FactoryTh/iStock via Getty Images

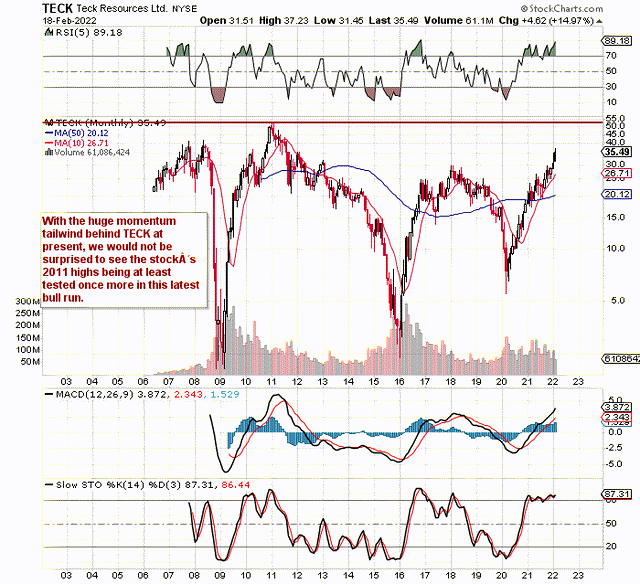

If we look at a long-term chart of Teck Resources (TECK), we can see that the share price is now firmly above the 2018 highs. Therefore, given the momentum shares are currently enjoying at present, the next clear line of sight for the stock is the 2011 high well north of $50 a share. Shares of TECK have now gained 63% over the past 6 months and 35%+ over the past three months alone.

This strong momentum is confirmed by the monthly MACD indicator which sees its averages actually diverging (bullish sign). Furthermore, the monthly histogram continues to rise which again should bring more trend followers into this play at present. Before we discuss the more near-term chart, however, investors should take note of the massive cyclicality in this stock which obviously has huge ramifications if one is on the wrong side of the trade.

Strong Momentum in Teck Resources (StockCharts.com)

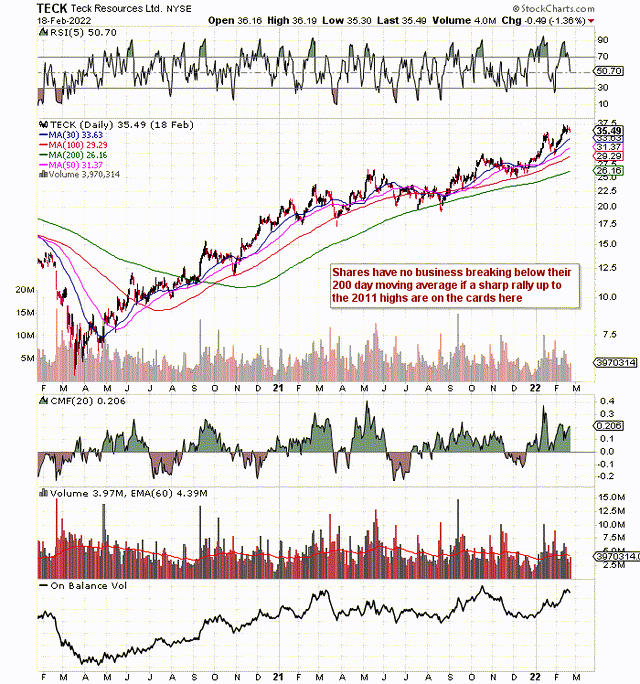

On the daily chart, we can see that shares remain well above all four of the main moving averages we use for trend-following purposes. The 200-day moving average has provided solid support for the best part of 18 months now. Suffice it to say, if shares’ next port of call is the 2011 highs, then, shares have no business dropping below the 200-day moving average for the remainder of this exciting bull run. Trends in the stock’s quality, as well as the company’s valuation, should confirm this point of view.

TECK continues to trade above all major moving averages (StockCharts)

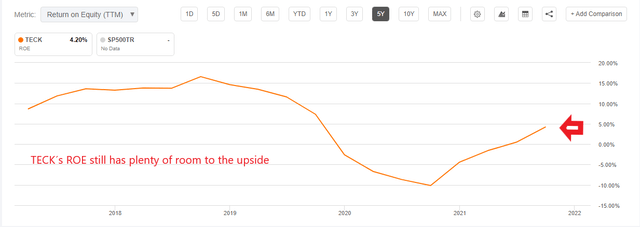

If TECK normalized EPS estimate of $1.86 comes in on target for the fourth quarter, earnings per share for the year will hit $4.29. This would be a colossal increase over fiscal 2020 and momentum is not set to stop there. With $6+ in earnings per share being projected for fiscal 2022, we see TECK’s return on equity growing at a swift pace over the next few years. Currently, TECK’s ROE comes in at just over 4.3% over a trailing twelve-month average. As the chart demonstrates below, it was not very long ago when this key profitability metric topped 16%. Suffice it to say, TECK’s return on its equity has plenty of room to run here based on historic trends, and the share price should follow suit to the upside.

Return on Equity in TECK Resources (Seeking Alpha)

Furthermore, operating margins in TECK now come in just under 20% over a trailing twelve-month average. The sector’s equivalent is approximately 14% which means TECK continues to outperform its peers. More importantly though is that TECK’s operating margin has plenty of room to run also when based on historic numbers. In mid-2018, for example, operating margins topped 35%, so it will be interesting to see if we can return to these types of percentages in this current bullish cycle.

TECK’s book multiple currently comes in at 1.11 (Trailing) which is cheap in itself but it is what is coming down the track here which should interest investors more. For one, the forward book multiple (1.06) is lower as management’s modus operandi is to continue to invest aggressively in the business. Take the recent third quarter for example. Over $1.2 billion of an operating cash flow purse of $1.48 billion was plowed into the likes of the QB2 project plus the Neptune facility upgrade. Suffice it to say, as long as inflation persists in the likes of the steelmaking coal space, etc., we should continue to see heavy re-investment for some to come in TECK. In fact, we most likely will see surpluses here with respect to cash flow outpacing committed growth capital so investors should expect more capital to be returned to them plus also a sustained reduction in debt.

Suffice it to say, TECK’s bullish technicals are certainly being backed up by the fundamentals. With a current earnings yield of close to 8% and with significant cash flow generation potential in the quarters and years to come, there is no reason to believe at present that the market will begin to price in a cyclical top here. There will come a point, however, when TECK’s searing growth will not be accompanied by corresponding share price gains but we believe we are nowhere near that juncture yet.

Therefore, to sum up, the company’s upcoming fourth quarter quarterly earnings numbers will give the market a further opportunity to price shares higher here. $1.86 per share as mentioned is the bottom line number expected on revenues of $3.63 billion. Convincing beats and, more importantly, encouraging comments regarding the first quarter of 2022 and beyond have the potential to move the needle once more here in TECK. We look forward to continued coverage.

Be the first to comment