bfk92/E+ via Getty Images

Eco Wave Power (NASDAQ:WAVE) is a Swedish-Israeli developer looking to commercialize a design to harvest electricity from the movement of the sea and ocean waves. Wave power has not yet been successfully commercialized, though Eco Wave Power believes that its system can change that. This article will offer an overview of the company’s product and risks to determine if it is a quality investment.

Technology Overview and Development

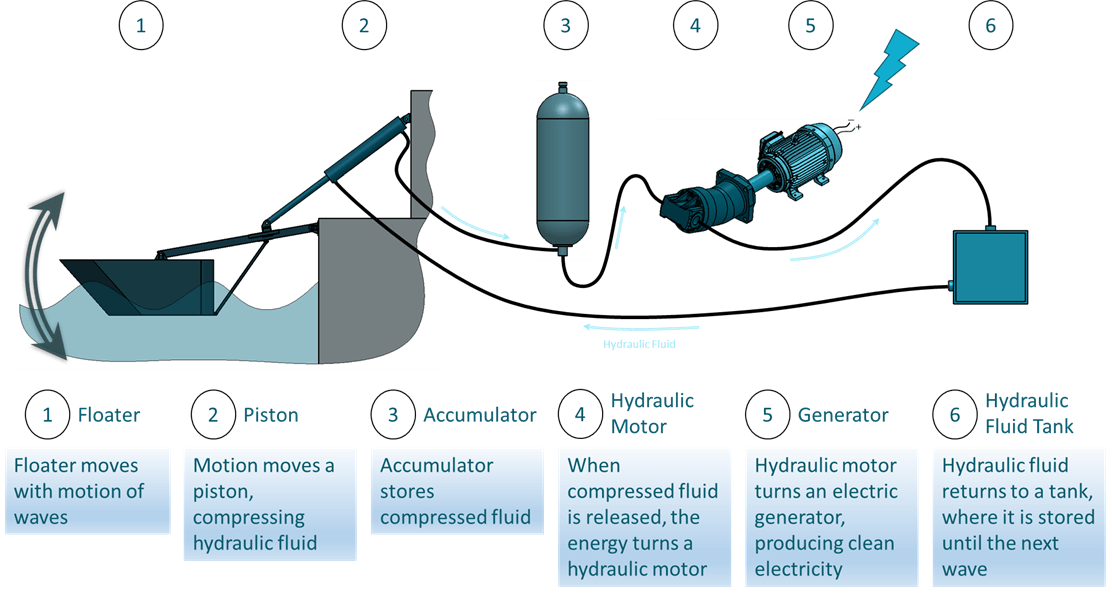

Unlike many of the companies I’ve profiled recently, Eco Wave’s technology isn’t particularly complex. Its basis is a hydraulic system, the same technology that makes the brakes in your car function. I would try to explain Eco Wave’s adaption, though the figure below explains it with far fewer words than I could.

Eco Wave Power

The company’s simplistic design is one of its most attractive attributes. With just a few points of failure, primarily based on well-understood technologies, the system is designed to last. Calling it “simple” is just about the highest praise I can give. Finding a simple solution to a complex problem is an extraordinarily challenging exercise that can be critical to the success of a product. Just look at Tesla’s (TSLA) failed initial production run of the Model 3, which was significantly over-engineered.

Eco Wave Power

But even with this simplicity, there are some nuances of the design. One such example is the company’s automated control system. Through internal testing, Ms. Braverman shared that the company’s control system allows for far more efficient operation, improving energy production by a factor of ~5x over the raw mechanical/hydraulic system.

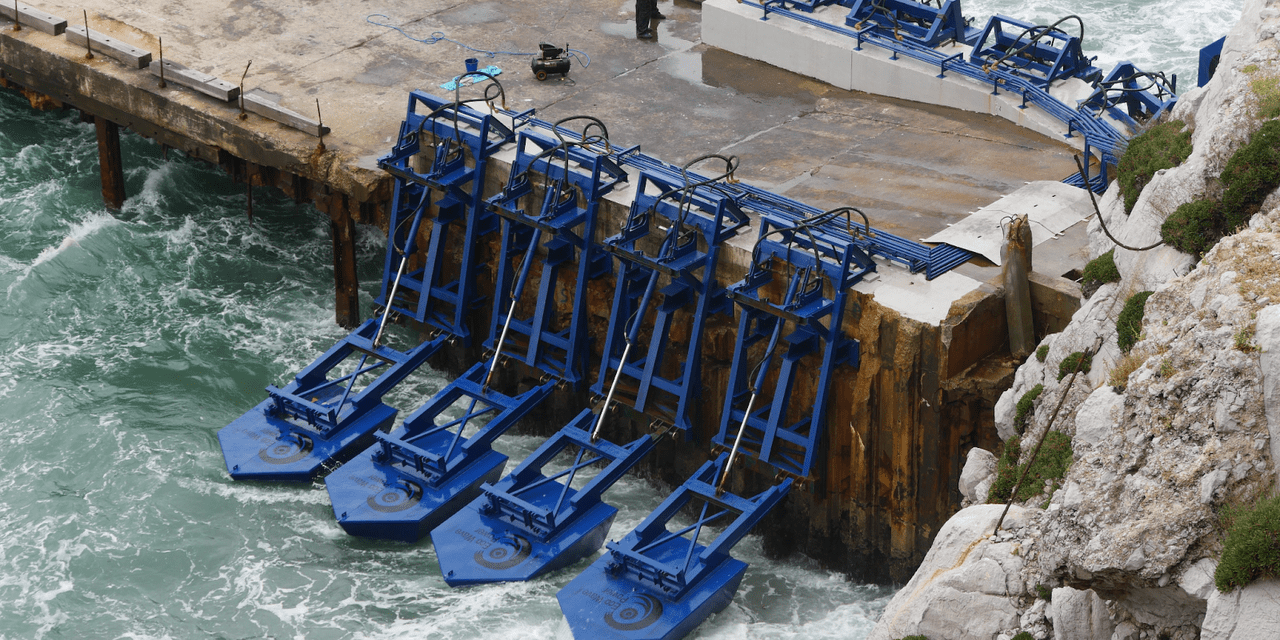

Additionally, Eco Wave has two different floater designs, the Power Wing and the Wave Clapper, to operate in different environments. As demonstrated by the figure below, the Wave Clapper design is a bit more narrow and pointed, while the Power Wing is wider and flatter. These design differences suit the Wave Clapper more for limited-space operations while the Power Wing is better suited for greater variability in wave heights.

Underside of Wave Clappers (Pointed) and Power Wings (Flat) – (New Atlas)

Though, as you may notice in the above figure, there is some deviation from the baseline Wave Clapper and Power Wing design. This is part of Eco Wave’s optimization work to develop floaters for projects that don’t fall at either of the two extremes. In order to cater towards projects that fall somewhere in the middle of the spectrum, this development is necessary.

But what’s proven even more clever, is the company’s ability to harness wave power with on-shore and nearshore installations. Reliable power generation from waves has long been a focus of researchers, who realized its potential as a major energy source as early as 1799. Yet, the idea has yet to take off in the commercial sphere.

While some of the issues stem from the flawed designs of alternative models, which lacked efficiency and caused ecological damage, modern deployment has been largely hampered by cost and reliability. Wave power has traditionally been examined as an off-shore power source and the deployment of off-shore infrastructure is far more costly than its on-shore counterparts. Look no further than wind power, where an on-shore installation has an LCOE of $36.93/MWh, while a similar off-shore installation has an LCOE of $120.52/MWh (not including an energy storage system).

In order to be a competitive power source, even as a renewable, the system needs to offer competitive pricing. Luckily, despite challenging operating conditions, Eco Wave believes its design can undercut most fossil-fuel plants. The company estimates an LCOE of €42/MWh, or $42.28/MWh, for commercial scale installation of 20 MW and above, which are expected to enjoy price reductions due to economies of scale. Readers should note that this dollar equivalent may be misleading due to recent economic developments; a long-term conversion rate of €1:$1.2 would yield an LCOE of $50.40/MWh. This still places it at the bottom of the cost curve, below hydroelectric, nuclear, and coal.

Furthermore, this €42/MWh target is likely to come down given time. As explained by Ms. Braverman, this estimate includes significant provisions for uncertainty given Eco Wave’s lack of commercial operation. So, simply by constructing and operating a commercial facility, the company can likely lower this target, which conforms to the International Energy Agency’s ocean energy system LCOE standards.

However, like other renewable power sources, wave power operates with a compromised capacity factor. Capacity factor, defined by the US Energy Information Agency, is the “ratio of the electrical energy produced by a generating unit for the period of time considered to the electrical energy that could have been produced at continuous full power operation during the same period.” As discussed in my previous article, nuclear energy has the highest capacity factor at an average of 92%. Solar has the lowest, at an average of 27%. In compatible locations, Eco Wave estimates an average capacity factor of 40%.

