MarsBars

Everyone wants to own a high quality company when everything is looking up, and that’s why you would have to pay a premium to own it. In the same vein, the market dislikes uncertainty, and will discount stock of companies who are working through near-term issues. However, to ignore a stock when the chips are down is the same fallacy as to pay a premium for a company when everything is seemingly looking up.

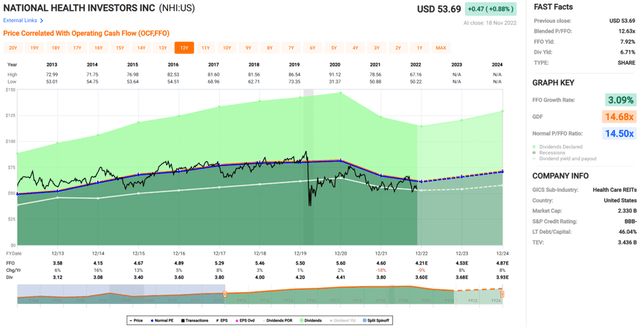

This brings me to National Health Investors (NYSE:NHI), which, at the current price of $53.69, is now trading cheaply relative to its 52-week high of $67 achieved as recently as September. In this article, I highlight why NHI is an under the radar investment for high income while the market isn’t paying attention.

Why NHI?

National Health Investors was founded 31 years ago, and is focused on owning and leasing out healthcare-related properties, including Senior Housing and Skilled Nursing facilities. Its portfolio is generally located in population-dense areas along the East Coast, Sunbelt, Midwest, and West Coast regions of the U.S., across 32 states.

Like many other players in the senior care REIT space, NHI has seen challenges stemming from tenant labor challenges and wage inflation, which has pressured rent coverage. This contributed to normalized FFO per share for the first nine months of the year declining on a YoY basis from $3.55 to $3.43.

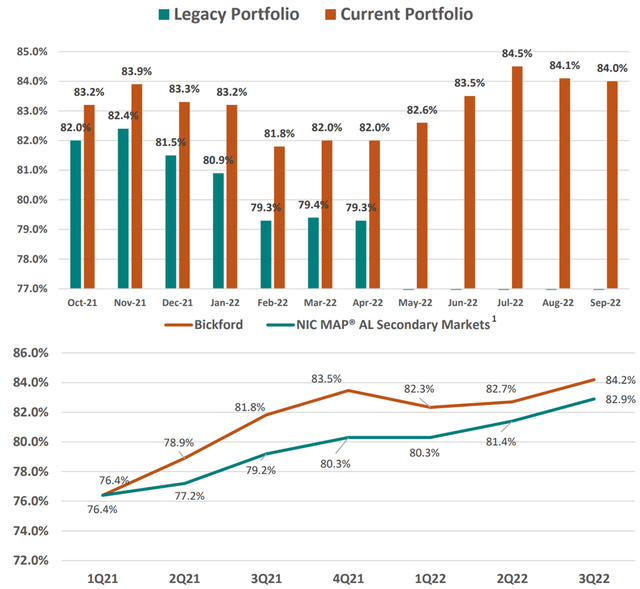

However, I’m encouraged by recent improvements and tenant lease restructurings, which helped to increase trailing 12 month EBITDARM coverage for the senior housing segment from 0.98x to 1.14x. Adjusting for the troubled tenant Bickford’s April 1 rent reset, their coverage is now at a much healthier 1.32x. Also, the issues don’t appear to be on the demand side, as Bickford’s occupancy has steadily improved since the start of last year, as shown below.

Bickford Occupancy (Investor Presentation)

Management has also been busy disposing of underperforming properties. Since announcing its asset optimization plan in the middle of last year, NHI has disposed of 32 senior housing properties for net proceeds of $296 million. Those properties had a cash NOI yield of just 2.7% and low EBITDARM coverage of only 0.47x. Encouragingly, management expects additional tenant transitions, rent restructures, and lease maturities to have a modest impact on near-term NOI.

Plus, skilled nursing properties, which account for one-third of NHI’s net operating income appears to be overall healthy, with solid EBITDARM coverage, as noted below in the recent conference call:

The SNF portfolio, which represents 33% of annualized adjusted NOI continues to have solid EBITDARM coverage at 2.47 times, including 3.24 times at NHC and 1.97 times for other SNF operators in our specialty hospital. The year-over-year and sequential decline in the coverage is driven primarily by NHC, whose corporate level fixed charge coverage ratio has been impacted by a decline in revenue from federal government stimulus programs.

NHC remains an excellent credit, and along with the Ensign Group, anchors our SNF portfolio. Our five other SNF operators, which represent approximately 7% of adjusted NOI, have received minimal rent concessions since the pandemic began, and we did not provide any SNF related deferrals in either the second or third quarter.

Looking forward, NHI is well-positioned to handle near-term uncertainties from a balance sheet standpoint. This includes one of the best balance sheets in the healthcare REIT space, with a net debt to adjusted EBITDA of 4.5x, down from 4.9x at the end of last year. This was driven in part by $434 million worth of debt paydown since the start of the pandemic.

Furthermore, the majority (78%) of NHI’s debt is fixed rate, and as of the end of October, NHI had full availability on its $700 million revolving line of credit. These factors contributed to Moody’s (MCO) raising its outlook on NHI from Baa3 negative to stable.

Meanwhile, NHI pays an attractive and well-covered 6.7% dividend yield, supported by an 82% normalized FAD (funds available for distribution) payout ratio. Management also thinks the shares are rather cheap, and repurchased 1.3 million shares during the third quarter for $82 million, and 2.5 million shares year-to-date, reducing annual dividend obligations by $8.9 million.

Lastly, I see value in the stock at the current price of $53.69 with a forward P/FFO of 11.9, sitting below its normal P/FFO of 14.5 over the past decade. Analysts have a consensus Hold rating on NHI with an average price target of $60.60, translating to a potential 20% total return including dividends.

Investor Takeaway

National Health Investors is an under the radar healthcare REIT that investors can consider for high income. It has a solid balance sheet, attractive and well-covered dividend yield of 6.7%, and trades at a discounted P/FFO relative to historical norms.

Furthermore, management has been busy disposing of underperforming properties while they remain opportunistic with share repurchase. This could potentially lead to outperformance in the near term. For high current income and potential upside, NHI is a worthy choice.

Be the first to comment