ridvan_celik

Introduction – the question that sparked this

This article will be a little different from my normal, high-quality dividend growth valuation-based articles. Lest you be disappointed, if you read through until the end, or just skip there, I have included a bonus section, with a listing of the highest-quality dividend growth stocks, and my assessment of their current valuations based on Historical and Future-derived fair values, as well as current analyst estimates.

Like with many moments of significance in my life, this opportunity to think about my current approach to life presented itself when my high school-aged daughter asked me what I expect she thought was a simple question: “Dad, how do you invest in stocks?”

My immediate answer was what you might expect, something along the lines of you’re too young to worry about investing, you need to be focused on grades and college and other more important stuff. However, this question stuck with me and kept coming back. It made me recall my investing education, and especially how my journey was likely harder than it really needed to be because of my lack of someone to provide me with a simple foundation. My own family did some things well – teaching me the importance of prudent living, budgeting, and basic financial acumen from an early age, however, my first forays into actual investing were a lone affair.

Background – my early investing education

When I was in my early 20s and had my first good paying job that put me in a position to have a little discretionary money, I decided I wanted to invest some of that money. I knew that my parents and grandparents did some investing, but when I would ask, I would often get the same answer I initially gave my daughter, you’re too young, you have other things to worry about, and maybe, more significantly, investing is risky. So, I set out on my own to learn about investing. This was the very early 2000s at the peak of dot-com mania.

Where did I turn for my investing education? I started watching CNBC and listening to the talking heads. I also walked into a random, strip mall financial advisor office for help. Additionally, I did pay some attention to my perception of the company I worked for, and some companies that were suppliers to that company. This all resulted in me purchasing a high expense mutual fund from my new financial advisor, opening a high expense brokerage account – because I’d been told that it was worth the extra expense to get the better service they offered, and investing in 3 different individual stocks.

The mutual fund turned out to be a dud – successfully pulling many fees from me for a long period of time, without producing much in the way of tangible results. The three stocks included some stock in the company I worked for that produced a high-single digit return for me, and paid a nice dividend, while I owned it. The second stock was in a supplier for the company I worked for that I saw an activist investor take a big stake in on the talking heads show, and which subsequently went through two bankruptcies, which effectively wiped out my equity. The third stock was a technology stock recommended by my financial advisor, that during the dot-com bust lost about 80% of its value and took decades to recover.

All told, I lost a significant portion of the initial money that I invested. Looking back, this was a small amount of money, and with hindsight, I am glad I learned the lessons that I did, when I did, no matter how hard they were at the time. These painful lessons showed me the importance of being more educated in investing. They also provided the first foundations in my investing strategy: valuation matters, quality is important, be careful who and what you listen to, fees eat returns, dividends are nice, and getting rich quickly is more likely luck than skill but getting rich slowly is a high probability outcome of a solid financial and investing strategy.

Going back to the question that sent us off on this tangent, “Dad, how do you invest in stocks?”, as most parents probably desire, I want to share with my children some insights that hopefully won’t take away all the opportunity for difficult lessons, but that may provide a better foundation to build upon than the talking heads and strip mall financial advisor did for me.

Strategy – teaching financial and investment acumen

To help my high school and middle school-aged children learn to invest in a more structured way, I have devised a strategy that I plan to follow with them to help them along their journey. I will likely be receiving some bonus money for a project at work that has gone very well, and instead of investing that money in my own accounts, I plan to invest it in their financial education, while teaching them the following steps:

- Learn basic personal finance principles

- The mechanics of investing – opening and using an investment account

- Deriving a list of potential stocks for further investigation

- Easy evaluations of company quality

- Basic valuation principles – simple historical and future-looking valuation methods

- Simple measures of risk

Learn basic personal financial principles

My kids don’t likely realize that they have already been attending the school of basic finance for many years. This is an area that my parents did well with for me, and that I have continued to practice with my own kids. This won’t be a big surprise to many, but the school utilizes two practicums: living within your means, and working hard.

