PhonlamaiPhoto

Investment thesis

Texas Instruments Incorporated (NASDAQ:TXN) has been taking advantage of the supply shortage of semiconductors, and this shortage is expected to last until a new manufacturing capacity is built. I expect that the current high demand and low supply situation will last until 2025 when new factories start operating. Until then, TXN will be able to earn substantial revenue, and I expect strong cash flow. The company is not only stable but could be a great choice for income investors, especially after the expected fourth quarter 8.9% dividend increase. Due to the current semiconductor cycle stage, I am “buy” on TXN.

Semiconductor cycles affecting TXN

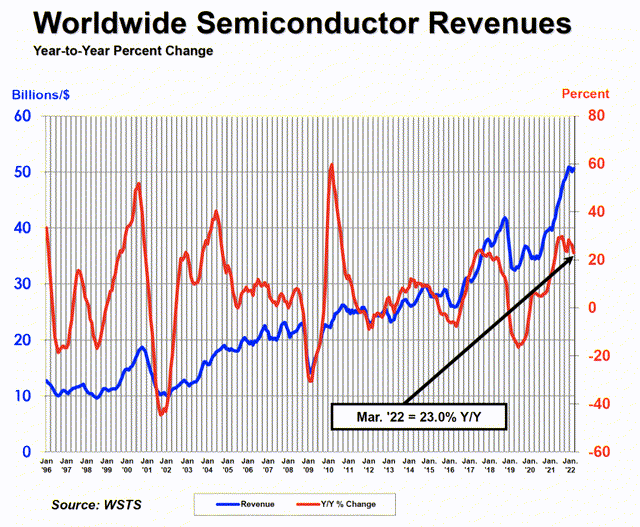

On the surface, the semiconductor industry is a great industry to be in, and as technology progresses, more and more semiconductors and chips will be needed. In addition, TXN is a stable company with huge parts of its revenue coming from growth markets, the company is planning a new factory in Texas and spends billions on R&D to keep up with the latest trends. But there are extreme swings in revenue even on a year-on-year basis. It is not uncommon that revenue doubles over a couple of years and then falls by 50% in upcoming years. This has been the case for decades and all semiconductor producers are well aware of it.

The end products usually experience slow and steady growth. In terms of supply-demand, the demand is almost fixed and increasing in the long term so the cycles form on the supply side. Demand has been increasing for decades so manufacturers increase capacity, but this sudden increase in supply (by building a new factory) causes prices to tank which leads to a 20-40% revenue decline. However, when the current capacity and the supply start to dry up and demand slowly increases, the price of semiconductors skyrockets, causing revenues to double in just a couple of years. To run a factory at 50% capacity or 100% capacity there is not much difference in costs because there are minimal variable costs. Due to this fact, it is still better to overproduce and sell at cheaper prices. However, this strategy increases the number of semiconductors in the marketplace which affects the whole semiconductor supply.

During the last bust cycle in 2014-2016 (not including the pandemic) semiconductor prices dropped by 20% in just 2 years. In the recent boom cycle from the second half of 2020, the prices have risen by 30-40% until now. This is great news for TXN as the company generated billions of dollars’ extra profit during this period. And despite that Citi cut estimates for TXN, I believe that until the new manufacturing capacities come into the market the boom cycle will remain. I agree with Citi analysts that the current boom cycle is not going to be as strong as in the previous 2 years, however, the record inflation, the slowly growing demand, and limited supply indicate to me that TXN is the right choice for the next 2-3 years.

Around 2025-2026, I expect that the boom cycle will be over and the bust cycle will begin as several new manufacturing units come to the market not just by TXN but by its peers as well. TXN’s peer Intel (INTC) announced new plants in Ohio, Arizona, and recently in Germany. However, this takes years of planning and construction but the operational dates are similar to TXN’s new factory. The Ohio plant is expected to make the first semiconductor in 2025. Construction of the first two factories is expected to begin late in 2022 and production in 2025. However, this might be delayed because part of the funding by the federal government depends on the Chips Act. All in all, looking at the current cycle it seems to me that TXN can still be a good choice for investors who are aware of the semiconductor cycles because I expect that the next bust cycle will begin around 2025.

