gesrey

We are taking a contrarian view and starting to build positions in beaten-down regional banks the last month, and there are some good opportunities in the financial sector, and specifically in smaller regional banks. We see the rising rate environment as having a predictably favorable effect on net interest income in most banks. One bank that will see a benefit is a great dividend king, and that is United Bankshares (NASDAQ:NASDAQ:UBSI). The higher rate environment is just starting to drive margin improvement and when combined with outstanding loan growth, the company is in great shape to deliver earnings gains the next few years. The market is providing a gift ahead of a perceived recession. Even if it happens, a moderate recession, much of this has been priced into banks. We like it. The fear of loan demand cratering is overblown. Short-term the rate hikes caused some ‘rate shock’ but we are moving past that. Like we have seen in other banks, low interest rates have weighed, and pressure on bond yields have kept these stocks down. Loan loss provisions are a concern, given the economic woes we are seeing right now impacting borrower’s ability to pay. In this column, we will look at the key metrics we look at for regional banks like this. The bank has recently reported earnings, and there are key trends to be aware of. The stock would be a tremendous buy under $35 in our opinion, but is a good buy under $40, with its near 4% dividend yield. Let us discuss.

Revenues jump

The bank’s operational results have followed a path similar to that of other regional and major banks. Thanks to continued loan growth and deposit strength, the bank saw revenues continue to improve. A higher net interest margin helped performance. With the present quarter’s revenues of $258.1 million, the company registered a 3.7% increase in this metric year-over-year. Many other regional banks have seen mixed revenues versus last year, while some are improving. It really is a mixed situation in the sector. The result was about a $9 million beat against expectations. What is more, we saw great performance on earnings

Earnings performance solid

The increase in revenues year-over-year was driven by loan and deposit growth, and better margins thanks to higher rates. The bank reported net income of $95.6 million, or $0.71 per share, which was a nice increase of $0.11, or 18%, from the same quarter of 2021. What investors need to decide is if there will be continued improvement or not. We believe that 2023 will be even better based on the trends we are seeing for banks.

What is more, we see net interest margin improving. Loan quality and a huge change in loan loss provisions boosted performance. Margins should remain strong with higher rates on loans issued relative to what is paid to deposit holders. In Q2 there was a net interest margin of 3.38%, which was up a big 39 basis points from the sequential Q1 of 2022. Further, the provision for credit losses was actually a credit this quarter. The bank saw a benefit of $1.8 million for Q2 on such provisions.

Loans and deposits grow

Despite a shaky economy there continues to be positive progress on loans and deposits. Growth in loans and deposits is key for any bank, small or large. This is bread and butter banking. Take in deposits at a low interest rate, and lend at a higher one. Collect the difference. Winning. A model that works for millennia. Annualized loan growth was 15%. Total loans grew to $19 billion, up from $18 billion to start the year. This is solid growth. Deposits dipped slightly to $23.0 billion from $23.3 billion from the start of the year, but investment securities held jumped to $5.1 billion from $4.3 billion.

Asset quality

As you know, loan growth is a strength, but only if they are quality loans. This quarter saw the loan loss provisions become a net credit, which helped the bottom line. But we like to look at a few metrics of asset quality and they are all trending in the right direction. This is bullish.

First let’s look at nonperforming loans. The asset quality is strong. Nonperforming loans fell as a percentage of all loans. They were $70.3 million, or 0.37% of loans, down from $90.8 million, or 0.50% of loans to start the year. Total non-performing assets overall were down to $84.2 million or 0.29% of total assets. This is a big improvement from $105.6 million, or 0.36% of total assets top start the year. Folks, things are improving despite the shaky landscape.

On top of that, the allowance for loan & lease losses continues to decline and this is a critical trend. The allowance for loan losses in Q2 was $213.7 million, or 1.13% of loans, a drop from the $216.0 million, or 1.20% of loans at the beginning of the year. Further, net charge-offs were just $5.2 million.

We also like to look at certain return metrics which are key. All of the metrics we followed improved sequentially from Q1. The return on average assets was 1.32%, up 19 basis points from 1.13%. The return on average equity was 8.33%, up from 6.96%. Excellent. And the return on tangible equity jumped from 11.63% to 14.23%. These are exceptional trends. Finally, the efficiency ratio is a stellar 54.6%, the best it has been in a year.

The dividend

So we really like owning banks into this weakness, as they are, in our opinion, pricing in a bad recession. We don’t see that in the cards, we lean toward a mild recession. Regardless, start buying here, and get paid to wait. Over the long-term, this is a strong dividend payer, with a great history of being a serial dividend raiser:

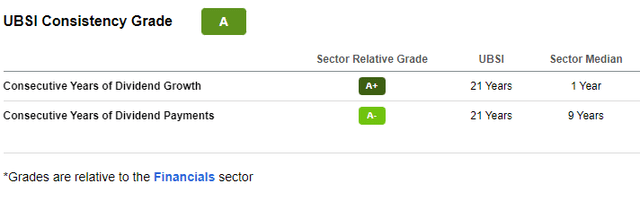

As you can see, the dividend has been hiked year after year. While it may not go up every 4 quarters, it gets raised routinely. This is a key way to build long-term wealth. Invest, collect dividends, and reinvest them to compound the gains, while routinely adding to positions. After decades, your position should be large enough to collect dividend paychecks to live off of in retirement. Or at least, pad your income. This is strong relative to the sector:

As you can see, there has been a generation of consecutive dividend growth. From a dividend safety standpoint, the payout ratios have crept up some years as the dividend goes up and EPS and cash flow varies. Right now the dividend is relatively safe, with a cash payout ratio of 25% and a dividend payout ratio to cash flow of 55%. We think this dividend isn’t going anywhere, especially with $12 per share cash on hand.

Bottom line

This was a good quarter. This is a high-quality, under-the-radar name. It pays a healthy dividend, which has been raised time and again. Buy this stock and benefit from the higher rate environment over the next few years.

Be the first to comment