RiverNorthPhotography/iStock Unreleased via Getty Images

When it comes to real estate, one of the most common types of properties is retail properties. That brings us to one of the largest retail property REIT on the market today by way of National Retail Properties (NYSE:NNN).

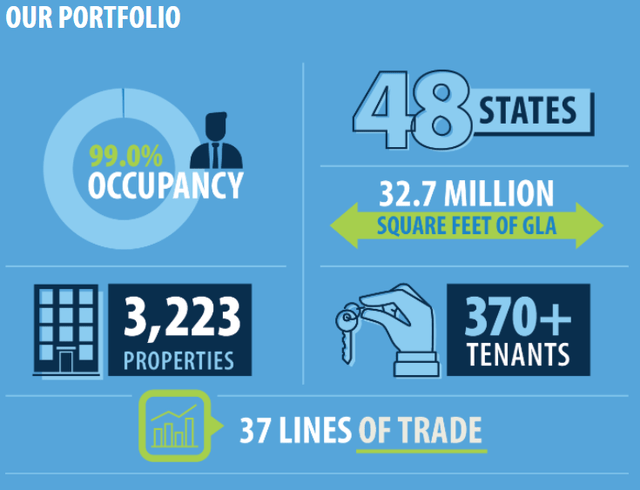

National Retail Properties is an established triple net-lease REIT with 3,223 single-tenant properties across 48 states, as of the end of 2021.

NNN has often played the “little brother” role as it has often been compared to Realty Income (O) due to the make-up of the portfolio, which we will take a closer look at in the article today.

Building A National Presence

As I mentioned, National Retail Properties often gets compared to Realty Income and rightfully so. Both are net-lease REITs and both REITs focus heavily on retail real estate, signing long-term leases with its tenants.

However, National Retail Properties also has its own way of doing things, which differs itself from Realty Income. The management team for NNN chooses to focus more on middle-market tenants, similar in many ways to STORE Capital (STOR). Choosing this approach can add a little more risk than taking the traditional approach of dealing with investment grade tenants, but it also creates higher lease spreads, which impacts the company’s cash flows.

The term “middle-market” does not necessarily mean less of a tenant, as they could still be high-quality tenants in themselves, just not investment grade due to size.

During the company’s Q4 Investor Presentation, management gave investors a look back at how they have clawed back from the pandemic and give insight into where they are heading.

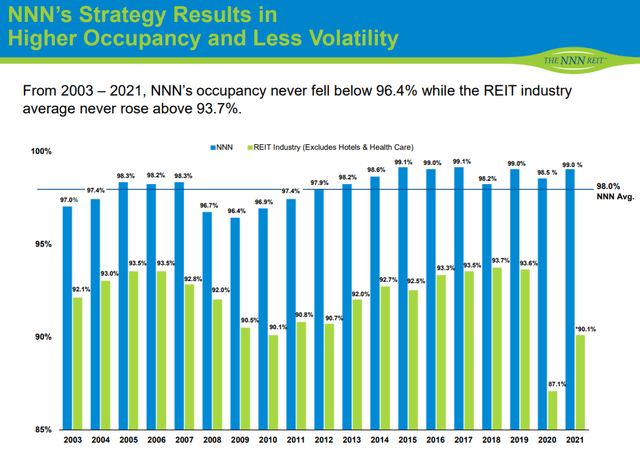

The company ended the year with an impressive portfolio occupancy rate of 99.0%. Since 2003, the company’s occupancy rate has NEVER fallen below 96.4%, meanwhile the average for the REIT industry has never climbed higher than 93.7%.

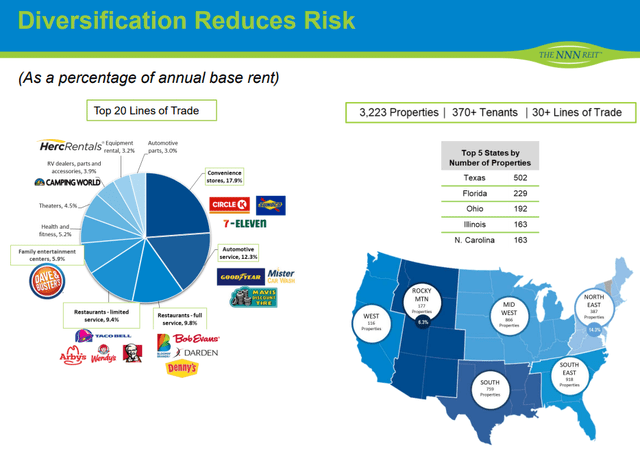

Although the company operates heavily within the retail sector, they choose their tenants wisely. They look to avoid retail categories that are more susceptible to the threat of e-commerce.

If you follow me on social media, you have heard me mention multiple times the importance of portfolio diversification. National Retail Properties management takes the same approach when it comes to their real estate portfolio. The company has over 370 national and regional tenants.

Here is a look at the company’s top 20 lines of trade:

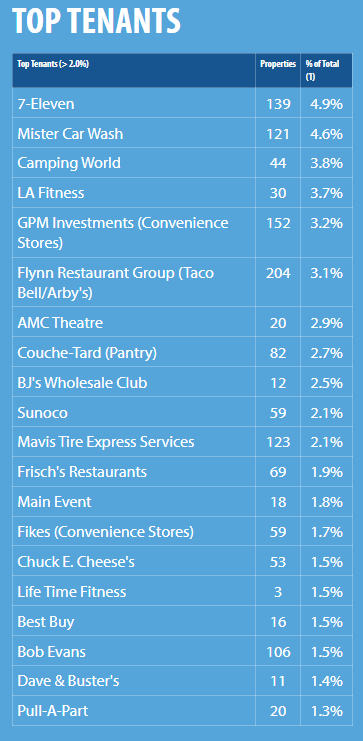

The company’s top 25 tenants make up 56% of annual base rent. Here is a look at those top tenants.

Q4 Investor Presentation

A Promising Total Return Investment

National Retail Properties beat analyst expectations for Q4 and raised their 2022 FFO guidance at the start of February.

Q4-21 core FFO per share was $0.75 compared to analysts expectation of $0.72 and AFFO came in at $3.06.

Revenues during the quarter came in at $187.3 million, easily beating analysts expectation of $184.4 million. Revenue grew nearly 15% year over year and was up 4% from Q3.

NNN’s operating metrics backed up the company’s strong results as the company reported occupancy of 99.0%, with a weighted average lease term of 10.6 years.

Based on the results the past few quarters, things appear to have recovered if not more than recovered and management has steered the ship back in-line with its pre-pandemic path.

Also during 2021, the company sold 74 properties totaling $122.0 million.

The company survived the pandemic filled 2020 on the backs of its strong balance sheet. The company ended Q4 with $171.3 million in cash on the books and no amounts drawn on its bank credit facility combined with no material debt maturities until 2024. NNN has a credit rating of BBB+.

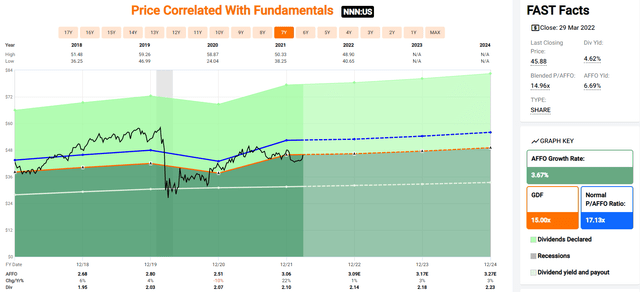

In terms of valuation, the company is trading at a very intriguing forward P/AFFO of 14.7x. This seems to be very low for a company performing as well as NNN and when you compare to their five-year P/AFFO average of 17.1x.

For comparable purposes, Realty Income is trading at P/AFFO of 19.3x. Should NNN be trading right in-line with Realty Income may be another topic for another day, but the gap should not be this wide, which means NNN could see some multiple expansion in the near-term.

Investor Takeaway

There is no denying that National Retail Properties is a strong REIT that has performed well over the years. The company is run by a superb management team that has built in flexibility with a strong balance sheet coming out of the pandemic.

The company finished 2021 strong and expects 2022 to continue the momentum as things (hopefully) return to a sense of normalcy.

In addition to a strong balance sheet and portfolio, which resulted in strong financial results in 2021, the company also provides investors with a stable dividend.

Currently, shareholders of NNN receive a dividend of $2.12, which equated to a dividend yield of 4.62%. The company is in a prestigious dividend aristocrat club for having paid a growing dividend for 32 CONSECUTIVE years.

Trading at a forward AFFO multiple of only 14.7x seems to be very attractive for long-term minded investors looking for a solid total return investment.

Be the first to comment