Ibrahim Akcengiz

Investment Thesis

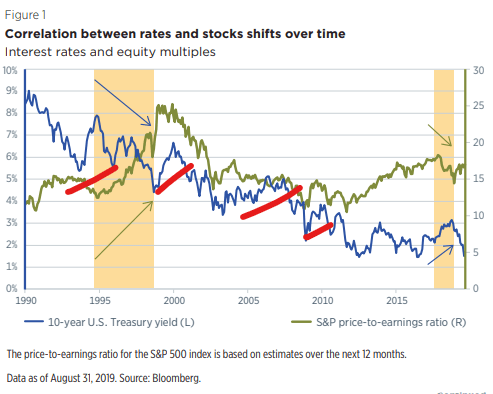

The Fed has been aggressively tightening monetary policy for the last couple of months in the face of stickier and higher-than-expected inflation. Higher rates generally have a negative impact on equity multiples and tend to affect growth stocks that trade at lofty valuations the most. Past tightening cycles have therefore been associated with P/E multiple contractions, with only a few exceptions. Given the low visibility that markets have when it comes to the Fed’s next moves, I believe that it is important to factor in a higher risk premium for growth stocks. In other words, investors should be fully aware of the uncertainties that are hanging on the macro outlook and should expect to pay less for the same stocks than a year ago.

Bloomberg

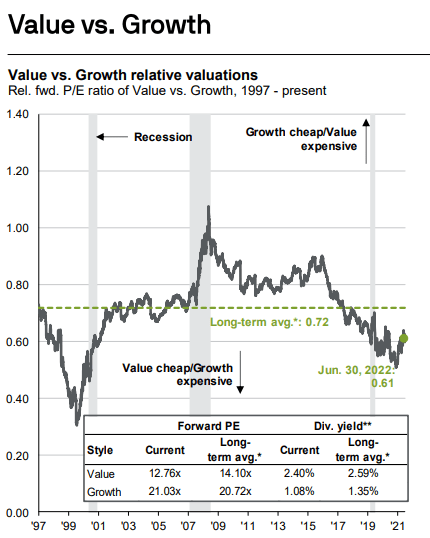

Since the NASDAQ 100 Index is down by more than 25% since early January 2022, retail investors are now back to buying stocks in an attempt to purchase their favorite companies at what they believe are very cheap valuations. However, I think it’s important to take a step back and get some historical perspective of where growth is relative to value. We started this market correction with growth being the most expensive style relative to value since the dot-com crash. And while the recent correction contributed to a reversal in the direction of the long-term average, we are still far below it. Eventually, the Fed will pivot and provide support to the economy and markets indirectly. However, the timing remains uncertain for now. As a result, I think that growth stocks still have more room to go lower in the next months, and investors should definitely keep some cash available to buy these stocks once the Fed decides to pivot.

JPMorgan

Strategy Details

The Vanguard S&P 500 Growth ETF (NYSEARCA:VOOG) tracks the investment results of the Standard & Poor’s 500 Growth Index. The strategy is made up of the growth stocks of the S&P 500.

If you want to learn more about the strategy, please click here.

Portfolio Composition

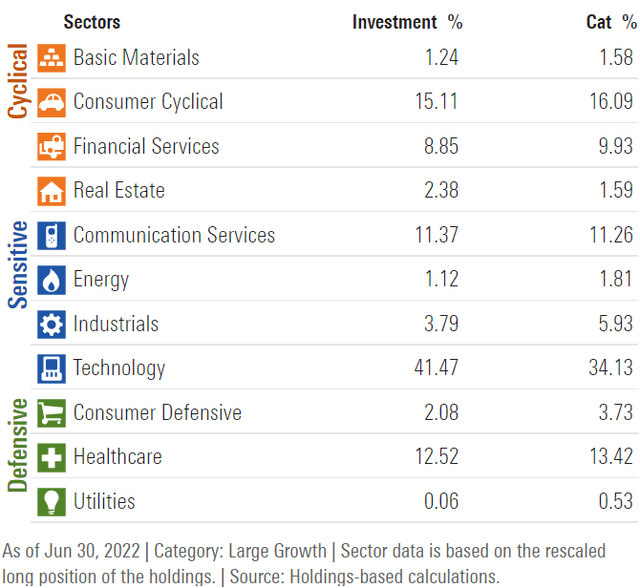

The index invests ~41% of total assets in Tech stocks, followed by Consumer Cyclicals (15%) and Healthcare (~12%). The largest three categories have a combined allocation of approximately 69%. In terms of geographical allocation, the U.S. accounts for ~99%.

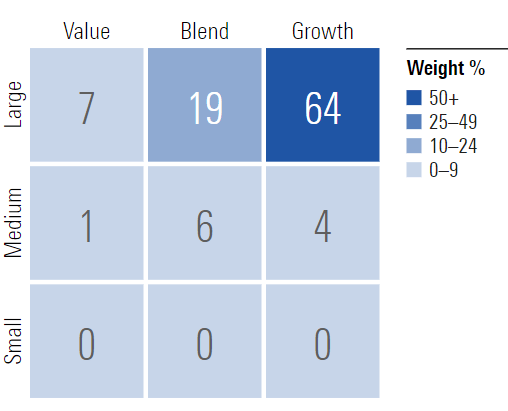

Unsurprisingly, ~64% of the portfolio is invested in large-cap growth equities, characterized as large-sized companies where growth characteristics predominate. Large-cap issuers are generally defined as companies with a market capitalization above $8 billion. The second-largest allocation is large-cap blend stocks, which account for 19% of the portfolio.

