galitskaya/iStock via Getty Images

Investment Thesis

Parks! America, Inc. (OTCQB:PRKA) is not your typical stock. When it comes to finding bargains in the stock market, it is oftentimes better to ‘fish in the smaller ponds’, so to speak, than to look at highly efficient and well-followed industries/sectors. Generally, the larger the market capitalization, the more attention a stock gets. Finding mispriced stocks in these large ponds becomes increasingly difficult as time goes on, which is why I love discovering new micro-cap ideas that I can add to my portfolio. Parks! America is a stock that I have been aware of for some time, and I have finally decided to start building a position in the company after a broad market sell-off this year. Taking advantage of year-end tax loss harvesting in this month of December could pay off handsomely over the long-term for patient investors.

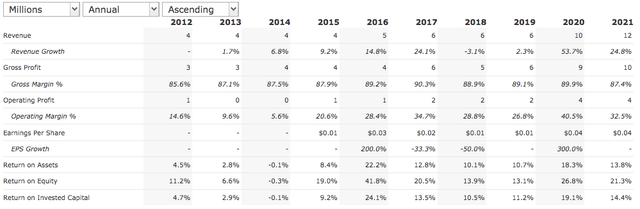

Parks! America, despite being small, is simply a great business, with predictability and high gross margins of 88% and return-on-equity of around 21%. Gross profits and operating profits are at their highest level in the last ten years, and operating margins are also impressive at over 30%. Not only that, but revenues have doubled over a five-year period, and tripled over a ten-year period. This lends credibility to management, which is aligned with shareholders and the company has recently chosen a new CEO with years of experience in the amusement park and leisure/hospitality industry.

The fundamentals are exceptional for a micro-cap stock, and valuing the business based on common metrics such as earnings per share and EV/EBITDA leaves room for meaningful share price appreciation in the near, as well as in the long-term.

Introduction

You may be asking yourself, why Parks! America, and where did you discover this obscure micro-cap stock?

I first became aware of Parks! America a couple of years ago through my research into the Focused Compounding Hedge Fund, run by Andrew Kuhn and Geoff Gannon. At this time, the stock was trading for just 14 cents a share. This was during the depths of the 2020 market crash, and at the time, I was too preoccupied with learning and adding to other holdings in my portfolio to take the stock seriously.

My familiarity of micro-caps was extremely limited back in early 2020, and I was just beginning to learn about over-the-counter stocks and incorporate cloning as part of my investment strategy. I did exactly what most market participants do when they come across Parks! America – they write it off as just another over-the-counter stock that is not worth their time.

It wasn’t until I read Andrew Kuhn’s letter to the Parks! America Board of Directors that I fully decided to clone Focused Compounding and buy shares in PRKA for myself. If you are interested in learning more about the company, I highly recommend that you read Andrew Kuhn and Geoff Gannon’s letter after this article, and see the approach and attitude taken by them. I found the content and tone of the letter to be impressive.

Recent Insider Buying

After I warmed up to the idea of cloning Focused Compounding and investing in Parks! America for myself, the share price had skyrocketed and hit a fresh high of 88 cents per share in July of 2021. Unbeknownst to all, the stock was experiencing a ‘blow-off top’ and would soon crash back to reality. Now that the stock has sold-off along with the broad market in 2022, shares are roughly 60% off of the highs, presenting a wide margin of safety for long-term investors.

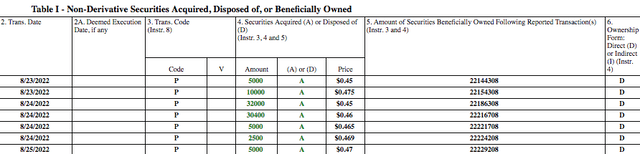

Through my perusing of the OTCmarkets website, I found that just as recently as August 23rd, 2022, insiders were buying back shares of PRKA in the open market.

PRKA Insider Buying (otcmarkets.com)

After doing more research, I found that this particular director and owner of the company had also bought shares in June of this year, as well as in April, for much higher than the current market price. This director also had made considerable buys in the open market throughout 2021, and has been aggressively purchasing shares of PRKA in the open market for years, despite owning over 22 million shares already.

In fact, multiple directors of the company have bought shares in 2022 on the recent decline, and this reinforced my belief that the shares are currently undervalued. There are countless reasons why an investor would sell stock in a given company, but only one reason that an investor would buy – they believe that the shares are undervalued, and are worth much more than the current market price.

It remains to be seen if the directors of the company are done buying shares in the open market, but now that the price has fallen nearly 20% since August 25th, the discount is even better. As we approach the end of the 2022 calendar year, further tax loss harvesting could put more pressure on the stock and create fantastic buying opportunity for long-term shareholders who wish to accumulate more shares.

Competitive Advantages, And Risks To The Business

Parks! America’ has 3 locations.

The location in Pine Mountain, Georgia is particularly lucrative compared to the Missouri park, which faces more local competition and suffers more in terms of profitability. The Georgia park is also situated in an advantageous location, with higher population density and is in much closer proximity to major cities.

The relatively newly acquired Aggieland Safari park in Texas is similar to the Georgia location, with higher population density and more room for growth in future years, not only in terms of number of customers, but also profitability metrics. The Texas park is also more competitively priced when compared to local alternatives. In my opinion, this newer Texas park is the real overlooked gem when looking at the business from a long-term perspective.

The Wild Animal Safari parks also offer a distinct competitive advantage compared to other local attractions, in the form of up-close interactions with a diverse group of exotic animals at lower price-points than most competitors. This is more apparent concerning the Aggieland Safari park, with ticket pricing data which I have referenced from a previous Seeking Alpha article on the company –

Texas, Adult ticket $25

Competitor: Natural Bridge Wildlife Ranch, Adult ticket $29

In the past, the strategy from Parks! America has been to keep lower prices for admission, growing the customer base consistently and making more profit off of food and beverage sales, feeding packs for animals, and other higher margin concessions. This is an increasingly smart business strategy over the long-term, as the company can offer more value to consumers while not charging more for admission – strengthening the reputation of the business.

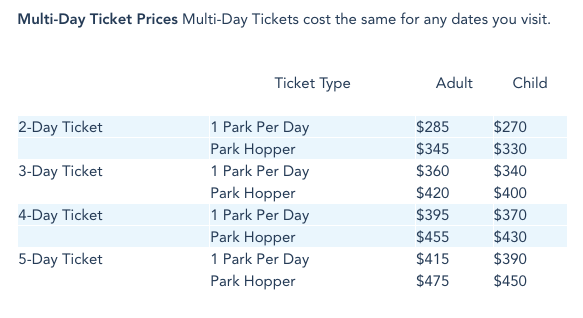

Another thing to keep in mind is the tendency for consumers to ‘trade down’ in terms of spending on entertainment during recessionary times. The company’s Wild Animal Safari parks have been compared to attractions at amusement parks such as Disneyland in the past, and with ticket prices increasing more and more due to inflation, the safari parks are a low-cost alternative to Disneyland and other attractions. This is a phenomenon that will likely become more apparent in 2023 as the impact of rising interest rates works its way through the economy. Below is a table showing ticket prices for Disneyland, and as you can see, the prices are vastly different.

Disneyland Ticket Pricing (disneyland.disney.go.com)

Parks! America’s ticket pricing is much more favorable to the middle class, who make up such a large percent of the U.S. population. While many families with children who live in Texas, Missouri, and Georgia may not go to Disneyland or other theme parks due to higher fuel costs, high ticket prices, and other inflationary factors, they may decide to focus more on local attractions and ‘off-the-beaten path’ areas closer to home. This would be beneficial to Parks! America in both the near and long-term, if these patterns of behavior become more of the norm.

Some further risks to the business to keep in mind are changing weather patterns and their potential negative effect on sales and profitability. In 2013 and 2014, inclement weather affected attendance in the Wild Animal Safari parks substantially, resulting in the only years where the company did not have meaningful profits in the last decade. As climate change becomes a bigger issue, severe weather patterns are becoming more regular and drastic. Recently as of August 2022, droughts are affecting nearly one-third of Americans, meanwhile catastrophic flooding has been occurring in other parts of the world. These extreme weather patterns and climate fluctuations could cause volatility in terms of park attendance, especially during the busiest seasons. This will remain as a substantial long-term risk for the company.

Fundamental Analysis, Earnings Potential, Further Risks

The year 2020 was an incredible year for Parks! America, not only in terms of revenue growth, but also in terms of earnings per share. The Wild Animal Safari parks were one of the few businesses that was deemed safe enough to continue to operate in the face of a pandemic (having a drive-thru element to the business), and with widespread school closures, more parents could take their kids to the parks for fun and education.

Looking at the financial results from 2021, it seems to be the case that revenue growth and earnings power have benefited greatly, showing potentially long lasting follow-through on changing consumer behavior.

PRKA Financial Data (quickfs.net)

Back in December of 2021, Seeking Alpha contributor Kevin Mackie wrote an article on Parks! America that included some interesting thoughts on earnings growth, and potential share price appreciation;

the stock price would be $1.20 in 2026 if they can have $0.08 worth of EPS at a multiple of 15 at that time. That would represent a 13% rate of return, more than enough for my personal goals. Since their TTM earnings are $0.06, getting two more pennies’ worth in five years doesn’t seem at all out of reach. However, we have to look at what would have to happen for them to get those pennies per share. With 75 million shares outstanding, they would need $6 million of net income to get EPS of $0.08.”

Source: Kevin Mackie

At that time, the author deemed that PRKA was not a great buy, and was spot-on in his analysis. The main takeaway was that management should sell the Missouri park, noting that margins would immediately increase and considerable capital would be unlocked to increase shareholder value in a number of different ways. Now that 2022 is coming to a conclusion, the shares have pulled back substantially. Further tax loss harvesting over the next month should create more selling pressure in the stock, presenting an attractive buying opportunity from a long-term investment standpoint.

One idea I found quite interesting from reading previous analysis on the stock was the idea of moving animal assets from the Missouri park to the parks in Georgia and Texas, utilizing currently unused acreage and drawing more visitors to the parks with different animal offerings. The relatively newly acquired Texas park has ample room for expansion, as only 250 acres of the 450 acres totally owned are being used. This is part of a long-term bullish outlook on the stock, as the population metrics and growth in the state of Texas continue to be favorable for companies like Parks! America. While management does not seem keen on selling the Missouri park as of now, the further expansion and development of the Texas park should more than make up for any shortcomings in terms of profitability.

Others have noted the company’s excellent capital allocation in the past, and it has been recognized by the market as a great company with a management team that is aligned with shareholders. The newly appointed CEO, Lisa Brady, also has extensive experience in the amusement park and resort/leisure/hospitality industry;

For the last decade, Ms. Brady has served in a variety of leadership roles of increasing responsibility with Cedar Fair Entertainment Company including investor relations, strategic planning, M&A activities, resort and adjacent development, and implementation of key growth initiatives.”

Source: Parks! America names new CEO

In addition, continued insider buying over the last several years shows that management has great confidence in the future prospects of the business, despite past doubts about the Missouri park and profitability.

However, an economic slowdown and prolonged recession could hurt the company’s earnings power in general. While consumers may be inclined to visit the Wild Animal Safari parks as part of a ‘trade down’ in terms of choice of ticket pricing, they may spend less on high-margin concessions at the parks.

If earnings were to show a decline for the FY 2022 calendar year and revert back to $0.03, the current share price would be just over a 11x multiple. If earnings per share stay the same, at $0.04, then applying the same multiple would give a share price of around 44 cents. With an EV/EBITDA ratio of around 10x, other valuation metrics suggest that the stock is not overvalued in the slightest. This is perhaps why insiders have been continually buying shares in the open market over an extended period of time.

Assuming earnings growth in the years ahead after 2022, with EPS of $0.05 and a fair 15x multiple, we reach at a stock price target of 75 cents. Even applying a conservative 10x earnings multiple to the current earnings of $0.04 would result in a target price of 40 cents per share, with potential for appreciation to 50 cents or more with continued growth in the coming year. Given the company’s history of predictability, high gross margin of 88%, and return on equity of just over 21%, I believe that the fundamentals justify an earnings multiple of greater than 10x for future years. In my opinion, this makes the stock an attractive buy at current levels under 40 cents per share. Taking advantage of year-end tax loss harvesting could pay off very handsomely in the long-term.

Risks Of Micro-cap Investing

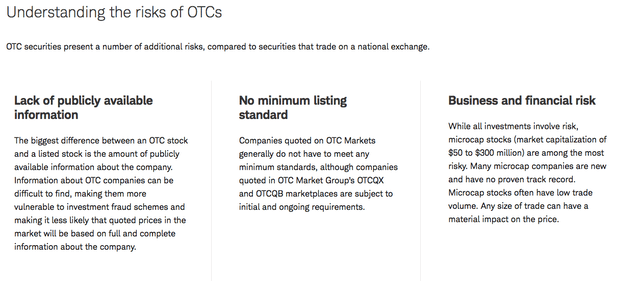

Many micro-cap stocks are known to be exposed to issues regarding financing activities, and the potential inability to compete with larger companies due to limited financial and personnel resources. Trading over-the-counter can present many issues that market participants should be aware of, including liquidity issues, lack of margin eligibility, possible lack of transparency regarding quotes, a limited number of Market Makers willing to fill orders

Over-the-counter stocks are not listed on major exchanges, which can alter the public’s perception of these businesses and make it difficult to facilitate trading. These securities are traded “via a broker-dealer network” due to the fact that many micro-cap stocks are too small to meet the requirements of a major exchange listing. There are usually more fees associated with trading OTC stocks, because these trades must be made through market makers who hold a number of securities and make trades happen.

Below is a table describing the main issues which OTC stocks are known to have.

Risks Of OTC Stocks (Schwab.com)

Parks! America has a market capitalization of approximately $26 million and trades on an OTC exchange, making it fall in the category of both a micro-cap stock, as well as a “penny stock.” These stocks are typically seen as among the most risky, with little publicly available information and are often associated with low trade volumes, which can present with illiquidity.

While many people could become annoyed with the illiquid nature of some of these stocks, I tend to enjoy the calmness and serenity that comes with owning a stock that is not trading every single second of every day. With Parks! America, I have definitely found this to be the case. On the other hand, I do own some highly volatile and liquid stocks, so I like to find companies such as Parks! America that can act as a counterbalance in my portfolio and compliment my other holdings.

While Parks! America is considered to be a micro-cap penny stock, it is drastically different than many others that you will find while browsing the OTCmarkets website.

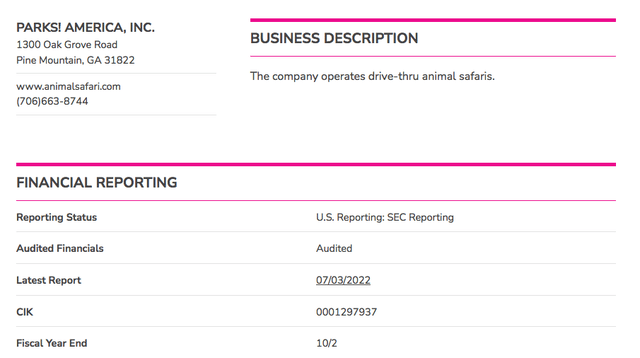

Parks! America Company Profile (OTCmarkets.com)

While many companies listed over-the-counter are not SEC reporting companies, Parks! America stands out with lots of readily available information for shareholders. Another thing that makes the company stand out in the world of micro-cap stocks is profitability. The company has a long financial history, with operating profit, as well as positive earnings to show in each year since 2015, and most years in the last decade.

Due to the many risks of investing in OTC stocks outlined previously, I like the cloning approach when it comes to finding micro-cap investments. Having notable investors handpick micro-cap ideas which meet their standards can help tremendously in one’s quest to find the best long-term micro-cap investments.

Conclusion – My Strategy For Investing In Parks! America

Parks! America is an overlooked micro-cap stock with great long-term potential. With a small market capitalization of $26 million and low annual share turnover of just 1%, the shares fit nicely into my portfolio with my other holdings. For some market participants, illiquidity could be a deal-breaker and the OTC “penny stock” status could present as a risk.

Company specific risks include extreme weather patterns causing detriment to park attendance, a decline in earnings for the calendar year based on an economic slowdown or recession, as well as potential issues regarding financing activities. However, the company has demonstrated excellent capital allocation in the past, with a good management team that has extensive knowledge on running parks and is in alignment with shareholders. When considering the continued and most recent insider buying, the stock looks increasingly attractive at current levels.

As the share price continues to be under pressure from year-end tax loss harvesting, my strategy has been to place low limit orders and good-til-cancelled orders around $0.33 to $0.38, buying a meaningful amount of shares as trading facilitates. I believe that Parks! America’s fundamentals indicate that the stock deserves to trade at over 10x earnings, and with continued earnings growth in the coming years, the share price could increase well above $0.75 once more. I currently view the shares of PRKA as a Strong Buy, and will continue to add shares to my portfolio over the course of the next month.

Be the first to comment