DNY59/E+ via Getty Images

It’s still all about the Fed.

The front-page headlines in the Wall Street Journal for August 20, 2022:

“U.S. Stocks Fall With Focus On The Fed.”

It almost seems as if my Friday posts, Federal Reserve Watch, should be combined with my Saturday posts on The Stock Market.

Here is how the Wall Street Journal starts:

“U.S. stocks fell Friday, ending the week lower and snapping a four-week stretch of gains for the S&P 500, as investors second-guessed how aggressively the Federal Reserve will need to move to tame inflation.”

“The market endured a stretch of choppy moves as traders reassessed their bets on what the Fed might do at its September meeting.”

“For weeks, many investors had been feeling confident that inflation had possibly peaked and that the central bank would soften the magnitude of its future interest-rate increases.”

“But comments in recent days from central bank officials, combined with the release of the minutes from the Fed’s July meeting, put the possibility of continued aggressive rate increases back in focus.”

“On Thursday, Federal Reserve Bank of St. Louis President James Bullard said he would lean toward a 0.75-percentage-point increase in September.”

Seems as if the Federal Reserve just cannot stay out of the news these days.

The Problem

This, to me, is the problem.

The actions of the Federal Reserve are dominating the financial markets right now and, therefore, investors must pay attention to what the Fed says and does, interpret what the Fed says and does, and then hope that they have gotten it right!

This is all wrong.

The performance of the stock market should not be dependent upon “what the Federal Reserve might do at its September meeting.”

When the Federal Reserve dominates the news, to me, this is a sign that the Federal Reserve is not in control.

If the Federal Reserve is in control of what is going on, its moves and actions are not noticed. If the central bank has done its job well, then you never see its name in the press or on TV, or anywhere.

Central banks that have performed well and are performing well accomplish their task will little or no notice.

When a central bank has generated problems on its own, then the central bank gets noticed in the news.

Why is this?

Well, it’s because in such cases, markets are disorientated.

Things are out of equilibrium. And, when things are disjointed, uncertainty arises and in even more extreme cases radical uncertainty shows its head.

In the best of cases, investors have some idea of what possible outcomes might be.

In more discombobulated situations, investors don’t have any idea what some of the possible outcomes might be. This is, of course, the world of radical uncertainty.

And, so, investors turn back to see what “the experts”, the central bankers, have to say.

That seems to be where we are right now.

The Stock Market In 2022

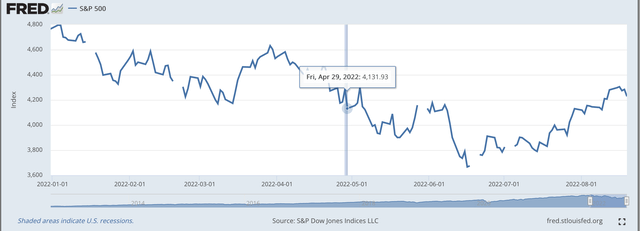

Here has been where the S&P 500 Stock Index has been this year. It began by hitting a historical high of 4,796.56 on January 3, 2022.

S&P 500 Stock Index (Federal Reserve)

March 18 was the day the Fed raised its policy rate of interest. Further changes were made this year on May 5, June 16, and July 28.

The substantial amount of volatility shown in the index is primarily a result of all the uncertainty surrounding the presence of inflation, how long inflation might stay around, and the debate over what the Federal Reserve might do and how persistent it might be.

The really stunning period came after the middle of June.

The Fed raised the range for its policy rate of interest on June 16 and by an enormous 75 basis points and what happened to stock prices?

Stock prices rose.

And, again in July, the Fed raised the range on its policy rate of interest another 75 basis points, and guess what? The S&P 500 continued to rise!

This was not the way it was supposed to go.

Furthermore, in June, on June 13 specifically, the S&P 500 Index closed more than 20 percent below the January 3 high.

The market seemed on the verge of a substantial downturn.

And, what happened?

The “fall” ended. The market “bottomed out” at 3,667 and was around 3,830 a month later.

Then stock market prices began to rise as investor sentiment changed and questions began appearing about the strength of the inflation and about how hard the Fed was really going to have to “step on the breaks.”

And the market continued to rise, even in the face of Federal Reserve claims that the battle was still on.

On Tuesday, August 16, the S&P 500 closed at 4,305.

As quoted above,

“U.S. stocks fell Friday, ending the week lower and snapping a four-week stretch of gains for the S&P 500, as investors second-guessed how aggressively the Federal Reserve will need to move to tame inflation.”

The apparent reason?

“Fed-talk.”

The Near-Term Future

There will be a lot of “Fed-talk” in the near future.

First of all, next week, the Fed holds its yearly retreat at Jackson Hole, Wyoming and there will be talks and reports and lots of white noise we will have to digest into September.

Then in September, we will face the growing discussion about what might be the next moves of the Federal Reserve as we prepare for the next FOMC meeting coming on September 20 and September 21.

The Federal Reserve will continue to “hog” the news for, at least, the next month.

Other News

Some other things that might be watched along with the stock market.

First, it should be noted that the value of the U.S. dollar jumped up over the past week.

For example, at the end of the previous week, it cost around $1.0300 to buy one Euro.

At the end of the week, the cost was $1.0042…almost parity with the Euro.

This movement is consistent with the Federal Reserve tightening up on monetary policy.

The second move of interest was the rise in the yield on the 10-year U.S. Treasury note. The week opened with the 10-year yield around 2.75 percent and ended the week with the yield on the 10-year note just under 3.00 percent.

This move was also consistent with the Fed tightening up.

But, uncertainty still reigns.

Oh, yes, the stock market, the subject of this post.

The Federal Reserve will continue to raise its policy rate of interest. It will also continue to reduce the size of its securities portfolio.

And, radical uncertainty still remains.

Be the first to comment