amriphoto/E+ via Getty Images

While I don’t have a personal or family connection to diabetes, I have invested in the space over the years and have a close friend with T1D who works at the forefront of insulin delivery technology. We often discuss new developments in diabetes medical devices, and he has been a longtime user and proponent of products from Tandem Diabetes Care, Inc. (NASDAQ:TNDM), which until this year was widely regarded as the leader in insulin pump technology, as their t:slim pumps with Control-IQ technology offered the most accurate delivery algorithm and the closest integration with the industry-standard CGM (continuous glucose monitoring) device, the DexCom (DXCM) G6.

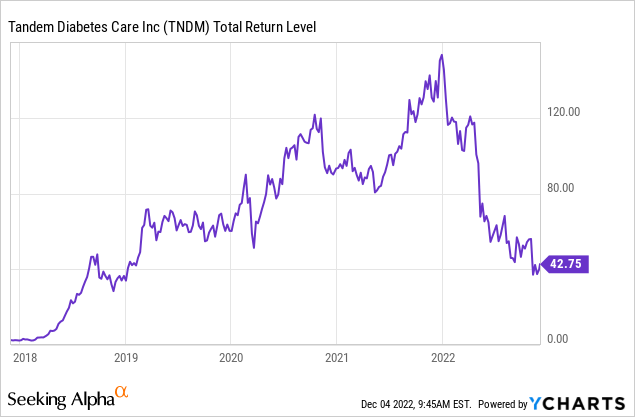

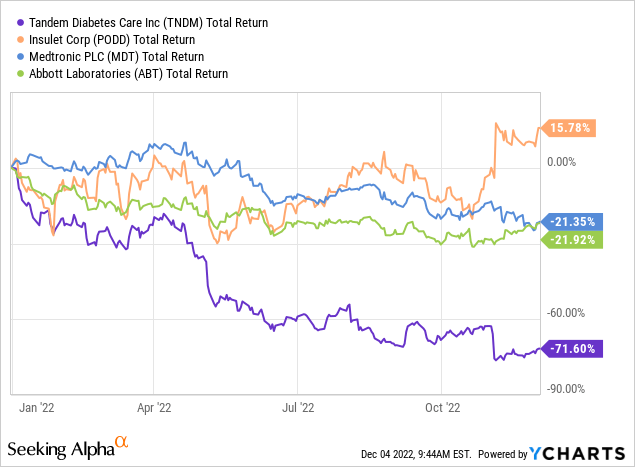

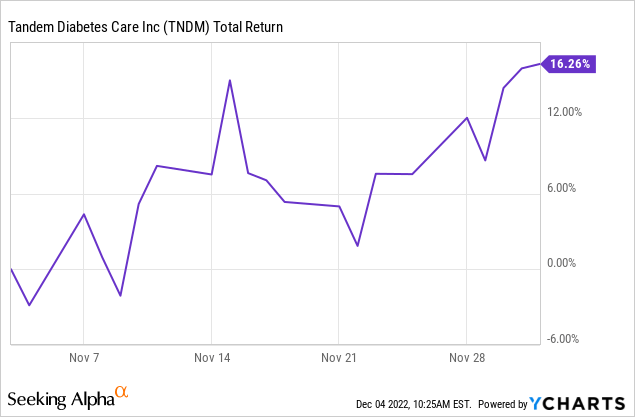

However, 2022 has seen Tandem’s stock plummet over 70%, so in this article, I will be taking a look at Tandem’s competition, its future plans, and its current valuation to see if the stock presents a compelling buying opportunity as a turnaround play in 2023.

An Uphill Competitive Battle

One reason for Tandem’s poor performance this year is increased competition on multiple fronts. The company is indeed working hard to close these new gaps, and although its Control-IQ and Basal-IQ technology is still considered the most accurate insulin delivery software, its t:slim pump is no longer the leader in size, convenience, or wearability.

With Tandem’s current market cap sitting at under $3B, its main competitors Insulet (PODD) and Medtronic (MDT) are much larger companies with significantly more personnel and financing resources at $21B and $106B market caps, respectively. With all three running expensive clinical trials and vying for FDA approvals in a relatively product new category with risky technological implications, the market clearly views this as a David-versus-Goliath uphill battle for Tandem.

A Tubeless, Waterproof Artificial Pancreas

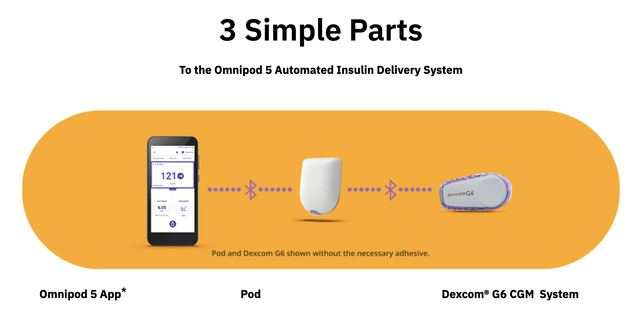

First and most importantly, let’s consider Insulet. The launch of its Omnipod 5, the first tubeless “closed-loop” pump controlled via mobile app, marked a new era in wearable diabetes tech. T1D pump wearers have been waiting for such a combination to be approved by the FDA for years, during which time many resorted to building their own “artificial pancreas” using Raspberry Pi devices and open-source algorithms from OpenAPS and Tidepool.

With two wearable tubeless devices, one for glucose monitoring and one for insulin delivery, the Omnipod 5 is the closest thing on the market to the “holy grail” automatic pancreas that all of the insulin device companies are working towards: a single wearable, tubeless, waterproof pump that monitors glucose levels, autonomously delivers insulin, and is controlled via mobile app.

In addition to the added convenience of a tubeless pump, insurance coverage also seems to be an issue hurting Tandem’s customer growth, as many T1D pump users report switching to Omnipod and Medtronic devices due to their insurers no longer covering Tandem’s expensive pumps after the company’s warranty runs out.

Extended Infusion Sets

Medtronic has also leaped ahead with its MiniMed 780G system, a waterproof tubed pump system with an integrated mobile app that is now available in most countries except the USA. In addition, Medtronic has launched the first extended-wear infusion set (the patch with cannula that delivers the insulin) that lasts seven days on average as opposed to competitors’ sets that last only 3 days on average.

While Medtronic has rolled out its new extended infusion set with fairly little marketing fanfare, for those with T1D these sets are a major breakthrough. Traditional 3-day infusion sets are costly and burdensome for patients who need to switch infusion sites after every wear and frequently experience cannula kinking and failure along with tissue irritation and even infections at insertion sites. Infusion sets have also been a major limiting factor to advances in tubeless insulin pump cost and wearability because pumps like the Omnipod 5 are capable of holding much more than 3 days’ worth of insulin, yet they need to be discarded and replaced every 2-3 days due to the integrated infusion set.

Anecdotally, T1D pump wearers often cite infusion set irritation, unreliability, and lifespan as their biggest gripe, and the discomfort and inconvenience of infusion sets are key reasons why many with T1D choose not to use wearable insulin pumps. 7-day infusion sets help to solve many of these issues, and as more companies launch tubeless pump systems, they will also need to offer extended infusion sets to remain competitive.

Tandem’s Response

Luckily for investors, Tandem has been working to launch competing products in both of these areas, and if successful it may once again have the most advanced artificial pancreas system on the market.

Tandem’s mobile app was approved by the FDA earlier this year, and the company has been working towards approval of its own integrated mobile app and waterproof closed-loop pump, tentatively called the Mobi, but investors have seen the Mobi’s tentative launch date pushed back multiple times. The company is now hoping that FDA approval comes in time to launch the first iteration of the Mobi by mid-2023, but the timeline is still uncertain.

Unfortunately, the first iteration of the Mobi will likely still have a short tube connecting the infusion set to the pump, with a tubeless version coming later and potentially not until 2027. This could obviously allow Insulet, Medtronic, and others time to release new products that might put Tandem even further behind before getting to a fully tubeless system.

On the infusion set side, Tandem recently acquired Capillary Biomedical, an Irvine, CA-based company founded by an industry veteran Paul Strasma that was developing a patented 7-day extended wear infusion set featuring a flexible plastic cannula called SteadiSet with SteadiFlow technology. While the terms of the deal remain private and limited information is available online about the company, CapBio’s January press release announced that its preliminary clinical trials showed promising data and that they had just been granted an IDE (investigational device exemption) to begin FDA-sanctioned clinical trials, the final step required before applying for full FDA approval. It also disclosed that CapBio had raised a total of $25 million in funding up to that point.

Furthermore, CapBio’s 2021 trial data revealed that its extended infusion set outperformed both 3-day and 7-day infusion sets by a wide margin, including Medtronic’s extended infusion set:

“Clinical studies into extending infusion set wear initially found that only one-third to half of conventional sets could survive for seven days in real-world conditions. Innovations such as Medtronic Diabetes Care’s Extended Wear Infusion Set (EWIS) have increased that to 74.8% survival after one week as reported in their pivotal study results released at this meeting. We’re very encouraged by our clinical data showing that 87.8% of SteadiFlow technology infusion sets survived for seven days. That thirteen percent improvement in survival rate means insulin pump users would experience half the infusion set failures, or twice the reliability, of the next-best infusion set.

– Mark Estes, VP of Sales & Marketing, Capillary Biomedical

Considering that Tandem announced its acquisition of CapBio in July 2022 during a period of turmoil and uncertainty in venture capital markets, that its Q3 cash position of $609MM was only $15M lower YTD from $624M at the start of 2022 versus CapBio’s $25M in pre-acquisition funding, and that its long-term debt has remained constant this year at $0.3M, I think it’s safe to assume that Tandem got an exceptional deal here should the product turn out to be successful and receive final FDA approval.

Valuation

Tandem’s growth has slowed throughout 2022, falling from the company’s initial projections of 19-20% YoY growth to actual results of 14% YoY growth in the latest quarter. Gross margins have fallen 3% YoY as well, and profits in Q3 2021 swung to a negative net income of $49M in Q3 2022. Sales have disappointed this year with the company now estimating 2022 revenue of $800-805M versus the analyst consensus of $836M. These poor financial results combined with the new competitive landscape have decimated TNDM’s share price, which has fallen from just over $153 last December to its current level around $43.

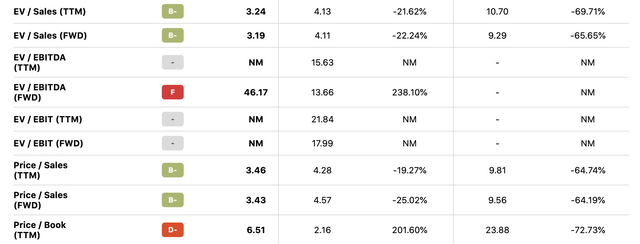

However, with the company still maintaining double-digit topline growth, the stock crash has resulted in an ultra-low valuation for TNDM relative to its peers, with the company now trading at a forward price-to-sales ratio of only 3.43, 64% lower than its 5-year forward P/S average of 9.56. Its price-to-book ratio is even lower by historical standards at 6.51 versus 23.88.

TNDM Valuation (Seeking Alpha)

Let’s compare this to PODD’s valuation, which at 16.9x forward sales and 35.4x book value is not only many times higher than TNDM’s despite having similar revenue growth, but is higher relative to PODD’s historical values as well:

PODD Valuation (Seeking Alpha)

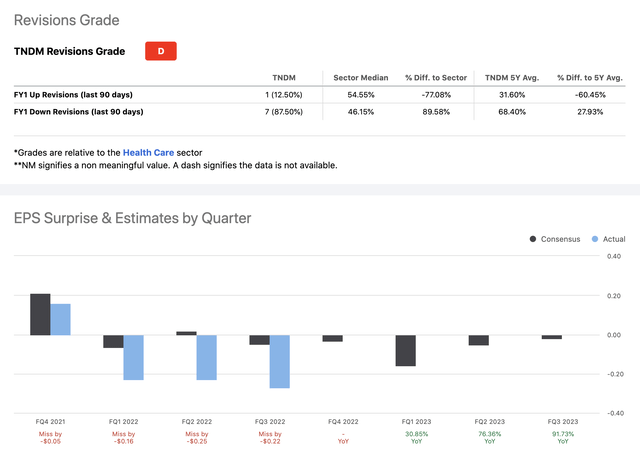

Lastly, as we can see from its wide earnings misses and recent analyst estimate revisions, sentiment is highly negative at the moment with seven downgrades and only one upgrade in the last 90 days:

TNDM Earnings & Revisions (Seeking Alpha)

While I’m not usually a value investor and TNDM is certainly a growth stock, I believe that the best time to invest in beaten-down stocks, in general, is often when forward market sentiment seems to be at a low, as this can signal that all of the bad news has been priced in, and any good news in the future will likely result in significant share appreciation.

To this end, Wells Fargo recently upgraded the stock, recognizing that its customer growth, while lower than forecasted, has remained resilient this year in the face of the strong competition outlined above. Analysts are often rightly criticized for following price trends, so perhaps it is unsurprising that TNDM began rebounding at the beginning of November two weeks prior to this upgrade. I imagine that other analyst upgrades will soon follow if TNDM’s uptrend continues.

Conclusion

Based on its ultra-low relative valuation, its leading insulin-delivery software, and its promising product pipeline of smaller waterproof pumps and extended infusion sets, I think Tandem Diabetes Care, Inc. stock offers a compelling risk/reward proposition at current levels.

For investors with a longer time horizon who are willing to tolerate high volatility and outsized earnings reactions, I rate Tandem Diabetes Care a strong buy on turnaround potential in 2023.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment