mcsilvey/E+ via Getty Images

Today will be the second article of the week covering some of Berkshire Hathaway’s (BRK.A) (BRK.B) equity investments. Yesterday I covered Jefferies Financial (JEF), and today I’ll be covering Louisiana-Pacific (NYSE:LPX). The company is a building products supplier based out of Nashville, Tennessee.

Investment Thesis

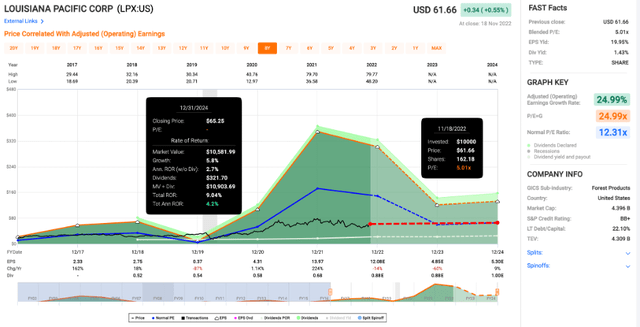

Louisiana-Pacific was one of the most recent additions to Berkshire’s portfolio. While business has been slowing down when compared to 2021, the company still looks cheap today. Shares trade at 5x earnings, which is well below the average 12.3x multiple. This is likely due to a projected decline in earnings for the next couple years, but I tend to think earnings will be better than projected.

Part of this is due to the massive buyback program that has been going since the beginning of 2021. It should be a significant driver of earnings going forward. They spent $1.3B on buybacks in 2021 and should clear $1B for 2022. That’s impressive for a company with a market cap of $4.4B, and if buybacks continue at a similar rate, shares outstanding should continue to decrease rapidly. Throw in a 1.4% dividend yield, and there are more reasons to be bullish than bearish on Louisiana-Pacific.

Business Overview

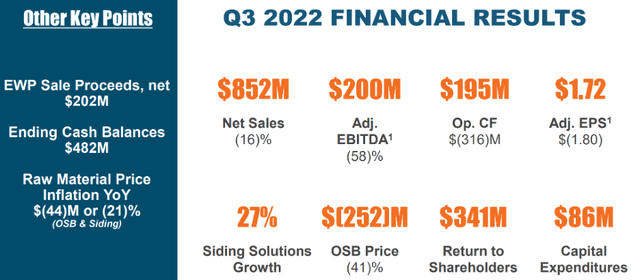

Louisiana-Pacific is a building products supplier with operations in the US, Canada, Chile, and Brazil. While results aren’t as impressive as 2021, Louisiana-Pacific has still managed to put together three solid quarters to start 2022. For the first nine months of 2022, siding solutions made up approximately one third of revenue, while OSB (oriented strand board) was the lion’s share of revenue. It was closer to a 50/50 split for Q3 as OSB had a decline in revenue from the previous year results.

One other thing worth noting on Q3 was the sale of the engineered wood products division in August for $202M. This gave them some dry powder, most of which will likely go into share repurchases. I’m curious to see what happens to companies like this if the economy slows down, as they are typically sensitive to the overall economy. In the past I have covered other building products suppliers like Builders FirstSource (BLDR) and BlueLinx Holdings (BXC). These companies are cheap based on earnings due to fears that the real estate markets will slow down, and Louisiana-Pacific is no exception.

Valuation

Earnings exploded in 2021 for Louisiana-Pacific, much like the other building products suppliers I mentioned. The problem is that earnings are projected to contract significantly in 2023 and 2024. I don’t know if EPS will decline by more than 50%, but I think there will be a material decline, even with Louisiana-Pacific’s buyback program. Shares currently trade at 5x earnings, well below the 12.3x average multiple.

Price/Earnings (fastgraphs.com)

If earnings are more resilient than expected, I would expect shares of Louisiana-Pacific to provide solid returns moving forward. If we do see some multiple expansion to go along with it, investors could easily see double digit returns. If the projects are more or less accurate and shares trade at the normal 12.3x multiple in a couple years, forward returns are more likely to be flat.

While I tend to think that earnings will hold up better than expected, we will have to wait and see how the economy holds up over the next year or two. I do think that revenues should hold up fairly well as price increases start to take effect. The continued price increases due to inflation will hit the top line for the company (like it does for BLDR and BXC), while the expenses stay relatively stable. One thing that separates Louisiana-Pacific from those two is the dividend payment.

Dividends & Buybacks

Unlike competitors BLDR and BXC, Louisiana-Pacific pays out a dividend that has been growing since 2018. The yield currently sits at 1.4%, so it isn’t much if you are looking for current income, but it’s better than nothing. The quarterly dividend has been at $0.22 this year, so we could see a dividend hike to start 2023, but it’s hard to predict since they don’t have a long history or regular pattern of increases.

Where Louisiana-Pacific is similar to BLDR and BXC is the large buyback program. They bought back 5.6M shares for a total of $325M in Q3. That is on top of 8.7M shares for the first two quarters of 2022, and another 21M shares in 2021. The buybacks are poised to continue, and shares outstanding should continue to decline at a rapid rate. If buybacks do continue at a similar pace (repurchases were $1.3B for 2021 and should be over $1B for this year), that will be a huge tailwind for earnings. You would be hard pressed to find another company with a market cap of $4.4B with a buyback program like Louisiana-Pacific.

Conclusion

The company isn’t a huge investment for Berkshire, but it is interesting to see them buy Louisiana-Pacific when the consensus is that the real estate sector will struggle over the next couple years with the recent increase in interest rates. My guess is that they are looking at the cheap valuation at 5x earnings and the massive buyback program and figure there is a large enough margin of safety to go long. The dividend yield isn’t huge at 1.4%, but it has grown annually since 2018. While business might continue to slow down, I think there are plenty of reasons to be bullish on Louisiana-Pacific.

Be the first to comment