Leestat

“Capitalism believes that its remit is exclusively to make maximum short-term profits.” – Jeremy Grantham

Looking at the upcoming destruction of European economies thanks to “energy woes” or “rogue wave” (a subject we are very fond off), setting up energy cap prices in some instances as winter will no doubt generate “social tensions” to say the least, we reminded ourselves when it came to choosing our title analogy of our The Law of The General Maximum. The Law of the General Maximum (French: Loi du Maximum général) was instituted during the French Revolution on 29 September 1793, setting price limits and punishing price gouging to attempt to ensure the continued supply of food to the French capital.

Also “old readers” of our musings might remember that we already discussed our “pre-revolutionary mindset” back in 2016 in our conversation “The Law of Maximum“:

“The Law of the Maximum was a law created during the course of the French Revolution as an extension of the Law of Suspects on 29th September, 1793. It succeeded the 4th May, 1793, “loi du maximum”, which had the same purpose: setting price limits, deterring price gouging, and allowing for the continued flow of food supply to the people of France. Numerous food crisis during the French Revolution which led to speculation on a grand scale were linked to the “inflationary” bias of the much-dreaded heavy issuance of “assignats” which lost rapidly their value, a subject we discussed in our previous conversations. According to Andrew Dickson White, Professor of History at Cornell, the ever-greater and ultimately uncontrolled issuance of paper money authorized by the National Assembly was at the root of France’s economic failure and most certainly the cause of its increasingly rampant inflation. This is as well confirmed by French economist Florin Aftalion 1987 in his seminal book entitled “The French Revolution – An Economic Interpretation” we have been quoting as of late.

What we find of interest with our title, from a historical perspective, is that with the repeal of “The Law of The Maximum” in December of 1794 came inflation, mass economic strife and riots that ultimately lead to the rise of the Directory and the end of the Thermidorian period. As per our last conversation, not only did “The Cult of the Supreme Being” contributed to the Thermidorian Reaction and the ultimate demise of Maximilien Robespierre, its instigator, but “The Law of the Maximum” was as well an important factor. By now, you probably understand our “pre-revolutionary” mindset when it comes to the selection of our recent title analogies. We would posit that NIRP, to some extent, is akin to “The Law of the Maximum” and creating as such a very strong “hoarding” mentality, leading to the unintended consequence for some consumers to increase their savings and company to delay “investing”. In our last conversation, we argued, while as well the Law of the Maximum encourages even more the search for short-term profits as highlighted above in our introductory Jeremy Grantham quote:

“No offense to the Supreme Being Cult members out there, but, in our book, NIRP is insanity as there cannot be productivity and economic growth without accumulation of capital, because simply put, NIRP is killing capital (savings).”- Source: Macronomics, August 2016 »

As such, we are not surprised in seeing price cap being set not only for energy prices in Europe but, as well, like in Denmark, price cap for rents. We find it “entertaining” because price controls have had a very long but not very successful history. Price controls distort the working of the market and lead to oversupply or shortage. They exacerbate problems rather than solve them. In France, owners of poorly insulated housing can no longer increase their rent, i.e. 17% of the stock. The demagogic interventionism of the French State will make the housing situation in France even worse, in particular given the current lack of supply and construction. We rest our case. But, as always, politicians want to be seen as “doing something” against “inflation”. Spoiler, it never ends well.

In this conversation, we would like to look again at the importance of stocks versus flows, not only from a macro and credit perspective but as well from an “energy” perspective as well we remind ourselves of the inability of mankind to comprehend power laws, or “rogue waves” in terms of “risk management”, a subject we covered back in the days in two of our most important conversations “The Worship of Mammon” and “The Disappearance of MS Munchen“

- Understanding “Stocks versus Flows is paramount

A key understanding for “macro issues”, credit issues and even energy woes come from understanding the difference between “stocks” and “flows”. This a very important concept, namely the accounting principles of “stocks” versus “flows”. We have used this core principle in the past when assessing the issues plaguing Europe versus the United States as per our September 2012 conversation “Zemblanity“:

“We mentioned the problem of stocks and flows and the difference between the ECB and the Fed in our conversation “The European issue of circularity“, given that while the Fed has been financing “stocks” (mortgages), while the ECB is financing “flows” (deficits). We do not know when European deficits will end, until a clear reduction of the deficits is seen, therefore the ECB liabilities will have to depreciate.” – Macronomics, September 2012

Back in September 2015, we pointed out the following in our long conversation “Availability heuristic”:

“Before we delve more into the nitty-gritty of our second point, it is important, we think to remind our readers of what is behind our thought process of the “stocks” versus “flows” macro approach. We encountered previously through our readings an essential post dealing with our core concept of “stocks versus “flows” from Mr Michael Biggs and Mr Thomas Mayer on voxeu.org entitled – How central banks contributed to the financial crisis which explains precisely why both Friedman, Keynes and the central banks have been behind the curve in preventing the previous financial crisis and potentially the next one:

“We have argued at some length in the past that because credit growth is a stock variable and domestic demand is a flow variable, the conventional approach of comparing credit growth with demand growth is flawed (see for example Biggs et al. 2010a, 2010b). To see this, assume that all spending is credit financed. Then total spending in a year would be equal to total new borrowing. Debt in any year changes by the amount of new borrowing, which means that spending is equal to the change in debt. And if spending is equal to the change in debt, then the change in spending is equal to the change in the change in debt (i.e. the second derivative of the development of debt). Spending growth, in other words, should be related not to credit growth, but rather the change in credit growth.

We have called the change in debt (or the change in credit growth) the ‘credit impulse’. The credit impulse is effectively the private sector equivalent of the fiscal impulse, and the analogy might make the reasoning clearer. The measure of fiscal policy used to estimate the impact on spending growth is not new borrowing (the budget deficit), but rather the change in new borrowing (the fiscal impulse). We argue that this is equally true for private sector credit.”- Mr Michael Biggs and Mr Thomas Mayer on voxeu.org »

As well, the approach comparing stocks versus flows can be applied when one looks at the current energy “rogue wave hitting Europe.

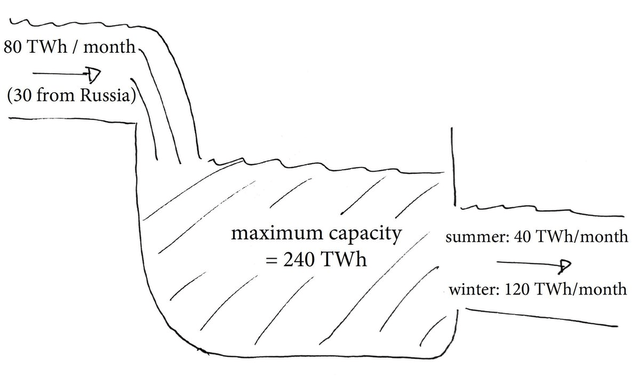

We have heard many pundits mentioning the growing gas stock reserves in Europe which should enable large parts of Europe to sail through an upcoming “treacherous” winter. This prognosis from a stock versus flow approach is deeply flawed.

If global economy hits recession and natural gas flows do not recover, Europe is doomed and heading towards “depression”. Russian gas flows into Europe have been much, much lower than at least the 2015-2021 high/low range. As well, LNG imports are currently constrained by capacity and availability. Nordstream 1 has been halted for maintenance. At current rate of 33 mcm/d (already much lower than the usual 162 mcm/d), Germany will need to look for at least 4 bcm of Natural Gas from somewhere else.

