nsj-images/E+ via Getty Images

If you are looking for steady capital appreciation in a small cap industrial stock that can survive a recession or two and that pays out a growing quarterly dividend, you may want to take a closer look at Mueller Industries (NYSE:MLI). Established in 1917, the company has been making industrial parts out of copper, brass, aluminum, and plastic for over 100 years and steadily growing the business, with particularly strong growth in the past 3 years. From the company press release, this is a brief description of Mueller Industries.

Mueller Industries, Inc. is an industrial corporation whose holdings manufacture vital goods for important markets such as air, water, oil and gas distribution; climate comfort; food preservation; energy transmission; medical; aerospace; and automotive. We are a leading manufacturer of copper, brass, aluminum, and plastic products. The range of these products is broad: copper tube and fittings; line sets; brass and copper alloy rod, bar, and shapes; aluminum and brass forgings; aluminum impact extrusions; PEX plastic tube; refrigeration valves and fittings; fabricated tubular products; and steel nipples. We also resell brass and plastic plumbing valves, plastic fittings, malleable iron fittings, faucets and plumbing specialty products. Mueller’s operations are located throughout the United States and in Canada, Mexico, Great Britain, South Korea, and China.

I last wrote about MLI back in December 2021 and I rated the stock a Strong Buy then when the stock closed at $58.44 on Dec. 8, after experiencing rapid growth in the second half of 2021. Although the price is now down to $54.93 as of market close on 6/10/22, the stock has traded in a range from around $50 to $59 over the past 6 months and still represents a Strong Buy in my opinion for its steady growth and small but growing dividend, along with occasional special dividends.

MLI 6-month trading range of $50 – $59 (Seeking Alpha)

At a forward P/E of only 6.14 and less than 5% short interest, the stock has plenty of room to run as long as the construction industry does not come to a screeching halt like it did in 2020. Part of the reason why MLI did so well in 2021 was due to rapidly rising costs including copper especially, which they were mostly able to pass on to their customers.

In my December article, I had expected the boom in construction from the Infrastructure bill that Congress passed in 2021 to boost the construction industry along with pent-up demand from the Covid lockdowns and supply chain disruptions. But then unforeseen events occurred including the Russian invasion of Ukraine, soaring inflation, and rising interest rates causing new home buyers to slow down purchases. Nonetheless, the demand for construction continues the rebound that began in 2021. In the first quarter of 2022 many of the raw material costs for construction started to come down, which is positive for construction confidence looking toward the second half of 2022.

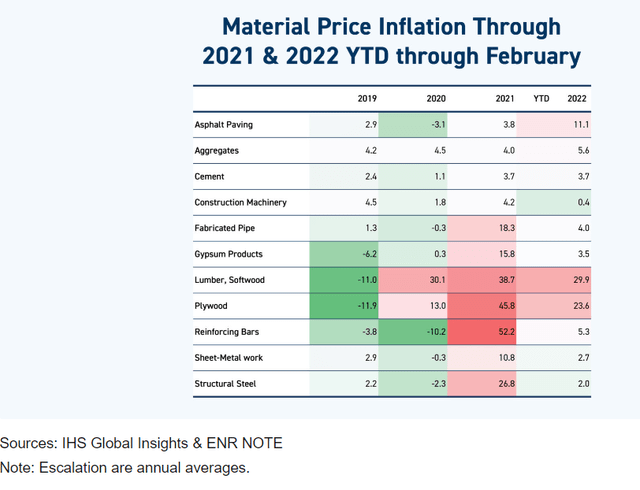

This recent blog entry from Swinerton shows the cost matrix for building materials and discusses the outlook for the remainder of 2022.

Construction Material Price Inflation (Swinerton blog)

Overall construction costs were still up about 8.5% as of May 2022, but total construction spending continues to rise, and hiring increased in the first quarter of 2022. Construction confidence has remained fairly steady through the first quarter of 2022 and is expected to continue in the second half of the year according to industry sources.

Each quarter, CFMA polls CFOs from general and civil contractors and subcontractors about markets and business conditions. The Confindex is based on four separate financial and market components, each rated on a scale of 1 to 200. A rating of 100 indicates a stable market; higher ratings indicate market growth.

The overall Confindex rating stayed at 116. The “current confidence” index rose two points, also to 116, and the “year ahead outlook” fell one point to 115. More interestingly, the “business conditions” index rose, up eight points to a rating of 131.

This is an indication of how strong demand is for construction services, says Anirban Basu, CEO of economic consultant Sage Policy Group, Baltimore, and a CFMA economic adviser. That’s surprising, given the rise in the cost of delivering construction services, he thinks. “And yet many of them are reporting that, if anything, their profit margins are set to expand going forward.” Basu cites regional megaprojects, such as Intel’s recently announced $20-billion semiconductor plant in Columbus, Ohio, data and fulfillment centers, health care and incoming infrastructure projects as some of the primary drivers of this demand.

Stock Performance and Comparison to Peers

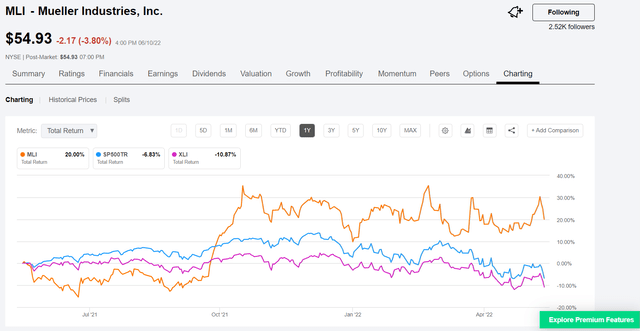

Over the past year, the stock has significantly outperformed both the S&P 500 as well as the Industrial Select Sector SPDR ETF (XLI).

1-year total return compared to XLI, SPY (Seeking Alpha)

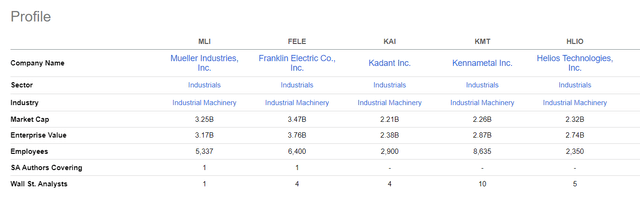

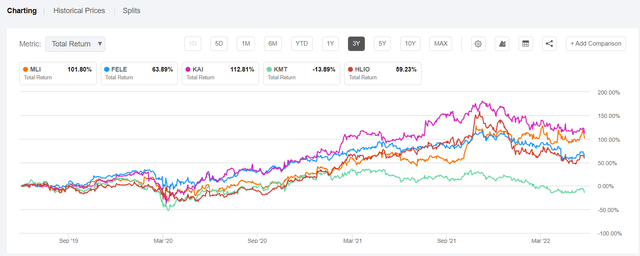

When compared to four of its peers including Franklin Electric (FELE), Helios (HLIO), Kennametal (KMT) and Kadant (KAI) over the past 3 years MLI is near the top based on total return of 101.8%.

Overview of Peers (Seeking Alpha)

Only Kadant performed better over the previous 3-year time frame.

Comparison of Peers – SA charting tool (Seeking Alpha)

Although KAI has performed well it has run up in price to the point where it is not as good a value as MLI currently, with a FWD P/E of 20.36 and EV/EBITDA of 13.8 versus MLI with FWD P/E of 6.14 and EV/EBITDA of 4.16. Kadant also pays a small dividend, currently yielding 0.58% based on the $.26 per share quarterly dividend, whereas MLI pays a $.25 quarterly dividend yielding about 1.85% on a forward basis.

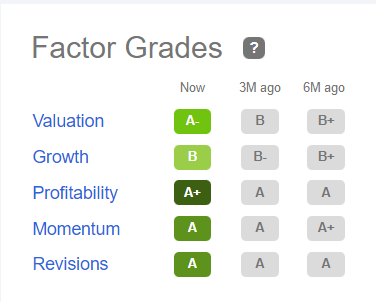

Looking at the Quant ratings for MLI, it is ranked #1 in the Industrial Machinery category and has flying colors with regards to the factor grades that the quant rating uses.

MLI quant rating factors (Seeking Alpha)

There is very little Wall Street coverage with just 1 analyst giving MLI a Buy rating. Authors on SA including me, give it a Strong Buy rating.

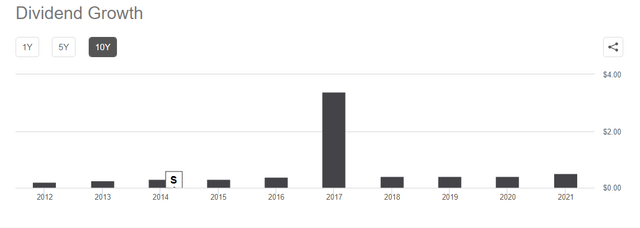

Dividend History and Capital Allocation

The company has been paying dividends to stockholders starting with a special dividend in 2004 and regular quarterly dividends in the 18 years since then. In 2017 another large special dividend amounting to $460M was paid to stockholders. The FAQ on the company’s investor relations website explains the specifics of that 2017 special distribution.

The Distribution will be $8.00 per share of common stock (less any applicable withholding tax), payable $3.00 in cash and $5.00 in principal amount of Mueller’s 6% senior subordinated debentures due 2027 (“Debentures”).

The regular quarterly dividend has not been reduced in the past 10 years and has grown from $.10 per quarter in 2020 to $.13 quarterly in 2021 and was increased again to $.25 per quarter in 2022.

MLI dividend growth (Seeking Alpha)

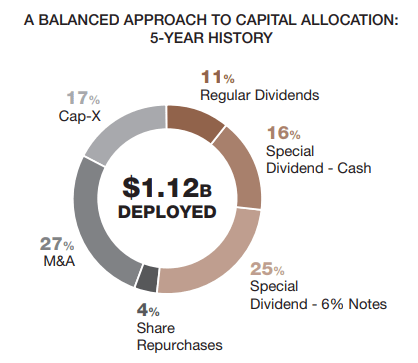

In the company’s 2021 annual report the capital allocation strategy is outlined and is described as prudent and balanced.

While we have ambitious goals for the future, we continue to employ a prudent and balanced approach for managing our capital allocation and risk, prioritizing re-investment in our operations and acquisitions to drive growth, as well as stockholder returns. Given our strong cash generation and healthy balance sheet, we recently announced a 92% increase in our regular quarterly dividend for 2022 from $0.13 per share to $0.25 per share. On an annualized run rate, this increases our dividend from $0.52 per share to $1.00 per share.

Balanced Capital Allocation (MLI 2021 Annual Report)

Q122 Earnings Results

The first quarter proved that the rising costs of copper and other raw materials, along with volume growth from recently acquired businesses did result in growing net sales and gross margin as I had predicted in my earlier article. To recap the recent history of M&A activity, MLI acquired 3 businesses in 2020 and 2021 – H&C Flex, Kessler Sales & Distribution, and Shoals Tubular.

Overall, the first quarter was strong and the outlook for the rest of the year remains positive. Here is a summary of the performance and outlook as described in the Q122 earnings report by CEO Greg Christopher:

“Building construction, the primary market we serve, remains healthy. The continued expansion of residential construction, along with the development of the infrastructure necessary to support local communities, will continue to drive demand for our portfolio of products. We believe we are well poised to benefit from both this ongoing trend, and from the anticipated recovery of other markets we serve that have been impacted by labor and supply chain issues. All in all, our performance remains consistent with the outlook we provided in our year-end report.”

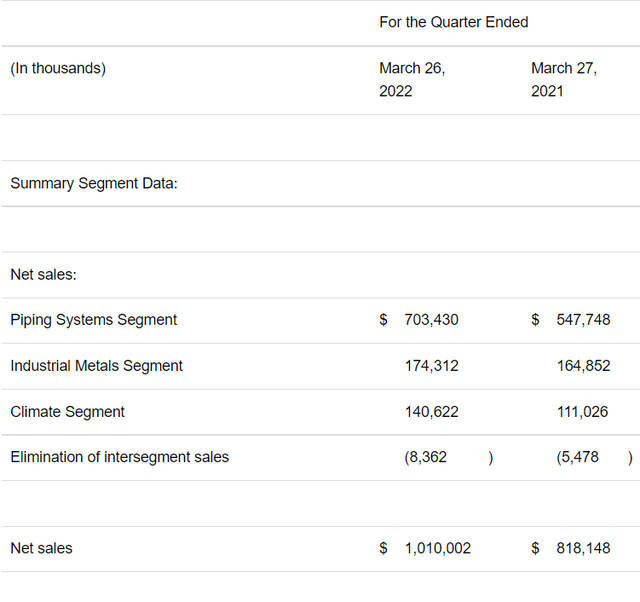

Net sales in the quarter grew to $1,010M compared to $818M in the year ago quarter. Operating income rose from $92.5M in Q121 to $212.7M in Q122. Net income was $158.3M compared to $63.1M in the prior year. Diluted earnings per share amounted to $2.78 versus $1.11 in the year ago quarter.

The Piping Systems segment realized the biggest change in net sales, while both Industrial Metals and Climate segments were modestly higher than Q121.

Net Sales in Q122 (Q122 Earnings report)

Cash at quarter end was $139 million with no net debt. During the quarter the dividend was increased from a quarterly dividend of $.13 per share to $.25 per share. Approximately $4 million in common stock was repurchased during the quarter.

Risks and Recommendations

The essence of MLI is steady growth both organically and via acquisitions and pays a steadily growing dividend. This is not a stock that is likely to soar 20 to 30% in one day and make you rich overnight, nor is it likely to decline in value by any significant amount from here either. However, there is some risk to the short-term price action based on the current macroeconomic and geopolitical environment.

Although MLI is US-based they are a global organization that depends on construction activities continuing to grow. If the US enters a recession and that growth slows by a considerable amount, the stock is at risk of seeing a decline in value. Likewise, if worldwide economic activity sees a substantial slowdown in the coming months that could also negatively impact sales.

The stock has some recent momentum and has held up well so far in 2022 despite rising inflation, a slowing in the housing market in the US, and concerns of a looming recession. For investors seeking capital appreciation from a steady grower that pays a small and growing dividend with minimal downside risk, MLI stock is worth considering at a price under $55.

Be the first to comment