Annabelle Chih/Getty Images News

Investment Thesis

While the semiconductor industry has a promising future, Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) is the world’s largest chipmaker, with significant revenue and high profitability. A possible China-Taiwan war may pose a real threat to this Taiwan chip manufacturer. However, its stocks are relatively undervalued according to some models, and it is worth investing in.

The Semiconductor Industry

Today, our economy can be described as a chip-economy because microchips have been applied to every technological advancement. Without integrated circuits, electronic devices cannot function as different parts of an appliance cannot communicate with one another. Hospitals, logistics, major tractor and agricultural manufacturers, and the food industry all use electronic equipment designed to operate at high speeds thanks to a microprocessor. In the robotic and AI era, the global market share of semiconductors is forecasted to surge steadily.

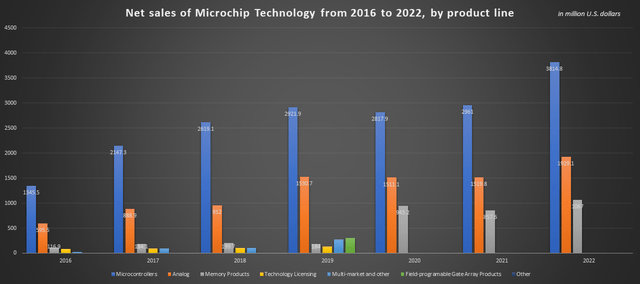

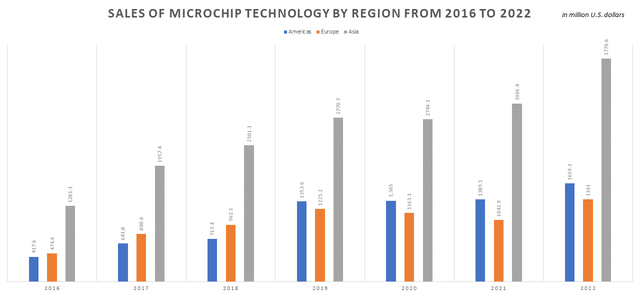

Since 2016, net sales of microchip technology have gradually increased, with microcontrollers and analog accounting for the lion’s share. Microcontroller and analog sales have increased since then, reaching 3814.9 and 1929.1 million dollars in 2022, respectively. In the meantime, memory products have achieved approximately 945.2 million dollars in sales versus 184 million dollars in 2019, a 5-fold increase that has now leveled off. These sales were generated primarily in Asian countries and are expected to reach 3770.6 million dollars in 2022, more than doubling the amount generated in the Americas and Europe.

Net sales of Microchip technology from 2016 to 2022 by product line. (Statista) Sales of Microchip technology by region from 2016 to 2022. (Statista)

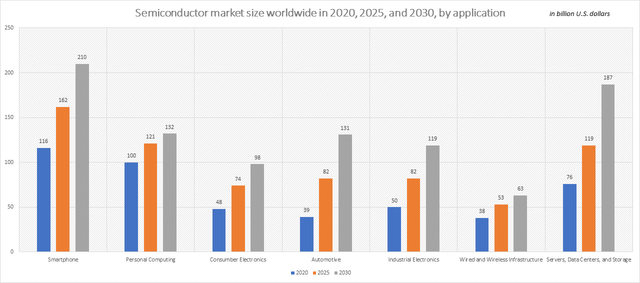

According to Statista, semiconductor general applications in other industries are expected to grow. Smartphones are predicted to be the leading application in the semiconductor industry by 2025, with sales estimated at 210 billion USD, followed by personal computing at 121 billion USD. While smartphones are still expected to consume the most microchips in 2030, servers, data centers, and storage are expected to outsell personal computing by 187 billion dollars in the period.

Semiconductor market size worldwide in 2020, 2025, and 2030, by application. (Statista)

With the introduction of Neuralink, Elon Musk now wants to implant a microchip into his own brain and recommend that others do the same. This will be a great deal if one billion people around the world are assumed to implant his chips in their brain. Also, Moore’s law states that the capability of an integrated circuit will double every two years as microchips become more transistor-rich, so does Neuralink. Nobody wants to be left behind, as predicted, every two years they would reasonably replace the old chip with a new one. So, Musk might sell up to one billion chips every two years even if the number of users does not increase. His work will help propel the semiconductor industry to new heights never seen before.

TSM – Taiwan Semiconductor Manufacturing Company

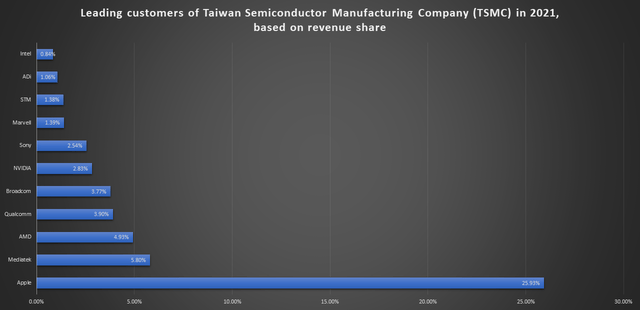

TSMC is the world’s leading semiconductor manufacturer and a major supplier to the West. Because many military equipments and U.S. research labs use its chips, TSMC plays an important role in national security for the United States. Many major U.S. corporations are their major clients, with Apple accounting for nearly 25.93% of total revenue in 2021.

Apple accounting for nearly 25.93% of total revenue in 2021. (Statista)

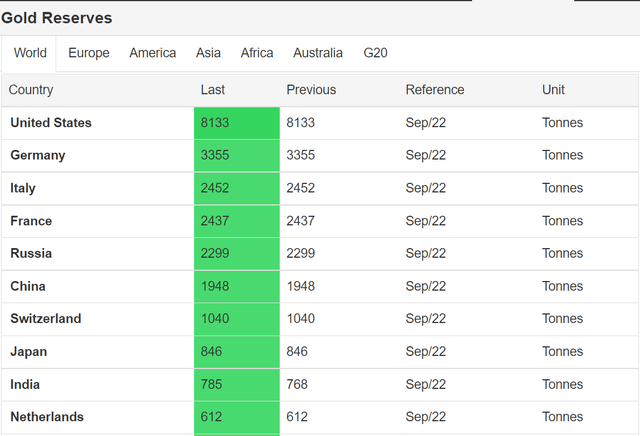

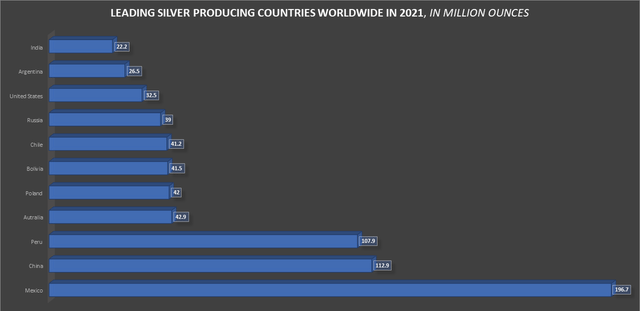

Geopolitical Risk But Opportunity

Many may be asking whether China will invade Taiwan; actually, no one could answer this question thoroughly. From my perspective, China should probably have to defend the Taiwan issue for two reasons. First, they require sovereignty to reach out into the Pacific Ocean and balance the power with the United States. Second, not only the chip war, but China may intend to take over the semiconductor industry in order to promote Silver’s utility. Lithium is widely recognized as the primary source of microchips and batteries. I think that China should potentially have looked into replacing this material with silver. To compete with the USD, they must convert their monetary system to a precious metal standard. However, because the United States has the largest gold reserve at around 8,133 Tonnes in September 2022, China cannot afford the gold standard. Fortunately, they have a large number of silver-mining sources at around 112.9 million ounces, nearly tripling that of the US and being the second largest worldwide following after Mexico. Hence, dominating Taiwan can help them achieve two goals with a single bullet: sovereignty and silver-battery and -chip industry.

Due to its future applications in microchip and battery, China can promote the utility of silver when they control the semiconductor industry. This has the potential to raise the price of silver as well as its intrinsic value. They can then easily convert their monetary system to a silver standard. However, they must have the support of other countries, particularly those in Asia. They have nearly finished with the BRICS network, especially Egypt and Saudi Arabia have recently joined it. This may be a serious challenge for the United States because if oils and commodities are valued and transacted by Chinese-silver money, the US dollar will suffer. Thus, many ASIAN countries may be likely to turn away from the United States and lean toward China. If this happens, an ASIA currency supported by BRICS would be realized.