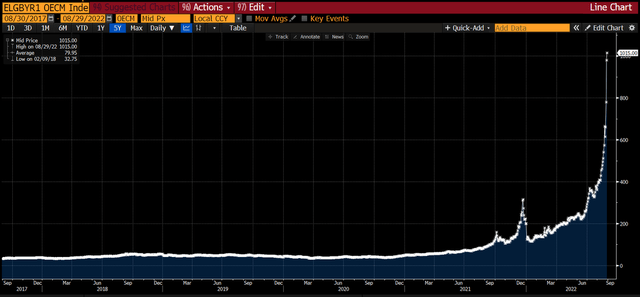

German power for next year broke through the €1,000 per MWh level for the first time as the European energy crisis intensifies towards total destruction:

Electricity prices (Bloomberg – Twitter)

We already touched on the subject of “Rogue Waves” in our conversation “the Italian Peregrine soliton,” being an analytical solution to the nonlinear Schrödinger equation (which was proposed by Howell Peregrine in 1983), and being as well “an attractive hypothesis” to explain the formation of those waves which have a high amplitude and may appear from nowhere and disappear without a trace, the latest surge in Energy prices in Europe have drawn us towards the analogy of the 1991 “Perfect Storm”. Generally rogues waves require longer time to form, as their growth rate has a power law rather than an exponential one. They also need special conditions to be created such as powerful hurricanes or in the case of Europe, tremendous inflationary forces at play when it comes to the very significant surge in energy prices and stupid past energy policies when it comes to nuclear energy. We already touched on this.

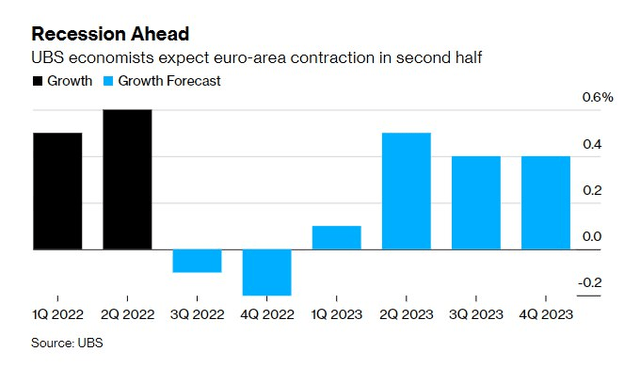

Europe is in big trouble:

UBS Forecast (Bloomberg – Twitter)

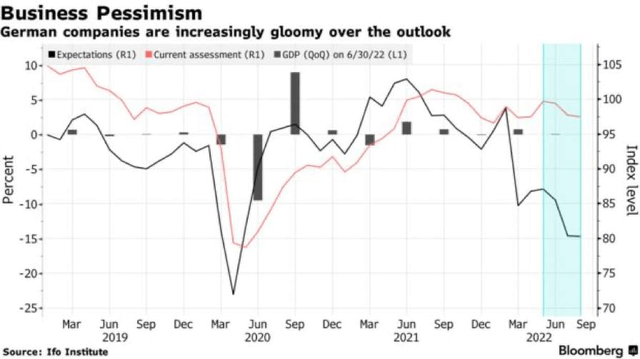

German IFO in the doldrums:

Business confidence (Bloomberg – Twitter)

ING on latest German Ifo numbers:

“Today’s Ifo index adds to the long list of evidence that the German economy is sliding into a winter recession. The question no longer seems to be if it will be a recession. The only question is how severe and how long that recession will be.”

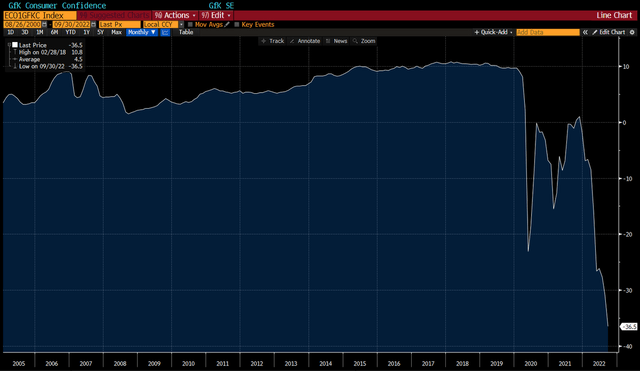

GERMANY SEPT. GFK CONSUMER CONFIDENCE INDEX -36.5 (record low); EST. -32.0 – BBG

German Consumer Confidence (Bloomberg – Twitter)

While a 12-meter wave in the usual “linear” model would have a breaking force of 6 metric tons per square metre (MT/m2), although modern ships are designed to tolerate a breaking wave of 15 MT/m2, a rogue wave can dwarf both of these figures with a breaking force of 100 MT/m2. Of course, for such “freak” phenomenon to occur, you need no doubt special conditions, such as the conjunction of fast rising inflation (high winds), global tightening financial conditions and falling consumer confidence (falling pressure towards 940 MB), as well as fast rising energy prices and defaults (swell). So if you think having a 99% interval of confidence in the calibration of you VaR model will protect you against multiple “Rogue Waves,” think again…

When it comes to “stock versus flows” applied to “energy woes” we agree with Alexander Stahel’s take on Twitter:

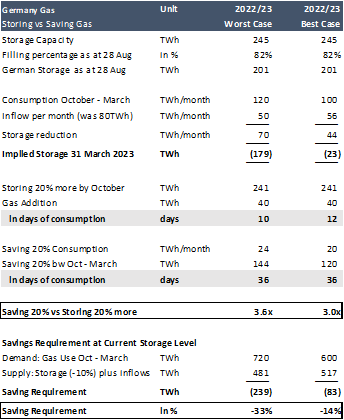

“Saving gas is 3x more important than filling storages. Germany (below; by extension most of EU) needs 3x more gas in winter than it has storage. With 80% reduced NS1 flows, GER must save up to 33% of gas & subject to LNG inflows (Feb regas terminals?) & temperatures. »

Gas needed (Alexander Stahel – Twitter)

Here is in full display the energy “rogue wave” currently hitting Europe:

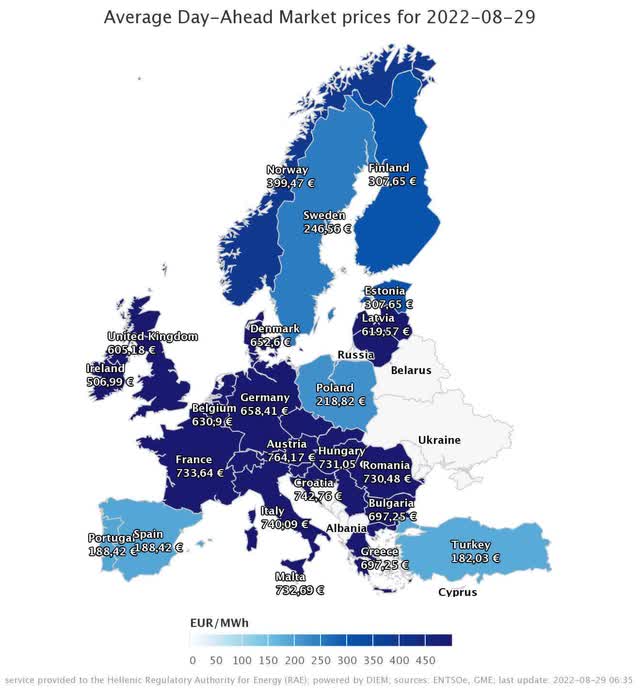

« MAP OF THE DAY: Wholesale day-ahead electricity prices breaching the €700 per MWh barrier in multiple European countries today. Two years ago, the typical price was less than €50 per MWh. These are prices paid for **today’s electricity** »

Europe Electricity prices (Bloomberg – Twitter)

Stocks versus Flows when it comes to Energy woes as correctly explained by Josh Young on Twitter:

“Static vs Flows” is why Europe is facing an energy crisis despite high current natural gas storage levels. The macro tourist crowd continues to get oil and gas wrong.”

In similar fashion, credit growth is a stock variable and domestic demand is a flow variable. You can have a highly leveraged company with a high level of debt (stock) perfectly able to operate thanks to rising free cash flow (flows). For illustration purposes we have argued in the past for our readers at OHM Research that coal would stage a come-back, regardless of the “hate” coming from the ESG cult. As such we recommended piling onto leveraged company Peabody Energy Corporation (BTU) as well as less volatile and leveraged Alliance Resource Partners, L.P. (ARLP) in December 2020 but we are rambling again.

