ryasick

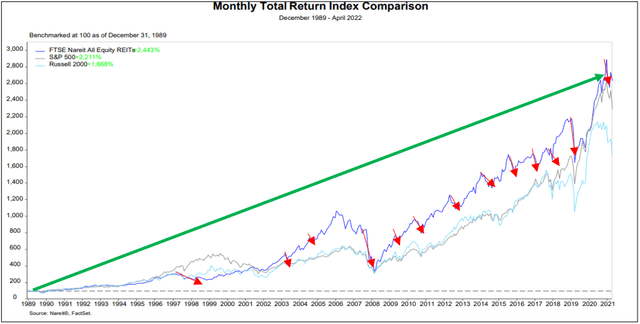

Historically, it has always been a good idea to buy real estate in the form of publicly listed REITs (VNQ) after a market crash. From the chart below, you can see that they tend to drop too much as the market corrects, but they then also quickly recover thereafter:

NAREIT

To give you two recent examples:

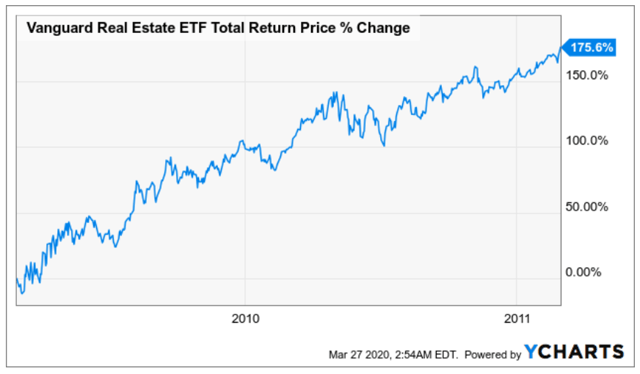

Following the crash of the financial crisis, REITs nearly tripled in value in just two years!

YCHARTS

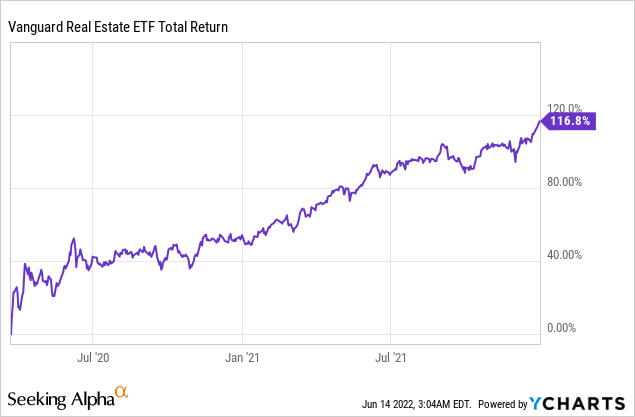

Then following the pandemic crash of 2020, REITs more than doubled in just a few:

YCHARTS

Today, REITs are once again down significantly and we think that investors are likely to earn significant returns in the coming years as they recover.

This time, REITs crashed due to fears of rising interest rates, but as we have explained in previous articles, these fears are largely overblown because:

- REITs balance sheets are the strongest ever with low leverage at 35% on average and long maturities at nearly 10 years.

- Rents are growing the fastest in many years due to inflation.

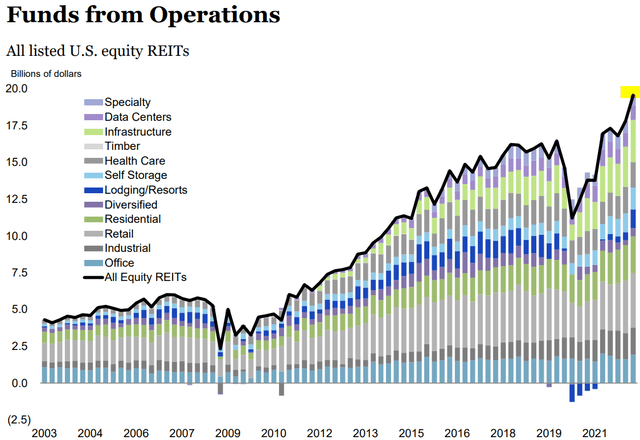

- And by the time most of the debt needs to be refinanced, interest rates will have likely come back down, but rents won’t, leaving REITs with higher cash flow than ever:

NAREIT

Therefore, we think that REITs are once again offering some generational opportunities to build wealth by buying real estate at a discounted price.

In what follows, we highlight two of our favorite opportunities to buy today:

Vonovia is already our largest international holding and we continue to buy more of it. The reason why we’re investing so heavily in it is that we think that it offers a generational opportunity to high-quality German apartment communities at just 35 cents on the dollar.

Vonovia

Vonovia is commonly perceived to be a blue chip and it has never in its history traded at a large discount to NAV until this year when its share price collapsed as if the world was coming to end.

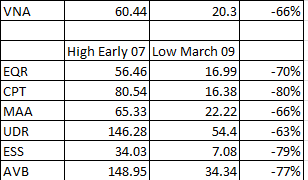

I recently saw a tweet from a fellow shareholder (since deleted) who pointed out that Vonovia’s drop is equivalent to that of US apartment REITs during the great financial crisis. The LTVs were equivalent at around 40-45% and US apartment REITs (EQR; CPT; MAA; UDR; ESS; AVB) traded at their peak at 20-25x FFO, which is also in line with Vonovia’s peak valuation of 24x FFO:

Back then, buying apartment REITs at pennies on the dollar proved to be a generational opportunity and investors made fortunes in the recovery.

Today, we think that Vonovia is no different. In fact, I would argue that buying Vonovia today is potentially an even better opportunity than buying US apartment REITs in 2008-2009 because of two main reasons:

Reason 1) More resilient fundamentals: Something that’s underappreciated by investors is that German apartment communities behave very differently from those in the US. Back in 2008-2009, rents dropped quite significantly in the US. It’s a free market and rents fluctuate based on supply and demand, which makes revenue a lot more cyclical. The German residential market is much more heavily regulated, which limits rent growth during good years but also reduces or even eliminates the downside during tough times since demand always exceeds supply. Rents in Germany did not drop in 2008-2009 and today, rents are regulated too low and are still catching up to the recent inflation. Therefore, we see no threat of a major decline in rents. On the contrary, rent growth is accelerating at the moment, despite the collapsing share price.

Reason 2) Much smaller existential threat: back then, the entire banking system suddenly stopped working, and refinancing debt became impossible. This put US apartment REITs at high risk and forced many to issue highly dilutive equity just to survive. At the same time, rents were dropping, leverage was growing, and the whole environment was very uncertain. Today, in comparison, Europe is facing a severe crisis, but the banking system is working just fine, leverage is reasonable, and rents are growing. I suspect that Vonovia is down so much because investors fear that the rising rates could cause asset prices to drop and cause Vonovia’s leverage to become excessive. But as we explain in a recent article, we think that this is unlikely for a number of reasons. Scope ratings recently released an outlook for the European residential sector and it nicely captures our thoughts:

“Drastic asset devaluations look less likely given current asset values of companies are significantly below reinstatement costs. Severe deterioration of the credit quality of residential companies is unlikely. Rental growth and cash flow prospects remain positive supported by upward rent adjustments; shifting demand from prospective homebuyers towards renting due to rising interest rates; housing shortages in several European markets; and positive demographics in large European cities.”

In other words, Vonovia’s NAV estimate already is significantly below the replacement cost of its properties and we need more, not less, housing. Rents are growing rapidly and the demand significantly exceeds the supply. There also continues to be good demand for these assets in the private market from lower risk-tolerant institutional investors like pension funds and life insurers that need resilient, inflation-protected cash flow to meet their long-dated liabilities.

For these reasons, we think that a major drop in asset values is unlikely. Of course, values may drop a little, but pricing Vonovia at just 35 cents on the dollar seems way overdone.

The CEO, CFO, and other insiders have been buying more shares throughout the year, and the company also expects to do buybacks – all while paying down debt with retained cash flow and asset dispositions.

We expect 100%-plus upside and earn a near 8% dividend yield while we wait. We think that the dividend is sustainable, but we would actually welcome a cut if it allowed them to accelerate the deleveraging and push for more aggressive buybacks. It would only lead to more upside in the long run.

What’s the main risk you might ask? The war in Ukraine spirals out of control, turns into a larger conflict, and causes persistently high inflation and higher interest rates even as Europe enters a severe recession. I view this as unlikely given that Russia is losing the war just against Ukraine, but I closely monitor the situation in Ukraine and its impact on the European economy, its inflation, and interest rates.

Alexandria Real Estate (ARE):

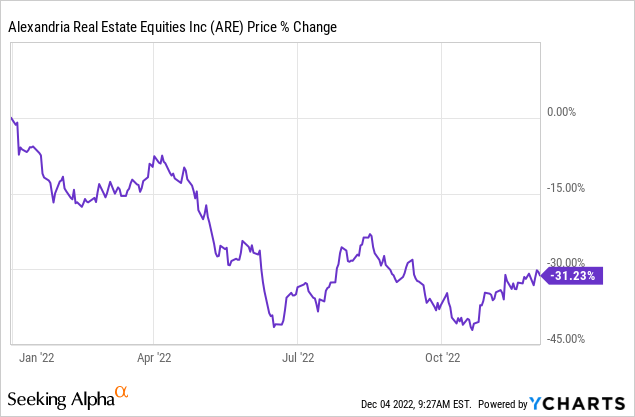

Alexandria Real Estate (ARE) is the largest holding in our Retirement Portfolio. It owns mainly life science buildings and it is down heavily in 2022 because the market fears that its rent growth will slow down as even the bigger Biotech companies like Vertex (VRTX) and Regeneron (REGN) have a harder time accessing capital.

Alexandria Real Estate

The rising interest rates then add fuel to the fire.

But what the market appears to have missed is that ARE’s rents are already deeply below market, which provides a predictable “reserve” of future growth as it hikes rents closer to market. Even if rent growth slows down in the near term, ARE will still have rapid growth prospects ahead of it. In the last quarter, ARE again hiked rents by nearly 30% on expiring leases. On a cash basis, its same-property NOI rose 10.6% year-over-year across the entire portfolio, which is the third-highest growth rate in the company’s entire history.

They also have a strong investment-grade balance sheet with low debt at 27% of gross assets and no major maturities for many years to come so there is little to worry about here. Here is a note that the CEO made about their balance sheet on last earnings call:

“The execution of our capital plan this year was exceptional given the macro environment. We did $1.8 billion of 12 and 30-year bonds with a weighted average rate of 3.28% in a term of 22 years, which was completed in February.”

The CEO also noted on the earnings call that their growth has been “exceptionally strong” with near double-digit FFO per share growth and they even slightly hiked their guidance.

So in short, the company is doing better than ever, and I think it’s just a question of time before the market realizes this and reprices its shares at over $200, unlocking at least 50% upside from here. The dividend yield is small at 3.2%, but it’s also growing rapidly.

Again, what’s the main risk? Interest rates could remain higher for longer and it could cause investors to lose interest in higher-growth REITs for a longer period of time. It could cause a REIT like ARE to underperform for a while, but ultimately, we would still expect to earn good returns in the long run because this wouldn’t have a major impact on the company’s fundamentals. More so on its market sentiment.

Alexandria Real Estate

Closing Note:

There are over 200 REITs out there and we invest in the best ~25 of them at High Yield Landlord as we attempt to outperform the market. Vonovia and Alexandria are two of them.

Be the first to comment