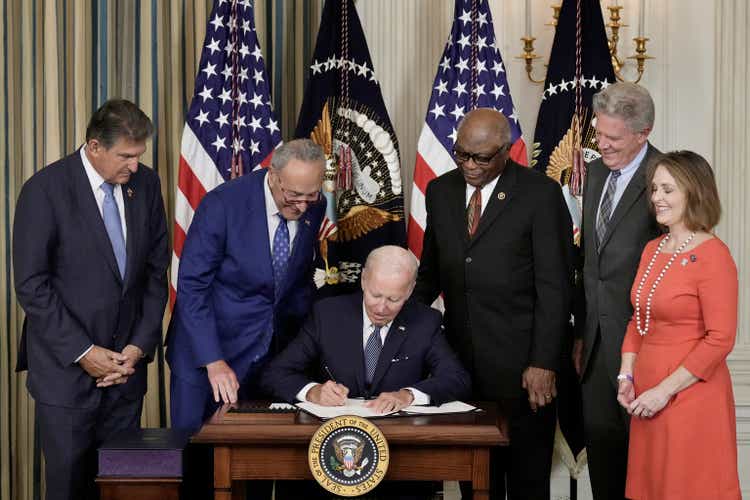

President Biden Signs Inflation Reduction Act Into Law

Drew Angerer/Getty Images News

Ford Motor Co. (NYSE:F), along with General Motors Co. (GM), Volkswagen AG (OTCPK:VWAGY) and other global automakers, had been counting on the U.S. to provide substantial financial support for the development of emission-free BEV vehicles – as well as incentives for consumers to replace their internal combustion – ICE – models.

Government policies, initially mandating increases in fuel efficiency standards and then the progressive elimination of fossil fuel altogether, are the primary driver behind the industry’s embrace of BEVs. Mainstream consumers (apart from those who have flocked to Tesla (TSLA)) have shown relatively mild interest in BEVs, which impose some economic and convenience penalties, along with their benefits. Range anxiety, cost and the undeveloped charging infrastructure worry potential buyers.

Slow growth

Consumer interest nevertheless is growing, though not at a rate suggesting that automakers will swiftly realize a return on the $100 billion already committed for new models and battery plants.

The euphemistically-named Inflation Reduction Act, a slimmed-down version of the bill that failed in the Senate last year, provides $374 billion in climate and energy spending. Its provisions include a sunset at the end of 2022 on the $7,500 per vehicle incentive which had been in place for BEVs, up to a maximum of 200,000 vehicles. The incentive in the new bill stipulates that vehicles must be built in North America and that battery makers in the U.S. must phase out their reliance on mineral suppliers from China and countries that aren’t U.S. trading partners.

The Act introduces a $4,000 tax credit for the purchase of used electric vehicles (EVs) and updates the $7,500 credit for new ones, with a major change: There are now eligibility caps on the price of new vehicles, based on the buyer’s income, that qualify for that credit. The caps imposed are $55,000 for electric cars and $80,000 for SUVs and pickup trucks.

“The manufacturing tax credits and grant funding will help accelerate the domestic industrial base conversion currently underway. Unfortunately, the EV tax credit requirements will make most vehicles immediately ineligible for the incentive. That’s a missed opportunity at a crucial time and a change that will surprise and disappoint customers in the market for a new vehicle. It will also jeopardize our collective target of 40%-50% electric vehicle sales by 2030,” said John Bozzella, CEO of the Alliance for Automotive Innovation, a trade group representing automakers.

Eligibility questions

Ford’s two most important BEVs, the Mustang Mach-E and the F150 Lightning pickup, are built in North America – but some more costly versions of the models may be ineligible for the incentive. Likewise, some buyers may be ineligible for incentives based on their income.

Ford’s BEV family (Ford Motor)

Specific provisions of the Inflation Reduction Act may be tweaked in coming months, from an administrative standpoint. Automakers are sure to lobby the government for relaxation of some provisions that would make it easier for consumers to qualify for incentives.

Notwithstanding the new law, Ford is in the midst of a sweeping corporate reorganization intended to transform itself into a maker of battery-powered vehicles, with its stated expectation that 40% to 50% of its global vehicle volume will be emission-free by 2030. Ford said in March it will spend up to $50 billion through 2026 on the ambitious migration, up from a previously stated goal of up to $30 billion. Ford’s market capitalization currently stands at $61.6 billion.

Ford’s white-collar labor force also is undergoing transformation, as engineers and others in the legacy internal combustion business are phased out and replaced with specialists in battery, electrification, software and digital technology. In the past week the automaker announced it will be eliminating 3,000 jobs, 2,000 white-collar and 1,000 contract workers, in order to cut costs – representing about 1% of its 183,000-member global work force.

An internal company email explaining the layoff to Ford employees, signed by Bill Ford Jr., executive chairman, and Jim Farley, CEO: “Building (an electrified) future requires changing and reshaping virtually all aspects of the way we have operated for more than a century,” the email said.

Until that future arrives, Ford also is contending with quality problems and inflated warranty costs with its legacy models. In April, Ford hired a top quality guru from the J.D. Power & Associates, which measures customer satisfaction, to spearhead a drive to reduce defects afflicting several Ford models, including its No. 1 moneymaker, the F150 full-size pickup truck.

While it’s impossible to forecast battery electrification’s future with any precision, it’s reasonable to assume that the technology will continue grow at an uncertain rate. Breakthroughs in battery performance, the price of gasoline, and development of a charging network could stimulate growth. Ford has staked its future on fairly rapid growth of BEVs, financed in part by the cash flow from its legacy pickup truck business and partly from equity capital and borrowings.

Toyota’s approach

I have written that a much more sensible strategy, from an investment standpoint, belongs to Toyota Motor Corp. (TM). Toyota is deliberately moving more slowly, counting on its gas-electric hybrids to save fuel while offering BEVs in limited number until conditions are more favorable for the technology’s widespread adoption.

(The success of Tesla has convinced many in the auto industry that Toyota is mistaken and that widespread BEV adoption is at hand. Certainly the price run-up in Tesla’s common stock has caused rival auto executives to salivate. The case can be made, however, that Tesla is a one-off, a phenomenon that won’t be easily repeated by legacy automakers.)

In my view, the prospects for mainstream BEV adoption in the U.S. make Ford shares risky for long-term investors. Those who hold F shares already may want to hang on, especially since Ford has reinstated the dividend. Such investors should monitor BEV growth carefully – and Ford’s BEV sales in particular – using simple arithmetic to determine growth rates and whether the automaker can make good on its stated BEV sales goals over the next eight years.

Be the first to comment