welcomia

Thesis highlight

I believe investing in Mister Car Wash (NYSE:MCW) would yield decent upsides. The $15 billion U.S. car wash industry is relatively immune to economic downturns, and MCW focuses on the automated part of the industry, which requires less labor and allows for better velocity and margin per location. I believe the market is expected to continue growing due to the increasing preference for “do-it-for-me” car washes, the growing number of cars on U.S. roads, and the increasing recognition of the eco-friendly advantages of automated washes.

Company overview

Mister Car Wash is a business that was founded to clean cars. The company provides services to clean both the inside and outside of vehicles. Mister Car Wash serves customers in the United States.

The car wash industry is big and resilient

MCW specializes in the automated segment of the car wash industry, which is more efficient and generates higher profits per location because it requires less labor.

I believe that this sector will experience sustained growth due to several secular trends. To begin, I think the car wash industry is flourishing because of the growing preference for “do-it-for-me” car washes over “do-it-yourself” ones, as customers increasingly value efficiency, cleanliness, and time savings over all else. Second, I think the market will grow because the number of cars on U.S. roads will continue to increase. Third, I think people are starting to see the environmental benefits of automated car washes, such as water recycling and safe chemical disposal, as an alternative to traditional hand car washes.

Additionally, most car washes are owned and operated independently, making up a small portion of the market. According to the S-1, MCW has the resources to invest in personnel development, infrastructure upgrades, and new product development in a way that smaller competitors cannot. Despite this, MCW locations only represent a negligible share of the market, and the combined share of the top ten operators is less than 10%. For MCW, I see this as a golden chance to further cement their position in a market that is both lucrative and rapidly growing.

MCW has significant scale advantage

My belief is that after decades in business, MCW has amassed a great deal of resources and capabilities, making it the most popular national brand of car wash. In addition, I think MCW’s size, uniformity of operations across all locations, and culture of continuous improvement have allowed them to develop a system that ensures every wash is both quick and thorough for their customers. There are many benefits, but three of the most significant are a widespread reputation for quality and reliability and a strong regional support system.

The MCW national brand has the most competitive advantage of the three I mentioned earlier. Having a single, cohesive national brand helps retain current members and attract new ones, which in turn boosts revenue and the size of the organization. Customers benefit greatly from this because their experience is uniform across all of MCW locations. On top of that, MCW has a marketing leg up because a unified strategy can promote growth at multiple locations simultaneously. Therefore, the lower the per-location marketing cost, the greater the number of MCW locations (i.e., more efficient use of marketing dollars).

Next, MCW has a massive regional support infrastructure with plenty of facility maintenance employees, regional managers, and training specialists. I think MCW has a very good hierarchy because each regional manager is in charge of an average of six general managers. This lets them focus on teaching, mentoring, and making sure that standards are always high. My opinion is that MCW has a strong and large enough regional support infrastructure to integrate acquisitions and open new locations in both established and new markets.

Operating model is optimized for speed

In order to maximize throughput at each location, MCW employs a labor optimization model. MCW’s investments in enlarging exteriors, conveyor-based locations, and dedicated member lanes make this possible, in my opinion. In addition, I think MCW stands out from the competition because it gives its customers easy access to its services through online and mobile app tools.

I believe MCW will reap long-term benefits from these initiatives, as the company can put the money it saves toward expanding its marketing efforts and storefront acquisitions. This is important because there aren’t many barriers to entry in the car wash business. Because of this, MCW needs to find ways to set itself apart from the competition through its business model.

Unlimited Wash Club Membership improves business resiliency through economic cycles

According to 3Q22 data, 69% of MCW’s total wash sales come from the Unlimited Wash Club [UWC], making it the largest car wash membership program in North America. UWC’s launch, in my opinion, is a watershed moment because of the steady stream of income it promises to bring in, regardless of the state of the economy or the weather. Its “member-centric” business model, which prioritizes ease of use, convenience, and speed for its clientele, has allowed MCW to achieve this goal with flying colors. The ability of MCW to efficiently plan and optimize its workforce thanks to key data insights from UWC Members is just one example of the positive spillover benefits provided by UWC.

Valuation

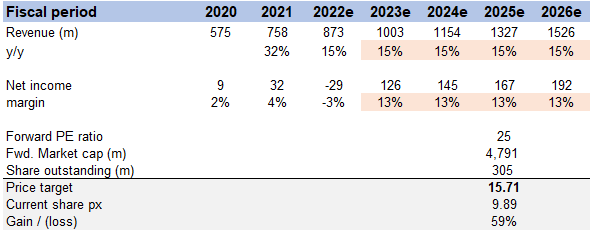

My model suggests a price target of $15.71 in FY25. This assumes that revenue will continue growing at a mid-teens level, and the forward earnings multiple will be 25x in FY25e.

Own estimates

For my FY22 estimates, I used management guidance, and I believe that due to the large TAM, MCW can continue to grow at historically high rates in FY23e and beyond through organic openings and acquisitions (which it has been conducting successfully recently). While I believe there is room for margin expansion, I assume a flat net margin going forward because I believe MCW should continue to reinvest in the business for growth.

In terms of valuation, MCW currently trades at 25x forward earnings, and I assumed that this level would be maintained in the future.

Risks

Car wash industry has low barriers to entry and scale

There are no major barriers, such as intellectual property or technological barriers, that prevent anyone from starting a car wash business and potentially scaling it across North America. It’s a financial and time issue. Although MCW is currently the largest, its market share could be threatened if the second- and third-placed companies merged.

Weak capital market

Although the sector as a whole is resilient to economic downturns, the MCW expansion strategy is not. MCW’s strategy for expansion involves the purchase of existing businesses, with funding coming from a combination of debt and equity. The high cost of debt, typical in a bad macroeconomic environment like the one we’re in right now, could hamper MCW’s expansion plans.

Conclusion

I believe MCW is undervalued. In my opinion, the rising number of cars on U.S. roads, the rising awareness of the environmental benefits of automated car washes, and the rising preference for “do-it-for-me” car washes should all contribute to the market’s continued expansion.

Be the first to comment