Orbon Alija/iStock via Getty Images

The iShares Core S&P U.S. Growth ETF (NASDAQ:IUSG) should be thought of as a value weighted bet on US technology firms. That means you’re taking a slightly narrower bet than with the general market on stocks like Apple (AAPL), Microsoft (MSFT) and some old FANG friends. We think that the time isn’t right for a bet like this. Last earnings came in from these major companies and they looked rather good, but there are possible headwinds still incoming as the impacts of the rate hiking environment become fully digested. Markets have appreciated signaling by the Fed around the future of rate increases, and of earnings that have still been strong, but while market leaders might be more resilient than most, they can still succumb. We think that in a market like the current one an ETF approach needs to altogether be eschewed for more active selection, because there are cheap stocks still on the market. Things that the market depended on before might not be the place to be as paradigms shift.

Breaking Down IUSG

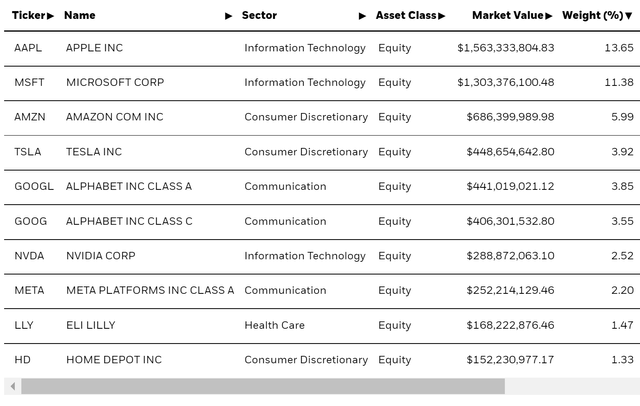

IUSG features some of the most recognisable names possible for retail investors.

IUSG Holdings (iShares.com)

All the largest cap tech companies, constituting both the core of tech exposures but also the overall market in the US just because of their sheer megacap size, dominate this ETF. Ultimately, the play here is just a slightly narrower bet than the overall market and will depend meaningfully on the earnings performance of these companies in coming quarters.

Recent Tech Earnings

Google (GOOG) (GOOGL) (or technically Alphabet) delivered reasonably well in the earnings. The key takeaway was that high quality search ads business showed a fair bit of resilience where other advertising has been taking a hit on tech platforms like Twitter (TWTR), which only has growing issues with the Musk saga. However, advertising in general, even outside of tech, has been able to produce results. On one hand this is a positive indicator across the board, and not what we’d have expected from companies like Omnicom (OMC) and IPG (IPG), but it also means that if advertisers are going to fall in the next quarter, Google hasn’t particularly proved its ability to resist. Moreover, idiosyncratically YouTube is having issues with competing TikTok, with its sales coming below expectations. We still think that with the economic climate being what it is, there is still space for the company to see declines in its businesses, with ad spend an area more liable to turn. However, while we believe this, forecasts were raised by OMC in their earnings, so if there is a hit coming to advertising spend it hasn’t come yet.

Microsoft was another company that reported continued strong double-digit growth. The Azure growth figures did come below expectations, which may lead one to believe that tech spending might be decelerating further as companies rethink budgets, but in our opinion that would be reaching. There are currently no signs that declines have baked into results. However, tech spending could still take a hit if unemployment spirals further. On one hand, public cloud remains strong, and the demand for public cloud in end-markets depends more on server needs than it does on headcount, but enterprises facing businesses like Microsoft would still have to contend with a slowdown.

Conclusions

Tech earnings still showed signs of strength, but the questions around the economy remain. Real commitment to rate hikes hadn’t become evident until mid-June. Whether the hammer is dropping on the economy further remains to be seen. We are seeing layoffs especially in tech, and hiring freezes are notable. They are not always in companies that are more exposed to negative trends and news like crypto. Unemployment can spiral, and inflation remains largely unsolvable by the Fed or any immediate possible action. The question is do investors really want to bet on the status quo when paradigms are shifting? There’s something to be said for quality, but these businesses still depend on a decent economy for growing into their multiples, and there are lots of things on sale right now. An active approach is better for volatile markets.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment