stuartmiles99/iStock via Getty Images

A Quick Take On Absolute Software

Absolute Software (NASDAQ:ABST) recently reported its FQ3 2022 financial results on May 10, 2022, missing revenue and earnings estimates.

The company provides endpoint visibility and related cybersecurity technologies for enterprises and public agencies.

While prospective investors may see a possible bargain in ABST’s current market valuation, I’m more cautious on its ability to take full advantage of its NetMotion acquisition and its need to pay down debt in the process.

I’m on Hold for Absolute in the near term.

Absolute Software Overview

Vancouver, Canada-based Absolute was founded in 1993 to provide a range of cybersecurity software technologies that are embedded in firmware products.

The firm is headed by Chief Executive Officer Christy Wyatt, who was previously CEO of Dtex Systems and Chairman, CEO and President of Good Technology.

The company’s primary offerings include:

-

Secure Endpoint Products

-

Secure Access Products

The firm acquires customers via direct sales and marketing efforts to obtain OEM partners.

Internationally, the company has relationships with distributors and other partners to offer its capabilities to potential customers in various countries and regions.

Absolute Software’s Market & Competition

According to a 2020 market research report by Grand View Research, the global zero trust security market was an estimated $19.8 billion in 2020 and is forecast to reach $61.4 billion by 2028.

This assumes the market will grow at a very strong CAGR of 15.2% between 2021 and 2028.

Market growth is expected due to an increasing proliferation of endpoint devices and growing adoption of cloud computing environments.

Additionally, the rise in the ‘work from home’ economy for businesses of all sizes along with a growing number of increasingly complex malware attacks is forcing companies to focus on improved security solutions.

Major competitors that provide or are developing zero trust security solutions include:

-

McAfee

-

Symantec Corporation

-

Palo Alto Networks (PANW)

-

FireEye

-

Cloudflare (NET)

-

VMware (VMW)

-

Check Point Software (CHKP)

-

SonicWall

-

Trend Micro (OTCPK:TMICF)

-

Others

Absolute Software’s Recent Financial Performance

-

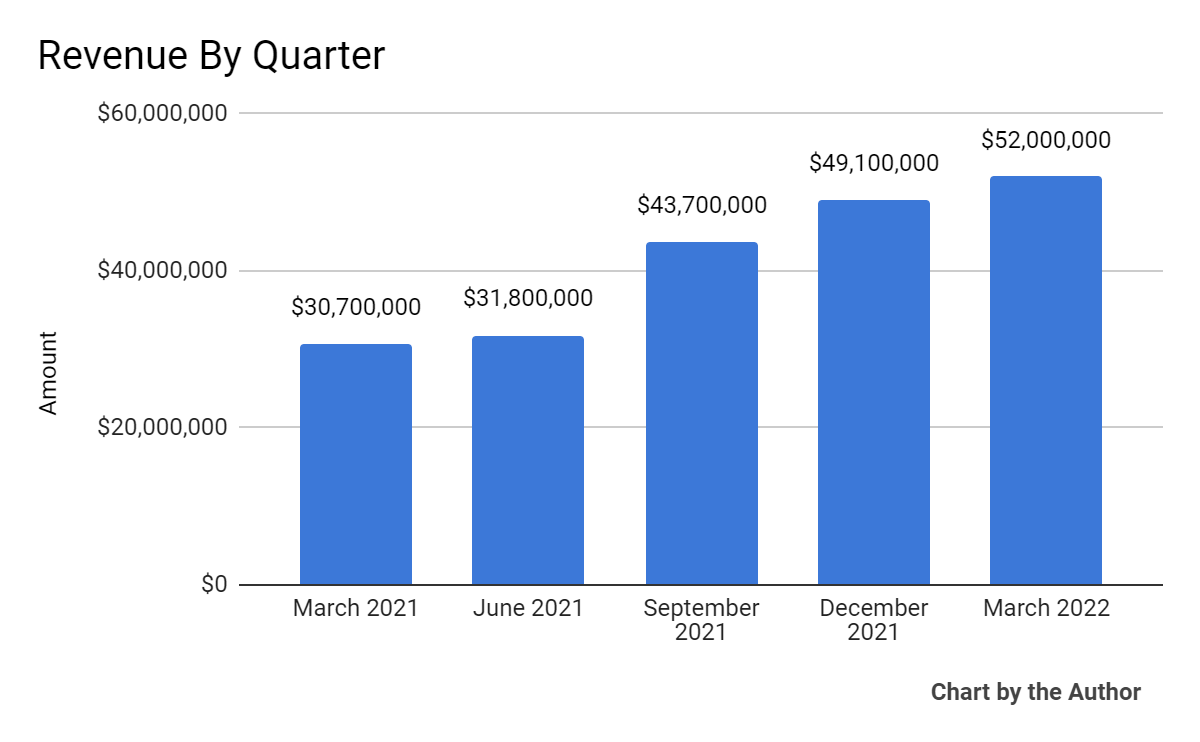

Total revenue by quarter has grown considerably in the past 5 quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

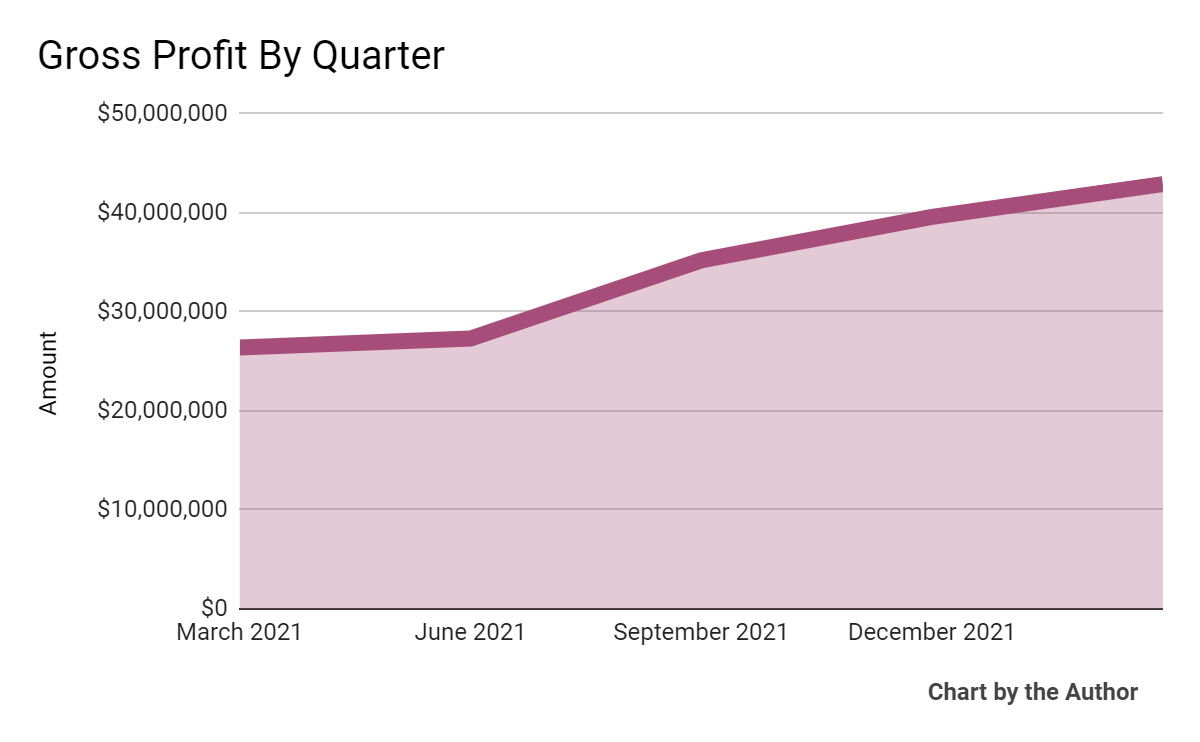

Gross profit by quarter has followed approximately the same trajectory as total revenue:

5 Quarter Gross Profit (Seeking Alpha)

-

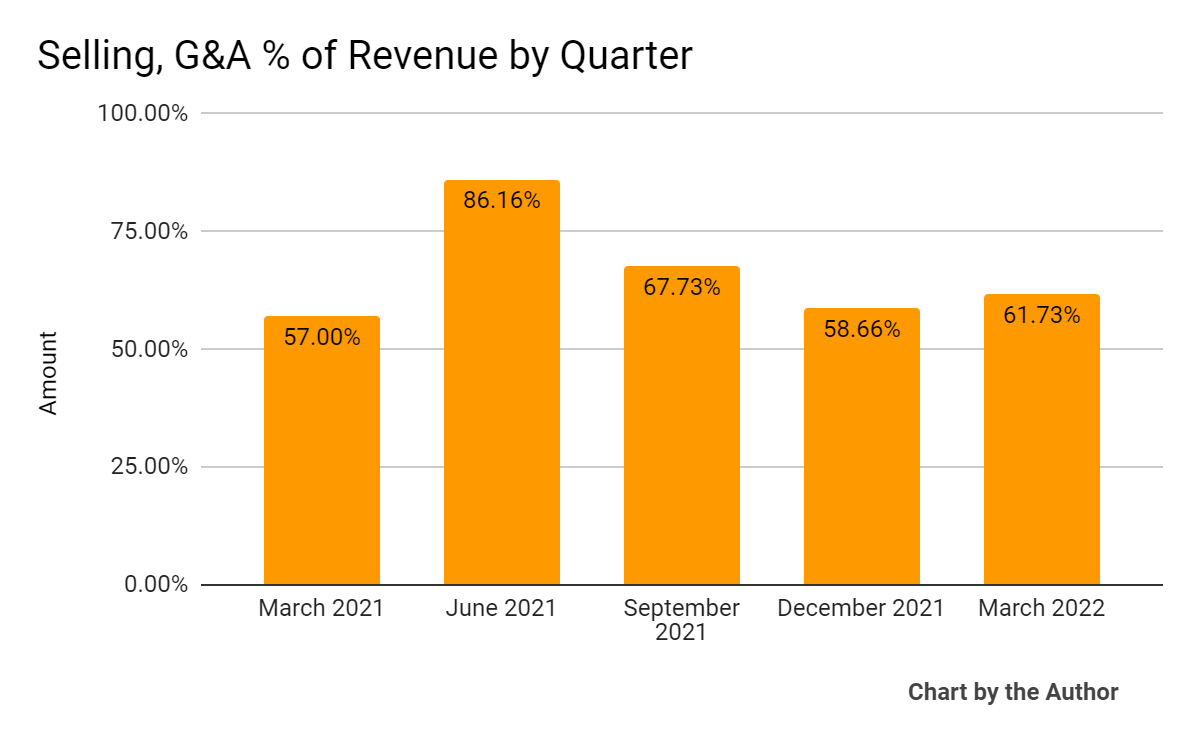

Selling, G&A expenses as a percentage of total revenue by quarter have remained stable in the past 3 quarters:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

