Melpomenem/iStock via Getty Images

There are no facts, only interpretations.” – Friedrich Nietzsche

Today, we take an in-depth look at an interesting and fast-growing small-cap SaaS concern. It was brought public via a SPAC last summer. Like most of that ‘vintage’ of public debuts on the market, this name has found itself deep in ‘Busted IPO‘ territory. An analysis of the company’s prospects follows below.

Company Overview:

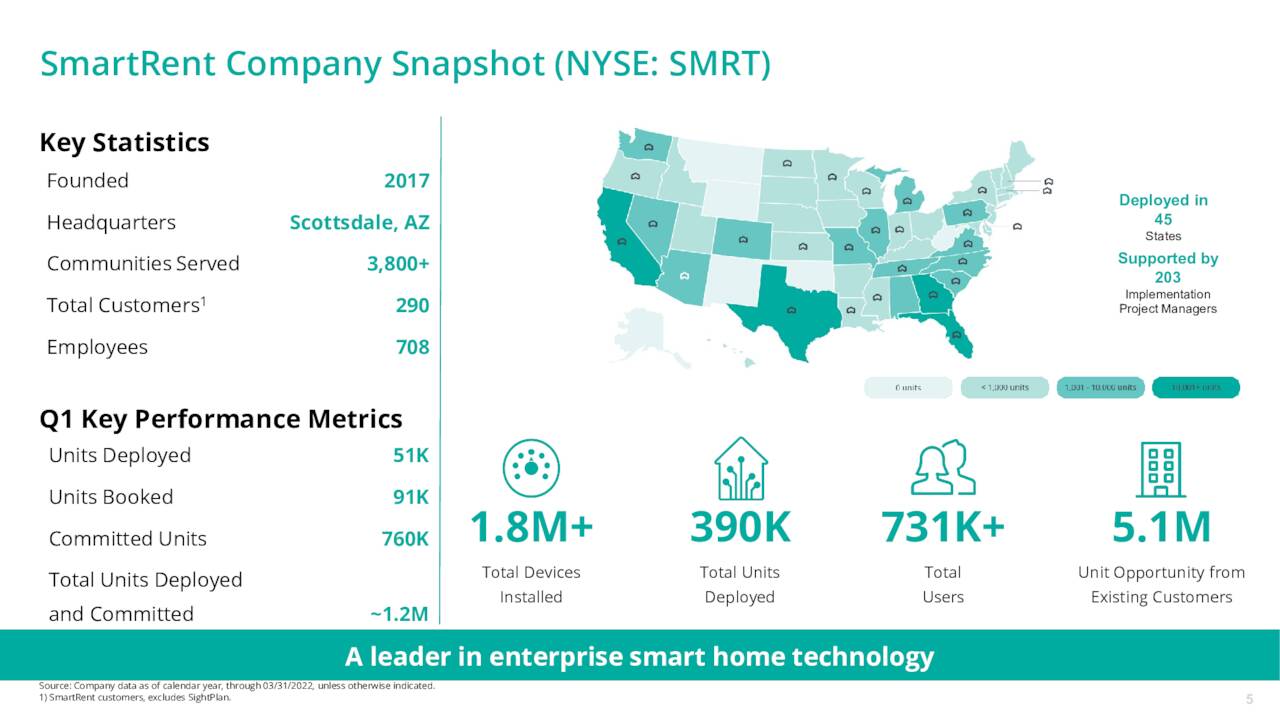

SmartRent, Inc. (NYSE:SMRT) is a Scottsdale, Arizona provider of smart building hardware and SaaS solutions to property owners, managers, and residents, including 15 of the 20 largest multifamily residential owners in the U.S. The company’s hardware agnostic real estate platform is deployed in over 3,800 communities in 45 states. SmartRent was founded in 2017, adopted its current business model via a 2020 acquisition, and went public through a reverse merger into a subsidiary of special purpose acquisition company (SPAC) Fifth Wall Acquisition Corp. in August 2021, with its first trade executed at $12.50 per share. The SPAC went public earlier the same year, raising net proceeds of $325.2 million at $10 per share. SmartRent currently trades just over five bucks a share, translating to a market cap just above $1 billion.

June Company Presentation

SmartRent Offering

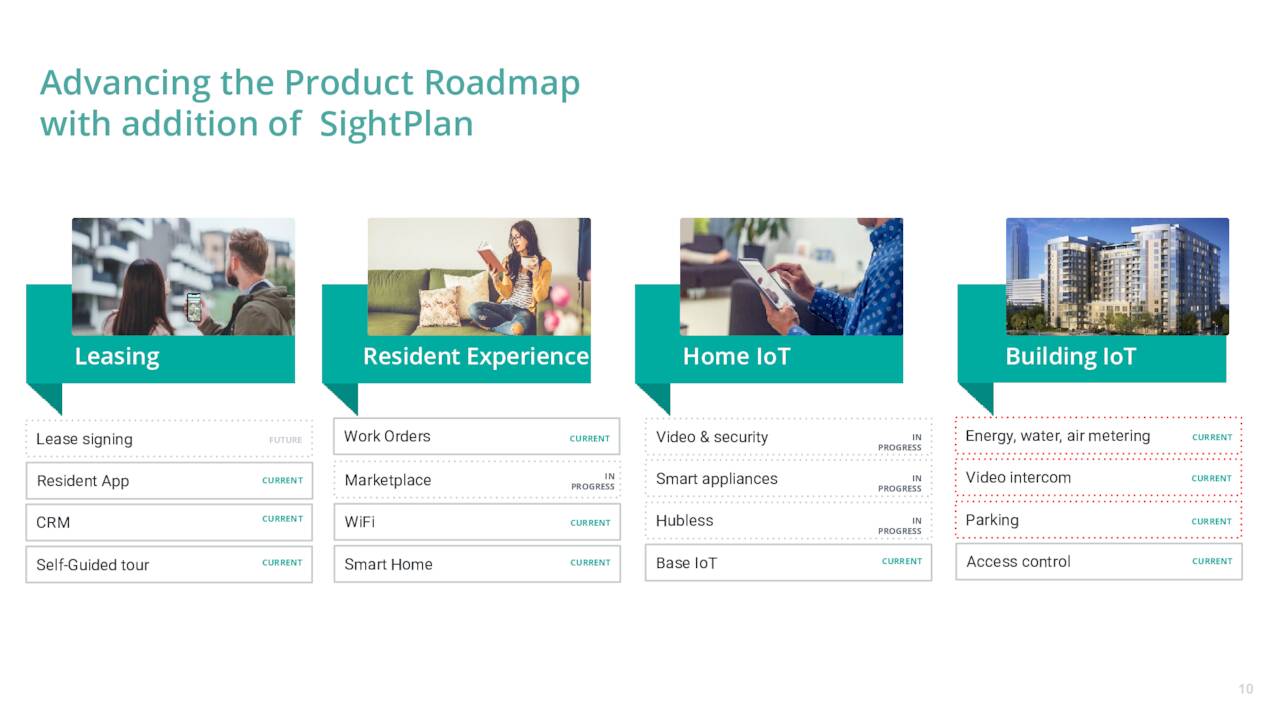

The company’s technology offering includes enterprise software, hardware, and resident solutions that are hardware agnostic, meaning they are compatible with Amazon (AMZN) Alexa, Yale smart locks, Google (GOOG, GOOGL) Home, Honeywell (HON) thermostats, etc. Furthermore, SmartRent boasts an open architecture that can integrate with most property management systems, such as Yardi, Entrata, and RealPage. These solutions are complemented by a team of installers and support staff. A typical installation for the homeowner may consist of door-locks, thermostats, sensors, light switches, a hub device, a software subscription, and support – all of which can be securely controlled from an app. It can also integrate with already installed technology, such as Ring video-enabled doorbells. In other words, SmartRent technology is compatible with existing residential properties, a feature that it believes provides it with a competitive advantage. Including its recent acquisitions – more on that below – SmartRent had ~422 customers controlling 6.3 million units, into which they had hub devices deployed into 390,681 units as of March 31, 2022.

June Company Presentation

Revenue Disaggregation

The company generates revenue from the sale of hardware devices, professional installation services, and hosted services. Hardware devices include door-locks, thermostats, sensors, and light switches, which connect to a SmartHub device. This unit contributed FY21 gross margin of negative $0.8 million on revenue of $69.6 million. The top line represented 118% growth over FY20. Professional installation services accounted for FY21 gross margin of negative $15.5 million on revenue of $22.7 million, representing 85% improvement at the top line. Hosted services include monthly subscription revenue for access to its software applications and generated FY21 gross margin of positive $6.2 million on revenue of $18.3 million, which was up 121% from FY20. It is obvious from this disaggregation that the company’s model is to grow its hardware installed base and collect high-margin monthly SaaS subscription fees off it in perpetuity.

Acquisitions

Since going public, the company has wasted little time getting into the industry consolidation game, paying a modest $5.9 million for iQuue, a provider of smart home and smart building technology (including access control, door code management, etc.) in December 2021. For the consideration, SmartRent also received 19 new customers with 16,637 units deployed.

June Company Presentation

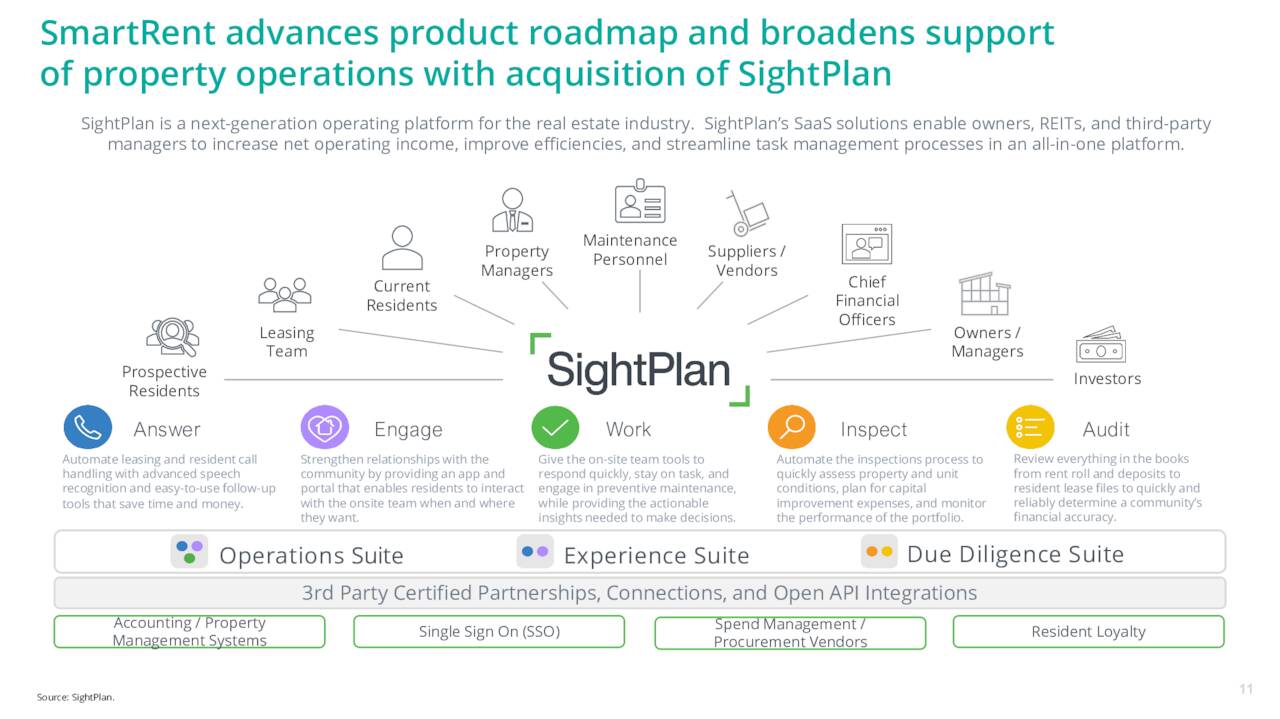

This acquisition was followed by the purchase of property operating solutions concern SightPlan for a cash consideration of ~$135 million in March 2022. The acquiree caters to real estate owners and managers with resident engagement, field service and maintenance management, inspections management, and other SaaS services. The deal represented a purchase of a complementary product suite, allowing SmartRent to offer a more holistic solution in an attempt to be the one-stop SaaS provider for its customers. Case in point: although the acquisition onboarded 132 new customers comprising 1.2 million units, it added 39 common customers encompassing 2.4 million units. Those 39 (mostly large) customers now have most (if not all) of their property management needs housed under one platform deployment. That said, the purchase price amounted to ~10x FY22E SaaS revenue – a bit of a headscratcher as the new inflationary environment value paradigm was on full display by late March 2022.

June Company Presentation

Real Estate Internet of Things Market

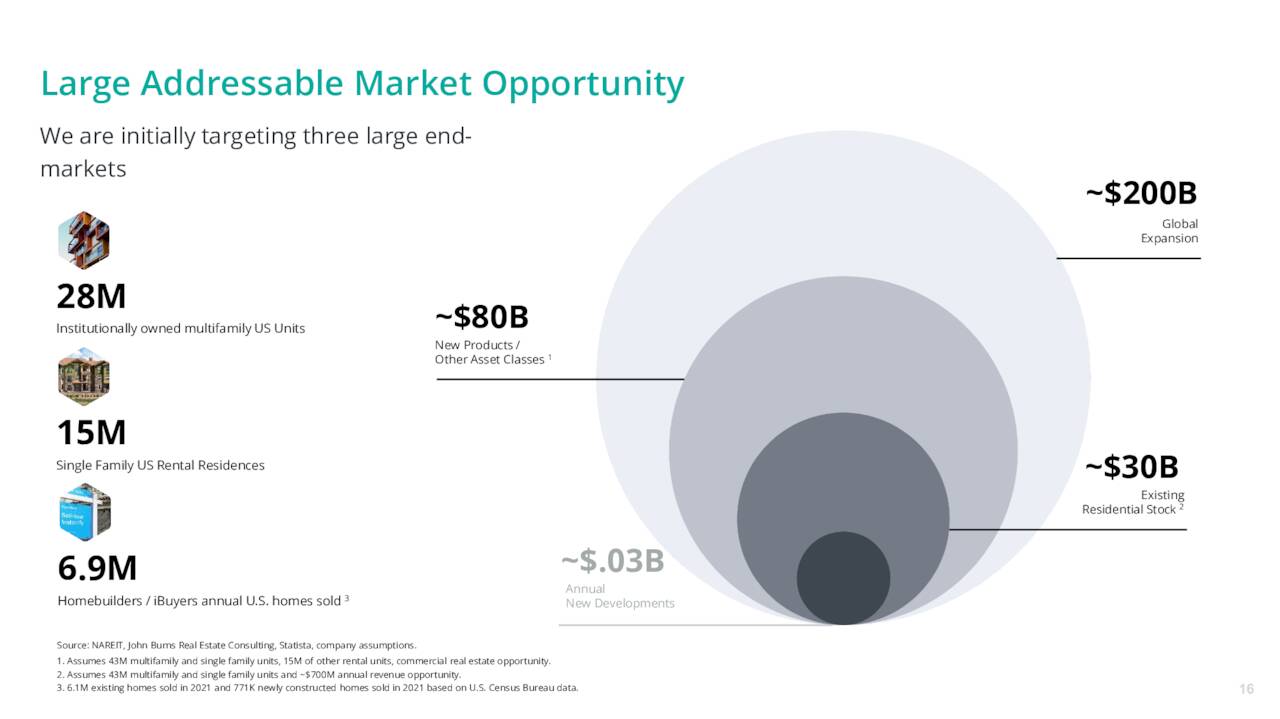

Anyone familiar with the United Nations Agenda 2030 knows that the pathway to its utopian goals includes smart cities and smart homes. As such, the global residential real estate internet of things (smart homes solutions) market was valued at $79.1 billion in 2021 and is expected to accelerate to $314.0 billion by 2027 according to Mordor Intelligence. SmartRent believes it is the market leader in its niche of the $30 billion domestic smart home opportunity, with Latch (LTCH) providing similar offerings but generating about three-eighths the revenue in FY21 ($41.4 million vs. $110.6 million for SmartRent).

June Company Presentation

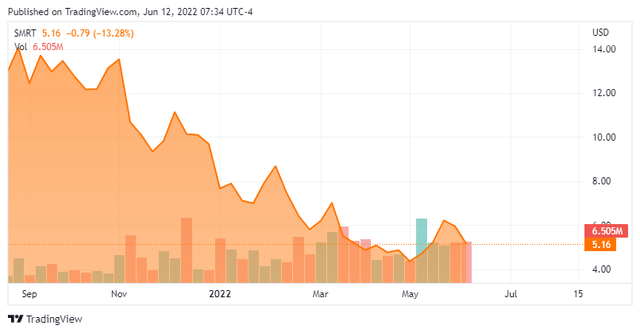

Stock Price Performance

Like Latch, SmartRent’s birth was via SPAC. The story of the seemingly endless parade of 2021 SPAC IPOs has been repeated many times: after management promised meteoric revenue growth on its road show, its stock established all-time high share prices shortly after its IPOs and then sold off significantly as the era of the risk-off trade was ushered in by inflation rates not seen in 40 years. SmartRent’s stock was no exception, achieving an all-time high of $15.14 a share on its first day in the public markets (August 25, 2021), subsequently plummeting to an all-time low of $3.56 on May 11, 2022, down 77% peak-to-trough.

For the avoidance of doubt, the company’s performance was not all exogenously (inflation) inflicted. Management was unable to foresee supply chain constraints inhibiting its ability to procure hardware; thus, delaying its deployment. As such, it slashed its FY21 revenue target from $119 million to $103 million (based on a range midpoint) in November 2021. These supply chain impacts carried into FY22, compelling SmartRent to project a FY22 Adj. EBITDA loss of $42.5 million on revenue of $235 million when it reported 4Q21 earnings on March 24, 2022. Although the top line outlook reflected 112% growth over actual FY21 revenue of $110.6 million, it was well below analysts’ expectations of ~$280 million.

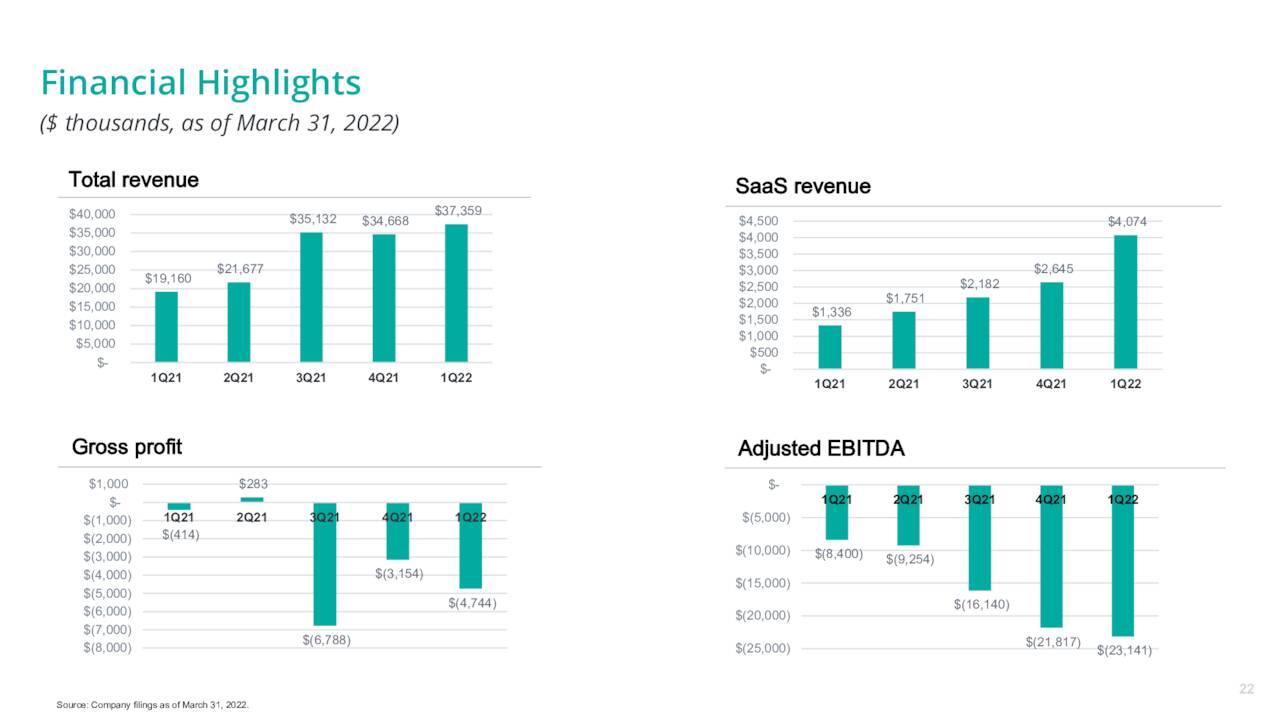

1Q22 Earnings & Outlook

That guidance did not change when SmartRent reported its first stanza of 2022, clocking a GAAP loss of $23.6 million (-$0.12 a share) and negative Adj. EBITDA of $23.1 million on revenue of $37.4 million versus a GAAP loss of $9.4 million and negative Adj. EBITDA of $8.4 million on revenue of $19.2 million in 1Q21, representing a 95% increase at the top line. Hindered by the supply chain, the company deployed 51,196 units in the quarter, up 58% year-over-year.

June Company Overview

Given the supply chain headwinds, there was cause for optimism as units booked increased 101% year-over-year to 91,482 while bookings surged 122% to $72.0 million. SmartRent (sans SightPlan) added 41 new customers in the quarter. Committed units (binding orders) were 760,591 as of March 31, 2022, up 26% from the same date one year prior. Furthermore, SaaS average revenue per unit (ARPU) per month for bookings in 1Q22 was $4.17 versus $4.08 in the prior year period, while annual recurring SaaS revenue rose 208% from $5.3 million in 1Q21 to $16.3 million in 1Q22.

Balance Sheet & Analyst Commentary:

Owing to the cash outflow from the SightPlan acquisition, SmartRent held unrestricted cash of $278 million and no debt as of March 31, 2022, and had access to an additional $75 million on a revolving line of credit. The company burned through $28.8 million from operations in 1Q22, which was significantly worse than a $7.9 million outflow experienced in the prior year period, but with total liquidity of $353.0 million, there are no dilution concerns.

June Company Presentation

Street analysts have not abandoned SmartRent, posting four buy and two outperform ratings against only one hold. However, their median twelve-month price target of $9 is down from ~$12-$14 at the onset of 2022. On average, their FY22 outlook does not differ much from the company’s, expecting a loss of $0.39 a share (GAAP) on revenue of $240.5 million. They then anticipate a pivot towards breakeven in FY23, with the company only losing $0.13 a share on revenue of $515.2 million, reflecting a 114% improvement at the top line.

Also in the bull camp is board member Robert Best, who purchased 225,000 shares at $4.64 on May 13, 2022, bringing his trust’s total ownership interest to over 4.8 million shares.

Verdict:

With the general market selloff, the bloodbath in SPAC-birthed IPOs has continued unabated; however, the valuations have now gotten slightly more rational. On the day SmartRent went public, it was trading at ~22x FY21 revenue net of cash. It is now trading at just over three times FY22E revenue net of cash, although it is unlikely to sniff breakeven until at least FY24. With that said, the opportunity appears substantial. Removing SightPlan’s contribution, SmartRent’s customer base comprised 5.1 million units as of March 31, 2022, meaning that its remaining opportunity (no installation or bookings) from its existing clients was 4.0 million units. Assuming $4.17 monthly APRU in SaaS revenue, its existing client base represents a $200 million untapped annual recurring opportunity. It has already penetrated 15 of the top 20 U.S. multifamily owners, but the top 20 only represent 3% of the addressable domestic market. And, of course, there is a significant international opportunity.

That said, in this high interest rate environment, a V-shaped recovery in high-growth, profitless stocks is unlikely. As such, would-be investors are better served with a small ‘watch item‘ holding for now. I recently established a small position in SMRT via covered call orders.

The world is a tragedy to those who feel, but a comedy to those who think.” – Horace Walpole

Be the first to comment