Editor’s note: Seeking Alpha is proud to welcome The Long Game as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

borealisgallery/iStock Editorial via Getty Images

The gaming industry is a notoriously unpredictable, hit-driven industry, but the crown jewel of Take-Two Interactive (NASDAQ:TTWO) – Rockstar Games – has an almost guaranteed likelihood of success with its upcoming “Grand Theft Auto VI.” The share price is down 38% since the Zynga acquisition, which more than makes up for the expensive takeover price and weakness in the mobile segment. Given the recent negative sentiment, I see asymmetric upside to the current price with the eventual release of “GTA VI” and optionality from new IP in Take-Two’s development pipeline.

Company Overview

Take-Two develops and publishes high quality games for consoles and PCs through Rockstar Games, 2K, and Private Division, and for mobile devices through Zynga. The game portfolio includes 13 franchises that have sold over 5 million units, such as “Grand Theft Auto,” “Red Dead Redemption,” “NBA 2K,” “Borderlands,” and 17 of the top 200 U.S. grossing mobile games including “Farmville,” “Words With Friends,” “CSR Racing,” and “Empires & Puzzles,” among others. Their strategy is to deliver the best content and build a loyal fanbase. This leads to sequels and recurring spending, and ultimately creating franchise longevity and valuable IP.

Take-Two runs a decentralized structure, with its headquarters in New York and development studios based all over the world. Creative teams work best when studios are given the freedom to run autonomously from the parent organization. That’s why their studios have more control over their content, announcements, and deadlines, and will often see pushbacks to release dates.

Historically, most of the business revenue came from consoles and some from PC. They largely missed the mobile growth opportunity over the past decade and were playing catch-up with small mobile acquisitions of Social Point, Playdots, and Nordeus. This has now changed, given the Zynga acquisition and almost half of the expected bookings for FY23 to come from mobile.

|

Revenue Split by Platform |

Console |

PC |

Mobile |

|

FY22 |

72% |

16% |

12% |

|

FY23 est. (author’s calculations) |

45% |

10% |

45% |

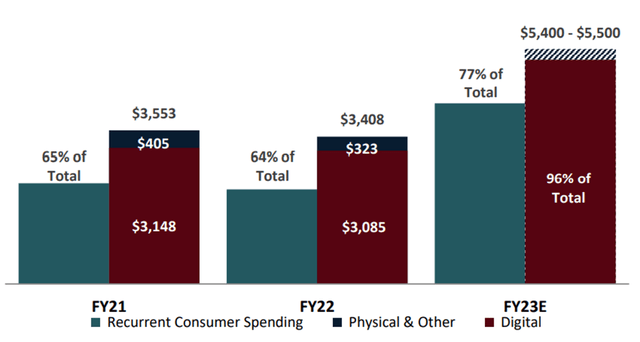

The other major structural change is that recurrent consumer spending (RCS) – which includes virtual currency, add-on content, in-game purchases – has increasingly been driving bookings growth (growing at 21% CAGR vs. 14% for net bookings).

Net Bookings (Second Quarter Fiscal 2023 Results & Guidance Summary)

Gaming company financials were historically lumpy around game release schedules and console cycles, but RCS has the double benefit of monetizing the game over a longer time frame and smoothing out the top and bottom lines. Still, most gaming companies rely on only two or three games for the bulk of their revenue, making them inherently riskier. Take-Two’s top five games accounted for 83% of bookings in FY22 and Zynga’s top four games (across online spend and advertising) were 52% of bookings in FY21. Given management’s guidance, the combined entity should see about 70% of bookings come from its nine largest franchises this year. For comparison, Activision Blizzard’s (ATVI) three largest franchises (“Call Of Duty,” “Candy Crush,” and “Warcraft”) were 82% of its 2021 revenues.