In any case, TSMC faces significant political risk, but it could be a fantastic long-term opportunity for the semiconductor industry. Many well-known investors, including Warren Buffett, have spotted this promising opportunity and have already invested in this Taiwanese firm. As a result, spending the entire time studying this industry would not be a waste of time.

Gold Reserves by Country. (TradingEconomics) Leading silver producing countries worldwide in 2021. (Statista)

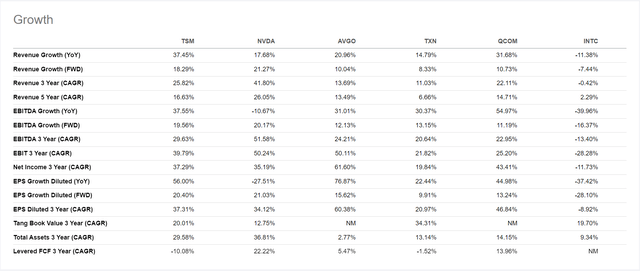

TSMC Has A High Revenue

TSMC is one of the fastest-growing companies in the semiconductor industry. Its revenue has witnessed a strong growth of 37.45% over the previous year, which is the highest among its peers. For the upcoming fiscal year, its growing is still expected to be at a high rate of 18.29%. Meanwhile, EBITDA increased by 37.55% year over year, which is higher than most of its competitors and only lower than QCOM growing by 54.97% year on year. Earnings per share diluted has also grown at a rate of 56% year on year, following after AVGO at 76.87% year over year.

TSMC has the highest growth in revenue among its peers. (Seeking Alpha)

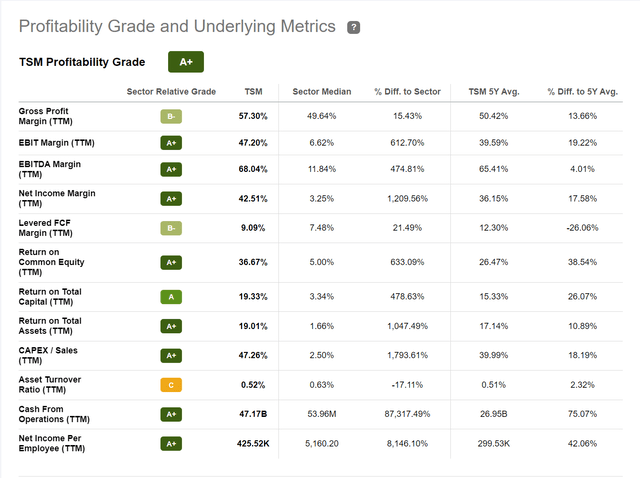

TSMC Achieves A Great Profitability

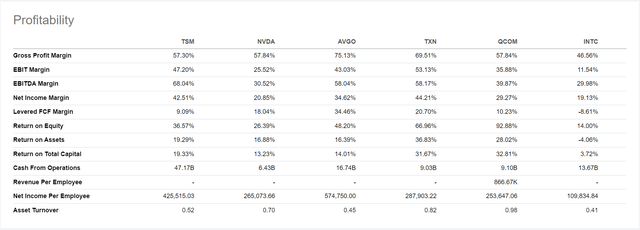

With reference to TSM profitability grades rated by Seeking Alpha, TSMC has the enormous capability of achieving a greater profitability when compared with its peers. Particularly, TSMC has generated nearly 47.17B of TTM operating cash flow, which is 87,317% higher than the sector median. This figure is roughly 75% higher than the sector median in five-year average. Meanwhile, there is a difference in levered FCF margin between TSMC and the sector median, at about 21.49% in TTM 2022 as opposed to -26% in five-year average, a significant upsurge. Additionally, TSM gross profit margin has stabilized for five years when it is 15.43% different from the sector median in TTM 2022, and 13.66% in five-year average. In this rating, EBIT margin and EBITDA margin have also performed well. Most importantly, the firm has a remarkable ability to yield an attractive return, as evidenced by its return on common equity, return on total capital, and return on total assets. These figures are all higher than the sector median with record numbers in TTM 2022.

