JamesBrey

This article was written by Preferred Stock Trader for Trade With Beta.

Ashford Hospitality Trust Preferred Stocks And Their Unusual Price Action

Not surprisingly, Ashford Hospitality Trust, Inc. (NYSE:AHT) is a hotel real estate investment trust (“REIT”). It has 5 preferred stocks with the ticker symbols AHT-D (AHT.PD), AHT-F (AHT.PF), AHT-G (AHT.PG), AHT-H (AHT.PH), and AHT-I (AHT.PI).

The price action in AHT common stock and the AHT preferred stocks has been stunning over the last 2 months. I don’t know if I have ever seen such a disconnect between a group of preferred stocks in relation to their own common stock and in relation to other preferred stocks in the same sector. This has provided investors/traders with a massive buying opportunity. If AHT preferred stocks simply return to their relative pricing of 2 months ago, investors/traders can achieve a total return of 30% from now until year’s end, which equates to an 80% annualized return – very big for a preferred stock.

AHT Preferred Stocks Versus Other Hotel REIT Preferred Stocks

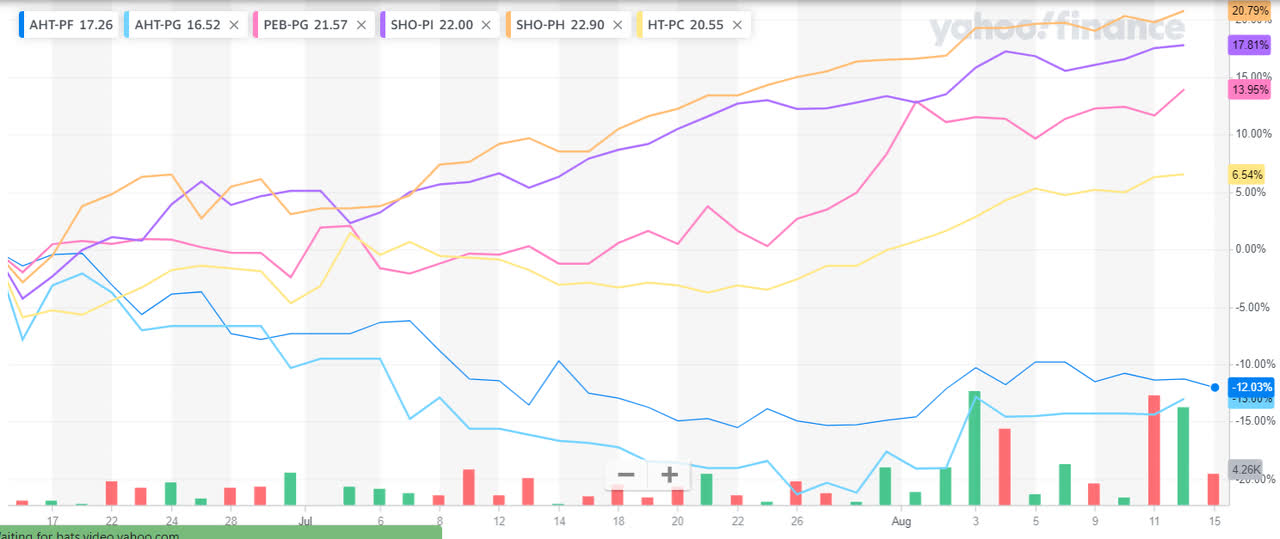

So, let’s examine the trading in AHT common and preferred stocks versus those of hotel REITs Pebblebrook Hotel (PEB), Hersha Hospitality (HT), and Sunstone Hotel (SHO).

2 Month Hotel REIT Preferred Stock Price Comparison

Yahoo Finance

As you can see from the above chart, while other hotel REIT preferred stocks have rallied from 14% to 20% during the strong rally over the last couple of months, some of the AHT preferred stocks have fallen in price by 13%. So there has been an approximate 30% disconnect in the relative pricing of AHT preferred stocks versus some other hotel REIT preferred stocks. This offers a huge mean reversion opportunity for AHT preferred stocks

The skeptic is probably thinking, “well, something bad must have happened to AHT during the last 2 months to warrant this massive price disconnect.” Au contraire. Just the opposite has happened. AHT common has exploded higher, blowing away the other hotel REIT common stocks.

2 Month Price Chart of ATH Common Stock Relative to SHO, HT and PEB

Yahoo Finance

As can be seen from the 2-month price chart above, while other hotel REIT preferreds stocks have certainly done well, AHT has exploded higher by 116%. So the 30% underperformance of AHT preferred stocks looks insane and a massive opportunity for a very profitable catch-up trade.

So why is AHT common stock exploding higher? AHT’s earnings (Adjusted Funds From Operation – AFFO) are exploding higher. They just reported AFFO of $1.23 per share in just the 2 nd quarter alone. Additionally, their balance sheet is much improved with $537 million of cash, much more cash than they had pre-COVID when disaster struck.

Safety

Although fundamental analysis is not particularly important for this trade, the 116% rise in the common stock of AHT over the last 2 months means that the common equity coverage of the preferred stocks has more than doubled, making the preferred stocks much safer.

Additionally, the amount of AHT preferred stock shares outstanding has fallen from 22.5 million shares pre-COVID to 6.5 million on June 30 th of this year. Thus, the $537 million of cash alone easily covers the $163 million worth of outstanding preferred stock, and the preferred stock dividend expense for the company is now less than $13 million per year. This preferred expense can easily be paid out of cash for years.

Why AHT Preferred Stocks Are Much Safer Than People Realize

For investors that are disgusted with AHT’s management, I totally sympathize. AHT has been a disaster, although primarily for common stockholders. The external manager operated the company at a high level of debt relative to equity, and with low liquidity. When COVID hit AHT was in trouble.

But management was willing to take extreme measures in order to survive, including massively diluting common stockholders, and that is what is most important for preferred stockholders. They issued a very large amount of common stock to raise cash, and like Hersha Hospitality, they temporarily suspended their preferred stock dividends. But with the cash they raised, they paid back all missed preferred stock dividends and have made preferred stockholders whole.

The primary reason why I believe AHT preferred stocks are very safe is that a bankruptcy would be a disaster for AHT. This is likely why they took such extraordinary steps to avoid bankruptcy and will almost certainly do the same in the future if necessary (although I very much doubt it will be necessary). The primary goal of an external manager is to continue to keep their management contract, collect the management fees, and often to grow assets under management to expand those fees.

Before proceeding, I want to give a shout-out to Richard LeJeune of the Pannick Report, who is my go-to guy for bankruptcy issues. He explained to me why a bankruptcy filing would be particularly disastrous for AHT.

Although the probability of the external manager losing their management contract is likely quite low in a bankruptcy, AHT has the problem that it uses secured debt (mortgages) to finance its hotel purchases. Usually, when management decides to go the bankruptcy route, the company can submit a bankruptcy plan that wipes out unsecured debt holders in order to clean up its balance sheet and re-emerge as a stronger company. But secured debt holders can reject the bankruptcy plan and take their properties. AHT’s external manager certainly doesn’t want to see that happen. The mortgage debt that AHT has cannot be wiped out in bankruptcy so there is nothing to gain and everything to lose by management by going into bankruptcy.

And the second reason that I think the AHT preferred stocks are safe is that AHT will very likely wish to issue more preferred stocks going forward as this is partly how they grow. If dividends are suspended on their current preferred stock, they will not be able to issue more preferred stock. This is why they paid back preferred stockholders for missed dividend payments as soon as they could even though they could have continued to suspend preferred stock dividends like Sotherly Hotels (SOHO) has done.

One other thing to point out is that by using mortgage debt, AHT can simply walk away from a money-losing hotel leaving the bank with the property while AHT wipes out their debt on that mortgage. Mortgage holders cannot force AHT into bankruptcy. The best they can do is take back a property if AHT doesn’t pay the mortgage on that property. They cannot touch the other properties owned by AHT.

The only risk I see for preferred stockholders is another market disaster scenario like COVID where AHT management might pressure preferred stockholders to swap their preferred shares for common shares. But usually, in those swaps, the company offers a number of common shares that are worth more than the preferred stock is currently worth. So that is really not a big deal as you can sell your common stock and re-invest the proceeds into something else that has been beaten down. And you really can’t invest in anything if you believe an economic disaster is looming.

AHT Preferred Stock Current Yields

Symbol Stripped Yield Current Price

AHT-D 9.61% $22.22

AHT-F 10.46% $17.92

AHT-G 10.53% $17.80

AHT-H 10.38% $18.30

AHT-I 10.45% $18.19

As you can see, the AHT preferreds have very generous yields with AHT-F, AHT-G, ATH-H, and AHT-I being the ones to own. These sell at prices far below par giving them lots of room for capital gains and are cheap relative to AHT-D which has a lower yield and much less upside. So these AHT preferreds meet the criteria I am looking for in preferred stocks lately. 1) they are hugely lagging the recent large market upswing, and 2) they sell way below par for large capital gains potential. And of course, I am always seeking undervaluation and the AHT preferred stocks have that.

Fair Value for AHT Preferred Stocks

I believe that the fair value yield for AHT preferred stocks is 8.3%. If AHT-F traded at an 8.3% current stripped yield now, its price would be $22.50. This is a 25% increase in price from its current $18.00. Since AHT preferred stocks have lagged some other preferred stocks by 30% while its common stock has massively outperformed other hotel REITs, a 25% increase in price seems reasonable to return the AHT preferred stocks to a reasonable fair value relative to other hotel REIT preferred stocks.

One of the more leveraged hotel REITs that also suspended preferred stock dividends during COVID is Hersha Hospitality. HT-D is the closest of their preferreds in price to $22.50 and it pays a 7.2% yield. If you believe, as I do, that AHT will do whatever extraordinary measures necessary to stay solvent, then an 8.3% yield looks attractive to me. And at $22.50, you still have price upside.

Here are the fair value prices of the AHT preferred stocks assuming an 8.3% current yield.

Fair Value Prices For AHT Preferred Stocks

AHT-D $25.70

AHT-F $22.50

AHT-G $22.50

AHT-H $22.80

AHT-I $22.80

Summary/Conclusion

Over the last 2 months, the action in the pricing of AHT preferred stock has been ridiculous (in a good way) offering investors a huge opportunity. AHT preferred stocks have underperformed some other hotel REIT preferred stocks by 30% despite the AHT common stock massively outperforming other hotel REITs with a whopping 116% price gain during the last 2 months. This creates a massive opportunity to enter a “reversion to the mean”-type trade. There is no reason for this disconnect and for some of the AHT preferred stocks to be down $2.00 per share during what has been a huge rally. In fact, they should have rallied more strongly than other hotel REIT preferred stocks given the huge improvement in their operations and in their common stock price.

And in terms of safety, AHT has a cash hoard that is more than triple the value of all its preferred stock and is a whopping 41 times their annual preferred dividend expense. And they just reported $1.23 per share of AFFO in their most recent quarter.

I also make the case that the management of AHT has no choice but to do whatever it takes to avoid bankruptcy. They proved this during the 2020 COVID crash by issuing a massive amount of common stock when they were in trouble in order to continue to operate. They really have no choice given their debt structure. A bankruptcy filing is unthinkable for management and given that their borrowing is non-recourse, lenders have no way to force AHT into bankruptcy.

The fair value of AHT-F, AHT-G, AHT-H, and AHT-I is in the $22.50 to $22.80 range. This is a 25% increase from their current prices. The 10.5% current yield and $18.00 current price offer a very large total return potential. If the relative pricing of AHT preferred stocks returns to where it was 2 months ago, AHT will achieve a total return of 30% from now until year’s end which equates to an annualized return of 80%.

Be the first to comment