We try hard to set an example for our kids of living within our means, and we discuss it regularly with them. We live in a nice house, but haven’t upgraded with increases in income. We drive nice cars, but keep them for a long time, and perform the majority of the maintenance and repairs on them. For my driving-age daughter, this is a requirement for driving – learning how to maintain, and even repair her vehicle. We wear nice clothes, but aren’t extravagant. If the kids want the latest fashions, we provide a way for them to earn money, and encourage them to buy second-hand, or on sale.

Our kids have also had chores since they were young. We don’t buy wants for them, except for birthday and Christmas contributions, but do provide a means for them to earn money to save for themselves. We also have helped them start small businesses, mowing lawns for neighbors, and babysitting. With the proceeds, in addition to saving for things they want, we also require them to set small amounts aside for college and philanthropy.

In addition to these practicums, I do believe that more formal education is important. To help with this aspect of the strategy, before we move to the actual investing portion, I will require my kids to read two of my favorite personal finance books: The Millionaire Next Door by Thomas J. Stanley, and The Psychology of Money by Morgan Housel.

The Millionaire Next Door (themillionairenextdoor.com)

The Psychology of Money (www.morganhousel.com)

I believe that The Millionaire Next Door does an excellent job of highlighting the difference between high net worth and high-income lifestyles, and of showing the difference between being rich in appearance versus rich from a financially independent perspective. I believe The Psychology of Money follows on with this theme, but further expounds on the importance of investing versus trading – the idea of following a focused investment strategy to accumulate wealth over time, versus trying to get rich quick through speculation, timing, and momentum. Both of these are foundational to personal financial acumen, which I believe is likely even more important than actual investing prowess.

The mechanics of investing

Once I feel they have a foundation in personal finance, we will then move on to actually investing. I remember one of the first hurdles I hit when trying to figure out how to invest, was even how to do it. I ended up with a high-priced brokerage because I didn’t know any better and remember being very intimidated by even opening an account. As such, part of my strategy in teaching my kids will be to walk through opening an account.

I have looked through several options for what this should be and have decided that I will help them open custodial brokerage accounts. We already have 529 accounts set up for them, and I don’t want these new investing accounts to be tied directly to their future education, plus you can always do a 529 conversion quickly and easily to gain that tax benefit if you do use it for education. There is also the Roth IRA option, which has some pluses, but, ultimately, I want these to be learning accounts, without the pressure of being for something specific, or with a specific timeline in mind.

For those that aren’t familiar with custodial brokerage accounts, two sources of information that I found helpful were Vanguard’s explanation of the accounts they offer here, and the explanation from Investopedia here.

Here is a quick summary:

Pros

- Very flexible

- No tax impact if under income and gift limits

- No limits on contributions or withdrawals

Cons

- Depending on income, could impact taxes and future financial aid

- Irrevocable – children gain full custody at the age of majority, and withdrawals prior to that must be for the exclusive benefit of the minor

Because we plan to use this as primarily a learning tool, and do not plan for there to be significant assets in these accounts, we are not overly concerned about potential tax implications (though I guess if the kids turn out to be investing geniuses, we may need to reconsider). Also, because we do not expect these accounts to have significant money in them, we are not concerned with the age of majority restriction. We want the kids to feel like this is their money that they get to control and invest, without exceptions. We view this as an investment in their life education, more than an investment in their direct finances.

Most brokerage companies offer custodial brokerage accounts, and we will likely use Vanguard. I have all my accounts, where I have a choice, with Vanguard because I love their low fees, the ownership structure that incentivizes efficiency and cost focus, and the long-term investment approach that they generally espouse.

My thoughts on this are probably best summed up by the founder of Vanguard, John Bogle who said:

Where returns are concerned, time is your friend. But where costs are concerned, time is your enemy.

The miracle of compounding returns is overwhelmed by the tyranny of compounding costs.

