Adrian Vidal/iStock via Getty Images

Geopolitical tensions are still high, but the markets ended in the green for the week. The S&P 500 rebounded by 1.41%, the DOW finished up 0.27%, and the Nasdaq closed the week out by 1.84%. What a difference a little rebound in the markets makes. The Dividend Harvesting portfolio was tendering on the edge in week 54 as it closed in the black by a slim margin of 0.73%. In week 55, the Dividend Harvesting portfolio finished up $209.54 (3.67%), and at the close of week 56, it’s in the black by 5.99% or $356.57. In the middle of March, the Nasdaq briefly crossed over into bear market territory before sharply bouncing off its lows. I am not the best at timing the markets, and I don’t have a crystal ball, but investing the same amount week after week allows you to dollar cost average into positions and methodically build out a portfolio. The continuous flow of dividends and broad diversification allows me to mitigate downside risk through periods of uncertainty. The Dividend Harvesting portfolio has closed in the black 98.21% of the time (55/56).

This series has never been about hitting a target yield, generating a certain amount of profit, or beating the market. I had two specific goals with this series. The first was to create a blueprint for constructing a dividend portfolio by documenting the journey starting from the beginning. The second goal was to illustrate how allocating capital each week toward investing regardless of the amount would be beneficial in the long run. Too many people are under the illusion that you need tens of thousands or even hundreds of thousands to benefit from investing. Instead of using my real dividend portfolio as an example, I decided to start a new account, fund it with $100, and add $100 weekly, providing a step-by-step guide to dividend investing. This methodology doesn’t have to be used for dividend investing, and it could be as simple as an S&P index fund or a Total Market fund. Hopefully, this series is inspiring people to invest in their future to attain financial freedom.

The Dividend Harvesting Portfolio Dividend Section

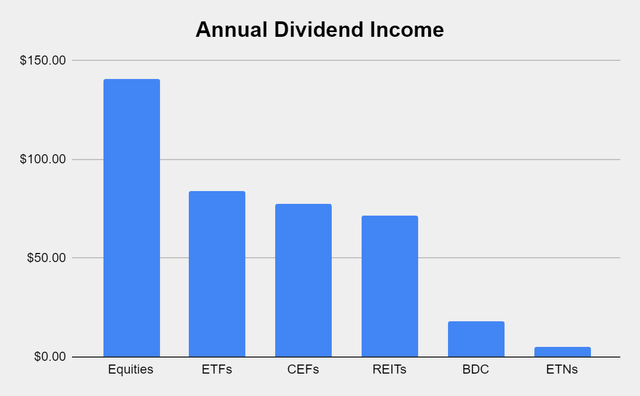

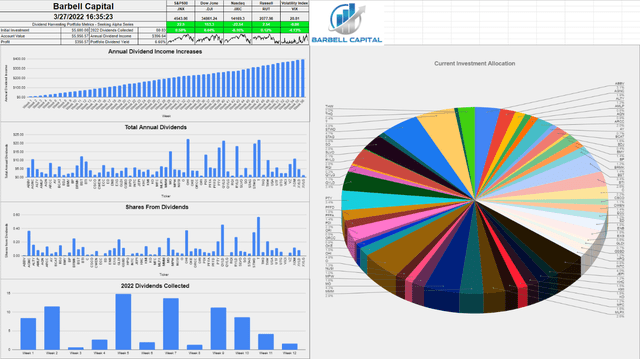

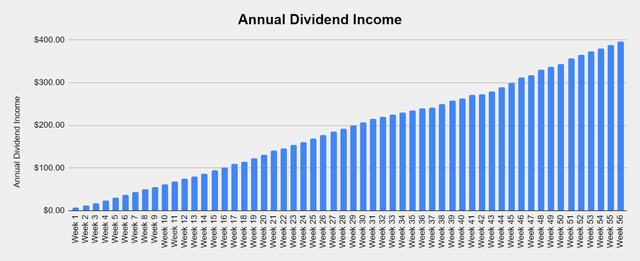

After 56 weeks, the annual dividend income from the Dividend Harvesting portfolio is a breath away from reaching $400. This chart represents exponential dividend growth as the snowball effect is still in its infancy. By making weekly investments in income-producing investments and reinvesting the dividend income, the annual income continues to grow at a rapid pace. Originally, the first week’s allocation of $100 allowed me to generate $7.44 in annual dividend income. Since the start of week 2, I have added 59 positions which have grown my annual dividend income by $389.20 (5,231%). By making these investments, I have created my own source of additional cash flow, which is the real premise of this portfolio.

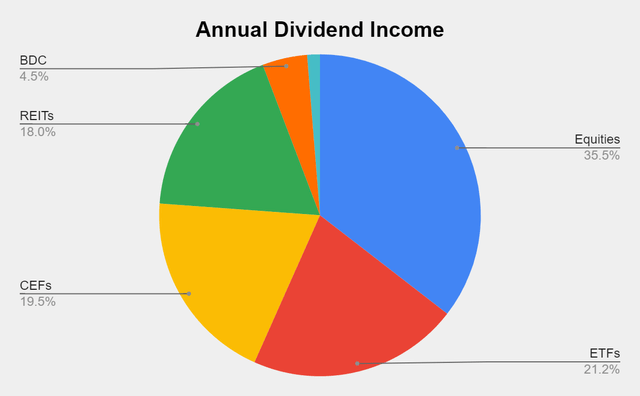

Here’s how much dividend income is generated per investment basket:

- Equities $140.71 (35.47%)

- ETFs $84.17 (21.20%)

- CEFs $77.28 (19.48%)

- REITs $71.56 (18.04%)

- BDC $17.90 (4.51%)

- ETNs $5.10 (1.29%)

Steven Fiorillo Steven Fiorillo

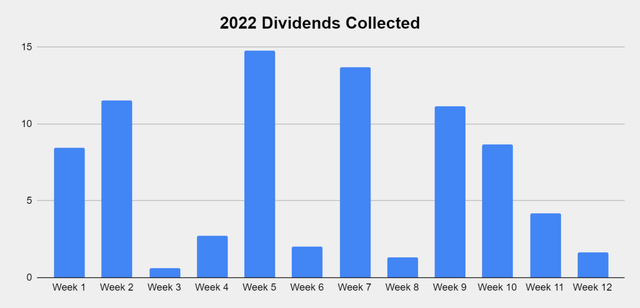

Collecting dividends can serve many functions in a portfolio. Some investors utilize dividends to supplement their income and live off. I am building a dividend portfolio for myself 30 years into the future. Since I am reinvesting every dividend, they serve multiple purposes today. In 2022 alone, I have collected $80.83 in dividend income over 12 weeks. This has allowed the Dividend Harvesting portfolio to stay in the black while growing the snowball effect. In down markets, these dividends allow me to gain additional equity in my investments while increasing my future cash flow. This style of investing isn’t for everyone, but if you’re looking to generate consistent cash flow while mitigating downside risk, this method has worked for me. I am hoping to collect between $450 – $500 in dividends in 2022, which will be reinvested, and finish the year generating >$700 in annual dividends.

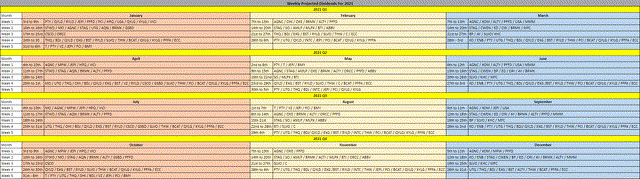

In week 56, I didn’t add new positions to the portfolio, so I didn’t pick up any additional weeks of dividend income. Interestingly enough, in last week’s comment section Jigawatts recommended the Lazard Global Equity CEF (LGI). This recommendation fills the gaps and creates 52 weeks of dividend income in the Dividend Harvesting portfolio. I know I have been saying I want this to occur organically, and I wasn’t going to invest in specific positions to fill the gaps, but LGI has made its way to the top of my watchlist for week 60’s reader recommendation week. I have not done the research yet, but I plan on reading up on the fund, and there is a strong possibility this gets added in week 60.

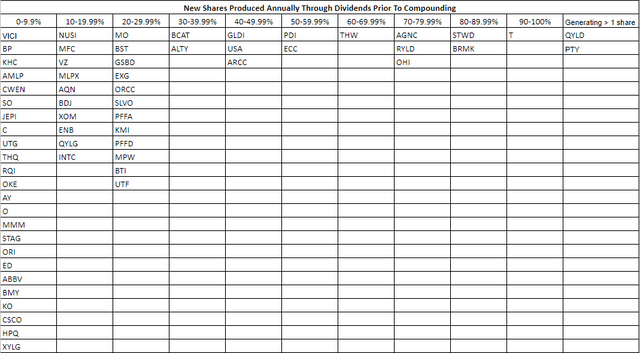

The goal of generating enough income from the dividends to purchase an additional share per year has been the never-ending project of this portfolio. As the PIMCO Corporate & Income Opportunity Fund (PTY) and the Global X Nasdaq 100 Covered Call ETF (QYLD) have already crossed over the threshold for generating an additional share, I am trying to get more of the current positions over the finish line. Eventually, more positions will generate one share per year in dividend income.