Valuation

TXN could be called the typical industry average company based on its P/E ratio. Both its forward P/E ratio and its ttm P/E ratio almost matches the sector median and average. However, this does not mean that TXN is fairly valued. I believe the company is slightly undervalued based on its dividend yield and Graham valuation model. Calculating with $8.86 ttm EPS and a moderate 6% growth for the next 12 months the current price is approximately 15% undervalued and the fair value would be around $178-180.

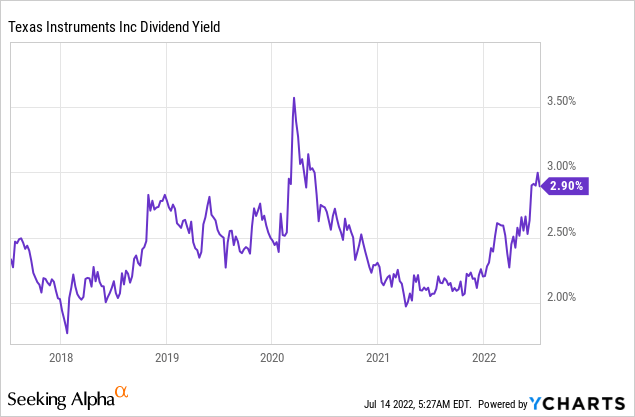

Based on its current dividend it is the best time to buy TXN because the dividend yield has not been this high in the last 12 months and also you could have only bought the company with a better than the current dividend yield of approximately 5% of the time in the last 5 years. Taking into consideration that the current semiconductor cycle is still in its growth phase this further supports my slight undervaluation theory. The industry is in its growth stage due to chip shortage because of limited manufacturing capacity. TXN’s new factory is expected to be operational by 2025 and the first products will start pouring into the market in the first half of 2025.

Company-specific Risks

There are several smaller risk factors for TXN in the upcoming years such as the geopolitical risks in the China-Taiwan region, as a substantial part of their revenue comes from that region. In addition, very high inflation and supply chain issues will remain a risk factor in the next 1-2 years in my opinion. But the biggest risk for investors buying TXN is if the semiconductor industry can grow the supply faster than expected. The demand might currently be flat for the next half year but then as usual it will return to slow and gradual growth. However, the new factories and investment announcements will add significant capacity and could increase the risk of overcapacity beyond 2023. If these factories start making products and flood the market with new products the boom cycle might end sooner than I expected.

My take on TXN’s dividend

Texas Instruments is a great target for income investors looking for security in a growing industry. The management has been raising the dividend for almost 20 consecutive years and they are on a good path to becoming a dividend champion company. The company also has a 32-year consecutive dividend paying history. This is not uncommon in the semiconductor industry where the demand is constantly growing in the long term. The company has positioned itself to the higher CAGR markets which make the dividend even safer. The payout ratio is slightly higher than the 5-year average but the dividend coverage is still at sustainable levels. In addition, there is room for future increases. The management usually announces the dividend increase in the fourth quarter and I expect them to do the same in 2022 as well. Analysts estimate an 8.9% increase in 2022 which would mean a $1.28 dividend per share quarterly. Calculating with the current price (because I do not expect much price appreciation in the next months due to the general market conditions) this would mean a forward dividend yield of 3.3%.

Final thoughts

I believe that TXN could be the right choice for two types of investors. It can be a great choice for income-seeking investors who want to capitalize on long-term strong dividend growth, possibly with above-inflation dividend increases. And it can also be a good choice for investors who are willing to take a bit more risk and want to capitalize on the recent price drop and believe that the current semiconductor cycle will remain until 2025. I believe that the current cycle will last until 2025, when several companies will come in with massive manufacturing capacity. Until then I am buy on TXN.

Be the first to comment