EtiAmmos/iStock via Getty Images

Elevator Pitch

My Buy investment rating for TDCX Inc.’s (NYSE:TDCX) stock stays unchanged.

I previously published an initiation article for TDCX on May 31, 2022. In this latest update for the stock, I review the company’s recent quarterly results. My Buy rating for TDCX has been maintained, after taking into account TDCX’s EPS beat for Q2 2022 and its unchanged FY 2022 guidance.

Excellent Financial Performance In The Recent Quarter

TDCX issued the company’s Q2 2022 earnings media release on August 24, 2022 prior to trading hours.

Its stock price jumped by +18% from $7.05 as of August 23, 2022 to $8.33 as of August 24, 2022. The company’s shares increased by an additional +14% in the next two trading days to end the August 26, 2022 trading day at $9.49. In other words, TDCX’s share price has gone up by +35% in the three days following its most recent quarterly financial results announcement. The market’s favorable reaction is a clear indication that investors have a positive view of TDCX’s Q2 2022 financial performance.

Revenue for TDCX grew by +23% YoY from $95 million in the second quarter of 2021 to $117 million in Q2 2022, which turned out to be +2% higher than the sell-side’s consensus top line projection of $114.5 million. I will discuss about the key revenue growth drivers for TDCX in greater detail in the subsequent sections of this article.

TDCX’s non-GAAP adjusted earnings per share or EPS of $0.15 for the second quarter of the current year was +22% better than the analysts’ consensus bottom line forecast.

The company’s strong EPS growth in the recent quarter was the result of an improvement in profitability. TDCX’s non-GAAP adjusted net profit margin expanded by +1.4 percentage points YoY from 17.8% in Q2 2021 to 19.2% for the recent quarter. Besides positive operating leverage effects driven by its top line expansion, the company also benefited from debt repayment and the resulting decrease in interest expenses. In local currency terms (SGD), TDCX’s interest costs contracted by -83% YoY to SGD0.5 million (or $0.3 million).

Travel Recovery Play

TDCX was a beneficiary of the recovery in the travel & hospitality sector for Q2 2022.

The company revealed at its Q2 2022 results briefing on August 24, 2022 that the revenue contribution from its travel & hospitality vertical (i.e. airline customer) increased by +25% YoY in the recent quarter. Notably, the travel & hospitality vertical’s second-quarter sales were still -16% lower as compared to pre-pandemic levels, implying that there is lots of room for further growth and recovery for this specific vertical.

TDCX also highlighted certain indicators pointing to the positive impact of the travel & hospitality sector’s recovery on the company in its Q2 2022 financial results press release. The company mentioned that it witnessed “an increase in business volumes from a client in the travel and hospitality vertical” for its content, trust and safety services segment in Q2, and noted that “a leading regional airline (in Southeast Asia)” was one of its new customer wins for the recent quarter.

New Client Wins And Concentration Risks

New customer additions were another key top line expansion driver for TDCX.

TDCX secured 15 new clients in the second quarter of 2022, which represented a +50% increase in QoQ terms. On a YoY basis, the company’s 25 new client additions for the first half of 2022 was equivalent to a +213% increase as compared to its 8 new customer wins for 1H 2021.

The addition of new clients isn’t just about growing TDCX’s future revenue; it also helps to diversify the company’s customer base and reduce concentration risks. At its recent quarterly earnings call, TDCX disclosed that the revenue contributed by its two largest customers as a proportion of its total revenue has decreased from 63% in Q2 2021 to 57% in Q2 2022.

Apart from the expansion of its customer base, the moderation in the pace of growth for the company’s two top clients is another factor contributing to the lower customer concentration. Looking ahead, TDCX should be able to accelerate its top line expansion while reducing client concentration risks, as it continues to add new customers boasting superior growth outlooks.

Reiteration Of FY 2022 Guidance Was A Positive Surprise

In my end-May 2022 initiation article for TDCX, I highlighted that “both TDCX and its clients are faced with slower revenue growth prospects in the short term”, considering the “receding of Work-From-Home tailwinds” and its impact on the company’s new-economy customers. As such, there were worries that the company might slash its top line and bottom line guidance for the full year when it announces Q2 2022 results.

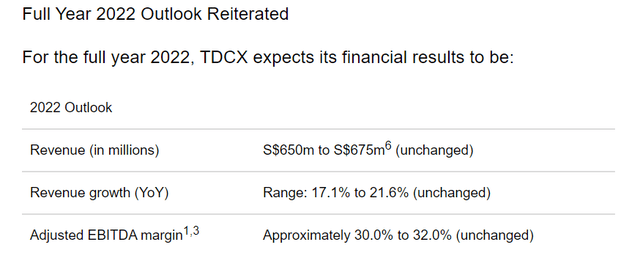

TDCX’s Full-Year FY 2022 Management Guidance

TDCX’s Q2 2022 Earnings Press Release

But TDCX had sufficient confidence in the company’s near-term prospects to maintain its fiscal 2022 guidance as highlighted in the chart above. The company explained at its Q2 2022 results call that its good Q2 2022 results and the significant number of new client wins in the recent quarter were the key reasons for reiterating current guidance.

Moving ahead, there is a good chance that TDCX’s future revenue growth might come in above expectations thanks to mergers & acquisitions or M&As. TDCX shared at its recent second-quarter investor briefing that “we’re quite certain on a number of (M&A) targets that I hope we’ll bring to your attention soon.” Therefore, it is likely that there could possibly be a string of acquisition announcements for TDCX in the coming months, which will boost its intermediate-term growth outlook.

Closing Thoughts

I continue to rate TDCX as a Buy. TDCX’s above-expectations Q2 2022 earnings and its reiteration of FY 2022 guidance are encouraging, and I see no reason to change my bullish view of the name.

Be the first to comment