Deriving a list of potential stocks for further investigation

Where to start on this one? There are many sources and lists of great companies that you should look at when deciding what to invest in. You should probably not get your list from the talking heads on TV, the common news headlines, or even from your Uber driver, but where should you get them?

My inclination for this exercise with my kids is to have them start with what they know. What companies and brands do they have good feelings about and feel that they understand?

Peter Lynch said:

Your investor’s edge is not something you get from Wall Street experts. It’s something you already have.

You can outperform the experts if you use your edge by investing in companies or industries you already understand.

The simpler it is, the better I like it.

After they have thought about and listed a series of companies or brands that they like and feel good about, I will then share with them a few other lists of quality companies. I always like referring to the Drucker Institute rankings of America’s Best-Run Companies here. I am also a big fan of David Van Knapp’s quality rankings that FerdiS regularly utilizes, such as in his recent update here.

I will emphasize, as I share these lists, that for this initial foray into investing, I expect my kids to stick with companies that they already know something about and have heard of. Researching and learning about new companies will be a longer-term investing opportunity for the future. Once they have identified somewhere between 10 and 20 stocks that they feel good about, we can proceed to the next steps.

Easy evaluations of company quality

Arguably one of the most important lessons I feel like I have learned over many years is how important it is to invest in companies that are high quality. As a long-term dividend growth investor, there is nothing worse than taking a pay cut because a company has had to cut their dividend. When this has happened to me on occasion, in hindsight, I often could have avoided it because the company was not as high quality as it should have been.

Peter Lynch said,

Time is on your side when you own shares of superior companies.

Warren Buffett said,

Time is the friend of a wonderful company, the enemy of the mediocre.

To allow investments time to compound, they need to have quality companies behind them that will stand the test of time. So, though the future is hard to predict, these are the indicators we can look to simplistically to get a feel for the quality of the company.

The first indicator of quality I like to look for is the credit rating. This isn’t foolproof, and not all companies have one, but this is a good first-pass starting point. For me, looking at the companies that I have had good success with over a long period, I limit my first pass as Standard & Poor’s of A- or higher and Moody’s of A3 or better. Both of these ratings are accessible for free with email registration.

Additionally, Value Line provides a Financial Strength rating for every company that they cover. I like to look for a rating of A or better. Though Value Line isn’t free, you can often access it through your library.

Morningstar provides Economic Moat and Capital Allocation ratings for the stocks they cover. I use these more for reference, but for those stocks that don’t have a wide moat, or exemplary capital allocation, I at least make sure I am comfortable with why. Again, though Morningstar doesn’t offer these ratings for free, they can often be accessed through your library.

Finally, on a more quantitative basis, I like to look at least 5-year average and current Return on Equity and Return on Invested Capital as indicators of competitive strength. Those companies that have high returns, and that have been stable over a long period of time, which you can determine by looking at averages and current values, are likely high quality. I like to see ROIC above 10%, and also like to see ROE and ROIC that are reasonably close together, since if ROE is much higher than ROIC, it can be an indicator that the company is relying on leverage to boost returns, which could be a sign of risk or degradation.

Basic valuation principles – simple historical and future-looking valuation methods

Where to go with valuation? As all of us reading these types of articles probably appreciate, this is an extensive subject, with no obvious right answer. The best we can hope to do is estimate likely outcomes without likely having all the information.

As Yogi Berra said,

It is tough to make predictions, especially about the future.

However, by investing in quality companies with sustainable business models over longer periods of time, we increase the likelihood of success.

As Warren Buffett said,

It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

However, he also said,

Price is what you pay. Value is what you get.

So how do we maximize the value that we are getting for the price that we are paying?

John Bogle said,

In the long run, investing is not about markets at all. Investing is about enjoying the returns earned by businesses.