TSMC has a tremendous ability to outperform its peers in terms of profitability. (Seeking Alpha) TSMC has a high profitability compared with its peers. (Seeking Alpha)

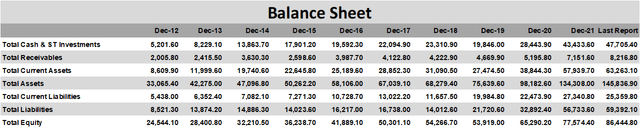

TSMC’s Balance Sheet Is Strong

TSMC has a strong balance sheet. (Seeking Alpha)

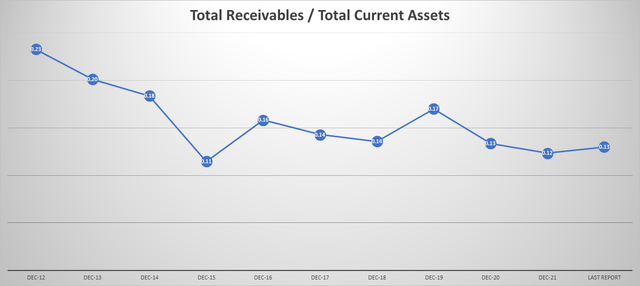

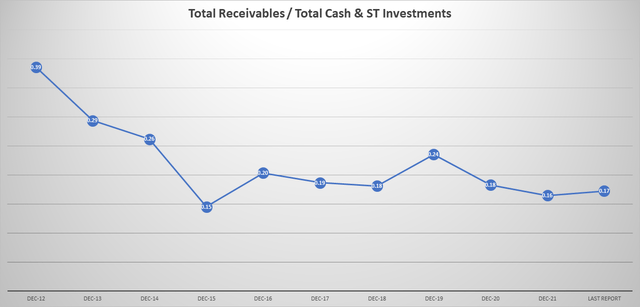

TSMC has a strong balance sheet in that the total current assets are always higher than the total current liabilities. It can boost the efficiency of the working capital and make the firm more adaptable to short-term financial obligations. Additionally, the total asset growth rate has been higher than the total liability growth rate. Perhaps the firm is comfortable investing in business development without a high level of leverage. When total receivables are divided by total cash & short-term investments and total current assets, we can see that these ratios have leveled off since 2015. It implies that the Taiwan semiconductor company has come through a sustainable long-term business operation.

Total receivables/total current assets has been stable since 2015, indicative of a healthy business. (Seeking Alpha) Total receivables/total cash & ST investments has been stable since 2015, indicative of a healthy business. (Seeking Alpha)

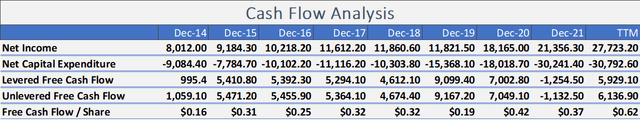

TSMC Has Generated Excessive Cash Flows

TSMC has witnessed an impressive growth of net income in the first three quarters of 2022. While the net income accounted for about 21,356 million dollars in fiscal 2021, it has increased to 27,723 million dollars in TTM 2022, with one more quarter left. Surprisingly, its TTM net capital expenditure has remained relatively stable at around 30,792 million dollars, compared to 30,241.4 million dollars in fiscal 2021. It simply means that $100 in Capex generated $70.6 in net income in fiscal 2021, whereas it can generate approximately $90 in the first three quarters of 2022, quite an impressive number. In addition to the recent massive upsurge of levered free cash flow and unlevered free cash flow, the free cash flow per share has been positive for years and increased from $0.37 to $0.62 per share in TTM 2022. So, TSMC has efficiently managed its capital and executed an effective operation to generate excessive cash flows.

TSMC has performed an effective operation to generate excessive cash flows. (Seeking Alpha)

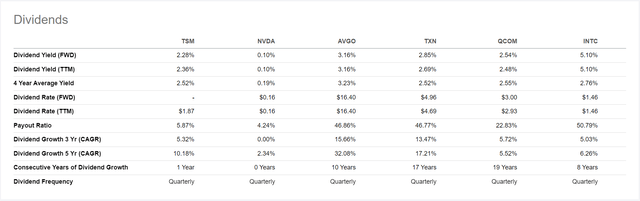

TSMC’s Dividend Sustainability

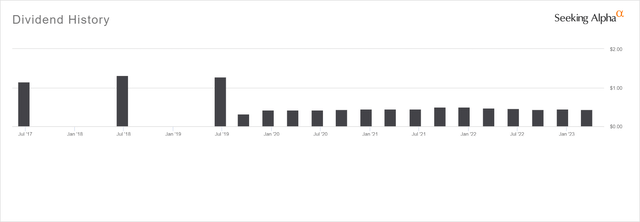

Regardless of TSMC’s low dividend grades, its dividend payment record is consistent and sustainable. Despite having a lower dividend yield and dividend rate than most of its peers, its four-year average yield is more stable, and its five-year dividend growth is strong. Many investors may underestimate TSMC’s dividend history because its payout ratio is as low as 5.87%. However, to maintain the high dividend yield, Broadcom Inc. (AVGO), Texas Instruments Incorporated (TXN), QUALCOMM Incorporated (QCOM), and Intel Corporation (INTC) must have spent 46.86, 46.77, 22.84, and 50.79 percent of their net income on dividends, respectively. As a result, TSMC’s ability to distribute dividends consistently is secured, and the risk of dividend cuts is reduced.

TSMC’s ability to distribute dividends consistently is secured. (Seeking Alpha)

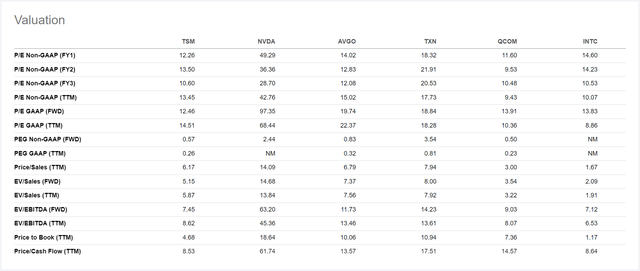

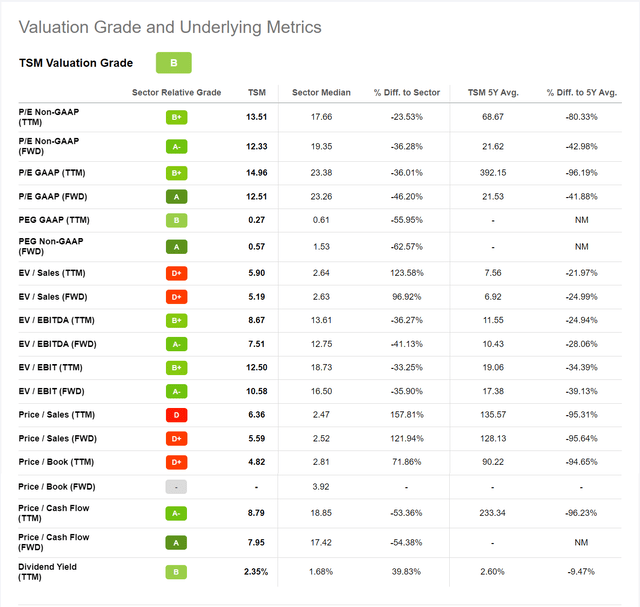

Valuation: TSM Is Undervalued

Evaluating the cost of borrowing, TSMC is undervalued as its return on invested capital is 33.6%, which is nearly nine times higher than the weighted average cost of capital standing at 3.8%. Put simply, the real return is nine times greater than the required rate of return, indicating that the company has conducted a healthy business.

Overall, TSMC has good valuation multiples when compared to the sector median, with lower PE and PEG than most of its peers. Unfortunately, the firm has generated a poor sale relative to its market capitalization. As a result, its price per sale ratio-TTM estimated at 6.36 is relatively high when the sector median is at 2.44, nearly 2.6-fold lower.

TSM has a good valuation multiples when compared to its peers. (Seeking Alpha) TSM has a good valuation multiples. (Seeking Alpha)

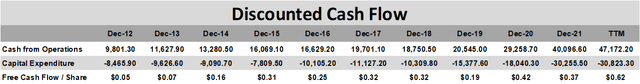

Discounted Cash Flow Model

Since 2012, TSMC has seen strong growth in operating cash flows and capital expenditure, while free cash flow has remained stably positive. This meets the requirements of the discounted cash flow model. By using this model, the intrinsic value of TSM can be estimated to be around $93 per share, which is approximately 13.12% higher than its current market value of $80.80. In other words, TSM is currently undervalued in terms of its ability to generate cash.