- Europe’s Energy Rogue Wave and the US Dollar problem

We have in the past in a part 2 conversation “Availability heuristic” from September 2015 argued the following: the liabilities structure of industrial countries is mainly made up of debt (they are “short debt”), in particular in Japan, the US and the UK. In contrast, the international balance sheet structure of emerging markets is typically composed of equity liabilities (“short equity”), which is the counterpart of strong FDI inflows that contributed to improve emerging markets’ external profile in the last decade. With a rising US dollar, what has been playing out is a reverse of these imbalances hence our “macro reverse osmosis”. This is the theory we put forward in terms of basic biology simple analogy at the time of our past musings:

“In a normal “macro” osmosis process, the investors naturally move from an area of low solvency concentration (High Default Perceived Potential), through capital flows, to an area of high solvency concentration (Low Default Perceived Potential). The movement of the investor is driven to reduce the pressure from negative interest rates on returns by pouring capital on high yielding assets courtesy of low rates volatility and putting on significant carry trades, generating osmotic pressure and “positive asset correlations” in the process. Applying an external pressure to reverse the natural flow of capital with US rates moving back into positive real interest rates territory, thus, is reverse “macro” osmosis we think. Positive US real rates therefore lead to a hypertonic surrounding in our “macro” reverse osmosis process, therefore preventing Emerging Markets in stemming capital outflows at the moment.” – Macronomics, August 2013.

Following on our “stocks versus flows” approach, one could argue in a simplified way that the United States US dollar “exorbitant privilege” (with most commodities priced in dollar) enables the US economy to operate without “working capital”, like a Walmart of the world because customers pay upfront.

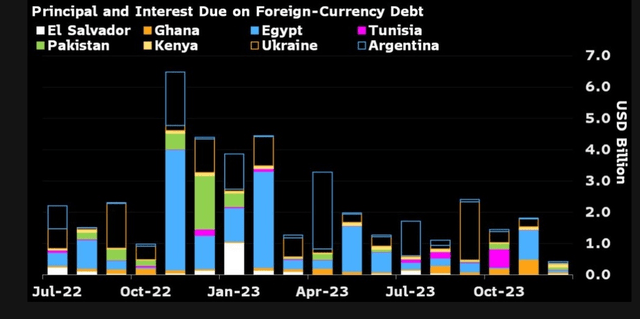

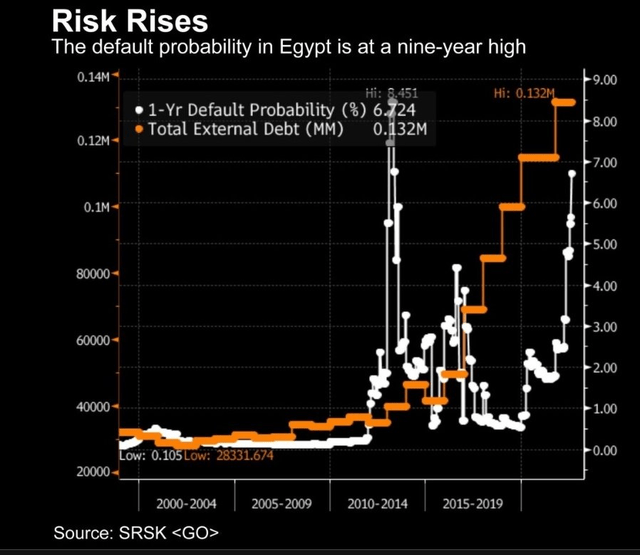

As such, Emerging Markets are deeply vulnerable to a surge of Mack The Knife (Positive Real Rates + US Dollar) which can in effect rapidly “wipe out” their hard earned US Dollar FX Reserves leading towards default for some (Sri Lanka and many more):

Debt profile of selected EMs (Bloomberg) Egypt Default Risk (Bloomberg)

Given the rise of the US Dollar and the current crisis coming from the sanctions onto Russia, and the Fed rate hikes, no wonder Emerging Markets FX Reserves are taking a hit as indicated by professor Steve Hanke:

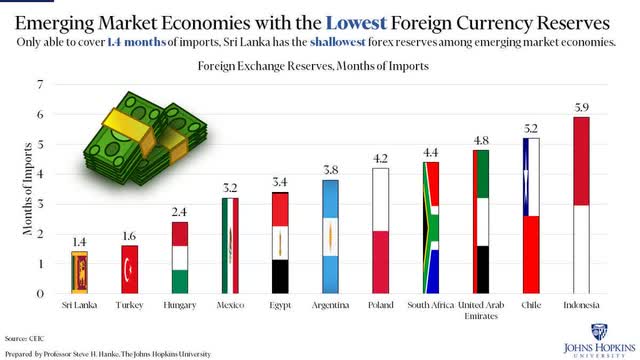

« Due to ill-advised sanctions on Russia, the costs of oil and grain imports have skyrocketed. As a result, emerging market economies are rapidly burning through their foreign currency reserves. Take a look at the EMEs that are running low on FX reserves. »

EMs FX Reserves (Twitter – Professor Hanke)

On a final note, we read with great interest, the latest note from Zoltan Poszar from Crédit Suisse entitled “War and Industrial Policies“:

“Finally, uninvestability means that for certain large countries in the global East, it makes absolutely and categorically no logical sense to roll their investments in G7 debt claims. Not just because of what happened to Russia’s FX reserves, but also because rolling a $1 trillion portfolio of U.S. Treasury securities means that you will fund the West’s effort to re-arm, re-shore, re-stock, and re-wire… …against the East” – Zoltan Poszar – Crédit Suisse

We agree with Zoltan Poszar that food and energy shortages are looming and as such commodity inventories will take off like FX reserves did after the 1997 crisis. Stocks versus flows but this time for commodities, not FX Reserves:

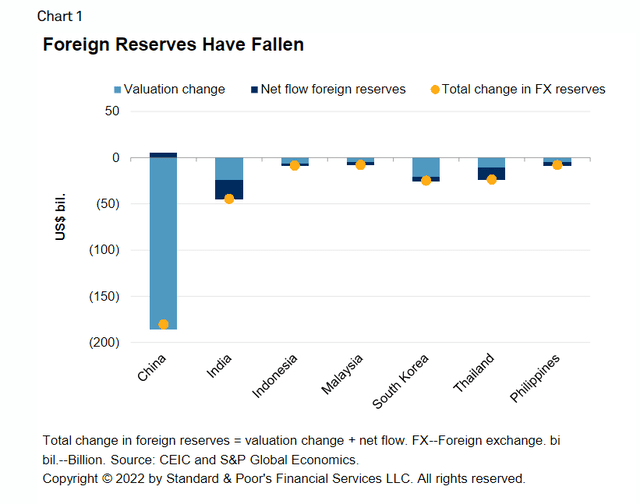

“Foreign reserves have declined in Asian emerging market economies in 2022, even though currency depreciation has alleviated much of the strain on foreign exchange markets.”

S&P Asian FX reserves (Twitter)

Demand globally for oil is extremely high while supply is tight. A lot of countries are selling their FX reserves to keep oil prices from ripping their economy apart.

Seizing the assets of the Russian central banks will no doubt create a headache for the European Union given the existing large stock of European debt which was as well financed (flow wise) from commodities players like Russia, buying European Government debt instruments, leading to a record current account surplus for Germany thanks to “cheap” energy. Now that “energy” isn’t “cheap” anymore and that Germany’s large current account surplus has “vanished”, we don’t see how the ECB will be able to support and prop up the Euro (new tool or not). We also wonder how European politicians are going to navigate these treacherous waters full of “rogue waves”…

“Every wave, regardless of how high and forceful it crests, must eventually collapse within itself.” – Stefan Zweig

Be the first to comment