Zynga

Take-Two’s $12 billion acquisition of Zynga was announced in January 2022 and closed in May. The positives from the takeover are that Take-Two get more exposure to mobile, which until now has been the fastest growing sector, and diversify their revenue with an established portfolio of games that aren’t subject to the console generational cycles. Management has highlighted $100 million in cost synergies that are already being realized, such as the Playdots closure. The downside is that mobile has been hit hard from the IDFA deprecation and the current macroeconomic environment. Free-to-play games are hit hardest by declines in consumer spending, as people can cut back but still play the game. It is also questionable whether the Zynga game portfolio meets the quality standards of the legacy Take-Two IP, and if it’s diluting value for shareholders.

“Grand Theft Auto VI”

Although no release date has been announced, the most important IP and catalyst in the next two years will be “GTA VI.” Analysts have accounted for the release in their fiscal year 2024 estimates (ending March 31, 2024) as have Take-Two management, implying a late-2023 release. Unless there is an announcement before Christmas, I expect it will be pushed out later into 2024 (FY 2025).

The “GTA VI” leaks in September will not affect the development timeline and, if anything, I see the leaked snippets as a reassuring insight that Rockstar is on track to deliver a title consistent with what fans know and love. Most of the negative commentary was around how unfinished the footage was, not anything negative about the game itself. Changing game mechanics is a risky endeavor; traditionally, the larger companies compete by spending more on brand, narrative, art, and polish, which makes it more costly for smaller players to keep up. That also helps marketing to the largest possible audience.

What destroys franchise value? Burning out the IP with too frequent releases of games known as “franchise fatigue,” or jumping on trends or game mechanics that don’t align with the IP. Rockstar has had years of feedback on what features and functions are popular, and DLC and in-game transactions provide years of data that can be tailored towards making the next iteration better. The leading indicators for a franchise in decline are falling review scores with consecutive iterations, followed by declining sales.

The evidence above suggests Rockstar are best in class at what they do, producing the highest quality games and putting the greatest importance on protecting their IP. This factors into our forecast by limiting the downside estimates in a bear case scenario.

Pipeline

Take-Two’s pipeline for 2023-25 is the largest it has ever been, with 38 mobile and 24 immersive core games to come. But in a hit-driven business, the number of releases won’t equate to revenue – especially for new IP. Most of the revenue will likely come from the existing franchises, but the positive here is that it also means less uncertainty around these revenues. Nor does the pipeline include any crossover of existing Take-Two IP into mobile, which is not only difficult from a technical point of view, but also risks diluting the IP. So don’t expect to see a “GTA” mobile game anytime soon. Any benefits here should be considered potential upside and not included in the forecast.

Valuation

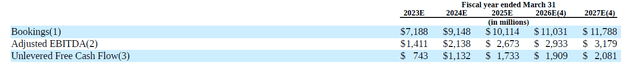

The Form S-4 filed back in March for the Zynga acquisition provided projections for the combined businesses. Looking out to 2025E, by which time “GTA VI” will have been released, management projected free cash flow (FCF) rising from 10% to 17% of bookings. FCF has historically averaged 20% FCF/sales for the past decade since “GTA V” was released, but we will stick with 17% for our base case valuation, which takes into account the effect of the lower margin Zynga business.

Summary of the combined company projections prepared by Zynga (Take-Two Interactive Software, Inc. – FORM S-4)

We can also see the 2023E bookings guidance is already short at $5.4-$5.5 billion (vs. $7.2 billion), and is short of the last quarter’s guidance of $5.8-$5.9 billion. It is too early to tell whether this is a short-term macro headwind or whether the IDFA changes have permanently affected Zynga’s profitability. A worst-case scenario would see further pipeline delays and Zynga’s business continuing to underperform.

Current analyst estimates for 2025E sales range from $7.31 billion to $9.17 billion. We will use these, and some leeway for FCF margin contraction/expansion, to obtain our bull and bear case estimates for 2025 FCF/share. Our base case top line is the midpoint of the analyst high and low estimates, and with a 17% margin we get $1,400m FCF. Total shares outstanding as of Q2 is 167.8 million, which gives us $8.34 FCF/share for 2025E.

|

2025E |

Bear |

Base |

Bull |

|

Bookings (m) |

$7,310 |

$8,240 |

$9,170 |

|

Unlevered FCF (m) |

$1,170 |

$1,400 |

$1,650 |

|

FCF/Bookings |

16% |

17% |

18% |

|

shares outstanding (m) |

167.8 |

167.8 |

167.8 |

|

FCF/share |

$6.97 |

$8.34 |

$9.83 |

|

P/FCF multiple |

18 |

18 |

18 |

|

March 2025 Price |

$125 |

$150 |

$177 |

|

Return (p.a.) |

9% |

18% |

26% |

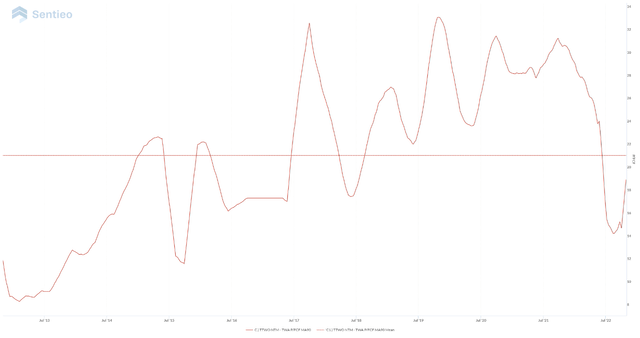

Now, for our 2025 estimates we need a P/FCF multiple. The average multiple for the previous 10 years (pictured below) was 21x; however, we will use a more conservative 18x multiple. This takes into consideration that we will be at the tail end of a growth spurt, and margin gains from digital delivery and RCS have largely run their course. So, 18x our $8.34 FCF/share estimate implies a base case valuation of $150 and a 18% annualized return over the next 2.4 years.

Take-Two Interactive NTM TWA P/FCF – Mean and 90 Day Moving Average 2012-2022 (Sentieo)

Risks

The key risks, in what I believe to be ascending order of seriousness, are:

- “GTA VI” flops. The most like-for-like comparison is CD Projekt Red’s “Cyberpunk 2077,” which had such a disastrous launch with bugs and performance issues that Sony (SONY) temporarily pulled it from the PS Store. It has still sold 20 million copies in just under two years and remains popular.

- Delays to game releases. Take-Two have a history of not rushing games, so this is likely to occur again. This often results in game release delays that might hurt the short-term financials, but it is the better economic decision in the long run to protect the IP and maintain the franchise value.

- Declining game quality. Pushing too hard on monetizing customers can be seen in the reviews of the latest iterations of sports games. This not just a concern with Take-Two, but also Electronic Arts’ (EA) “FIFA,” where customers are frustrated with the lack of improvements year on year, and with more gameplay centered around in-game transactions.

- P/FCF multiple. Any valuation based on financial ratios is highly sensitive to the multiple chosen. A sentiment shift could see a lower P/FCF and a rerating to 16x, for example, would see the base case price target fall to $133 (12% p.a. return).

- Pricing pressure from free-to-play games. Their popularity across all platforms could see a shift in consumer preferences away from games that have both upfront and in-game costs. I think Take-Two’s best franchises are less at risk as consumers will be willing to pay up for their high quality.

- Zynga user acquisition and monetization. It remains to be seen whether the IDFA deprecation will be a temporary or permanent hit to the earnings power of Zynga’s franchises. Zynga acquired ad monetization platform Chartboost in 2021, which gives me hope that they will be able to offset some of the damage – they might be able to leverage their first party data to improve their user acquisition and monetization.

Summary

There is very little risk that “GTA VI” will flop. Games are notoriously risky, but TTWO has the highest selling media title of all time with years of user data and feedback, a loyal community that continues to purchase 15 million copies of “GTA V” per year, and a long gap between titles so that consumers will be eager to experience the leap in gameplay and graphics.

Although gaming has traditionally been somewhat recession-resistant, the RCS in free-to-play titles isn’t as sheltered. This downside in mobile might hamper earnings for the next few quarters, but “GTA VI” will make up for it. Factoring this in, investors have a good chance of double-digit annualized returns for the next few years – even in our less-favorable scenario – with further upside if Take-Two has any new IP hits from the pipeline or successfully brings legacy IP to mobile.

Be the first to comment