Morningstar

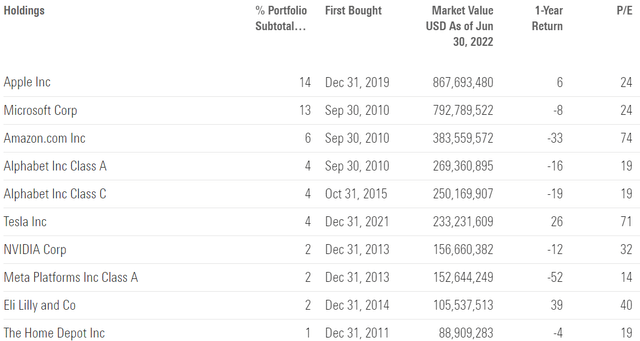

VOOG is currently invested in 240 different stocks. The top 10 holdings account for ~52% of the portfolio, with no single stock weighting more than 14%. The fund manages a concentrated portfolio. Before buying VOOG, investors must feel comfortable with the asset allocation and portfolio composition, since concentration might reduce some of the benefits of investing in ETFs and increase volatility. That said, VOOG has a similar concentration level to other growth strategies such as the Invesco QQQ ETF (QQQ).

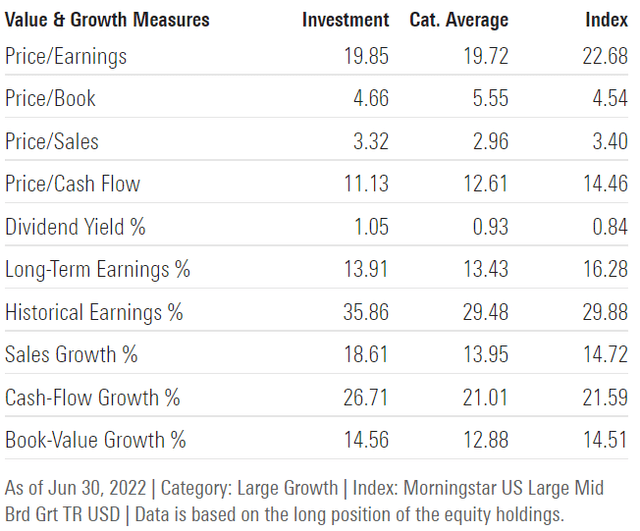

Since we are dealing with equities, one important characteristic is the portfolio’s valuation. According to data from Morningstar, VOOG trades at ~5x book value and ~20x earnings. Despite the tremendous growth potential that many of these companies have, I believe that VOOG is overpriced in the context of higher rates and inflation. While many analysts believe a Fed pivot is imminent, I think it’s unlikely to see a big shift in monetary policy until 2023. Inflation is still running close to 10% and is turning out to be stickier than anticipated. When the Fed pivots, and they will eventually, I believe high beta strategies such as VOOG will be attractive longs once again. Until then, I expect volatility to remain high, both to the upside and downside.

Is This ETF Right for Me?

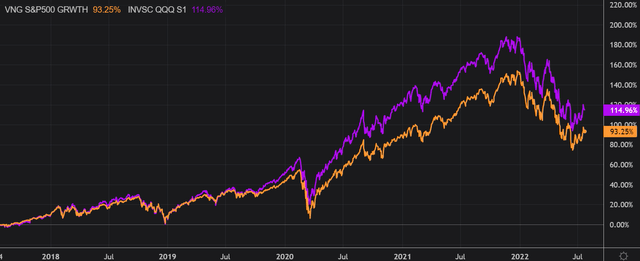

Since this strategy shares a large number of constituents with the Nasdaq 100 Index, I have decided to compare VOOG’s price performance against QQQ over the last 5 years to assess which was a better investment. Over that period, QQQ outperformed VOOG by more than 21 percentage points. That said, it is interesting to note that both strategies delivered similar returns up until Q3 2019 when QQQ started outperforming. All in all, I think that both strategies are very similar in terms of expected returns and potential drawdowns.

To put VOOG’s returns into perspective, a $100 investment in this fund 5 years ago would now be worth $193.25. This represents a compound annual growth rate of ~14%, which is a good absolute return.

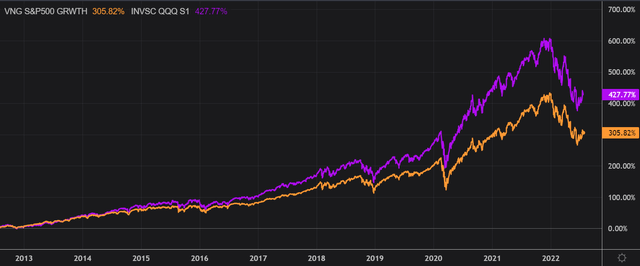

If we take a step back and look at the 10-year returns, the results don’t change much. QQQ came on top once again, outperforming VOOG since Q3 2019. Given how similar the two strategies are, I don’t have a particular preference at this point. That said, I believe that growth stocks are not out of the woods until the Fed reverses course on monetary policy. An abundance of liquidity has been the main driver behind many of these growth stocks’ returns in the last decade. As a result, I think that a return to a dovish monetary policy is a requirement for many of these names to start outperforming the market once again.

Key Takeaways

VOOG provides exposure to a basket of growth stocks that are part of the S&P 500 Index. This ETF runs a concentrated portfolio, where the top 10 holdings account for over 50% of total assets. We have noticed earnings multiples contraction since the beginning of the year as the Fed started to raise rates and engage in QT, and growth stocks have been hit harder than the broader market. This is in line with previous tightening cycles that have led to large market corrections such as the dot-com crash. In terms of relative price compared to value stocks, growth continues to be expensive and way below the long-term average trend. As a result, I believe growth will become once again an attractive investment style once the Fed pivots and provides support to the economy and markets. Until then, growth stocks remain risky, with downside risk persisting due to lofty valuations.

Be the first to comment