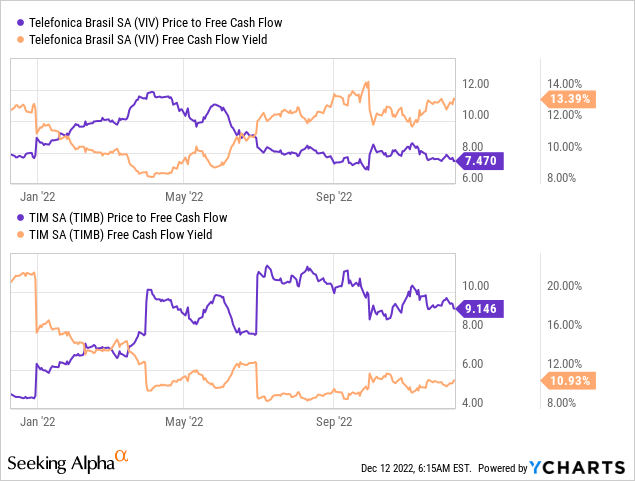

An improved performance and falling stock price has made the stock very attractive on free cash flow basis. Here the difference to TIM is apparent and acquiring shares of a clear market leader at much better valuation is a sign of potential opportunity. Analysts have given the stock an average target price of $10.7 representing an upside of 50%.

The mothership is thirsty for dividends

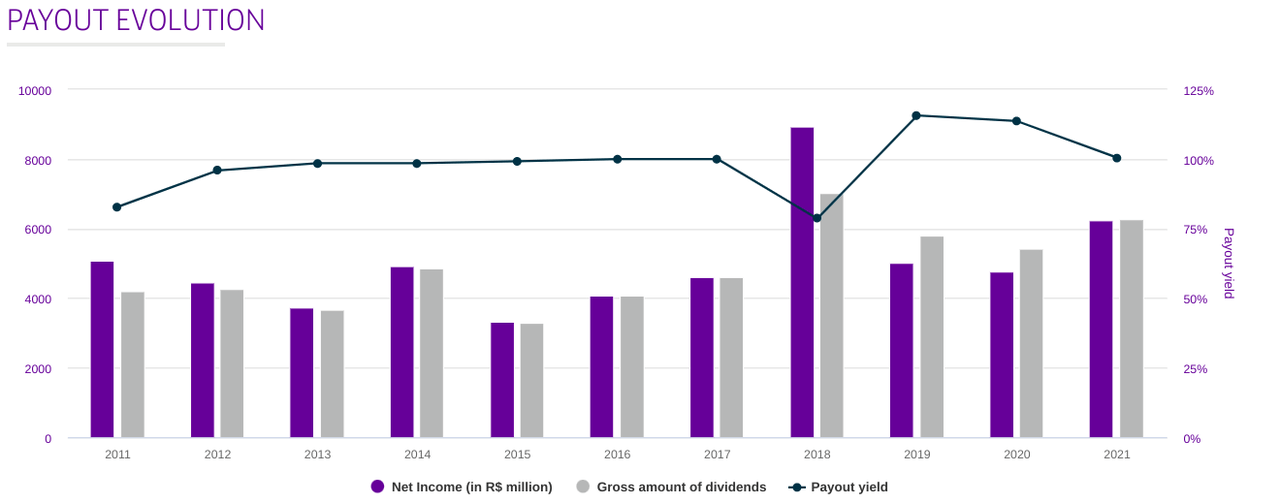

The Spanish Telefônica is profiled as a high dividend stock and needs its subsidiaries to deliver the profits back to the mothership. VIV pays practically all of its net income as a dividend as seen in the picture below provided by the company. Due to this the stock has normally yielded over six per cent.

According to Seeking Alpha the company has paid this year a dividend of $0.4 per share and one installment is still expected for December. Last year the dividend was $0.64 per share. In 2023 Fitch expects the company to pay a dividend of R$ 4.1 billion which would translate to approximately $0.46 per share.

Development of net income and dividend. (Telefonica Brasil IR)

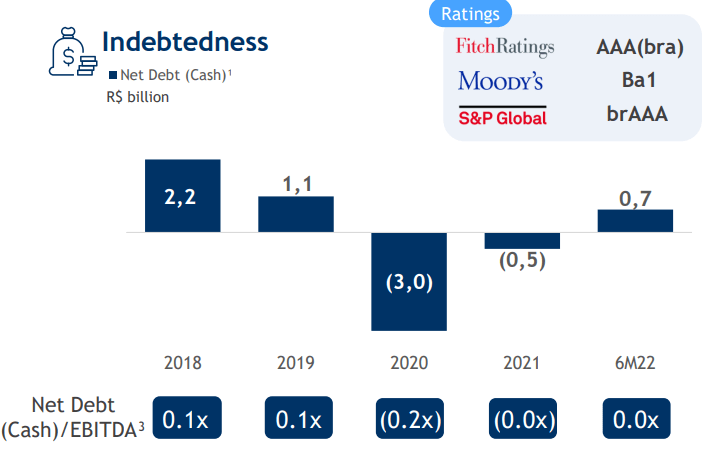

Is the high dividend safe? The dividend payment exceeds its net income, but the cash flow exceeded the dividend payment in 2020 by a factor of 1.69x and in 2021 by 1.19x. Furthermore, excluding the leases, Telefônica Brasil carries almost no debt. At the end of September the company had gross debt of R$7,549 million and cash R$6,151 million against a market cap of R$63 billion. Half of the long-term debt of R$ 5,031 million has a maturity in 2026 or after. This means that the company can continue rewarding shareholders as long as it takes care of the profitability of the business.

Indebtedness of Telefonica Brasil. (Investor presentation)

On top of the dividend Telefônica Brasil is also buying back shares. In February the company canceled treasury shares, reducing the share count by 0.83%. This year the company has bought back 0.57% of the stock.

Downside considerations

Perhaps the largest dark cloud looming over Telefônica Brasil is the currency. The dollar has recently depreciated against most of the currencies of emerging markets except Brazilian real. Most likely this is due to the political changes in Brazil and the economic policies that the new leadership is expected or has expressed to pursue.

From a technical perspective the investor should remain alert. When looking at the chart of the native stock (VIVT3), the price seems to be breaking below a major support area of R$37-38. Similar setup is developing in the stock listed in NYSE around $7.

Conclusion

Although MNOs are often shunned by investors, many of the MNOs in emerging markets are in a growth phase and operating in an oligopolistic but competitive environment. Naturally, heavy capex, technological change and potential price wars remain burdens for MNOs in the emerging markets as well. At the same time many MNOs in the emerging markets have more growth avenues than their peers in the northern hemisphere.

Telefônica Brasil is fundamentally sound and a steady performer. The company has underlying growth prospects that are materialising. The shareholders are rewarded with a large dividend cheque and share buybacks. While political risks and currency depreciation could present headwinds for the stock, a long-term dividend investor can utilize the weakness to build a position.

Be the first to comment