If we think about why we are investing to begin with, we likely want to put money into an instrument that will use that money to earn more money for us than we would otherwise get. With investing in stocks, we are literally investing in a business. We want to provide money to that business, which it will then in turn invest on our behalf to grow and produce future returns. Our expectation, as owners of the business is that, for the investment we made, the business will give us a share of future profits and cash flows.

With this in mind, the first place I would start in the valuation learning journey is to think about current valuations compared to historical valuations. What does that mean though? If, by investing in a business, we are investing in a promise of future profit and cash flow sharing, and if the price we pay dictates the share of those profits or cash flows, we want to try to pay as little as possible for as much of a share as possible. One way to assess that price per share of benefit is to look at pricing ratios versus historical averages. For the sake of first learning to invest, we will focus on two of the most direct ratios: the price to earnings (P/E) ratio, and the price to free cash flow (P/FCF) ratio. Earnings or profit is the gain that the company achieves through running the business. Free cash flow very simplistically is the cash left over after paying core expenses. It is a good indicator of how much money the company has to pay back to investors.

So, how do you arrive at a valuation based on these ratios? By comparing the current ratio, usually the Trailing Twelve Months (TTM) value is used, to a historical average (I usually use the 5-year average) – you can determine if it is currently trading at a premium (higher than) or discount (lower than) to the historical average. This isn’t perfect in that you can’t be certain the stock price will revert to a mean. The company could be in decline, thereby deserving a lower valuation, or it could be going through a legitimate turnaround, meriting a higher valuation, but in general, this simple method, which is very widely used and therefore somewhat self-fulfilling, can be useful to get an idea for fair value, or the price that you might want to potentially pay, by ratioing the price to the relative difference between the actual and average historical ratios.

Another very useful, and popular valuation to use specifically for dividend-paying stocks is to compare the current yield with the average historical yield, and ratio the difference to determine a potential fair value, like with the price ratios above.

This is all fine and well if you believe that history repeats itself, or that the investment will likely revert to the mean, but shouldn’t we also think about what the stock is likely worth based on the future? The answer is, YES! Without getting into some of the more advanced modeling that I actually use, and that I know many of you reading use, there are some simple ways to think about how the stock is likely to perform in the future.

First, the simplest source I like to go to for future-looking projections is analyst estimates for fair value or future prices. I don’t depend on these exclusively, but they are at least a data point in my research. Sources such as Seeking Alpha, Finbox, Morningstar, Value Line, Tip Ranks, and Reuters are good sources. By comparing the current price to the fair values or future prices from these sources, you can get a preliminary indication of how favorable the price might be against future expectations. This is a quick way to find potentially favorably valued stocks for further analysis. The lower the current price is compared to the estimate, the bigger the margin of safety could be for future returns. If the current price is higher than the estimate, it could be a warning sign that you need to wait for the valuation to come back into line.

Second, many research reports will list analyst estimates for long-term growth. Generally, the higher the projected growth, the higher valuation is likely to be because investors are willing to pay more for a growing share of future returns. If your historical valuation looks reasonable, and the projected growth is strong, that is an indicator that based on future projections, the valuation is reasonable. To determine what could be considered “strong” – I typically look for a growth rate over at least 7% (this is a really loose rule of thumb), which is roughly in line with the market average, but then also look at the growth rate compared to historical projections. If the growth rate is in line with what has been projected historically, that is a good sign. If it is higher, even better. If it is lower, you might need to do some more research to determine if the company may be in decline, which means the valuation may not be that attractive, or just out of favor, in which case, it might be a hidden bargain. This is easier said than done.

Third, going back to price-based ratios, the price-to-earnings growth (PEG) ratio, is often used to get an idea of how expensive a stock is based on future earnings growth. Generally, the lower the PEG ratio, the less you are paying for that earnings growth.

