Justin Sullivan/Getty Images News

As with most e-commerce platforms, eBay (NASDAQ:EBAY) has seen business normalize at higher levels. In the last few months, the stock fell under immense pressure as growth stalled due to the covid pull forwards. My investment thesis remains ultra Bullish on the e-commerce platform with the company finally constantly exploring improvements to the marketplace.

New Markets

eBay has used the pandemic boost in areas such as collectibles to reimagine the business. The company just announced the eBay Vault to secure collectibles such as trading cards. The e-commerce site had previously spent the last couple of years modernizing the payments platform, building out an advertising suite and adding the authentication of high-end sneakers.

During the pandemic, trading cards demand surged as people stuck at home with stimulus funds rediscovered collectibles. The company had already highlighted how demand surged over 140% during 2020, but the key to maintaining customers was to build a suite of services on the platform that had become more of a catch all for the card sector while specialized websites were picking off the high end collectors and investors.

The company estimates the new vault will store $3 billion worth of cards and other collectibles in the next few years. The vault provides an immediate funnel to list cards for sale on the platform in the future helping boost GMV for products previously leaving for another platform.

As with other card vaults, customers get both an ability to secure valuable collectibles, but also easily sell and ship an item directly from eBay without needing to send the card to multiple locations. In a lot of cases, the new customer could decide to leave the card at the vault and take advantage of future services including factional sales and trading.

In addition, the company has launched a Digital Wallet allowing buyers and sellers to maintain funds on the platform. A seller no longer needs to send the money to an external bank account before using the money to purchase an item on the platform.

In both cases, eBay may or may not become successful, but the company is now innovating and attempting to make the business more sticky and rewarding to customers. Over time, the e-commerce marketplace will create products that ultimately work creating an advanced platform keeping up with current trends.

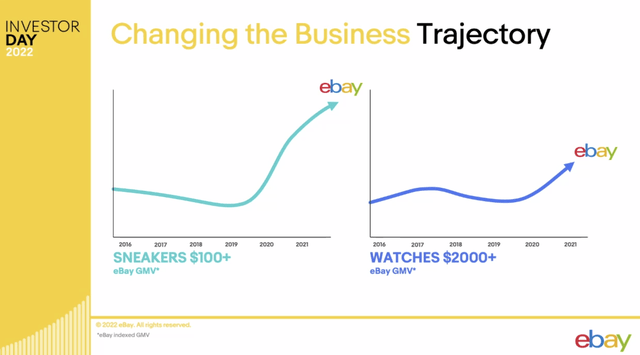

The company has already transformed the sneaker and watches business via authentication services recently launched with trading cards. eBay has grown GMV in these higher-end categories by solving the major confidence issue with making high-value purchases on an online platform from somewhat random sellers.

Source: eBay Investor Day 2022 presentation

Less Shares

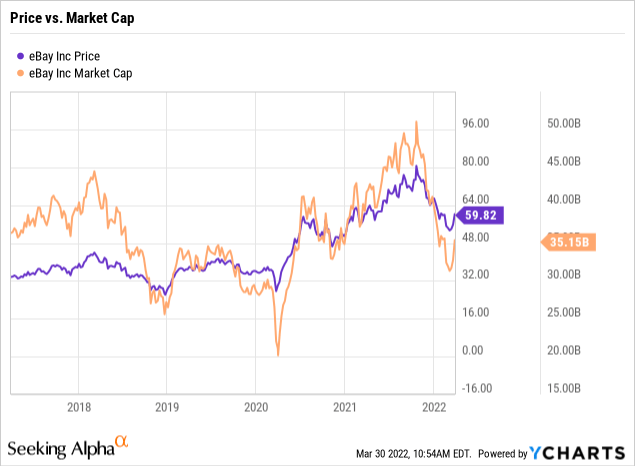

eBay now trades at a higher level than pre-covid, but the market cap isn’t larger. The company has repurchased so many shares over the last few years that the market cap is down to $35 billion versus over $40 billion at the 2018 peak when stock prices were only in the $30s.

The company spent ~$7 billion on buybacks last year for nearly 20% of the current outstanding share count. In addition, eBay paid out $466 million in cash dividends leading to a 1.5% dividend yield after the recent 22% hike in the quarterly dividend rate.

The company earned $4.02 per share in 2021 and despite a forecasted small decline in revenues this year, analysts forecast EPS jumping to $4.34 in 2022. The company has cut the average share count from 718 million in 2020 to an average of just 606 million shares in Q4’21 with an ending share count below 600 million.

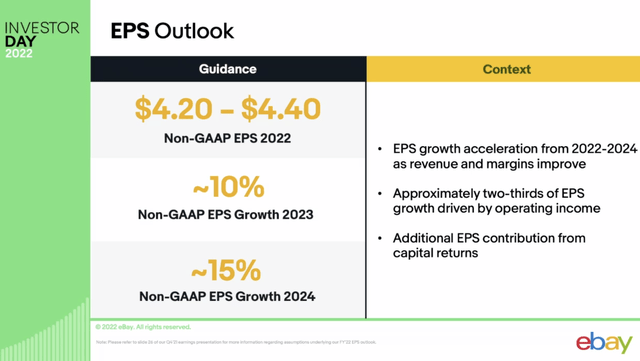

The stock only trades at 12.5x 2023 EPS targets of $4.79. At the Investor Day, eBay guided to annual EPS growth topping 10% with a target of reaching 15% growth in 2024. The new suite of services boosting revenue by just 5% annually could easily lead to this level of EPS growth via leverage. The share buybacks provide an additional boost to EPS going forward versus the previous buybacks masking weak results.

Source: eBay Investor Day 2022 presentation

With the stock at $60, eBay isn’t valued based on the potential of the company to beat what appear conservative revenue targets. As the EPS starts approaching $5 per share, the stock shouldn’t trade at 12x those estimates valuing the stock equal to a value stock, not one re-imaging the business based on tech improvements. The largest e-commerce marketplace is 50x larger then eBay.

Takeaway

The key investor takeaway is that eBay is far too cheap now that the company is constantly innovating. Despite the higher stock price, the stock is actually worth less now due to the lower share counts. Investors should use the recent weakness to load up on eBay.

Be the first to comment