AndreyPopov/iStock via Getty Images

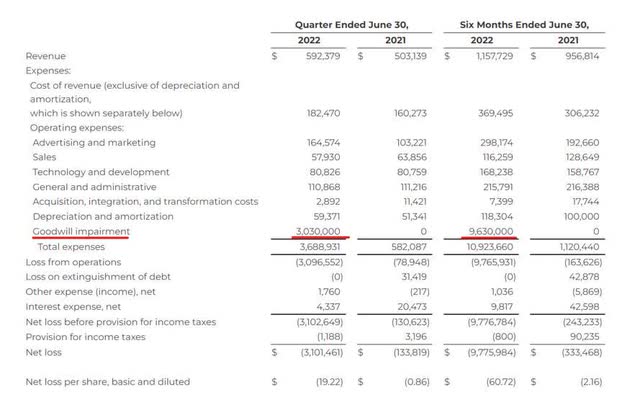

Teladoc Health Inc. (NYSE:TDOC) disclosed a $3.0 billion impairment charge and decreased its 2022 projections. As a result, the stock plummeted 24% in After-Hours trading.

Sales growth is also faltering, and the digital health company’s $3 billion impairment in the second quarter puts the company’s 2022 equity losses to a whopping $10 billion.

With key KPIs and guidance degrading concurrently, investors may wish to abandon this sinking ship before Teladoc causes even more harm to your portfolio.

Teladoc 2Q-22: It Could Not Have Been Worse

Teladoc, which provides telemedicine services via video-conferencing technology, benefited greatly from the outbreak. Teladoc’s technology enabled patients to consult with their doctors without having to travel to their clinics, resulting in an increase in revenue. However, as the pandemic fades, Teladoc is no longer able to meet the sky-high expectations that investors have put on its business.

Despite the fact that Teladoc’s sales increased 18% YoY to $592.4 million, the end of the pandemic is forcing patients back into doctors’ offices, which is hurting the digital health provider’s sales prospects.

Teladoc’s main issue is that it is not profitable, therefore slower sales growth occurs at a time when the company is still working to establish a successful business.

Teladoc also filed another significant impairment charge. A $3.0 billion non-cash goodwill impairment charge, or $18.78 per share, was made in 2Q-22, following a $6.6 billion impairment charge, or $41.11 per share, in 1Q-22.

Teladoc wrote down the value of its Livongo acquisition two years ago, which cost the corporation a cool $18.5 billion. Teladoc overpaid for its previous acquisition, and stockholders are now paying a high price for it.

Teladoc has lost an astounding $9.8 billion in equity as a result of impairments so far in 2022, which is a genuinely mind-boggling number by any standard. Despite the fact that impairments are non-cash and hence have no effect on cash flow, Teladoc’s shareholders will be dissatisfied with the company’s extreme value loss.

Goodwill Impairment (Teladoc Health)

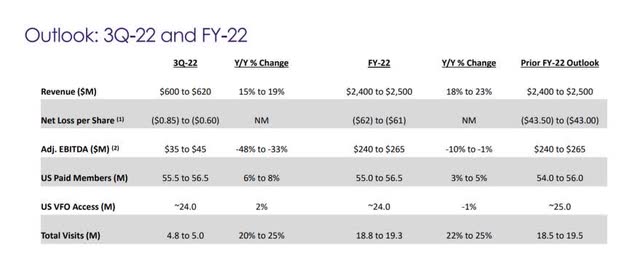

Soft Downgrade

Teladoc confirmed its 2022 projection but reduced expectations by stating that it anticipates adjusted EBITDA to trend toward the low end of guidance. Adjusted EBITDA is estimated to be in the $240-$265 million range.

3Q-22 And FY-22 Outlook (Teladoc Health)

Recovery Not Justified

Teladoc’s shares dropped from $56 to $33 after lowering its guidance in 1Q-22, but it later recovered to around $43. Until yesterday, that is.

After-hours, Teladoc’s stock price fell by 24%, wiping out all comeback gains made since the end of April and returning the stock price to where it was following the 1Q-22 setback.

Teladoc’s business is showing no signs of turnaround, and there are no substantial growth catalysts on the horizon, therefore the stock has done enough damage to investors’ portfolios.

TDOC Share Price (Yahoo Finance)

A Decelerating Business With A Premium Valuation

Teladoc is not profitable, and the digital health company has only been profitable on an adjusted EBITDA basis, not on a net income one. This is a significant issue for a company whose sales growth is slowing.

Despite enormous equity losses, slowed sales growth, and no profits in sight, Teladoc’s battered stock still trades at a 2.1x multiple based on $2.43 billion in predicted 2022 sales.

Why Teladoc Could See A Higher Valuation

With the exception of the onset of a new pandemic, developing a scenario in which Teladoc’s sales growth suddenly begins to increase again is difficult.

It turns out, and investors may have overlooked this truth, that patients prefer to see their doctors in person since healthcare is a deeply personal experience.

Teladoc’s business model took traction primarily as a result of a once-in-a-lifetime epidemic that made it difficult for consumers to obtain healthcare assistance in person in many circumstances. This presents Teladoc with a fundamental issue, and the company has yet to find a solution to its problems.

My Conclusion

It turns out that the recovery following the 1Q-22 guidance drop was unjustified, and investors who bought the company recently paid a high price. I believe it is time for investors to perform damage control and abandon ship.

Teladoc’s investment and acquisition strategy raises severe issues as the pandemic-boom fades, and with $10 billion in accumulated losses just in 2022, the digital health provider’s economic model is threatened. Teladoc’s stock appears to be headed for further declines, as the prognosis for 2022 was again ‘softly downgraded’.

Be the first to comment