Nadzeya Haroshka/iStock via Getty Images

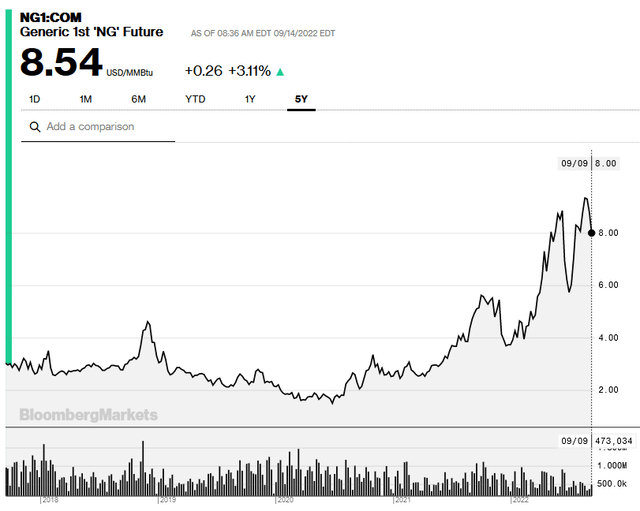

National Fuel Gas (NYSE:NYSE:NFG) is a diversified and integrated energy company headquartered in Williamsville, New York. The company has upstream O&G producing assets and integrates those operations with its large regulated gas utility business. As a result, NFG is ideally positioned to tangentially benefit from Putin’s horrific war-of-choice on Ukraine and Russia’s subsequent weaponization of energy by cutting off natural gas supply to Europe. That has caused increased demand-pull from the EU for US-sourced LNG, which has resulted in pushing up the price of domestic natural gas (see graphic below). Yet, NFG trades with a forward P/E of only 9.4x and yields 2.74%. The stock was down 2.9% on Tuesday’s big sell-off, and that is an opportunity for investors to BUY this stock.

Investment Thesis

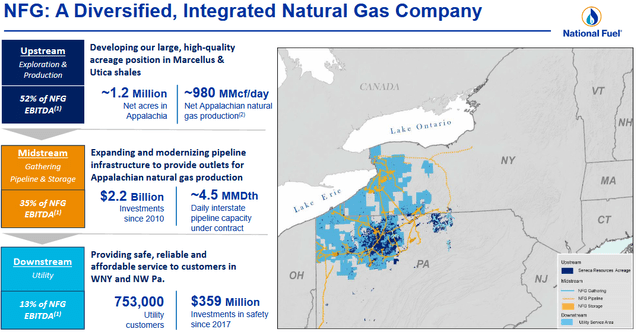

NFG operates O&G assets across four business segments: Exploration & Production, Pipeline & Storage, Gathering, and Utility. The company produces ~1 Bcf/day of natural gas from the Utica and Marcellus shale plays and its natural gas utility has 753,000 customers. A company overview is shown below:

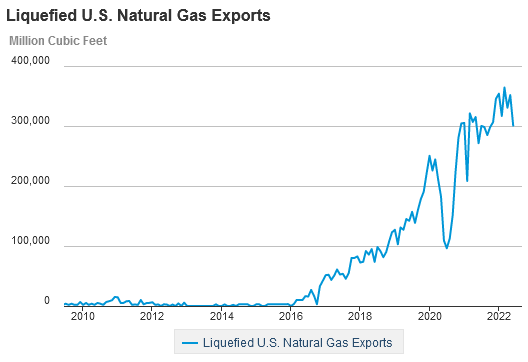

Meantime, due to relatively cheap shale gas, America’s monthly LNG export volumes have been rising steadily since 2016 (downward blips are largely the result of temporary LNG train shut-downs):

EIA

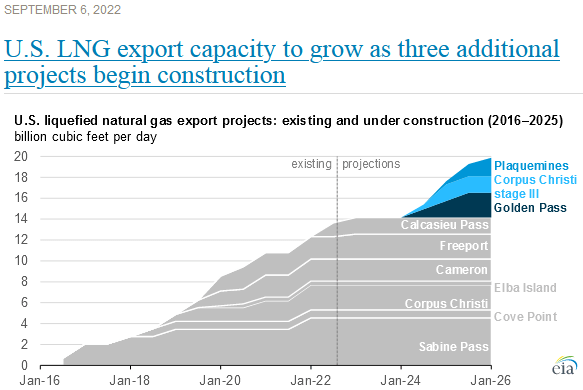

Indeed, as the EIA recently reported, the U.S. became the world’s largest LNG exporter earlier this year, with LNG exports up 12% as compared to the first half of 2021 – averaging 11.2 Bcf/d. Going forward, LNG exports are expected to continue to grow rapidly, with three new LNG projects coming online and ramping up in the 2024-2026 time frame:

EIA

The combination of rising demand for U.S. natural gas, and the resulting price increase, is an extremely bullish catalyst for a company like NFG that has ~1 Bcf/d of nat-gas production.

Earnings

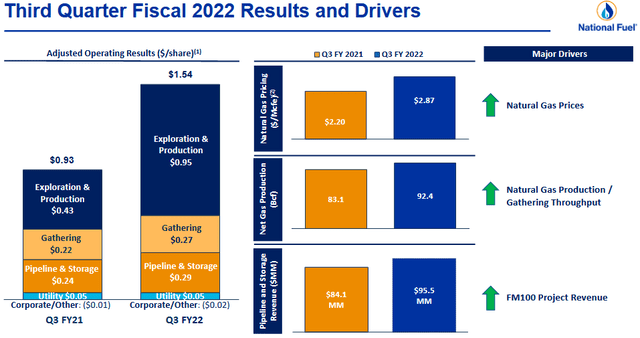

NFG announced its Q3 Earnings report in early August, and it was a $0.30/share miss on the bottom line in terms of consensus estimates. Highlights of the report included:

- Revenue of $502 million was up from $394 million in last year’s Q3.

- GAAP EPS of $1.17 compared to $0.94 in Q3 of last year.

- Adjusted EPS of $1.54 was up 66% yoy.

- Adjusted EBITDA of $318.1 million was up 36% yoy.

Note that NFG closed the sale of its West Coast assets for net-cash proceeds of ~$241 million. However, NFG recorded a loss of $44.6 million related to the termination of its remaining crude oil hedges as a result of the sale. In addition, NFG also incurred transaction & severance costs of $9.7 million related to the divestiture. These were the major factors in the relatively wide swing between GAAP and adjusted earnings as reported above.

During the quarter, Seneca (NFG’s upstream segment) produced 92.4 Bcfe +9.4 Bcfe (11%) yoy. This increase was primarily due to growth from Seneca’s Appalachian gas assets while crude oil production decreased 32,000 (6%) yoy due to natural production decline in California.

NFG’s Midstream segment was strong (GAAP earnings +21.2% yoy) while the downstream utility segment was relatively flat-to-down during the off-season (i.e., summer):

Clearly, the upside potential for NFG is in the E&P segment due to the “Putin factor” discussed earlier.

Going Forward

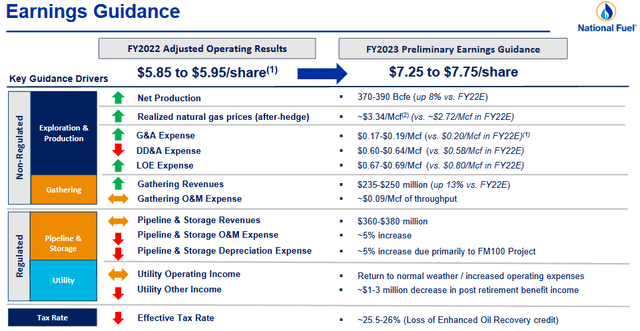

NFG gave preliminary FY2023 guidance during the Q3 presentation:

Note the mid-point of FY23 adjusted EPS is $7.50/share. Based on the current price of $70.11, that equates to a forward P/E of only 9.35x.

Risks

The primary risk with NFG appears to be a resolution of the war in Ukraine and a return of Russian nat-gas supplies to Europe. However, in my opinion, that appears to be a doubtful outcome as long as Putin remains in power as dictators can seldom admit they have made a big mistake. In addition, I doubt the EU will ever go back to trusting Russian energy supplies again. That said, the EU would likely take the gas supplies from Russia if the pipeline (or pipelines) are turned back on.

Meantime, NFG would likely see less industrial utility demand where higher inflation and higher interest rates lead to a recession. But, as shown on the previous slide, NFG’s utility segment is not the major generator of the company’s profits (the upstream E&P segment is).

NFG has a strong balance sheet and an investment-grade credit rating. Cash & cash equivalents were $433 million at the end of Q3, while long-term debt was $2.1 billion (down from $2.6 billion at the end of FY21).

However, for investors not comfortable with single stock risks, yet still want exposure to the defensive utility sector, I can suggest the Utilities SPDR ETF (XLU). See my recent Seeking Alpha article: XLU: Suddenly, Utilities Rock! The yield of the XLU (2.67%) is roughly equivalent to that of NFG (2.74%).

Summary & Conclusions

NFG is a very solid integrated and diversified energy company in the currently attractive and defensive Utility Sector. NFG has a rather large E&P upside due to its ~1.2 million net acres of prime Marcellus and Utica shale leasehold and its ability to grow production to help supply the LNG export market. The rising and high price of domestic natural gas due to the “Putin factor” is a positive catalyst going forward, yet the stock trades at a relatively muted forward multiple of 9.4x while throwing off a 2.74% yield. Lastly, NFG has raised its dividend for 52 straight years – with the latest dividend increase in June (+4.4%). NFG is a BUY.

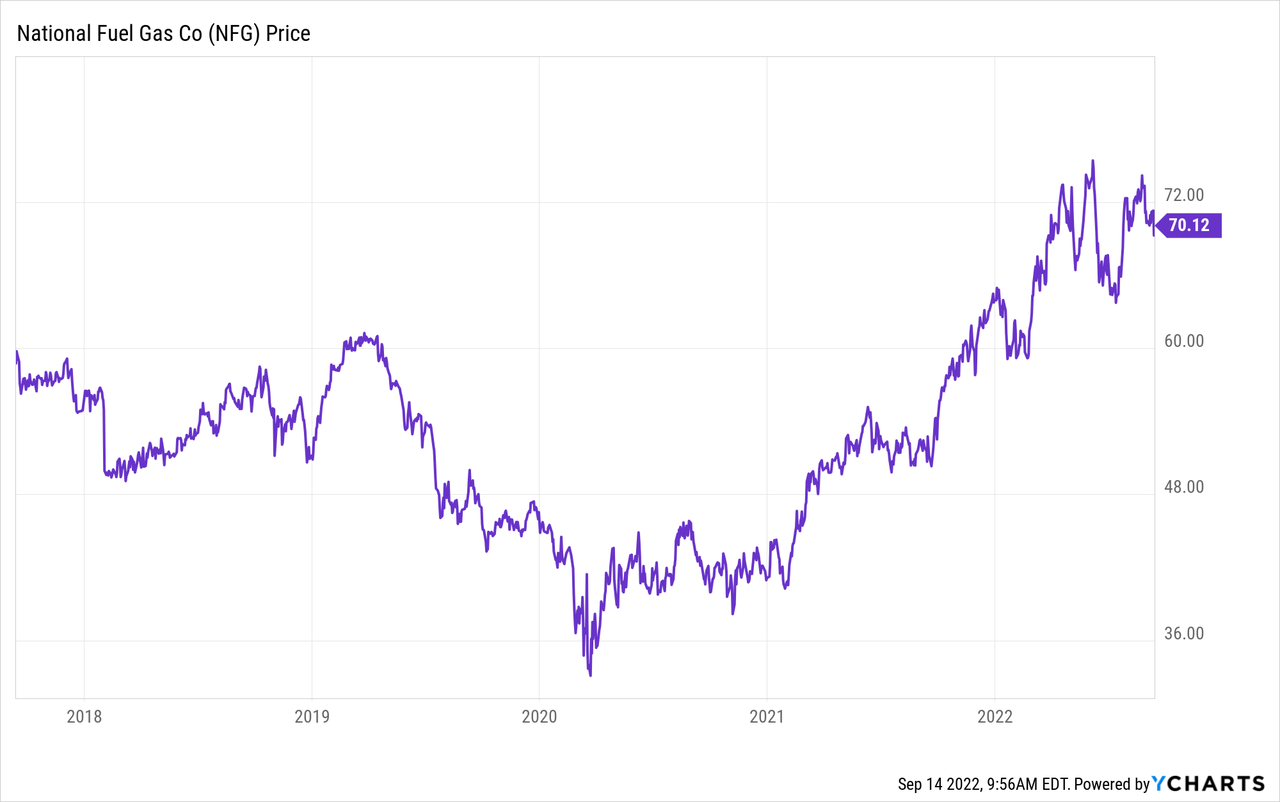

I’ll end with a 5-year chart of NFG’s stock price:

Be the first to comment