Finally, discounted cash flow analysis is fairly complicated, and requires several estimates that can be difficult to produce for a new investor (and even for us old investors), however, the theory is that by forecasting future earnings that a company might produce, and discounting them back to today’s dollars to account for inflation, and then putting in a rate of return that you are willing to accept, you can calculate a maximum price you should pay for those future earnings. Luckily, there are good online calculators, and even good websites, such as finbox.com and gurufocus.com that will do the discounted cash flow analysis for you and tell you what the answer is. They will even show the assumptions made as part of the analysis. It is also likely that many of the analyst estimates above take into account a discounted cash-flow analysis.

The final aspect of valuation you should think about is factor of safety. This essentially means because we likely don’t know everything about the company, what is likely to happen to the company, or even about what is likely going to happen in the broader market and economy, we should put a factor of safety against the valuation that we come up with. I typically use a 5-12% factor of safety against my valuations, to set the price I am willing to pay, based on how familiar I am with the company, and how confident I feel in the assumptions I had to make in the valuations.

Once I have determined a historically derived fair value, and a future derived fair value, and applied appropriate safety factors, I will then try to determine the ultimate price I am willing to pay. Before I purchase the stock though, there is one more step I use.

Simple measures of risk

If we have good companies that we understand well, that are high quality, and that we believe are fairly valued, what more do we need to think about before we invest our money in those companies? I like to check a few simple things, since there is always the possibility there could be some surprises that I haven’t found myself.

First, I check Seeking Alpha’s Factor Grades and Dividend Grades. I especially focus on those areas in the grades that are below average (C) since the grades are made relative to the sector of comparison. Just because they are low doesn’t necessarily mean it isn’t worthy of my investment, but I try to make sure the grade aligns with my understanding of the company, strategy, and prospects.

Second, I read recent articles on Seeking Alpha about the company. I try specifically to find articles on both sides: the Bull (positive) side, to see if the reasons they think the company merits investment match my own, as well as on the Bear (negative) side, to see if there is something I might have missed.

Third, I like to look at the current Short Interest, which basically shows how many other investors are betting the stock will go down in the future, instead of up. A high number here (this is another one where comparing to historical averages can be useful) can be a big red flag, and suggest you might want to wait for further developments.

A well-known secret practiced by the most successful investors related to investing success and risk mitigation is to be a lazy investor. You will rarely time an investment perfectly. You will have investments that go down significantly after you buy them. The worst thing you can do is to panic and sell your high-quality company at a discount to what you paid, the best thing you can potentially do is find some more money to buy the company while it is even more on sale – if it was that good of a deal when you bought it, it must be an even better one now that it’s on sale. One of the biggest destroyers of wealth, besides excessive fees, is letting noise impact your investing decisions, and therefore becoming a trader instead of an investor.

Ken Fischer said,

Time in the market beats timing the market – almost always.

Darcy Howe is attributed with saying,

[I]investing is like a bar of soap. The more you handle it, the smaller it gets.

Warren Buffett has often said,

Our favorite holding period is forever.

Summary

So, Dad, how do you invest in stocks? Investing isn’t very hard, and contrary to what I was originally taught, isn’t even that risky, when you have a strategy and approach it from the right mindset. It does very much help to have a solid financial and investment foundation. Ultimately, you are buying a piece of a real business that provides real products and / or services. If you understand the company, the company is high quality, the shares are fairly priced, and the risk appears to be low, you have likely found a great option to put your money to work. Perhaps the most important lesson though is the miracle of compounding. The longer you let a good investment grow, the bigger it will get, and it will get bigger in a non-linear manner. It sometimes takes an investment a while to turn out. Peter Lynch suggests his best ideas take between 3 and 10 years to play out many times. So, unless something drastic happens to change your initial opinion of the company, just hang on and enjoy the ride. The best batters and even the best investors never bat 1000.

Bonus – High-Quality Dividend Growth Valuations Update

Thank you for sticking with me for a simplistic primer in financial and investing acumen. I would love to hear any feedback or ideas you have for helping new investors learn to invest. I hope that my children will find this exercise of some value, and that they will be on a stronger initial foothold than I was when I started my journey many years ago.

If they do take up this challenge and complete the steps in my process, I will write future articles about what they invest in – I’m actually really interested myself to see if they provide me with a new perspective. I plan to offer very little guidance on the actual investments, just on the process to pick them. The only thing I plan to do as part of managing their custodial account is to have them explain to me any reasons for making changes. I want to train them to be long-term-focused investors, but I also do not want to rob them of learning through experience.

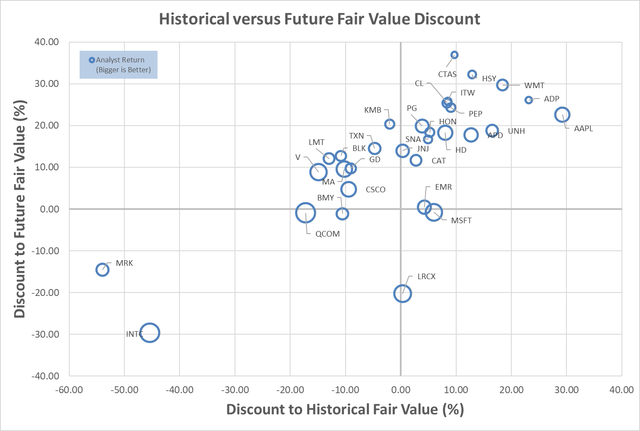

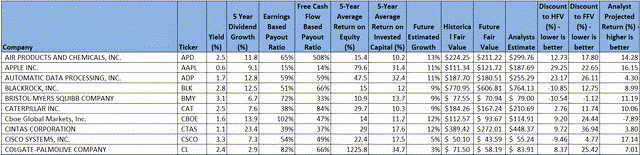

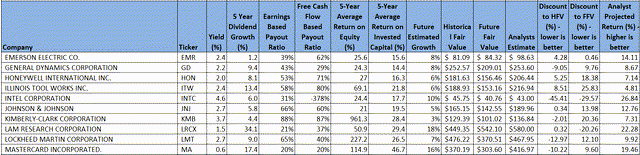

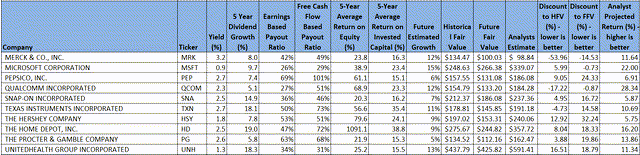

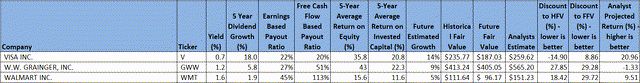

As a reward for sticking with me, I am including my most recent analysis of some of the highest quality, dividend growth stock valuations for the stocks I track, using some more sophisticated analysis and modeling than discussed above.

As I’ve described in previous articles, I like to calculate a fair value in two ways, using a Historical fair value estimation, and a future-looking fair value estimation. The Historical Fair Value is simply based on historical valuations. I compare 5-year average: dividend yield, P/E ratio, Schiller P/E ratio, P/Book, and P/FCF to the current values and calculate a composite value based on the historical averages. This gives an estimate of the value assuming the stock continues to perform as it has historically. I also want to understand how the stock is likely to perform in the future, so utilize the Finbox fair value calculated from their modeling, a Cap10 valuation model, FCF Payback Time valuation model, and 10-year earnings rate of return valuation model to determine a composite Future Fair Value estimate.

Additionally, I gather a composite target price from multiple analysts, including Reuters, Morningstar, Value Line, Finbox.com, Morgan Stanley, and Argus. I like to see how the current price compares to analyst estimates as another data point, and as somewhat of a sanity check to my own estimates.

Plotting three variables on one plot is tricky but using a bubble plot allows us to visualize three variables by plotting the Historical fair value versus the Future Fair Value on a standard x-y chart, and then use bubbles to represent the size of discount relative to analyst estimates.