TSM has a strong cash flow statement, satisfying the conditions of the DCF model. (Seeking Alpha)

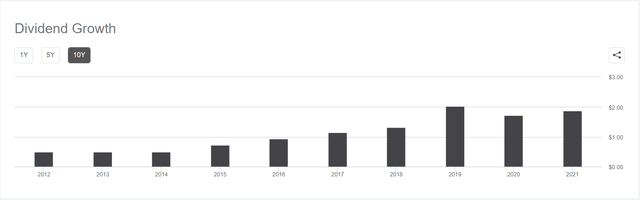

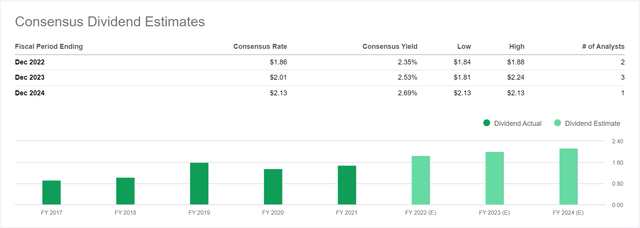

Dividend Discount Model

As previously stated, TSMC has a consistent growth rate and an exceptional ability to pay its shareholders. Since 2019, the company has a strong track record of earnings per share and dividend payments, and consensus dividend estimates are expected to rise gradually. Thus, TSM is the best fit for the Gordon Growth Model because of these factors. Rather than using the current dividends per share, we can use the dividend consensus rate for December 2022, which estimated by Seeking Alpha at around $1.86. CAPM calculates the cost of equity to be around 9.8%, with an expected growth rate of 8%. Therefore, TSM’s intrinsic value can be estimated at around $100 using the Gordon Growth Model, which is about 20% higher than its current market value of $80.80 per share.

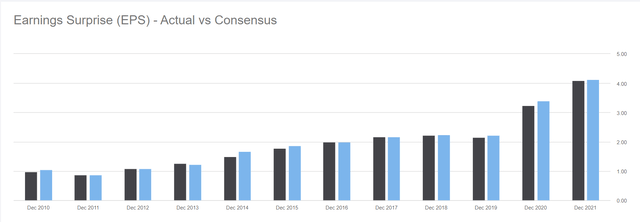

TSM has a strong dividend growth rate. (Seeking Alpha) TSM has a good history of dividend payment. (Seeking Alpha) TSM’s consensus dividend estimates are expected to increase gradually. (Seeking Alpha) TSM has a good history of earnings per share. (Seeking Alpha)

The Bottom Line

TSMC is a strategic company with a significant impact on The US and global national security. It not only has a significant impact on the global economy via microchip, but it is also an important part of China’s monetary reform strategy. If oil is the lifeblood of the global economy, then microchip is the body’s brain. According to this article, TSM is an investable stock in spite of the geopolitical risk. This is a unique opportunity that does not come along very often.

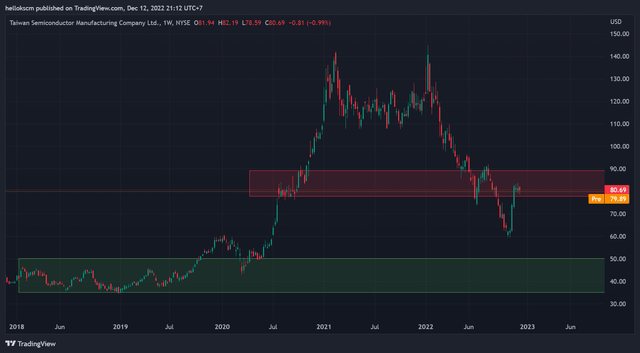

However, TSM’s price action is technically encountering a strong resistance, and the microeconomic outlook seems pessimistic. In addition, its beta, Sortino ratio, and expected shortfall have all surged recently, suggesting that this stock will be more volatile in the next short-term period. It would be irrational to buy here, and that we should be buying TSM around the zone of $35-$50. Therefore, I would rate this stock as “hold” for now and come back later, but you could consider slowly accumulating TSM if you don’t mind much about the potential short-term loss.

TSM technical analysis (TradingView)

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment