Bartlomiej Wroblewski/iStock via Getty Images

Investment Thesis

Since my last article about four months ago, the share price of IonQ (NYSE:IONQ) has dropped nearly 40%. At the time, one of my biggest arguments was the tremendous valuation. Given the price drop and the company changes, is now a better time to get in? In the meantime, a massive short report has also been published, from which I would like to address a few passages.

The problem of long-term estimation

My last article was a bit more about the prospects of the quantum computing market so that I won’t go into that today. Not much should have changed since we are only at the beginning of this technology anyway. But I would like to write a few words about the dangers of long-term predictions. I am generally skeptical of estimates extending five years or more into the future. The world is changing so fast that I think accurate estimates over that time are impossible. Therefore, I believe companies whose current valuation is based on long-range estimates should receive a discount rather than an upgrade in valuation.

Critics of this thesis would reply that quantum computers are a future technology, and IonQ is active in this area. As I described in my last article, with rapid technological changes, a breakthrough discovery could be made virtually any month that could put a competitor of IonQ in the technical lead. And the further the future estimates for a company, the greater the likelihood of such unpredictable events or discoveries.

Of course, you can look at this the other way around and say maybe IonQ will make this breakthrough discovery, but the likelihood is against it. Many companies and universities are currently researching quantum computing technologies in many countries. And competing companies like Alphabet (GOOG, GOOGL) have significantly greater financial resources and are therefore more likely to attract the best talent.

Metrics are needed, but it is important to choose them carefully. Quantum volume is a good metric. But is it really possible to expect something as new and complex as a quantum computer system to be characterized by one metric? You know, you can’t even characterize your computer, your cell phone, by one metric. In that case, if there’s any metric, it’s the price of the cell phone.

Source: Former chief architect of Google’s Sycamore, John Martinis

This website is a good source for news about quantum computing, and I invite the readers to look at how much information appeared in the last weeks alone. Many headlines have in common that the words “could” and “new” appear significantly often. And this shows the problem: New technologies have so much unknown. It’s a good thing for the technology itself, but it’s a problem for individual companies.

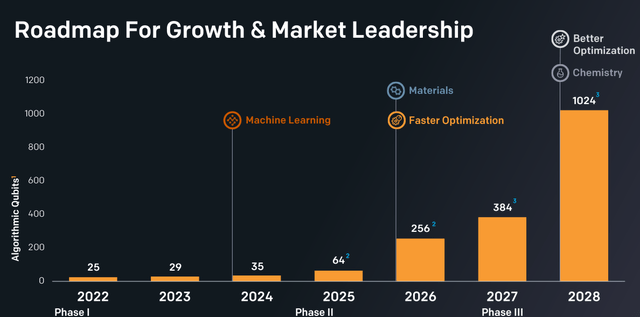

How do I come up with all this? Because IonQ has a few million in sales so far, and the $1.23B market cap is based on very long-term hopes, as shown among others by this picture on the investor presentation.

IonQ March Investor Presentation

I do not want to say that you should not have long-term goals. I want to express that the longer the period, the greater the uncertainty. And for us as investors, this is enormously important because we are providing our capital to a company in the present. Reading all this, the reader might think I’m fundamentally pessimistic about companies that plan well ahead. But that’s not true. I’m just saying one doesn’t know and should be cautious when the valuation is already high.

What’s new in the last few months?

The company has created subsidiaries in Germany and Israel to work more effectively with local authorities, apply for funding and increase international brand awareness. A collaboration with Airbus was also announced. Airbus wants to use computer models to optimize its fleet concerning lower fuel consumption, better aerodynamics, and optimized flight paths. IonQ has also announced a contract with Dow, a global chemistry and materials science leader. Their goal is to apply quantum computing to materials research.

And the company has introduced IonQ Forte as the latest generation of its quantum systems:

Forte is the latest evolution towards a “software-configurable quantum computer,” which is designed to allow the company to optimize the computing hardware for targeted user problems–ultimately, giving users customized algorithmic performance.

Q2 Results

As the company is a bet on the future, the current figures are not decisive, and I will only mention them briefly.

- Revenue of $2.61M.

- For the third quarter, IonQ is expecting revenue between $2.6 and $2.9M

- Cash, cash equivalents, and investments were $571.3 million as of June 30, 2022 ($43 million “real” cash, rest is primarily short-term investments)

- Full-year 2022 revenue is expected to range from $10.2 million to $10.7 million

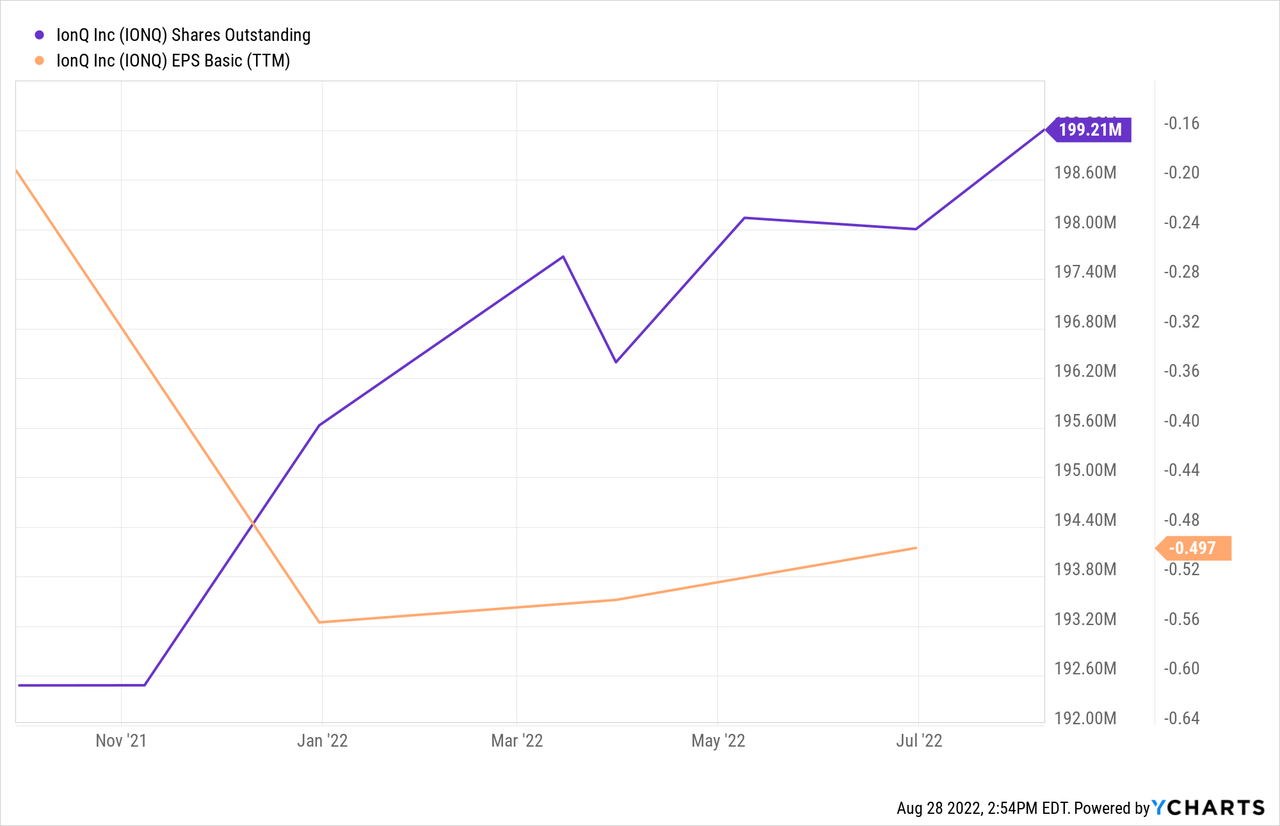

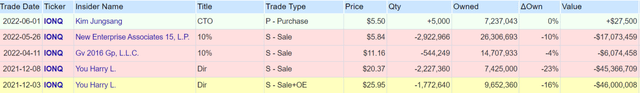

Share dilution and insider selling

One thing I always want to look at, especially with companies that are not yet profitable, is stock dilution and whether there is insider selling. In summary, there have been slight but nothing very spectacular in recent months.

openinsider.com

A short report by Scorpion Capital

This year, a short report was published by Scorpion Capital, which is freely available for everyone to read. On the day of publication on May 3, the share price was $7.15, so it had already fallen sharply. The whole work is a whopping 183 pages long, and I would like to summarize a few statements here. If you are interested, go ahead and read the report.

Their accusations are pretty severe:

- The story has been around for 30 years that quantum computers will soon be ready commercially

- Quantum computers are pure hype and far from being ready for the market

The short report includes links to external sources (such as this one or this one), including articles by professors who also work at Maryland (such as IonQ founder Christopher Monroe).

Another accusation is that the company is running a Ponzi scam and that its machine doesn’t even exist:

The Related Party section of the filing then explained why IonQ’s revenue is a farce: the two customers that drove 70% of its revenue in Q3 are the University of Maryland (UMD) and Duke – which spun off IonQ. The entities are so intertwined it is difficult to discern where they end and IonQ begins. Monroe and Kim, the two co-founders and Chief Scientist and CTO, respectively, oddly remain professors at UMD and Duke; IonQ licensed its core technology from the two universities in exchange for stock. IonQ even leases its office space from UMD. When IonQ says that UMD and Duke are its key “customers” of compute resources, it’s admitting that its largest customer is itself – i.e., its co-founders and their own academic organizations. (Page 146)

In other words, IonQ’s revenue is not only negligible but whatever little scraps they’ve scrounged up are related-party round-tripping. Of the whopping $233K of total Q3 2021 revenue, $164K or 70% was from UMD and Duke. The related party disclosure then exposes the circular nature of the flows – in Q3, IonQ expensed $313K of R&D as transactions with UMD and Duke as well as $101K in other items. In other words, IonQ spent $414K with its two largest customers, who then turned around and “purchased” $164K of quantum computing access and services.

(Page 147)

Scorpion Capital states that they have interviewed several ex-employees who testify that the photos on IonQ’s website are fake and staged and that they have never seen the machine in real life. (page 64)

And the list goes on. I think that’s enough for now. It’s too much to list everything. What is true now? Did they conduct interviews with ex-employees? It is always difficult to say what is true in this confusing fog. When a 180-page short report comes out, it never really contributes to confidence but always to uncertainty, which was already present in me anyway.

At this point, I would like to insert an excerpt from my first article about the company, where I already criticized the lack of information:

I could not find out the price for bookings of the quantum computers. Then I realized that there is very little information:

- Who is booking and why?

- Does that benefit IONQ’s customers at all?

- Are these possibly mere tests of individual companies?

- Are these bookings one-time or recurring revenue?

Or in other words: I find it extremely difficult to assess whether this is a sticky business with high added value for IONQ’s customers or not. Without knowing that, how should private investors like us evaluate our investments?

Conclusion

I don’t want to base my overall argument so much on the short report. However, all the points I mentioned before and in my first article on the company mean I cannot build trust here. And even if I assume that everything in the short report is not valid, there remains the enormous valuation, hardly any sales, and very little traceable information. Instead, there is a lot of uncertainty and competition.

Be the first to comment