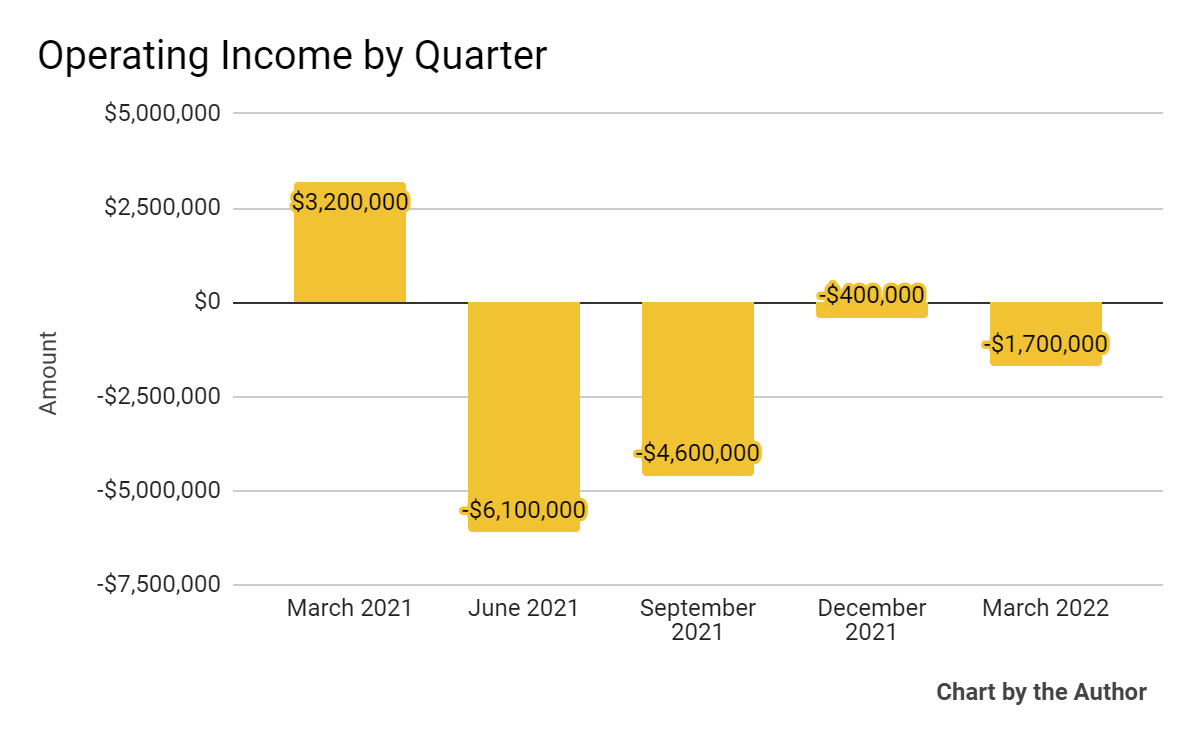

Operating income by quarter has hovered near breakeven in the two most recent quarters:

5 Quarter Operating Income (Seeking Alpha)

-

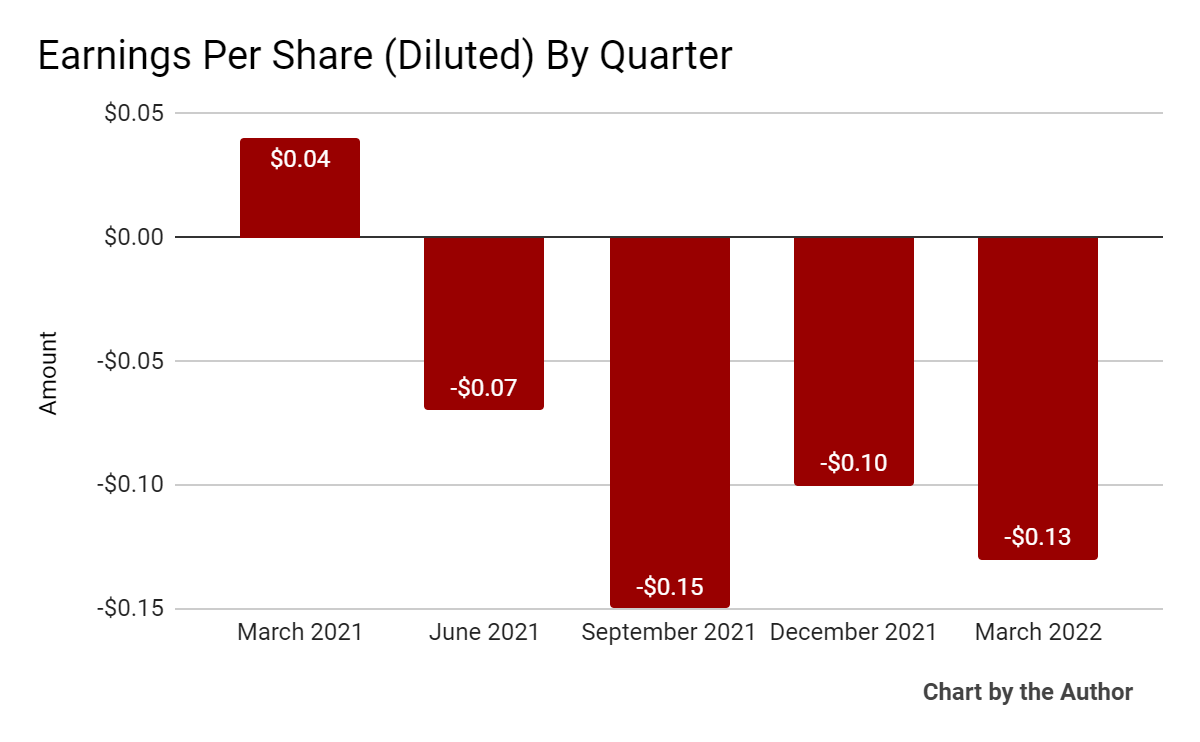

Earnings per share (Diluted) have remained negative in the 4 most recent quarters:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

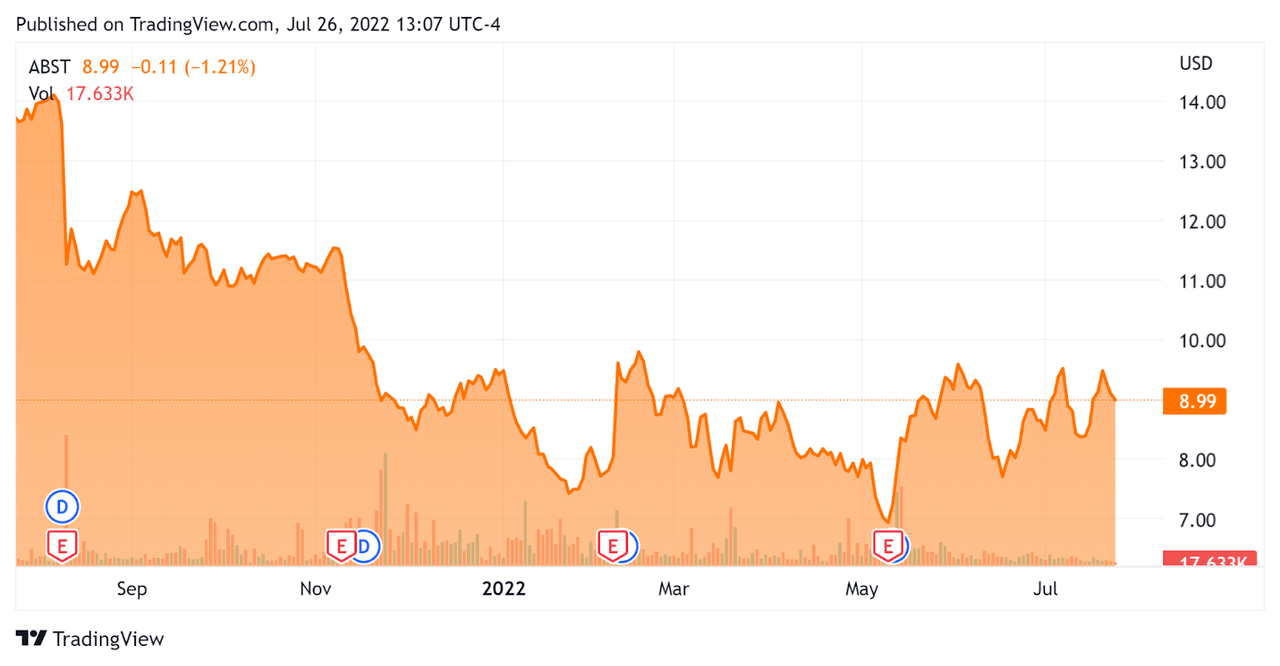

In the past 12 months, ABST’s stock price has fallen 34.8 percent vs. the U.S. S&P 500 index’s drop of around 11.1 percent, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Absolute Software

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Enterprise Value |

$669,970,000 |

|

Market Capitalization |

$466,520,000 |

|

Enterprise Value / Sales [TTM] |

3.79 |

|

Price / Sales [TTM] |

2.56 |

|

Revenue Growth Rate [TTM] |

51.99% |

|

Operating Cash Flow [TTM] |

$42,580,000 |

|

CapEx Ratio (Op C.F./CapEx) |

53.25 |

|

Earnings Per Share (Fully Diluted) |

-$0.45 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

ABST’s most recent GAAP Rule of 40 calculation was 54% as of Q1 2022, so the firm is performing well in this regard, per the table below:

|

GAAP Rule of 40 |

Calculation |

|

Recent Rev. Growth % |

52% |

|

GAAP EBITDA % |

2% |

|

Total |

54% |

(Source – Seeking Alpha)

Commentary On Absolute Software

In its last earnings call (Source – Seeking Alpha), covering FQ3 2022’s results, management highlighted reaching a $200 million annual run rate in revenue milestone.

The firm also recently launched a new product, Ransomware Response, that has the ability to ‘communicate with and control the [affected] endpoint to restore health and assist in recovery.’ Management says it has seen ‘strong customer interest’ in this new offering.

As to its financial results, adjusted revenue grew by 18% year-over-year, with approximately 70% of its Secure Access revenue coming from subscriptions.

Management is seeing revenue strength in enterprise and government segments but softness in education growth against strong comps due to previous COVID-related demand.

Adjusted EBITDA was better than expected due to slower than anticipated headcount growth.

For the balance sheet, the firm ended the quarter with $69 million in cash after generating operating cash flow of $17 million.

Looking ahead, management raised its revenue guidance to around 15.2% at the midpoint and Adjusted EBITDA margin guidance to 25% at the midpoint, up from 23% previously.

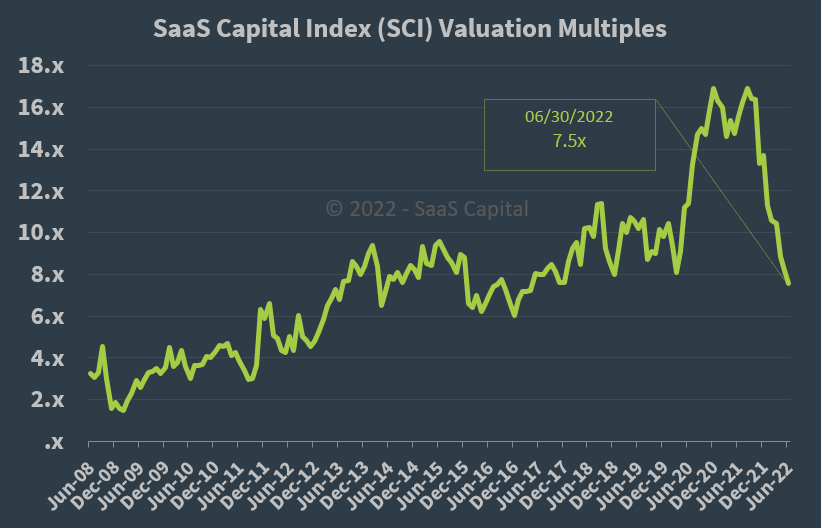

Regarding valuation, the market is valuing ABST at an EV/Sales multiple of around 3.8x.

Although the company is not a pure SaaS firm, the SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 7.5x on June 30, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, ABST is currently valued by the market at a significant discount to the SaaS Capital Index, at least as of June 30, 2022.

The primary risk to the company’s outlook is a potential macroeconomic slowdown or recession which the U.S. economy appears to be in already, and which may slow sales cycles and reduce its revenue growth estimates.

ABST took on a fair amount of long-term debt for its NetMotion acquisition in 2021, and its earnings results show the effects of higher interest expense.

Management’s job will be to reduce that debt load (which is variable interest rate debt) and its related hit to earnings.

While prospective investors may see a possible bargain in ABST’s current market valuation, I’m more cautious on its ability to take full advantage of its NetMotion acquisition and pay down debt in the process.

I’m on Hold for Absolute in the near term.

Be the first to comment