It is important to understand that this figure will vary significantly based on how choppy a given coastline is, but the general point still stands. Much like solar and wind, wave power setups will likely require an energy storage system to be made more reliable. Though, Eco Wave estimates that a location that supports a capacity factor of at least 20% will typically be economical and some locations could even support a capacity factor of over 80%.

While there may be some concerns regarding the durability of the system, especially if it gains favor in rough waters, this is an area that I believe Eco Wave has done a particularly good job of addressing. The company’s initial design validation work was conducted in the Black Sea in an effort to validate the integrity of the system in challenging conditions.

The system is also equipped with a number of measures to reduce the impact of volatile seas. Pneumatic, or hydraulic, dampers help moderate the violence of floater movement, passively improving system longevity. The system is also equipped with various sensors to monitor the surrounding ocean environment to recognize upcoming storms and reposition the floaters to avoid damage. Additionally, components in contact with ocean water, i.e. the floaters, are rated to withstand corrosion for 30+ years, further bolstering the system’s resilience.

The pilot facility operated in the Black Sea for over a year, being moved to the Jaffa Port in Israel in 2014 where it had operated consistently until 2020. In 2019, the company partnered with EDF Renewables IL, a subsidiary of Electricite De France, to install a larger scale project of 100 kW. The installation will be grid-connected, in an effort to further validate the company’s commercial viability. As of February, all of the new floaters were assembled and installation had commenced.

While the scale isn’t anything dramatic, this expansion offers another critical de-risking step. The project is expected to come online by the end of the year and will be the second of Eco Wave’s installations to be connected to a grid. Grid operation is critical in proving the system’s viability as a commercial installation. Through the 10 years of operation of the original floaters, and the upcoming expansion, this test program has lent significant commercial validation to the company’s design.

The Gibraltar Effect

But you may have noticed that I said this Israeli installation would be the company’s second grid-connected installation. Eco Wave Power opened its first grid-connected system in Gibraltar back in 2016, installing a 100 kW system. After operating for six years, Eco Wave has now decommissioned the site and is relocating the power converter to the Port of Los Angeles where it has entered into a collaboration agreement with AltaSea to install a grid-connected pilot facility at the port. The two will then look to secure grant funding and locate future project sites within the United States.

The decommissioning of Eco Wave’s Gibraltar test system is a significant milestone for the company, which represents tremendous success. The pilot plant was originally only expected to operate for two years, but its six-year run has proven invaluable to the team. Over the 49,632 hours spent connected to the grid in Gibraltar, Eco Wave was able to make significant optimizations to its operations.

In 2017, Eco Wave’s operation and maintenance costs, excluding labor, were 18% of initial CAPEX. This had fallen to just 3.2% in 2021. The company was also able to reach 73% of forecasted energy production in the period of August 2020 to July 2021, a marked improvement over the 30% achieved in the same period from 2017-2018. The Gibraltar plant also allowed Eco Wave to identify where losses occurred across its system, enabling more accurate modeling.

Furthermore, the company’s success as a grid-connected operation gave potential customers the confidence to put their interest into writing. In 2014, Eco Wave entered into a power purchase agreement (“PPA”) with Gibraltar to construct a 5 MW facility. This installation would cover up to 15% of the country’s total power needs, though it’s unclear what the current timeline is. The company has yet to determine a location for the project, but its successful operation of the facility means investors should expect developments in the future.

In April, the company entered into an official agreement with Port Adriano for up to a 2MW plant following the Gibraltar success. The Spanish plant is designed to be deployed in two stages, but Eco Wave Power can combine the two phases if it would prefer. Port Adriano can also choose to invest in the construction of the plant as a partner.

Back in 2020, the company entered into an agreement with A Administração dos Portos do Douro, Leixões e Viana do Castelo (“APDL”) to install up to 20 MW in the City of Porto in Portugal. The project will be spread across four sites, owned by APDL, to meet the total capacity goal over multiple phases. The company has already received permits for a 1 MW grid-connected installation late last year. Again, according to Ms. Braverman, the company has its Gibraltar plant to thank for this contract, as both Spain and Portugal are neighboring countries. Below is a rendering of what part of the project may look like.

Eco Wave Power

The Los Angeles pilot, in collaboration with AltaSea, has also been made possible as a result of the Gibraltar plant. Using the same equipment from Gibraltar, which was funded in part with a grant, has allowed the company to limit its spending while establishing a presence in the American market. The equipment is expected to arrive at the Port of Los Angeles in September, a milestone that I expect to be well-received by the company’s US-based shareholders.

Growing Operations

Eco Wave’s business is currently evolving from commercial validation to commercial deployment. This transition can often be make or break for companies, so it’s important to understand how Eco Wave is preparing itself. So far, it seems that the company has a solid roadmap in place.

Manufacturing won’t be much of a roadblock for the company, as most of its product is designed around off-the-shelf components. For its proprietary hardware, such as the floaters, the company plans to contract manufacturing to experienced operators. For example, to enable the construction of floaters for its upcoming Israeli facility, Eco Wave partnered with Lesico.

A significant advantage of utilizing off-the-shelf components, as explained by Ms. Braverman, is brand name suppliers, such as Bosch, Parker, and Siemens, bring inherent credibility to a project and alleviate some maintenance concerns given their global presence. Furthermore, this approach allows for a localization of supply chains at global project sites. Partnering with local manufacturers, such as Lesico, for the floaters enables the company to retain that localization advantage with its proprietary parts as well. The company also utilizes existing coastal structures to install its system, further reducing initial costs, complexity, and overhead.

With the significant commercial assurances stemming from the company’s extensive validation program, it has also been able to develop strong commercial interest. So far, the company has been able to generate pipeline interest for over 327.7 MW worth of installations, according to Ms. Braverman. I won’t discuss every one of these projects, for the sake of the reader and my own, but I will try to highlight the major ones beyond the three already mentioned.

In the United States, Eco Wave is progressing outside of California. New Jersey first expressed public interest in wave power, and Eco Wave Power in particular, earlier this year when assemblyman Robert Karabinchak announced intentions to include Eco Wave Power in the state’s renewable energy push. In March, Mr. Karabinchak began to work with the company to evaluate potential deployment sites and, in June, assemblyman Karabinchak introduced Bill A4483. The bill calls for New Jersey’s Board of Public Utilities to create a commercialization and deployment plan, and to offer financial incentives to companies and port owners for executing wave energy power stations.

Furthermore, Eco Wave Power believes that the $369 billion Inflation Reduction Act, combined with its recent progress in California and New Jersey, will significantly boost the company’s commercialization plans for the United States. While nothing has been officially announced yet, New Jersey looks quite likely to be one of Eco Wave’s next installation sites. With the DOE’s $25 million program to advance wave energy technologies, which doesn’t include funding from the Inflation Reduction Act, Eco Wave stands to benefit significantly from federal initiatives.

The company also has an MOU with the Pecém Complex to build a facility in Brazil. The facility will have a capacity of up to 9 MW. In China, the company has an MOU with CIMC OEI to evaluate the installation of a wave power facility. Under the agreement, the two companies would jointly operate a pilot plant and, if successful, appeal to expand towards a commercial installation. The MOU will expire at the end of 2023, so there is a timeline to be cognizant of.

Many of Eco Wave’s growing partnerships seem more like tests, orchestrated by the interested parties to evaluate the company’s technology for future installations. For example, the Portuguese government aims to have 70 MW of installed wave power capacity by 2030 and estimates that its coast could support 34 GW of wave power production. So a 20 MW installation, with a first installment of 1 MW, could just represent the country dipping its toes in the water.

If you read the framework of Eco Wave’s other deals, there is often information included about the potential for far greater utilization of wave power. So, I would suspect that countries which are among the first to adopt the company’s system will also be among the first to see the technology deployed at significant scale. But it is worth noting that this system is limited in its deployment as it is a coastal production system, therefore eliminating potential for utilization by landlocked territories.

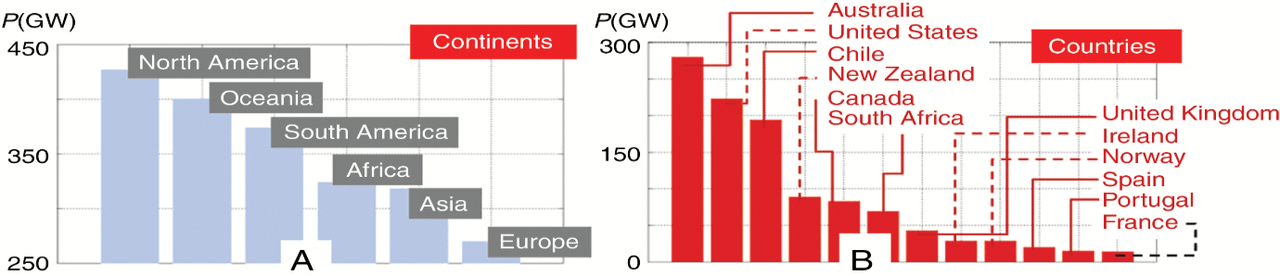

Thus, the next logical question is: what even is the global potential for wave energy? According to a study by the United Nations, the global wave energy resource along coastlines is at least 3.56 TW (3,560 GW or 3,560,000 MW). The researchers came to this determination by estimating that for every one meter of wave crest, there is between 10 kW and 100 kW of energy. Given the cumulative global coastline of 356,000 km, we come to our energy potential of at least 3.56 TW.

At 90% load, the researchers estimate the global potential of coastal wave energy to be greater than 28.067 TWh. To put that in perspective, global electricity production was 28.433 TWh last year. This extreme potential of coastal wave energy has made harnessing it “the dream of mankind.” The figure below offers a breakdown of this global opportunity.

Eco Wave Power

So, the system is geographically limited, but only at a very high upper limit – far above what Eco Wave Power could conceivably develop on its own within the next few decades. With 40% of the world’s population located within 100km of a coastline, wave power remains a rational solution as well. But, because manufacturing is outsourced, scaling is primarily a funding issue.

I’ll get into that a bit more later on. For now, it’s important to look at how Eco Wave Power plans to actually generate revenues. Instead of making its money mostly from the manufacturing and maintenance of the system like NuScale (SMR), Eco Wave plans to make its money mostly from the power produced by its system.

Eco Wave owns and operates the plant via a power purchase agreement, meaning it is responsible for initial capital and sustaining costs. So in order for this arrangement to be profitable for Eco Wave Power, it needs to sell power at a premium over its realized LCOE. Fortunately, as noted already, the system has a pretty low projected LCOE of €42/MWh. While I stated earlier that grids may want to add energy storage capacity to such an installation, the fact that Wave Power plans to operate through power purchase agreements means that it won’t be their responsibility to deploy those. Thus, in such a case, the company’s realized LCOE of €42/MWh isn’t impacted.

The average price of electricity in the US is $105.90/MWh at the moment, meaning that’s the benchmark that producers should shoot for with LCOE. Anything below that level will be economical. In Europe, prices are far higher, reaching €307.99/MWh in Italy earlier this year. Given this price difference, it may actually be more economical for the company to prioritize European developments at the moment.

Wave power also stands to be a strong choice for island nations or coastal territories because it has a low physical footprint, relative to wind and solar, and is highly scalable. Most electricity production comes from large, centralized, facilities that require billions to construct and can serve over 1 million homes. Oftentimes, that scale isn’t needed for these smaller areas. The company is currently undergoing a feasibility study, funded by the EU program New Energy Solutions Optimized for Islands, for a 1 MW station in Greece that will yield further evidence to support this use case.

Thesis Risks

As alluded to earlier, funding remains a roadblock for the company’s progression. It’s difficult to get a picture of what costs will look like, especially when it’s spread across so many projects with unknown financing agreements and scaling timelines, but I’ll do my best here. The company currently has $12.5 million in cash and cash equivalents which, at the company’s current burn rate of $3 million per year, will last for just over 4 years.

But this corporate burn rate isn’t inclusive of what Eco Wave will need to spend in order to support its early commercial buildout. Using a highly conservative construction estimate of $3 million per MW for early commercial projects, Eco Wave’s current capital would support that buildout of just over 4 MW, perhaps closer to 3 MW if the company’s burn rate is factored in. While this may not seem like much, the company will likely be able to stretch this quite far with the utilization of joint ventures. And there is already framework in place to support this strategy.

Looking at the press release for the proposed project in Spain, the company states “Port Adriano will have a right of first refusal to invest partially or fully in both stages of the project.” Building out this optionality will allow the company to begin developing its commercial project portfolio. Though, to fulfill its current pipeline, there’s still a long way to go.

This is where government initiatives begin to come into play. This brings some inherent risk, as grant funding is always subject to rejection or competitive bids, but it is worth being aware of the programs that Eco Wave may qualify for. In Europe, to support its ambitious plan to deploy 100 MW of ocean-based energy production by 2025, the EU has a few avenues to assist funding initiatives.

The EU’s €75 million BlueInvest fund is one such initiative, offering significantly more support than the DOE’s $25 million wave power funding program. But there is also opportunity outside of these relatively small funds, given the billions of dollars both regions have committed towards enabling an energy transition. Furthermore, with grant funding received in Gibraltar and Israel, alongside other grants, the company is likely to see further support as it moves towards broader commercialization.

But even without financial support from legislatures, the company can likely begin to appeal for competitive loan rates after a few projects are active. This is critical for the company’s success, leveling the playing field between them and alternative power sources with a more established presence. The vast majority of power infrastructure is funded via debt, making access to obtaining that debt instrumental to any company’s ability to build out its operations. So, just as the Gibraltar pilot facility was a transformative event for the company’s commercial acceptance, Eco Wave’s first few commercial operations are likely to be transformative in its financial acceptance.

At this point I’ve used the words “likely” and “would” quite a few times. Any time either of those two words are used, there is implied risk because something is not guaranteed. Furthermore, this is a path that is subject to delays that may be entirely out of Eco Wave’s control, given the number of stakeholders involved. While I do believe the company will be able to execute on this plan, timing is something that I remain concerned about.

On the topic of costs, the company must also be able to meet its target LCOE to be competitive. Because the company plans to operate primarily through power purchase agreements, the failure to do so will directly impact the company’s bottom line. Additionally, assuming Eco Wave remains dependent on JVs for its early installations, it could impact the company’s ability to scale as prospective partners are turned away by a soured investment proposition.

While all of these are worth bearing in mind, from the perspective of Ms. Braverman, the greatest risk to Eco Wave’s commercial buildout is the general lack of existing policy, legislation, and regulatory framework surrounding wave energy. Without such groundwork already in place, the permitting process is often significantly longer than the physical construction process, potentially contributing to substantial delays. While Ms. Braverman is optimistic that this issue will be relatively short-lived, as wave energy follows in the footsteps of wind and solar, legislatures aren’t exactly known for the speed at which they operate. With the company’s regulatory progress in Portugal and significant advancements in New Jersey, with the help of assemblyman Karabinchak, Eco Wave has already begun this process.

Valuation Discussion

With operating costs of ~$50/MWh, and a conservative revenue estimate of $125/MWh (given its target locations), Eco Wave’s gross profit per MWh looks to be in the range of $75/MWh. The company has over 325 MW of installations in its pipeline which, at a capacity factor of 40%, yields annual electricity production of 1,138,800 MWh. With the above assumptions, that yields annual revenue of $142.3 million and an annual gross profit of $85.4 million. Even if all of its early projects are JVs, the company would still be left with $71.15 million in revenue and $42.7 million in gross profit.

But without a clear roadmap for deployment, it is difficult to build a solid valuation model. So let’s look at what we know. Currently, the company is valued at $25.5 million (44,394,844 shares outstanding, ADRs are valued at 8x common shares), which is less than double its current cash on hand. While deployment may take a while, the company has a strong growth pipeline, especially as the market leader in an emerging renewable power source.

With this in mind, my takeaway here will be more qualitative than usual. It’s not how I usually like to do things, but a more quantitative review would rely on far too many assumptions to be even remotely reliable. That being said, I do like the company. Even if it takes the company 20 years to work through its pipeline, the current price would support a CAGR of over 20% over those 20 years using conservative estimates.

Furthermore, with an 18-24 month construction period, which includes the permitting process, the company could have 1 MW deployed in both Spain and Portugal by the end of 2025. As of May, electricity prices in Spain were €187.16/MWh, which would yield annual revenue of €655,809 (assuming 40% capacity factor). That alone isn’t nearly enough to justify a $24.4 million valuation, but the company’s growth is.

The installation in Spain would be followed by a second phase, adding another MW, while its project in Portugal continues to progress. The company has already received major permits for the first MW of its 20 MW installation in Portugal and the 5 MW Gibraltar installation only adds to this growth. Of course, this all assumes the technology works, and can be deployed, as hoped.

Investor Takeaway

I didn’t expect to like this company nearly as much as I do now. I actually expected to give it a negative review, quite the opposite of adding it to the portfolio. Still, despite my positive review of the company, investors should remain wary. Given the risks ahead and lack of commercial operations, Eco Wave may still be a bit expensive at its current price.

I would like to see the share price come down a bit further, though I do plan to add a small position to my personal holdings in the coming days or weeks. I plan to slowly add to that position over the coming months. Though, regarding the buying and selling of shares, investors should also beware that volume is quite low.

At its current size, Eco Wave reads more like an advanced venture capital target than a public company. That doesn’t make it bad, this is just to give an idea of the risk involved and the level of maturity of the company. If that’s fine with you, as it is for me, then perhaps it’s worth taking a small position.

Be the first to comment