Author calculation of Historical and Future Fair Value, analyst estimates

This chart is insightful once you understand how to interpret it. What we are looking for are stocks that are trading at a discount to both the Historical Fair Value and the Future Fair Value. So, those stocks that are farther to the left, and farther to the bottom, are potentially the stocks trading at the largest discount to fair value. This would be the bottom left quadrant of the graph. Additionally, those stocks with the biggest bubbles are the stocks that are trading at the largest discount to analyst estimates, so in theory, stocks in the lower left quadrant that also have large bubbles, should be very decent candidates for investment.

Based on the chart, Intel Corporation (INTC), Merck & Co Incorporated (MRK), QUALCOMM Incorporated (QCOM), and Bristol-Myers Squibb Company (BMY), all appear to be trading at discounts to both Historical and Future Fair Value estimates and may be good candidates for further investigation. Lam Research Corporation (LRCX) continues to be one of my favorites, and also looks to be attractively valued. You can read about the more in-depth analysis I did on Lam Research here, and get a feel for my normal articles. It is getting a little dated from a valuation perspective, but the strategy and business commentary are still relevant.

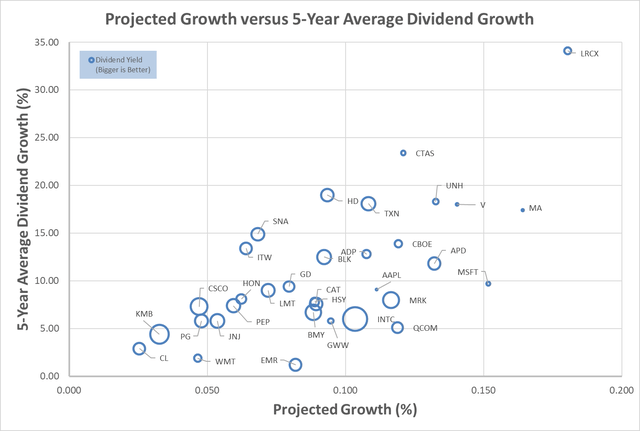

Being a dividend growth investor, I like to look for those companies that are growing strongly, offer a reasonable dividend yield, and also show the potential to continue the dividend growth. Let’s look at another chart that combines those. The projected growth is a composite growth estimate based on historical and future growth metrics including: 5-year average EBITDA growth, EBITDA 5-year growth forecast, 5-year average dividend growth, 5-year change in shares outstanding, Analyst long-term earnings growth forecasts, Forward Rate of Return forecast, and Net Income to Shareholder growth rate. I realize that this is quite the assortment of inputs, but I use all of them as indicators of future dividend growth and sustainability.

Projected Stock Growth, Dividend Growth and Yield (Finbox, Author’s Analysis)

To keep you on your toes, with this chart, we now want to look at the upper-right quadrant. We are looking for those companies that have the desirable combination of high dividend growth and high projected growth, so those farthest up and to the right. Additionally, the size of the bubble shows the relative current yield, with the larger bubbles belonging to companies with higher current yields. It isn’t a real surprise that many companies with the highest growth also have the lowest current yields, and lower growth companies are showing higher current yields. Companies that don’t fit this trend could potentially be overvalued (too small of a yield for the projected growth), companies that don’t really focus on their dividend, or companies that are currently undervalued (high growth coupled with high yield).

This chart also suggests that Bristol-Myers Squibb, Intel, and Merck could be especially good candidates for further investigation, combining reasonable historical dividend growth, with good projected business growth, and relatively high yields.

Here are tables of all of the above information, for those that prefer tables:

Finbox, Seeking Alpha, Author’s Analysis Finbox, Seeking Alpha, Author’s Analysis Finbox, Seeking Alpha, Author’s Analysis Finbox, Seeking Alpha, Author’s Analysis

Be the first to comment