JannHuizenga/iStock Unreleased via Getty Images

By Valuentum Analysts

The Coca-Cola Company (NYSE:KO) is a great company backed up by a well-known stable of brands. In recent years, Coca-Cola has transitioned from having approximately 400 brands to roughly 200 brands as part of its goal to place a greater emphasis on brands and products with promising growth outlooks. The company is focused on growing its sales of ready-to-drink coffee and tea products, soda, sports drinks, sparkling flavored drinks, juice, and even alcoholic beverages (particularly hard seltzer and spiked juice drinks).

In February 2022, Coca-Cola announced a 5% sequential increase in its quarterly dividend, which marked its 60th consecutive year of payout increases. We are big fans of this Dividend Aristocrat’s stellar cash flow generating abilities and its commitment to income seeking shareholders, though shares of Coca-Cola are quite pricy at current levels. Shares of KO yield ~2.7% as of this writing.

Financial Overview

Keeping in mind Coca-Cola’s financial performance took a hit in 2020 due to the coronavirus (‘COVID-19’) pandemic, the company had a GAAP gross margin of 60.3% and a GAAP operating margin of 26.7% in 2021 versus a GAAP gross margin of 60.8% and a GAAP operating margin of 27.1% in 2019. Coca-Cola’s GAAP revenues grew by 4% and its GAAP operating income grew by 2% from 2019 to 2021. Underlying demand for Coca-Cola’s offerings remains strong.

After pursuing a strategy of “refranchising” its bottling operations (effectively spinning off or divesting these assets), Coca-Cola has become a stellar free cash flow generator due to its reduced capital intensity (defining free cash flows as net operating cash flows less capital expenditures). The company’s annual free cash flows averaged $9.4 billion from 2019-2021.

In 2021, Coca-Cola generated over $12.6 billion in net operating cash flow while spending under $1.4 billion on its capital expenditures, allowing for almost $11.3 billion in free cash flow. Coca-Cola spent $7.3 billion covering its dividend obligations in 2021 and an additional $0.1 billion buying back its stock, activities that were fully covered by its free cash flows.

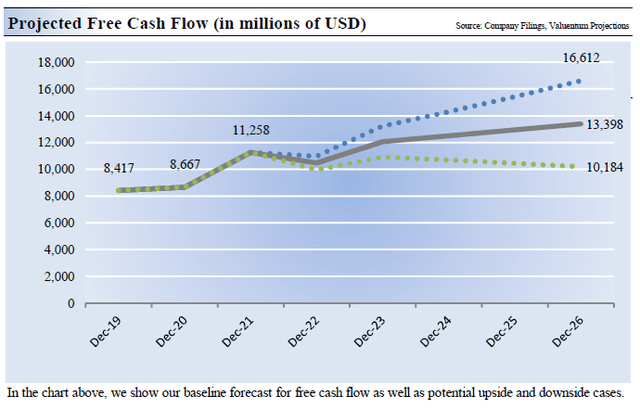

One of the reasons why shares of Coca-Cola have performed so well over the past year is due to the firm’s ability to generate substantial cash flows in almost any operating environment. Under our “base” case scenario, we forecast that Coca-Cola’s free cash flows will grow by a 3.5% CAGR over the next five full years to reach ~$13.4 billion by 2026. There is room for upside (the blue dots) and downside (the green dots) to this forecast, as you can see in the upcoming graphic down below. Growing its free cash flows is how Coca-Cola can continue to sustainably grow its dividend.

Coca-Cola’s free cash flow generating abilities are stellar. (Valuentum Securities)

During Coca-Cola’s fourth quarter of 2021 earnings call, management issued out favorable guidance for 2022:

We expect to generate approximately $10.5 billion of free cash flow of 2022 through approximately $12 billion in cash from operations, less approximately $1.5 billion in capital investments. This implies the fourth consecutive year of free cash flow conversion above our long-term range of 90% to 95%. We continue to raise the performance bar across the organization and are confident in delivering on this 2022 guidance. — John Murphy, EVP and CFO of Coca-Cola

We appreciate that Coca-Cola expects it will remain a free cash flow cow this year in the face of sizable exogenous shocks.

Adjusting The Business

In March 2022, Coca-Cola announced it was suspending its business in Russia after the country invaded Ukraine. The Ukraine-Russia crisis has exasperated already substantial inflationary pressures. These inflationary pressures along with supply chain hurdles are weighing negatively on Coca-Cola’s business, which the company seeks to offset by passing those costs along to consumers while investing in productivity enhancing projects. Here is what Coca-Cola had to say on these issues during its fourth quarter of 2021 earnings call:

There are several considerations to keep in mind for 2022. Overall, inflationary and supply chain pressures continue to impact costs across several fronts in the business, including input costs, transportation, marketing and operating expenses.

With regards to commodity costs, after benefiting from our hedging strategy in 2021, we remain well hedged in 2022, but at higher levels. Based on current rates and hedge positions, we continue to expect commodity price inflation to have a mid-single-digit impact on comparable cost of goods sold in 2022. However, we are taking actions in the marketplace using multiple levers, including RGM [revenue growth management] in its many forms, along with our productivity initiatives, to help offset much of the impact. – John Murphy, EVP and CFO of Coca-Cola

Management noted during the earnings call that Coca-Cola was pursuing targeted pricing increases and taking advantage of its brand strength to do so.

New Product Launches Underpin Growth Runway

The launch of new products such as Topo Chico, an alcoholic hard seltzer beverage made in partnership with Molson Coors Beverage Co (TAP), supports Coca-Cola’s revenue growth outlook. Topo Chico is a sparkling mineral water brand that is being leveraged by Coca-Cola to push into the alcoholic beverage space. Coca-Cola is also working with Molson Coors on developing an alcoholic beverage using its Simply juice brand.

In November 2021, Coca-Cola announced it would acquire the remaining 85% stake in sports beverage company BODYARMOR that it did not already own for $5.6 billion after taking a 15% stake in the firm back in 2018 (the second part of this deal closed in the final quarter of last year). At the start of 2019, Coca-Cola closed its acquisition of Costa Limited for ~$4.9 billion and has been steadily expanding the reach of Costa’s ready-to-drink coffee products ever since. Acquisitions favorably augment Coca-Cola’s growth runway.

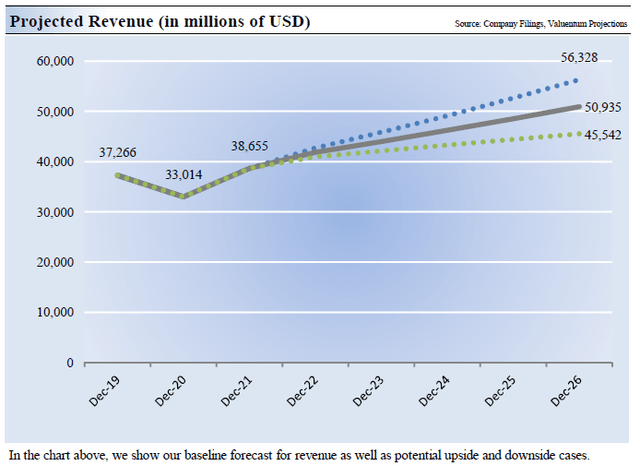

Sports drinks, ready-to-drink coffee and tea beverages, and alcoholic beverages represent key growth opportunities for Coca-Cola. We forecast that Coca-Cola will grow its revenues by a 5.7% CAGR through 2026 to reach ~$50.9 billion under our base case scenario. This will be achieved through pricing power, new product launches, and organic sales volume growth as the firm takes advantage of the uplift the recovering global economy and the resumption of activities that encourage soda consumption such as sporting events and going to the movie theater.

We forecast that Coca-Cola will steadily grow its revenues over the coming years. (Valuentum Securities)

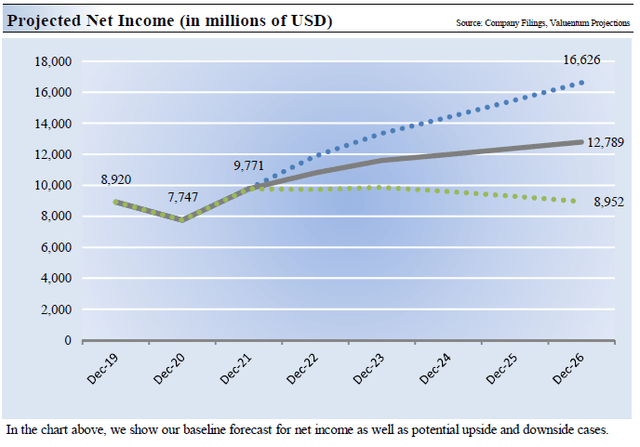

Due to its brand strength and related pricing power along with improving economies of scale, we expect Coca-Cola will steadily grow its earnings by a 5.5% CAGR through 2026. However, should inflationary pressures prove to be harsher than expected or should the global economy tip into a recession, then Coca-Cola would find it difficult to grow its bottom-line during this period.

We forecast that Coca-Cola will grow its earnings at a nice clip through 2026. (Valuentum Securities)

Valuation Analysis

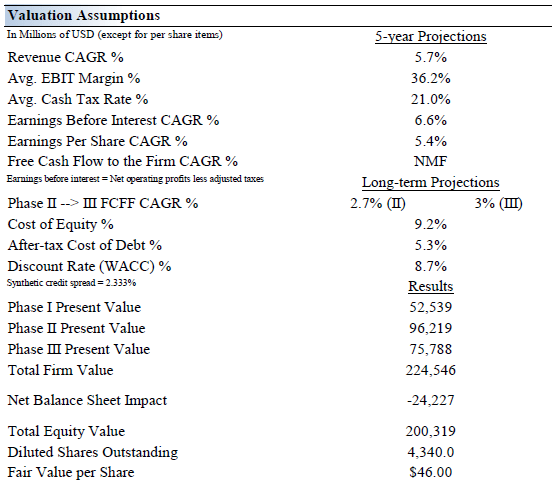

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows. The upcoming graphic down below highlights the key valuation assumptions we used to obtain our fair value estimate for Coca-Cola under our base case scenario.

An overview of the key valuation assumptions we used in our base case scenario covering Coca-Cola. (Valuentum)

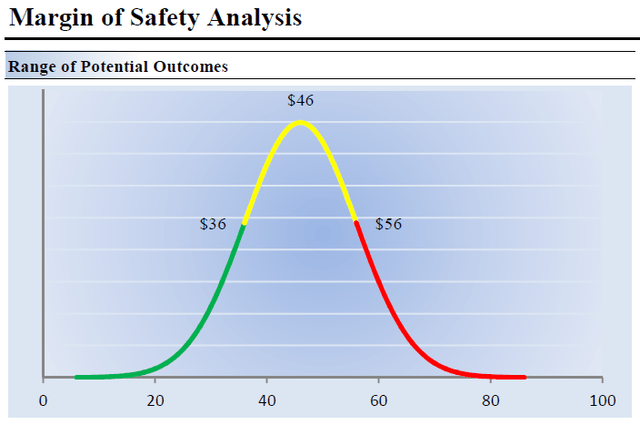

Although we estimate Coca-Cola’s fair value at about $46 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values. In the upcoming graphic down below, we show this probable range of fair values for Coca-Cola. We think the firm is attractive below $36 per share (the green line), but quite expensive above $56 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

Shares of Coca-Cola look pricey at current levels as they are trading well above the top end of our fair value estimate range. (Valuentum Securities)

Coca-Cola intends to spend $0.5 billion buying back its stock in 2022. Considering that shares of KO are trading well above their intrinsic value as of this writing and that Coca-Cola has a sizable net debt load on the books, we think that management should instead pay down debt. Share buybacks at current levels are destroying shareholder capital.

Concluding Thoughts

As an income generation opportunity, Coca-Cola has a lot to offer investors and its stellar dividend track record speaks for itself. There are not many companies out there that are Dividend Aristocrats, let alone Dividend Aristocrats with six decades of consecutive payout increases. However, Coca-Cola’s stock looks pricey at current levels. We are staying on the sidelines for now and we are keeping Coca-Cola on our radar in case shares fall back down to Earth. Coca-Cola is a great enterprise, but even under optimistic valuation assumptions its current share price is still quite lofty.

Be the first to comment