The Dividend Harvesting Portfolio Composition

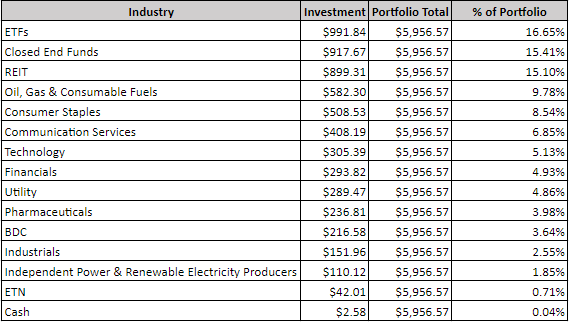

ETFs remain the largest segment of the Dividend Harvesting portfolio, and I don’t see that changing for a while. Individual equities make up 48.46% of the portfolio and generate 35.47% of the dividend income, while ETFs, CEFs, REITs, BDCs, and ETNs represent 51.34% of the portfolio and generate 64.53% of the dividend income. I have a 20% maximum sector weight, so when a singular sector gets close to that level, I make sure capital is allocated away from that area to balance things out. In 2022, I will make an effort to even out these portfolio percentages. As more capital is deployed, the bottom half of the portfolio weighting will increase.

Steven Fiorillo

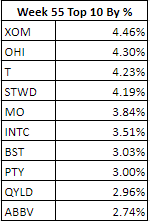

AT&T (T) went from being my largest position and now its dropped to 3rd. I have been watching the top allocations closely and am working on making sure I don’t exceed a 5% portfolio weighting again in any of my positions. Overallocation is dangerous, and by doing this, I’m capping my risk. If one of my investments goes under, the most I can lose is 5% of my capital.

Steven Fiorillo

Week 56 additions

In week 56 I added 1 share to the following positions:

- Starwood Property Trust (STWD)

- PTY

- BlackRock Capital Allocation Trust (BCAT)

- Medical Property Trust (MPW)

- Eagle Point Credit Company (ECC)

- Eaton Vance Tax-Managed Global Diversified Equity Income Fund (EXG)

STWD has been one of my favorite REITs for years as I believe their CEO Barry Sternlicht is best in breed. STWD goes ex-dividend on 3/30/22, and I wanted to pick up another share prior to the upcoming dividend. I have been a shareholder of STWD for years, and this has been a consistent dividend payer and was one of the REITs that didn’t cut or suspend its dividend during the pandemic. Since 1991 STWD has operated throughout numerous real estate cycles and has deployed over $83 billion in capital with record investments of $17 billion across its business lines in 2021. Over the past 2 years, Mr. Sternlicht has positioned STWD to benefit from strategic capital allocation, and I believe shareholders will benefit in the years to come.

PTY bounced off its recent lows the other week, and this has been a fund I have been dollar-cost averaging into. I probably won’t be adding to PTY any longer as I have significantly brought my average price down over the past several months.

BCAT has been one of the underwhelming investments I have made within this portfolio. I am down around -12.51% and have brought my price per share down to $18.70. As of the close on 3/25/22, BCAT seems undervalued as its market price closed at $16.36 with a NAV of $19.19, creating a -14.75% premium discount. I plan on buying another share or two over the next several months as I have a feeling BCAT will turn around.

I recently wrote an article on MPW, and after reading through their Q4 report and filings, I wanted to add another share. MPW just provided investors with a 9th consecutive dividend increase which has increased from $0.80 to $1.16. MPW is trading around its 52-week lows and looks cheap from a price to FFO metric. MPW’s dividend growth is supported by 74.03% in FFO growth over the previous 5-years. I think MPW is undervalued, and at around a 5.7% yield, I was happy to pick up more.

ECC is one of my only exposures to the CLO space, and I was down a couple of percent on this position. ECC reduced its dividend substantially from $0.20 to $0.08 at the height of the pandemic. This is a recent purchase for me, and the monthly dividend has recovered from $0.08 to $0.14 since spring of 2020. Something that I found interesting was that the Credit Suisse Leveraged Loan Index had generated positive total returns in 28 of the past 30 years. ECC provides an opportunity to gain exposure to senior secured loans.

I am basically even on EXG after dollar-cost averaging into the position. I love the holdings in this fund and own six of its top ten holdings in my regular portfolio. With big tech being roughly 15% of the portfolio and more than half of the top holding weighting, I am confident that EXG will follow the markets. While I wait for a rebound, I will sit back and collect my 8% distribution that’s paid monthly.

Week 57 Game Plan

I may add another share of STWD prior to the 30th to add to my upcoming dividend and put STWD closer to generating an additional share per year from its dividends. I am also considering adding to the Global X Russell 2000 Covered Call ETF (RYLD), Verizon (VZ), and maybe the Virtus InfraCap U.S Preferred Stock ETF (PFFA).

Conclusion

Thank you to everyone who continues to read this series. Creating a passive income fund isn’t an investment approach that everyone believes in, but it’s one of my investment cornerstones. I have a comprehensive investment approach where I invest in growth companies, value companies, and dividend companies/funds. I also utilize an indexing approach with funds for my retirement accounts. Income generation is just one aspect that I focus on when planning for the future. The passive income I’m generating will act as additional income in retirement. I look at this as a Barbell approach because I utilize several aspects of investing in my overall approach.

Be the first to comment