Bet_Noire

A pivot is coming, but not yet

Following the fastest period of monetary tightening in over four decades, investors and traders alike are scrambling for any whisper of a Fed pivot. So accustomed to accommodative monetary policy have financial markets become, there remains an underlying consensus that it is only a matter of time before policymakers reverse course from their tightening agenda and cut rates back to the zero-bound. Whilst such optimism has served investors so well during an era of secular stagnation, unfortunately, inflation has changed the game.

Unsurprisingly, due to these recent trends, having a view on the outlook for monetary policy has been a valuable input to one’s asset allocation process. When assessing the outlook for the direction of monetary policy, it is important to try and view the economy from the perspective of central bankers. The Fed’s mandate is to ensure maximum employment and stable prices. Thus, it is through these data points which provide the primary clues to the Fed’s future actions, while other dynamics such as coincident economic growth and historical Fed trigger points are also of value. Though these are by-and-large lagging indicators of the economy and nearly always lead to a policy mistake, the Fed’s mandate is the Fed’s mandate. As such, it is through these data points and historical pressure points that we can portend the likely path of monetary policy and the implications for investors.

Will the Fed stop hiking rates? Yes. Will they eventually cut rates? Yes. But we’re not there yet. The Fed has everything to lose, and very little to gain.

Maximum employment

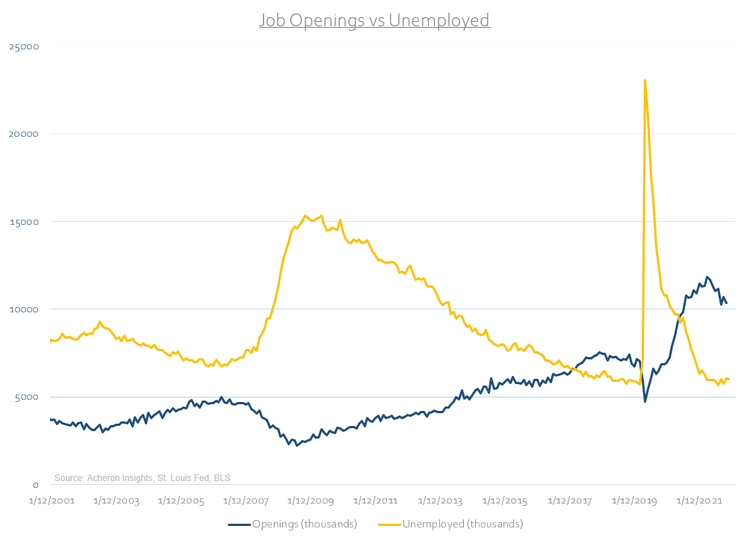

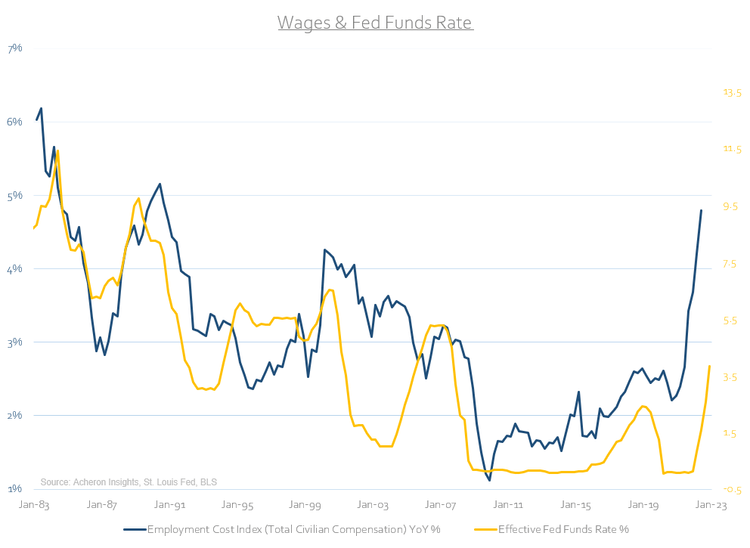

Though inflation has been the primary culprit for the excessive rate hikes seen over the past 12 months, it is important to also highlight we have had a historically tight labour market over the past few years which has led to the most rapid wage growth in half a century. Importantly, although we are slowly seeing signs of a turn, the labour market is still historically tight. Flawed though the JOTLS data may be, there remains a significant gap between job openings and unemployed persons.

Much of this tightness is due to employment and wage growth being perhaps the most lagging indicators of the business cycle. Job cuts are generally the last resort for employers and wages tend to be slow-moving and sticky. Fortunately, we are at the point whereby we can confidently state that both employment and wage growth have peaked for this cycle. Unfortunately, we are yet to see enough progress to warrant any kind of dovish Fed commentary from the labour market.

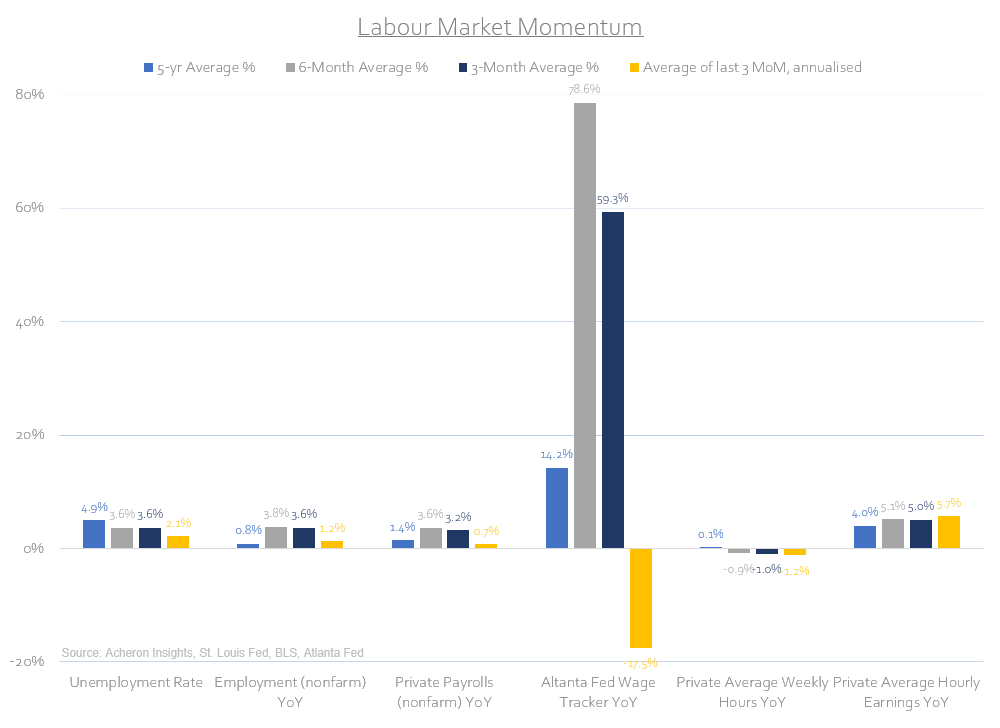

Indeed, if we assess the momentum of labour market data, the three and six-month averages of the year-over-year change in employment, private payrolls, wages, and average hourly earnings are still well above their respective five-year averages, whilst the unemployment rate is conversely below its five-year average. Although the annualised average of the last three-months monthly change for employment, private payrolls, wages, and average weekly hours is trending positively, labour market momentum overall is strong. Since the 1950s, the average level of unemployment that has coincided with a Fed pivot has been ~5.4%. The current unemployment rate is 3.7%. This is not a labour market consistent with a central bank cutting rates.

Price stability

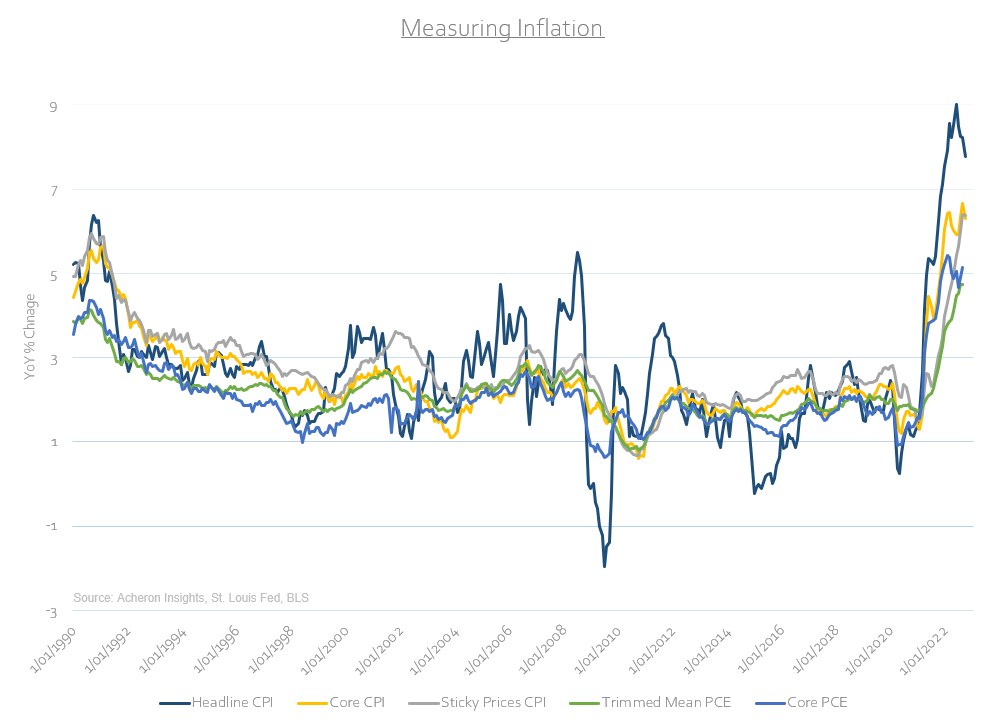

On the inflation front, many are betting on inflation rolling over sharply in the coming months. For the most part, I would put myself in that category, as I detailed here. Goods inflation, in particular, will prove a powerful disinflationary force through the first half of 2023. However, while we could easily see headline CPI fall back to anywhere from 3% to 5% by Q2 next year, this notion misses the point to some degree. The Fed is aware of this and has made it very clear their focus is on the sticky components within the CPI basket. That is, services inflation. Importantly, services inflation momentum is still hot.

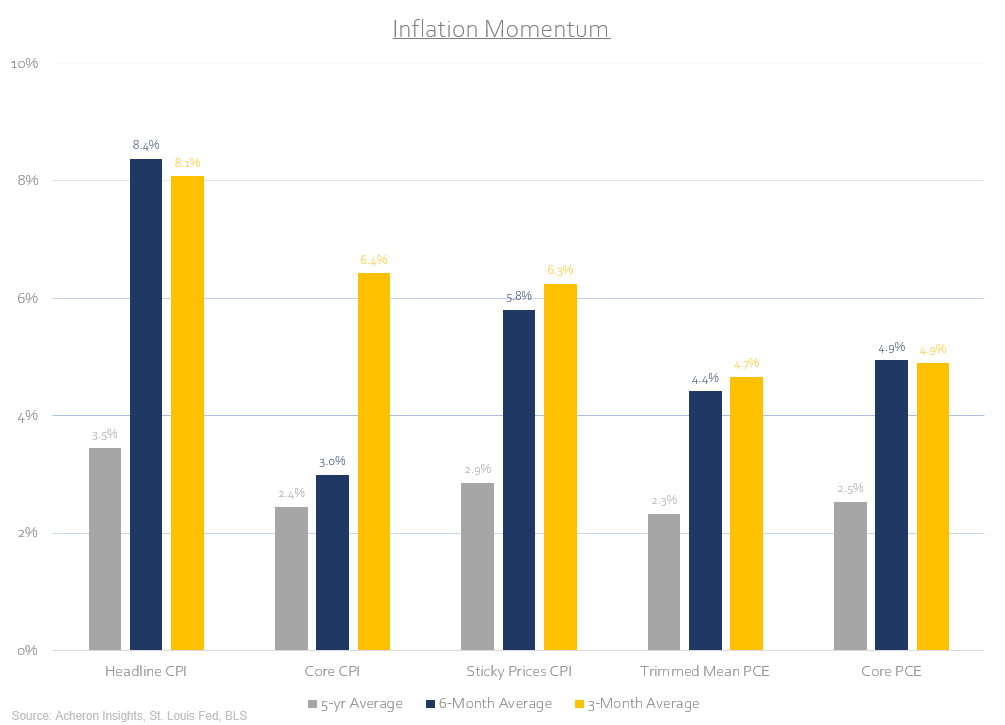

Outside of headline CPI, core CPI, sticky prices CPI, trimmed mean PCE, and core PCE have yet to inflect lower to any material degree.

If the Fed’s focus is on the services side of the equation, then until we see recent momentum in these measures of inflation rollover, the Fed will keep rates high. As of November’s inflation data, the three-month average of the year-over-year growth in core CPI, sticky prices CPI and trimmed mean PCE remain well above their six-month and five-year averages, with the three-month average of core PCE still in line with its six-month average and well above its five-year average.

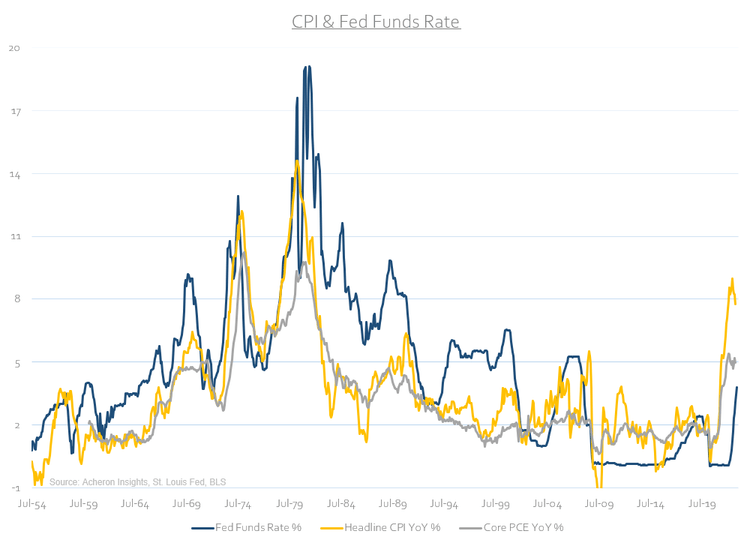

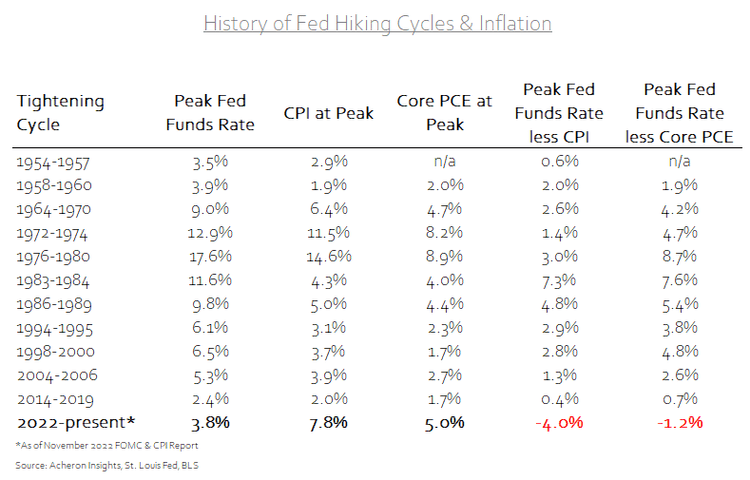

These are not inflation trends that warrant a dovish Fed pivot. The Fed has never stopped raising rates or started cutting rates with either headline CPI or core PCE (the latter being the Fed’s preferred inflation measure) above the Fed Funds rate. We are likely still two to three months away from this occurring.

Coincident economic growth is still strong

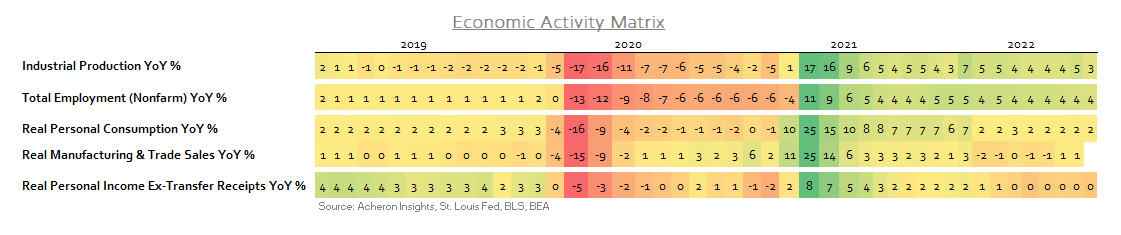

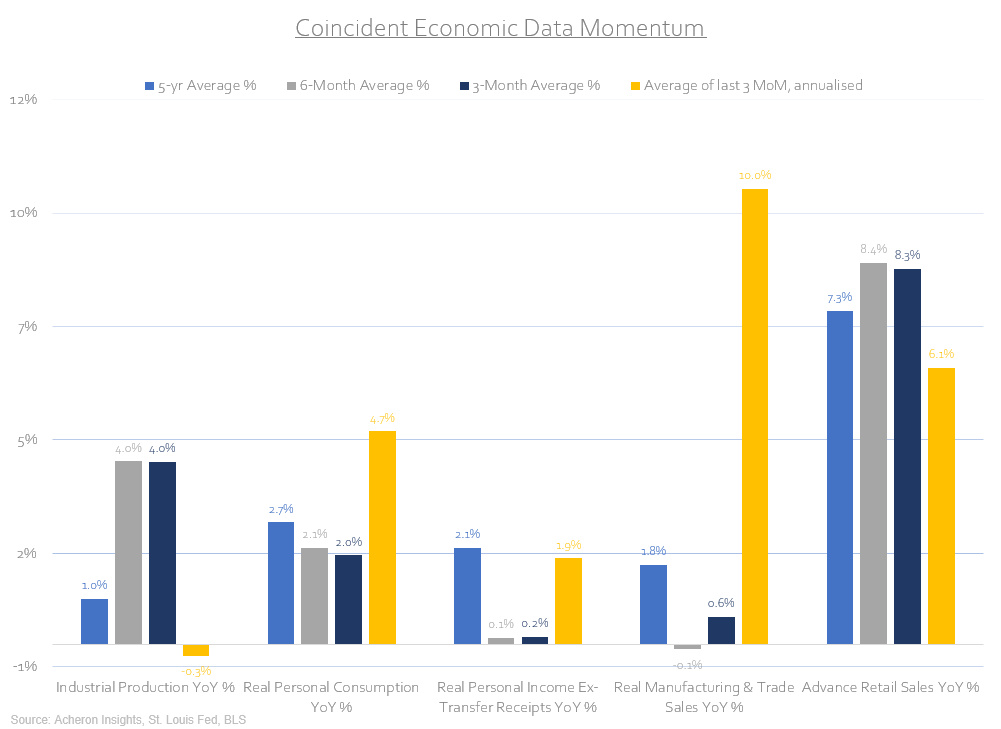

Coincident data points define the business cycle. They do not tell us where the economy is heading but instead inform us where it currently stands. My preferred coincident measures of the business cycle are the NBER’s recessionary criteria in industrial production, employment, real personal consumption, real manufacturing, and trade sales along with real personal income ex-transfer receipts.

As it stands, the economy remains robust. Although the leading indicators of the business cycle continue to point to deceleration throughout 2023, current trends in industrial production, employment, and consumption in particular remain strong. Outside of a decline in real income growth, the economic data points that would justify a Fed pivot from a coincident business cycle perspective are still lacking.

Again, although the outlook for the business cycle is poor and the Fed is undoubtedly tightening into a slowdown, current economic momentum is strong and robust. We are getting close, but we’re not there yet.

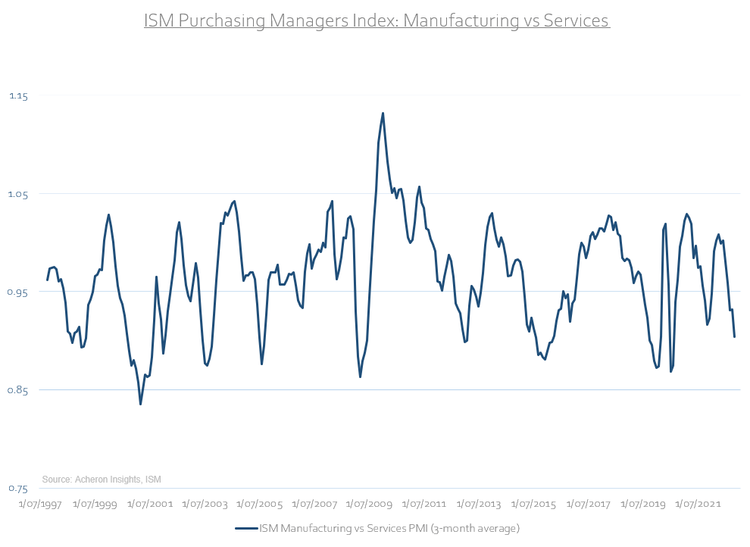

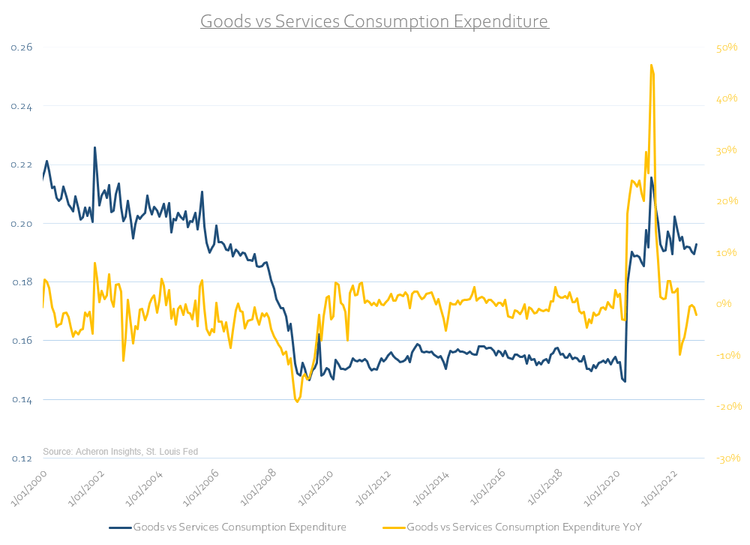

What is perhaps of greater significance from an economic growth perspective is the trend in services consumption versus goods consumption. As I mentioned, the Fed has made it very clear their focus is now on the services side of the equation. During 2020, services consumption virtually ceased while goods consumption soared. Unsurprisingly, this resulted in supply chain issues and saw goods inflation soar. However, what is noticeable over the past 12-18 months has been the shift back toward services consumption, as we can see below. Remember, services inflation is sticky and largely driven by services consumption and wages. A material decline in these trends is needed to support a meaningful Fed pivot.

When will the Fed pivot?

While the trends in employment, wages, inflation, and economic activity are behind the actions of the Fed, there are a number of other important data points and indicators that provide valuable insight as to when we might expect the Fed to begin cutting rates.

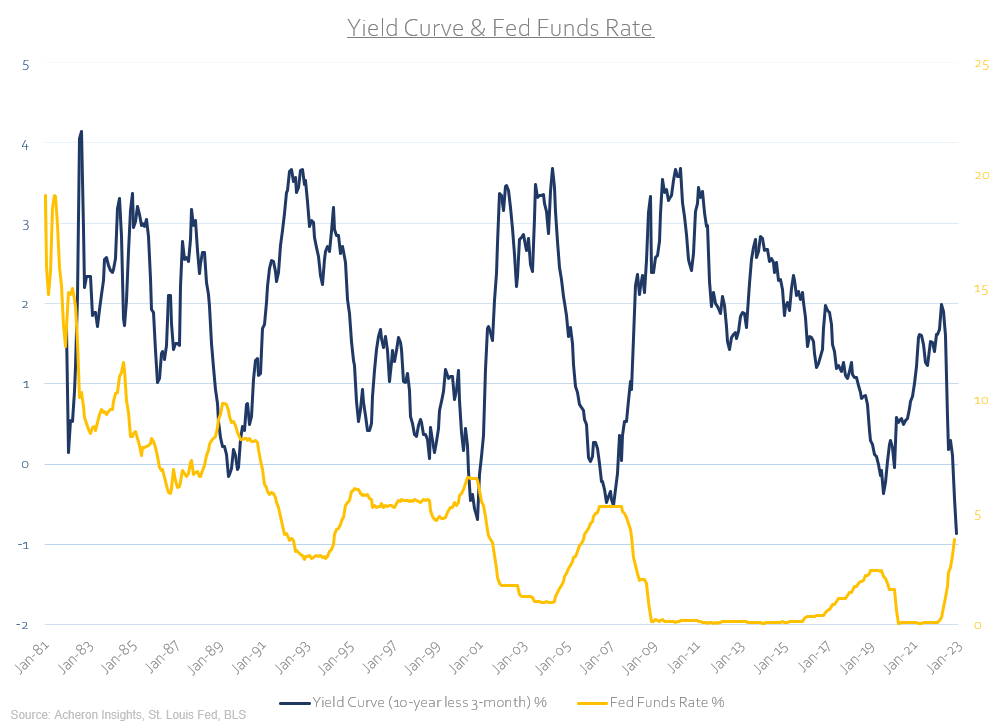

The yield curve is one such example. As I detailed within a recent article here, the 10-year less 3-month spread is perhaps the best indicator of an impending recession there is. When the 10-year less 3-month Treasury spread inverts for 10 or more consecutive trading days, its recession-predicting power is flawless. We have entered recession 100% of the time following such a prolonged inversion, with an average lead of about 311 calendar days, or about 10 months. It is therefore no surprise to hear that every inversion has also preceded a cut in rate by the Fed. Should history repeat, the Fed will eventually have to cut rates as we enter a recession. However, this is likely a story for the second half of 2023.

Unsurprisingly, the Fed has opted to dismiss such clear signaling from their iteration of the yield curve. Since 2018, they have made it very clear their preferred measure of the yield curve is the difference between the current 90-day T-Bill yield and the expected 90-day yield in 18 months. They claim this yield curve measure to be more predictive of recession as it better captures the market’s conviction that the Fed needs to cut rates and reduce the noise captured in the 10s/2s or 10yr/3m spread.

Powell reiterated this point earlier this year just prior to the 10s/2s inversion. Unfortunately for the Fed, their preferred yield curve has just recently inverted itself, as we can see below. Again, the market is suggesting a recession will eventually force the Fed’s hand.

Source: @kevinMuir via @RonStoeferlie

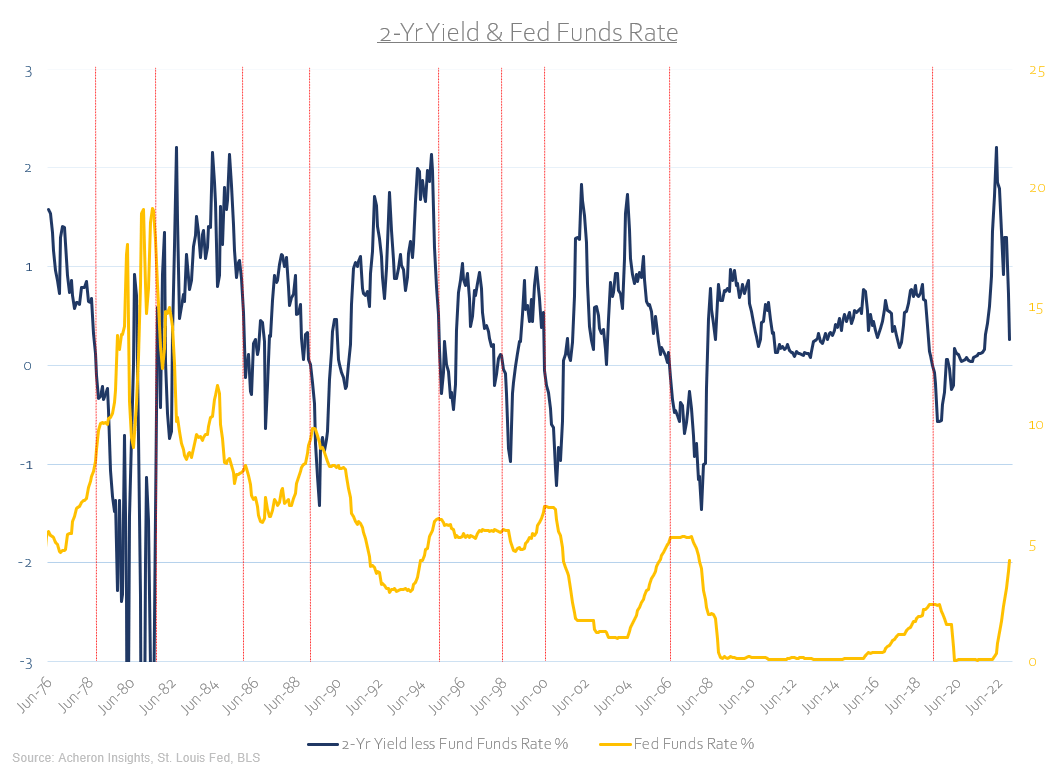

Another excellent yield spread that has preceded a Fed pause or Fed pivot is the difference between the two-year Treasury yield and the Fed Funds rate. Longer-term yields are generally an excellent predictor of movements in shorter-term yields. And, as we can see below, whenever the Fed Funds rate has exceeded the two-year Treasury yield, the Fed has paused or pivoted in nearly all cases, with the exception being in the late 1970s when a reacceleration in inflation forced the Fed to tighten. I suspect this spread will invert at some point during Q1 of next year, at which point, the Fed will be done hiking. Just remember, however, the Fed ceasing hiking rates is not the same as the Fed cutting rates.

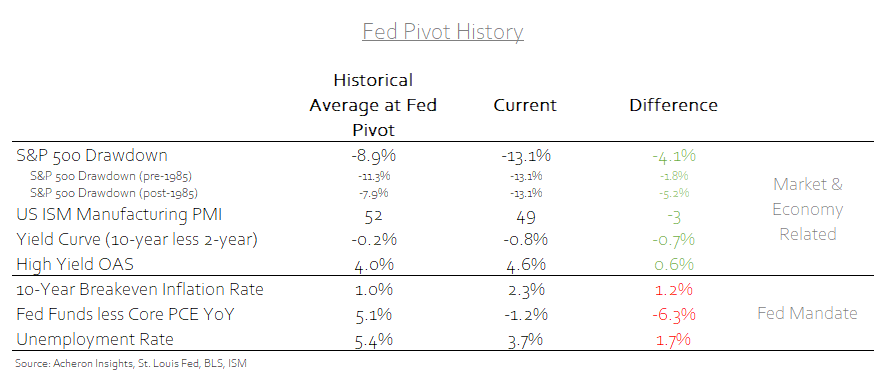

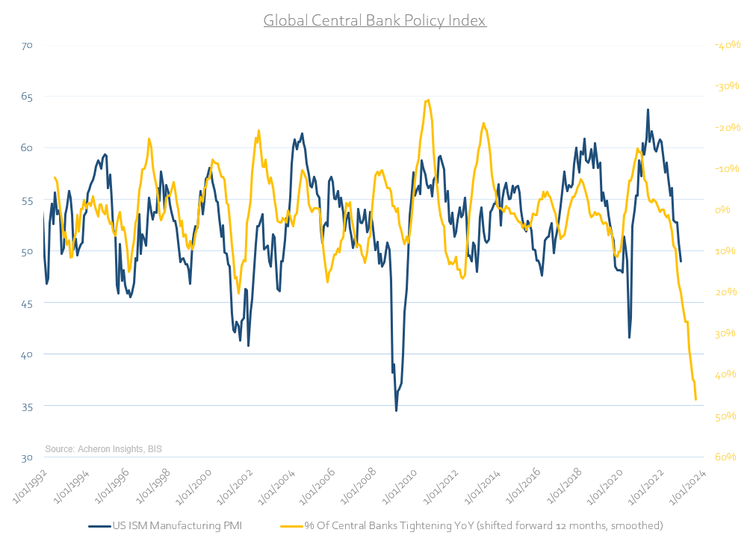

If we take a number of these data points and compare their current levels versus those at which the Fed historically stopped raising rates, we can reasonably observe how much further along into their tightening regime the Fed will continue. As we can see below, the peak-to-rough S&P 500 drawdown, ISM Manufacturing PMI, 10s/2s yield curve, and high yield credit spreads have all exceeded the average level in which the Fed has historically ceased raising the rate and in most cases began cutting. Conversely, the 10-year breakeven inflation rate, the difference between the Fed Funds rate and core PCE, and the unemployment are all yet to exceed their average levels prior to a dovish Fed pivot.

To me, the implications here are clear, inflation and labour market tightness are no longer allowing the Fed to be influenced in their monetary policy actions by market and asset price-related dynamics. Although there is undoubtedly a level whereby asset prices and credit spreads could get that forces the Fed’s hand, higher inflation and low unemployment have significantly lowered the ‘Fed put’. Unless stocks fall off a cliff, don’t expect any kind of dovish pivot until the labour market and inflation allow it.

So then, when will we see a Fed pivot?

The Fed has made it very clear they will again raise the Fed Funds rate by another 50 bps during this week’s FOMC meeting. The market very much agrees, pricing in a roughly 74% likelihood of this occurring.

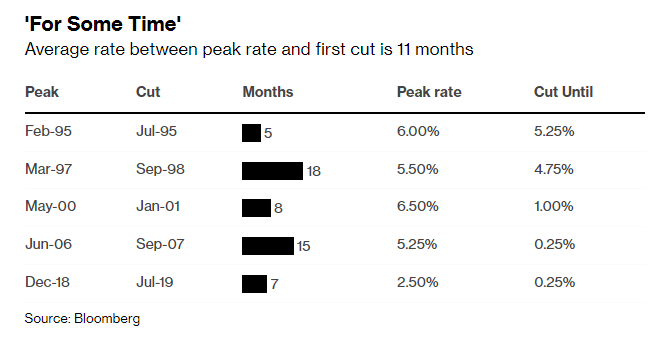

Though we will certainly see rate cuts at some point next year, Powell continues to hammer down his point of higher rates for longer. Even if the Fed stops hiking, they intend to keep rates at elevated levels for a sustained period of time in order to ensure inflation pressures abate. As noted recently by Bloomberg, “over the last five interest rate cycles, the average hold at a peak rate was 11 months, and those were during periods when inflation was more stable.” Whether we see the Fed hold rates higher for such a prolonged period of time remains to be seen.

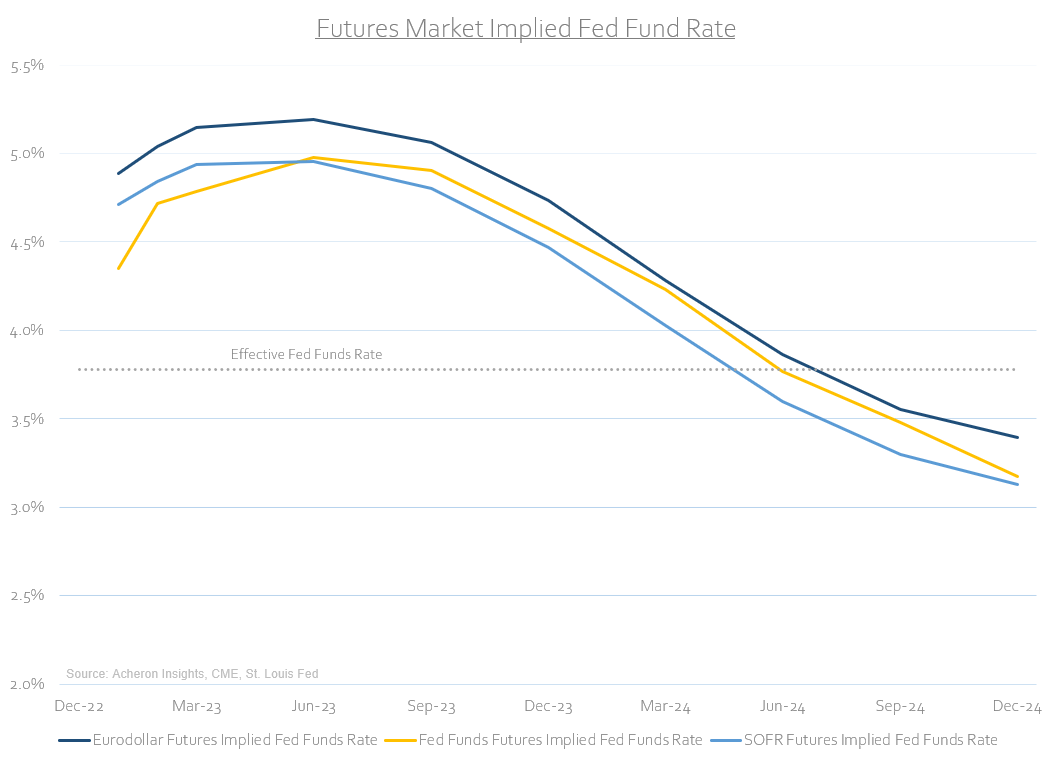

Source: Bloomberg The markets continue to price in a number of rate cuts from Q2-onwards next year following a peak Fed Funds rate around March/April. Market participants are clearly taking the ‘under’.

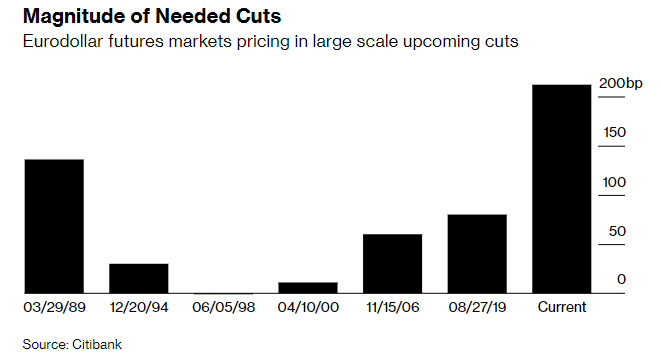

According to Citigroup, the “over 200 basis points of upcoming Fed rate cuts (in H2 2023) now priced into futures markets is the most ahead of any policy easing cycle back through 1989”. Again, the market is not getting the Fed’s message of higher rates for longer.

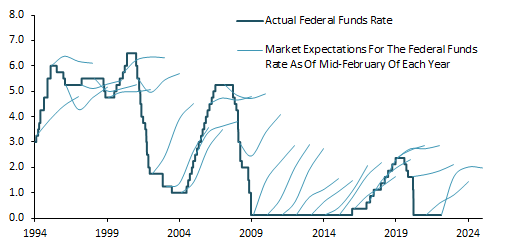

Source: Citibank via Bloomberg The problem is, neither the Fed nor the markets have a great track record of forecasting monetary policy. Source: Roberto Perli

Clearly, the all-important variable here is inflation. If we see the core measures of inflation fall back toward 3-4% quicker than expected, the Fed will cut rates in line with market expectations. If it doesn’t, then don’t expect any material rate cuts until we see coincident economic growth and the labour market materially rollover. A recession would of course induce such an outcome, but a recession is still some way off.

Don’t fight the Fed

For investors, the course of action is simple. Don’t fight the Fed. In the weeks since a 50 bp hike for December has become consensus, down from the prior four 75 bp hikes, a number of investors have seen this as some kind of “pivot”. Let me assure you, a 50 bp rate hike is not a dovish pivot. The time to buy risk assets is not when inflation is hot and the Fed is still hiking rates. It is that simple.

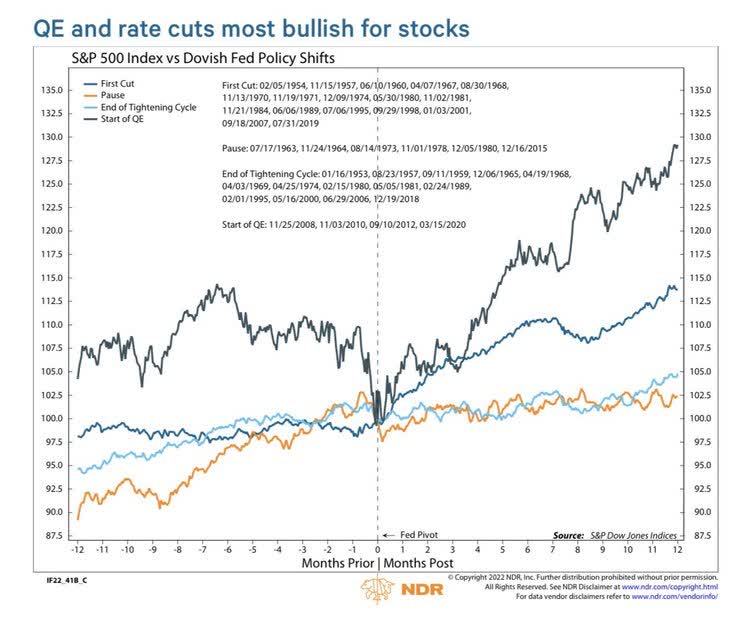

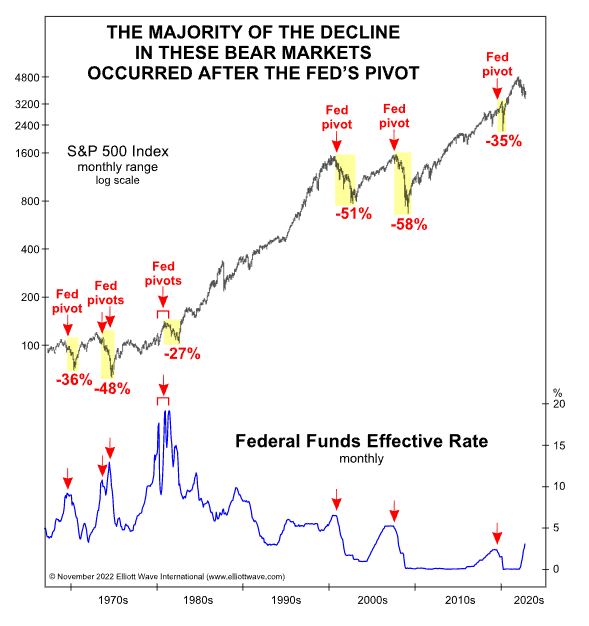

What’s more, when the Fed cuts rates, it generally does so because financial conditions allow them to. Such environments are initially unfavourable for stocks, but generally fairly positive for bonds. Investors will be better served focusing on fundamentals along with the leading indicators of growth and liquidity than just buying risk assets in the hope of a Fed pivot.

Source: @TommyThornton

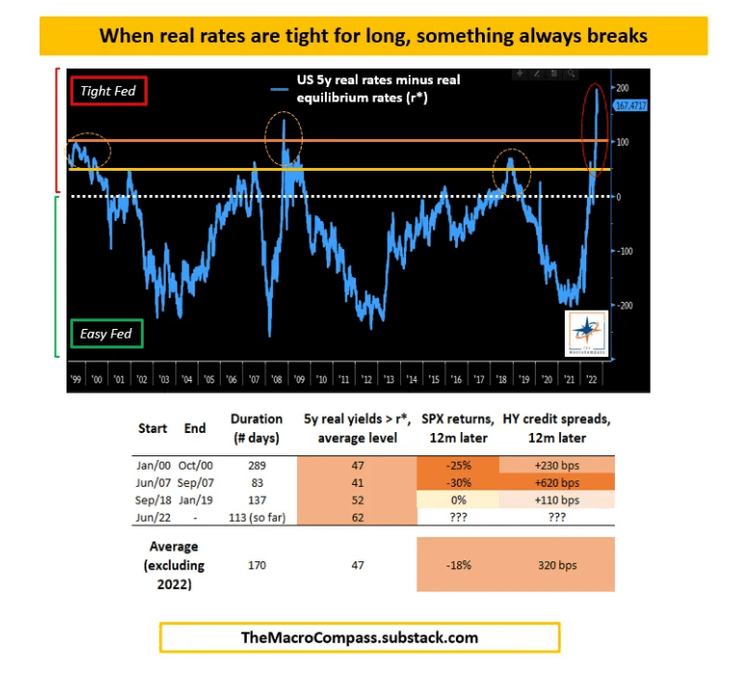

So long as monetary conditions remain tight with the backdrop of a slowing economy and lackluster liquidity, this is not a risk-on environment. Per @MacroAlf, ”the shock-move higher in US real rates was massive, but now it’s all about the time persistence. History teaches us the longer conditions are tight, the higher the chance something breaks.” Tight monetary conditions are not favourable of risk-seeking behaviour, Fed pivot or not.

Source: @MacroAlf

Remember, should the Fed indeed continue to tighten monetary policy into a crisis, then, they can easily justify this under the guise of fighting inflation and then do what central banks do best, cut rates and inject liquidity. This course of action allows the Fed to save face. If Powell and the Fed fail to tame inflation, then their heads are on the chopping block. They know this and are acting accordingly. The risks for the Fed are clear; they have everything to lose and very little to gain. This equates to very different monetary conditions than we are all used to. It’s not about what the Fed should do, but what they will do.

It is still too soon for a dovish pivot. Don’t fight the Fed.

Be the first to comment